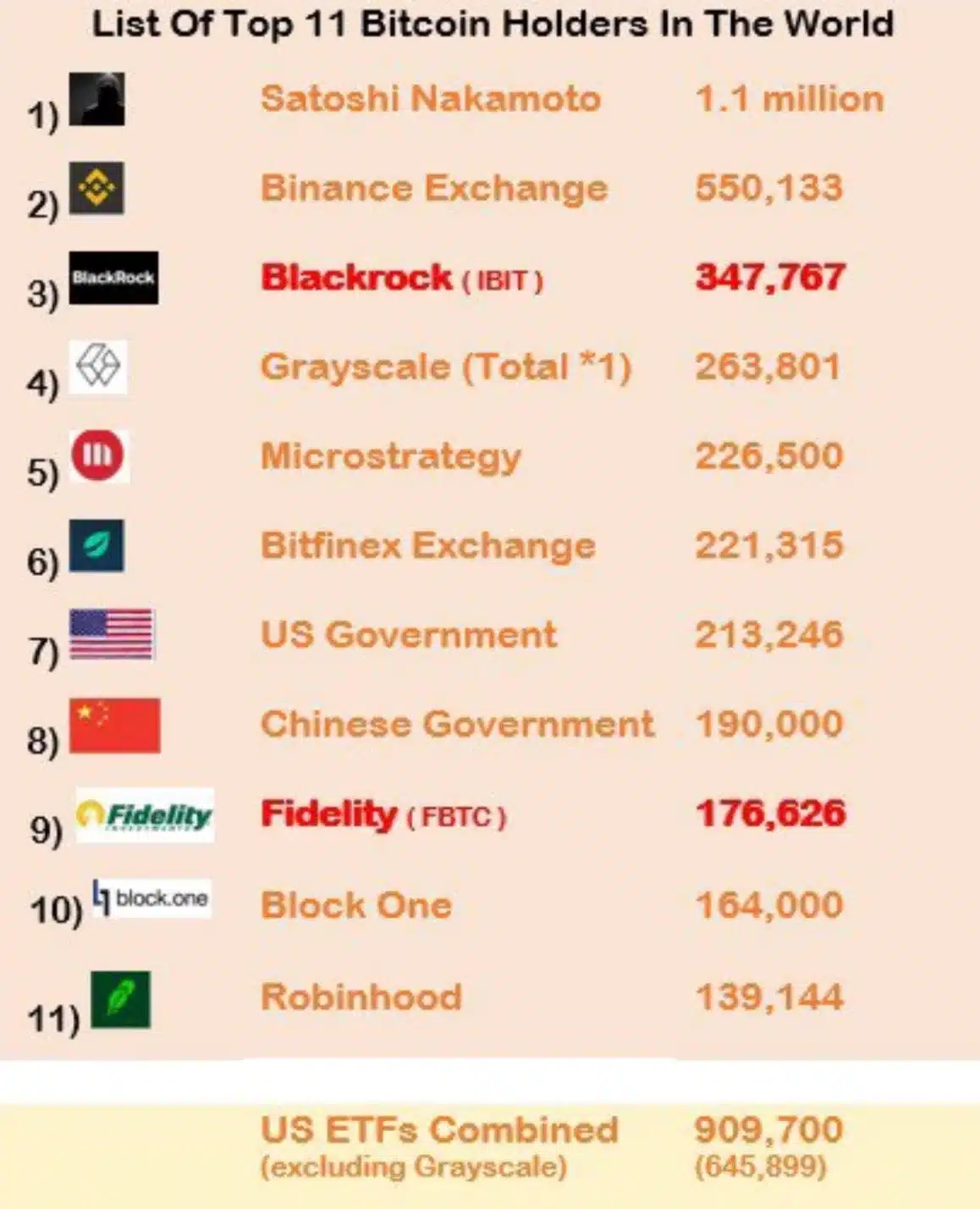

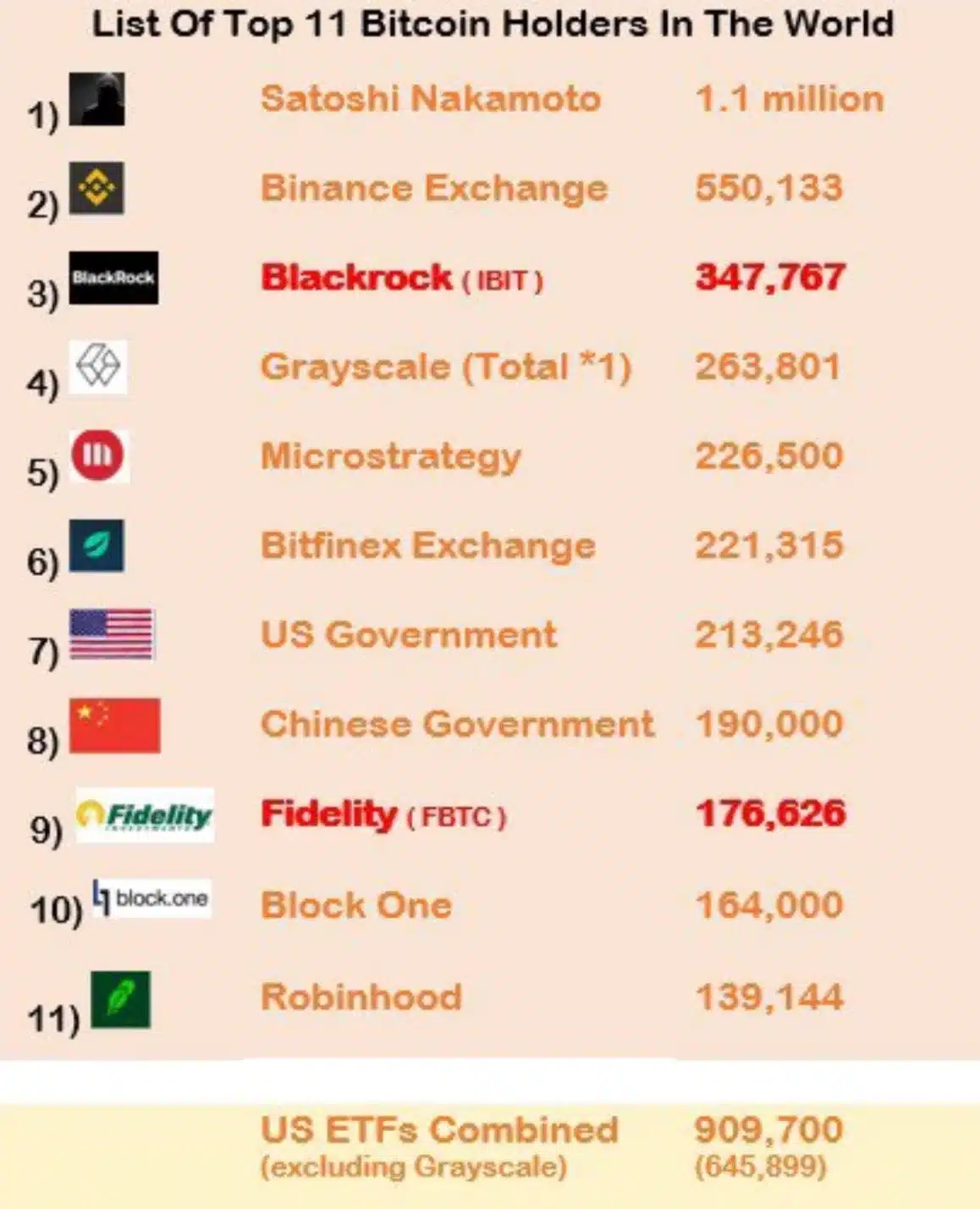

- BlackRock’s BTC ETF has now become the third largest Bitcoin holder.

- Projections suggested that Bitcoin ETFs could surpass top holders, including Nakamoto, by the end of 2025.

The growth of Bitcoin [BTC] Exchange-Traded Funds (ETFs) have been important, with BlackRock’s IBIT Bitcoin ETF now positioned as the third largest BTC holder in the world, just behind Grayscale.

Fidelity’s FBTC fund ranks ninth, while Satoshi Nakamoto continues to lead the way. This shift underlines the increasing institutional adoption of Bitcoin through ETF investments.

Bitcoin ETF update

According to the latest update of Farside InvestorsBTC ETFs saw net inflows of $27.8 million on August 12, with total net inflows since their inception reaching $17.369 billion.

Of these, BlackRock’s IBIT ETF stood out, having attracted a remarkable net inflow of $20.330 billion since its launch.

IIn contrast, Grayscale’s GBTC ETF has seen outflows totaling $19.462 billion over the same period.

Seeing the rise in Blackrock’s BTC ETF investments, Bloomberg senior analyst Eric Balchunas took to X (formerly Twitter) and said:

