- Marathon Digital announces an ambitious plan to boost Bitcoin investment.

- Bitcoin’s stock reserve across all exchanges reaches its lowest level since 2018.

Marathon Digital, a leading Bitcoin [BTC] mining company plans to raise $250 million to buy more Bitcoin.

After purchasing $100 million worth in July, Marathon now owns 20,000 BTC. Recent data shows that large investors, also known as whales, have steadily increased their BTC holdings in recent months, indicating strong market confidence.

This institutional commitment was reflected in the steady increase in accumulation indicators, which were supported by several measures, including supply reserves.

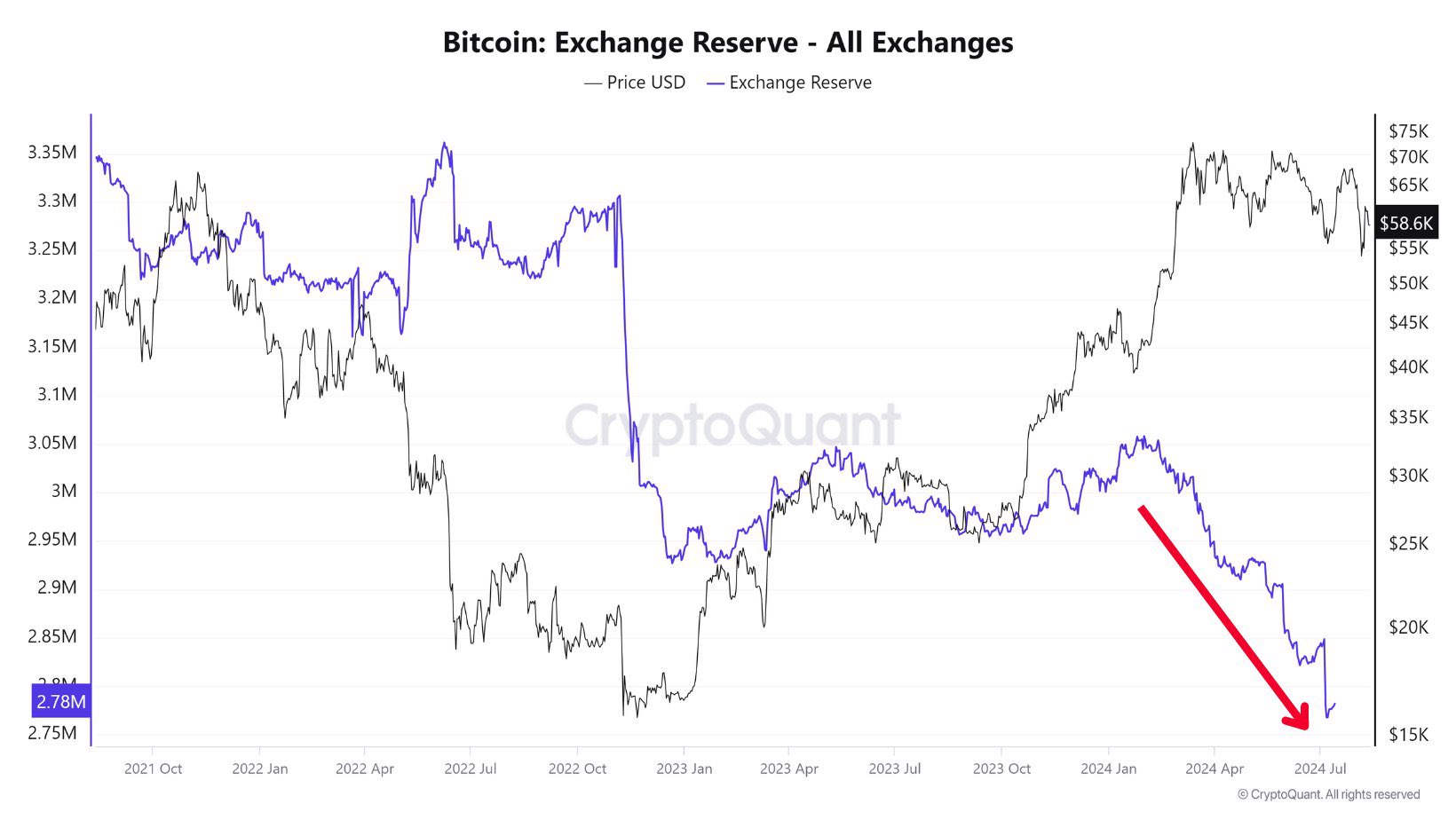

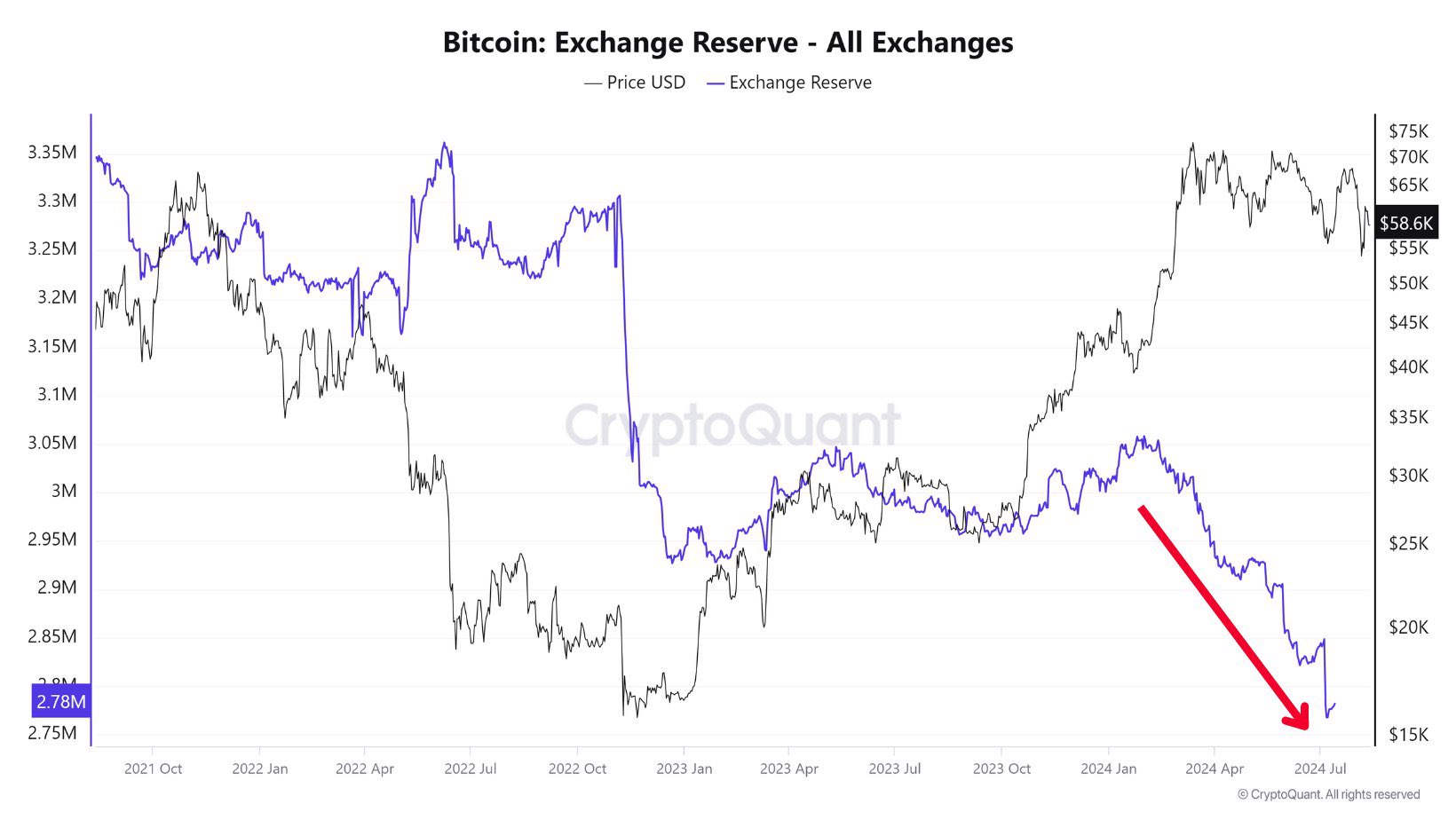

Source: CryptoQuant

BTC reserves across all exchanges have also fallen to their lowest levels since 2018, with a significant drop seen since the beginning of this year.

