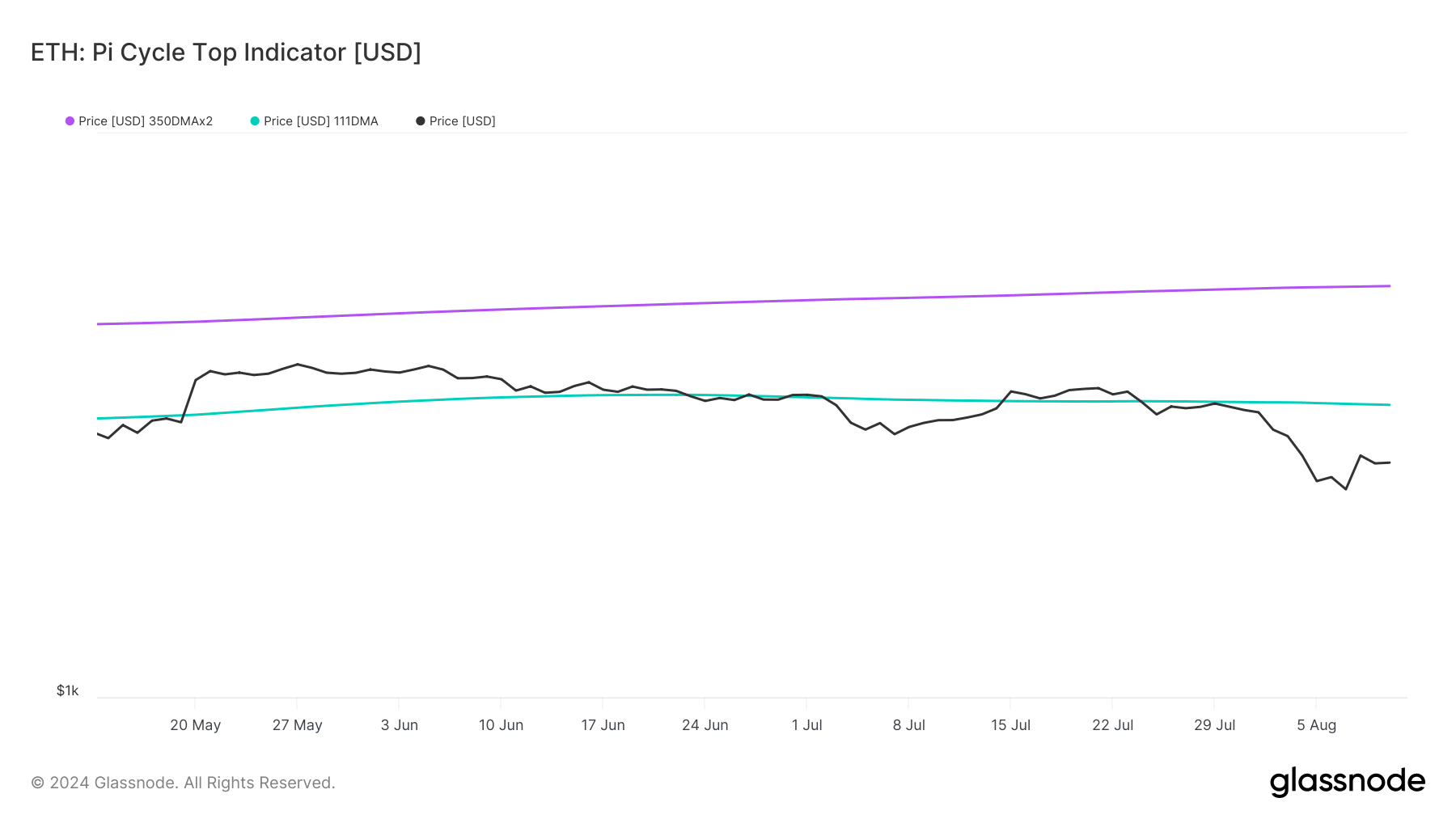

- The Pi Cycle Top indicator revealed that ETH’s possible market bottom was $3k.