“I didn’t realize that US ETFs are on track to overtake Satoshi in bitcoin, which was held in October. BlackRock alone is already at #3 and on track to become #1 by the end of next year, and will likely stay there for a long time Ht @EdmondsonShaun.”

Source: Eric Balchunas

This indicated that Bitcoin ETFs could surpass the current leading holders by the end of 2025.

Satoshi Nakamoto’s BTC shares

Currently, Satoshi Nakamoto, the pseudonymous founder of Bitcoin, is estimated to own approximately 1.1 million BTC, making him the largest individual holder.

BTC ETFs, excluding Grayscale, collectively own approximately 645,899 BTC, while total US ETF holdings are over 900,000 BTC.

Despite the ongoing debate over Nakamoto’s exact assets, the expected rise of Bitcoin ETFs reflected a notable shift in the cryptocurrency market.

We highlight the transformative impact of BTC ETFs, Spencer HakimianFounder of Tolou Capital Management, commented:

“People underestimated how reluctant institutions were to own Bitcoin on exchanges. Owning via ETF is a game changer. Allows risk-averse institutions to finally own Bitcoin. Game changer.”

While Bitcoin ETFs have seen significant momentum since their debut, BTC itself has had a tumultuous journey into 2024.

The cryptocurrency reached an all-time high of $73,000 earlier this year. At the time of writingBitcoin is on an uptrend, approaching $60,000 after a period of bearish movement.