This suggests that institutions are steadily accumulating Bitcoin, likely because they anticipate a positive market trend.

Such a drop in available supply is a strong bullish signal, indicating growing investor confidence in Bitcoin’s future.

For this reason, now is the time to consider a bullish stance on BTC as the market turns.

Liquidation levels

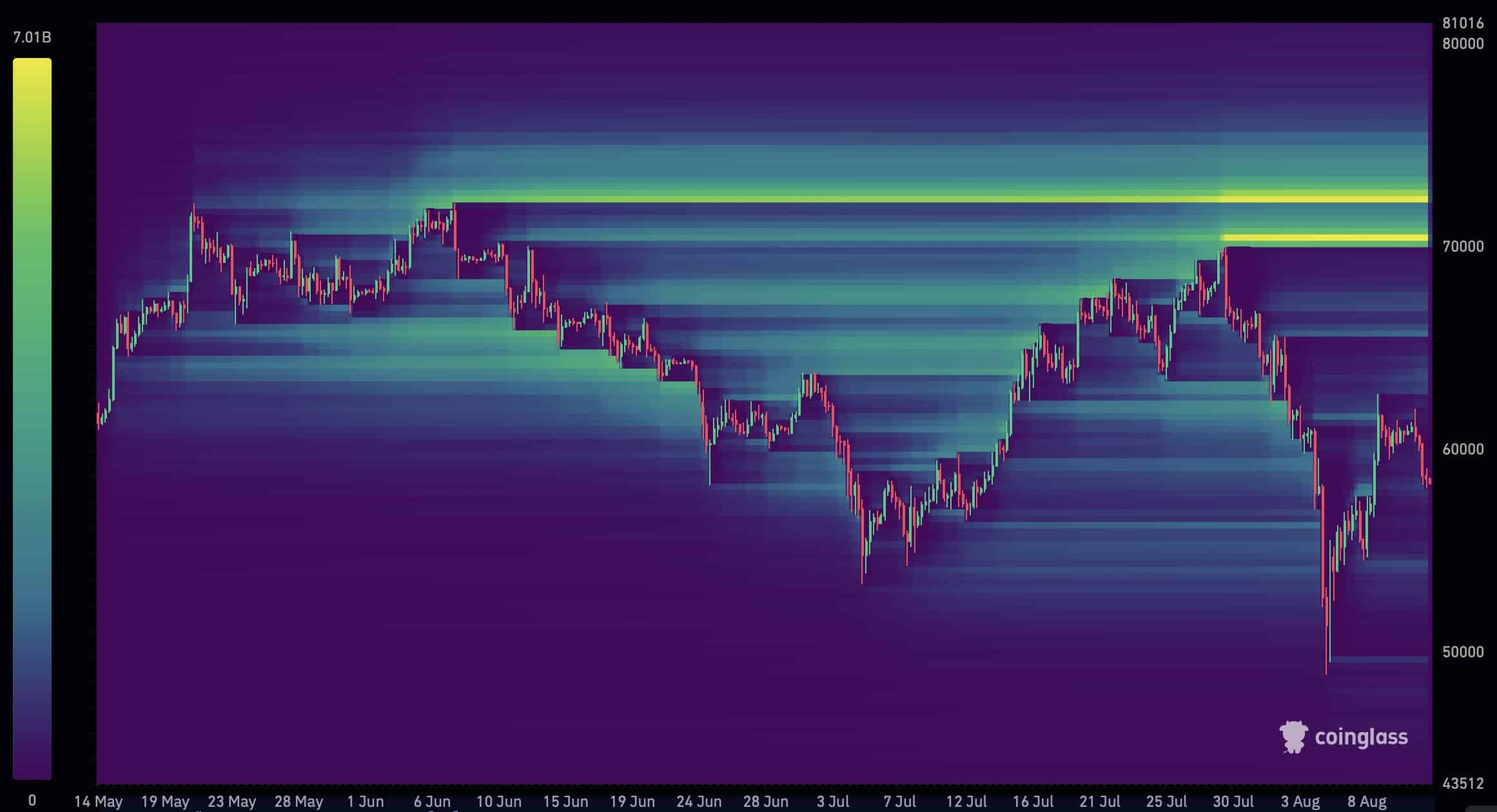

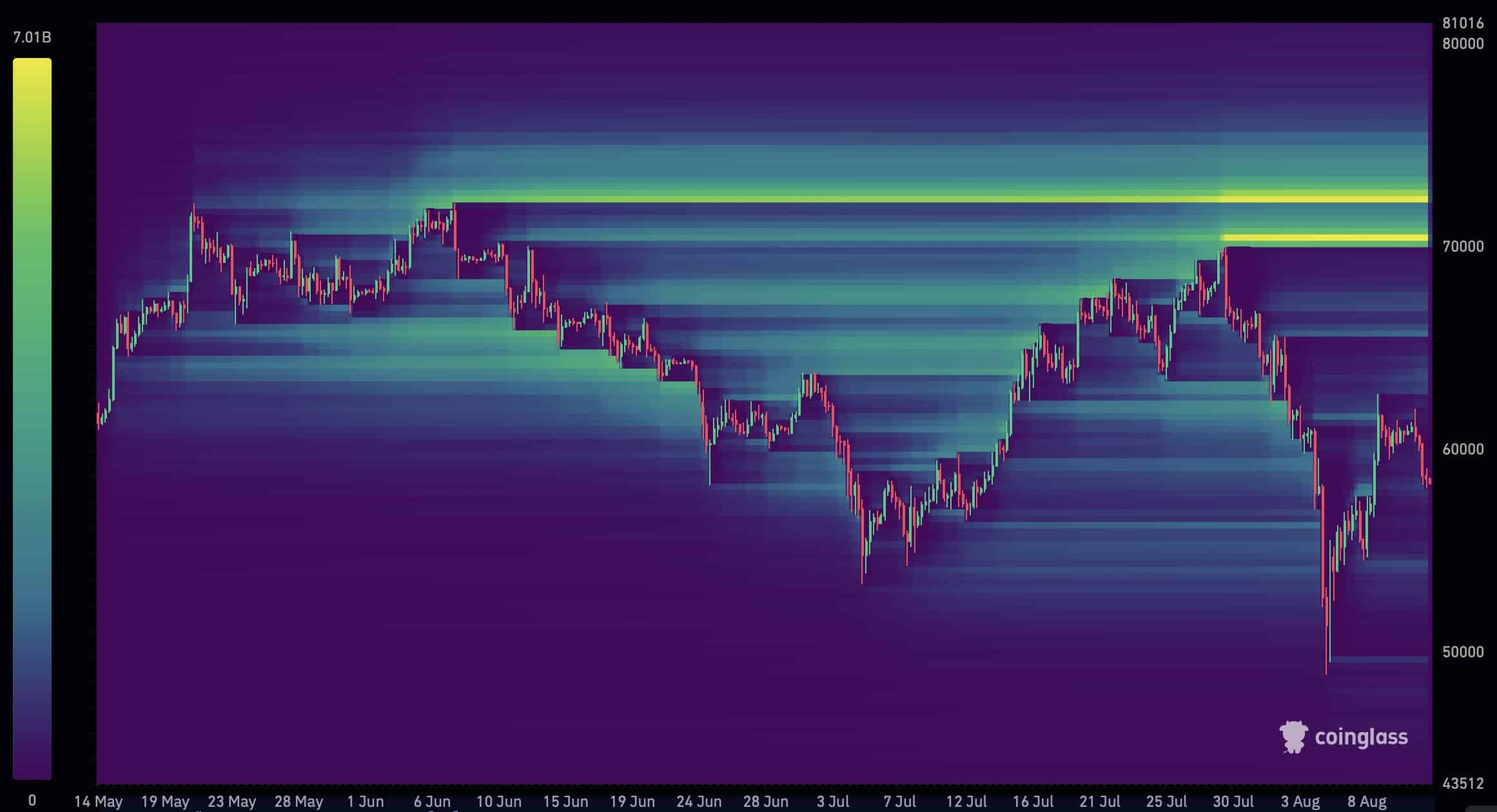

According to Coinglass, more than $15 billion in BTC short positions will be liquidated when the price reaches $72K.

Significant liquidity is between $70,000 and $72,000, indicating a market shift as large institutions accumulate BTC for long-term profits.

Source: Coinglass

Bitcoin opens a new CME gap

This week, Bitcoin created another CME gap, adding to the two major gaps it closed recently, with the latest close at $63K marking a local top.