- Most metrics seemed bullish on ETH, but some market indicators suggested otherwise.

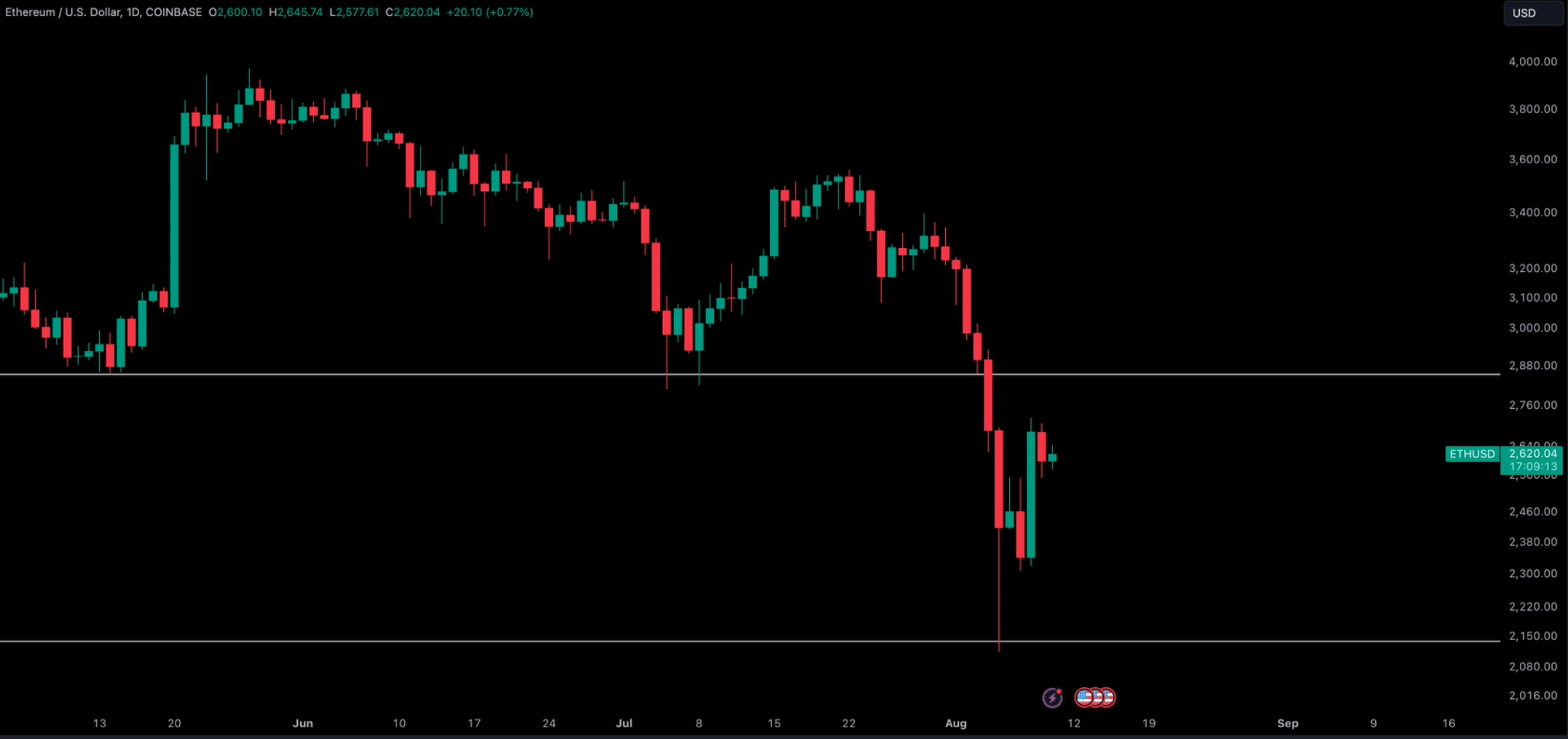

After a week of near double-digit price declines, Ethereum [ETH] showed signs of recovery in the past 24 hours. Taking into account the latest data, ETH could soon see a massive bull rally if it manages to regain a certain figure.