A new gap is now above the $61,000 price line. While the gap doesn’t always close, it often does, signaling price increases toward the gap.

Source: TradingView

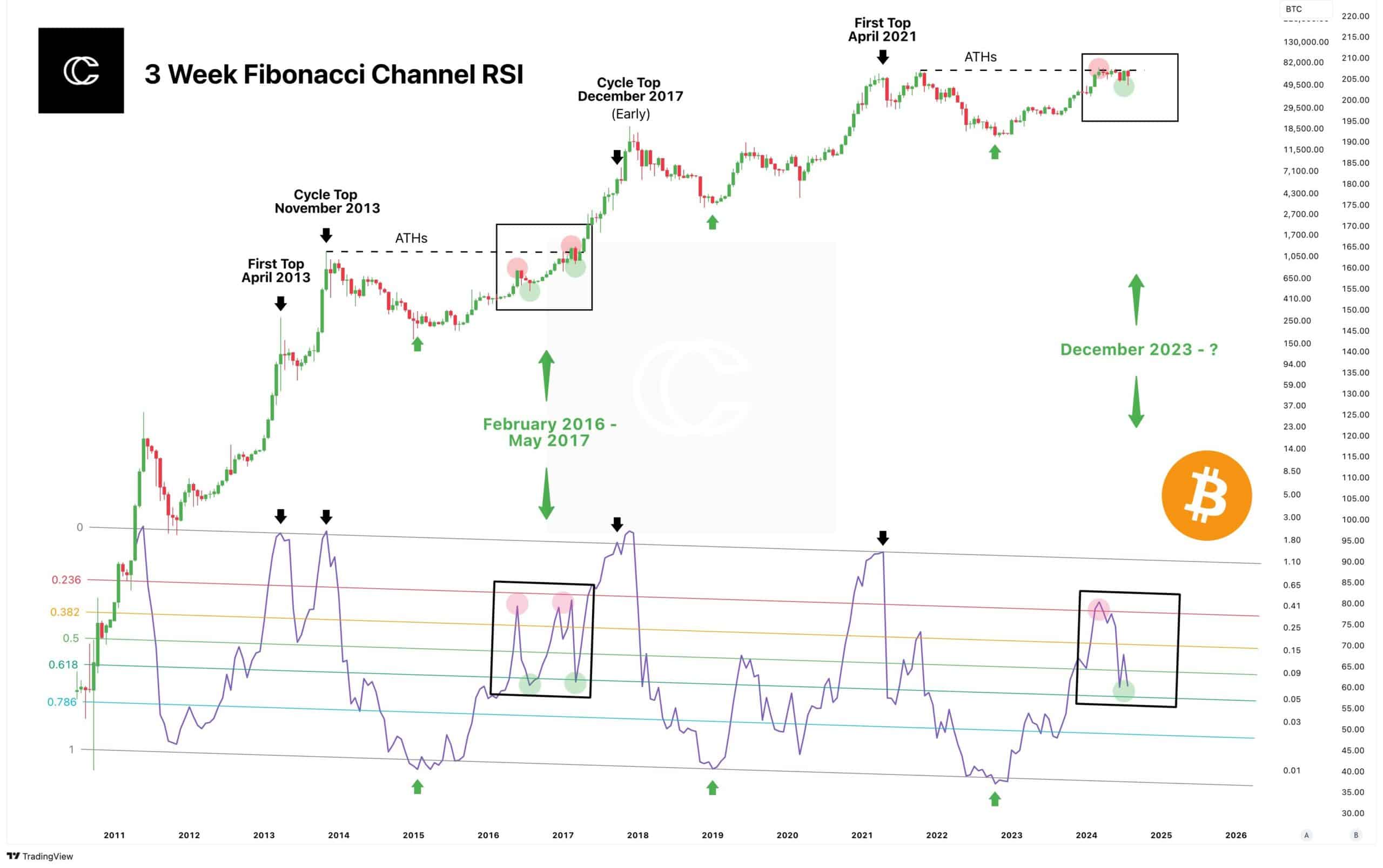

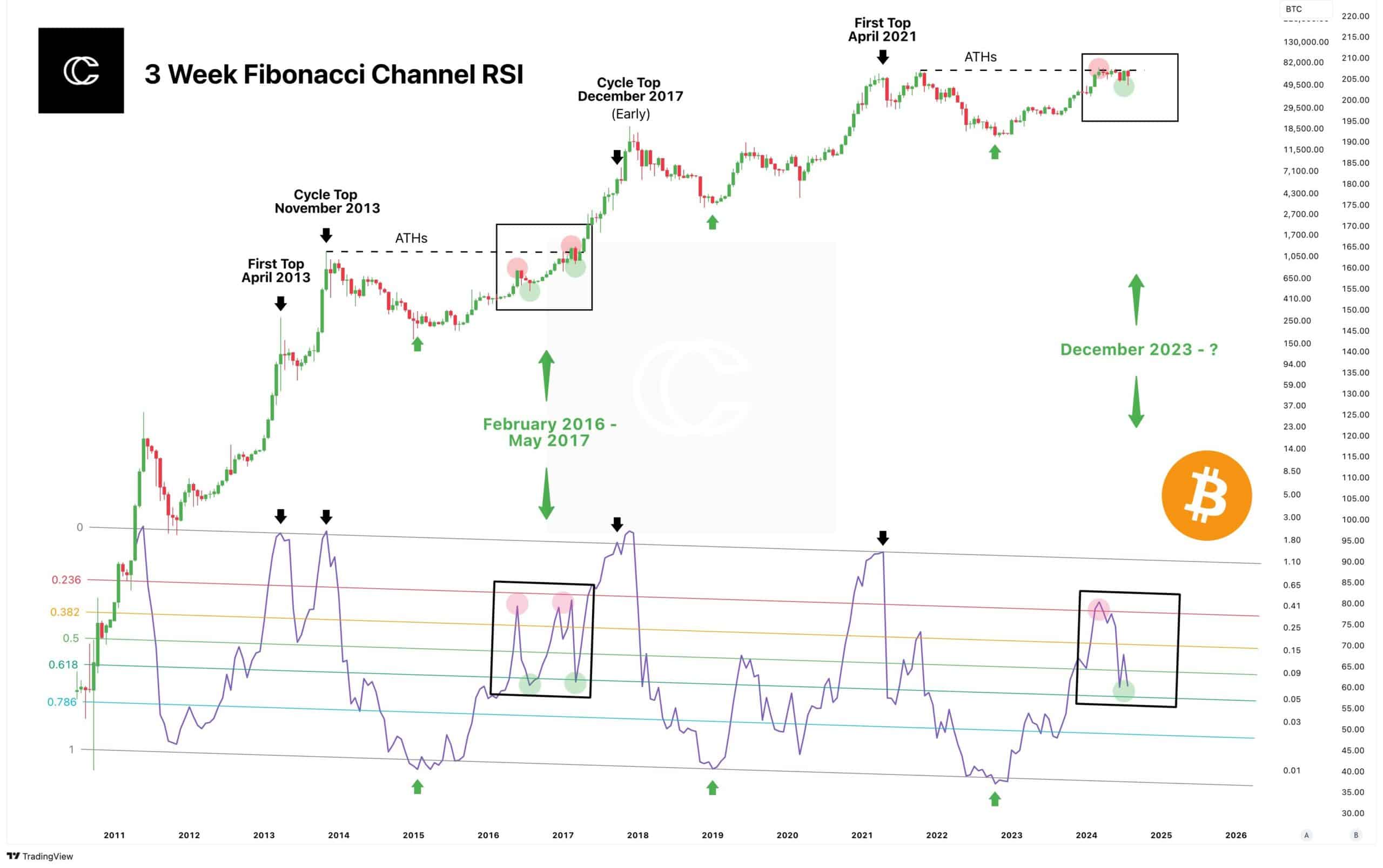

Bitcoin RSI at Fibonacci Level Analysis

The AMBCrypto analysis team noted that the 2-week Bitcoin RSI reached the cycle top, but the 3-week RSI provided a clearer picture of market sentiment.

Is your portfolio green? Check out the BTC profit calculator

BTC’s RSI pattern now reflects the 2016-2017 period when it was aiming for new highs.

Unlike previous cycle peaks, this indicates that the March 2024 move was significant, but it is believed that the bull market could continue for well over a year once institutions have finished accumulating.

Source: TradingView