Let’s take a closer look at what’s going on.

The bulls are buckling

According to CoinMarketCap’s factsThe price of Ethereum has fallen by more than 8% in the past week. Things took a turn for the worse in the past 24 hours as the price of the king of altcoins rose 1.7%.

At the time of writing, ETH was trading at $2,650 with a market cap of over $318 billion.

While that was happening, Crypto Tony, a popular crypto analyst, recently posted tweet to highlight an interesting update. According to the tweet, if ETH recovers $2,850, ETH could get back on track and even start a new bull rally.

Source:

The probability of ETH recovering $2,850

AMBCrypto analysis of Glassnode’s data revealed an interesting statistic. ETH’s Pi Cycle Top indicator revealed that ETH was trading well below the possible market bottom of $3k.

Therefore, it seemed much more likely that the king of altcoins would reclaim $2,850. If the benchmark is to be believed, ETH had a market top of over $5.3k.

Source: Glassnode

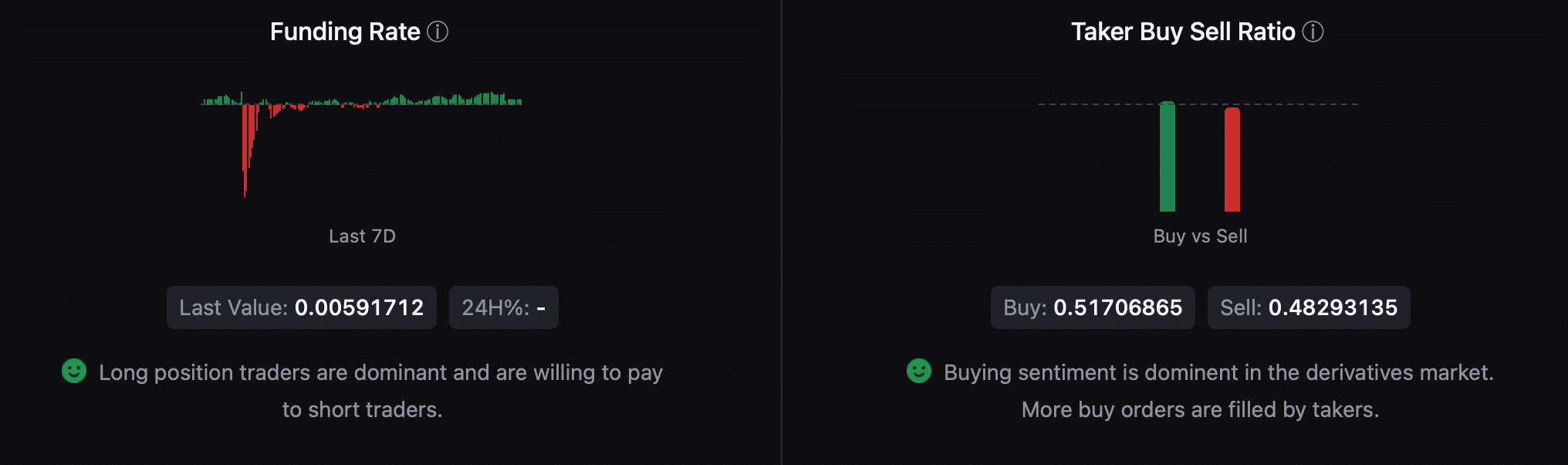

Next we took a look at CryptoQuant facts to better understand what to expect from the token. We found that the foreign exchange reserve fell, which means that the buying pressure was high.

The Coinbase premium was green, indicating that buying sentiment was dominant among US investors. Transfer volume has also increased over the past 24 hours, which was bullish.

Apart from this, things in the derivatives market also looked quite optimistic. For example, ETH’s taker buy/sell ratio showed that buying sentiment was dominant in the derivatives market.

More purchase orders were filled by customers. Moreover, another bullish measure was the financing rate, which increased.

Source: CryptoQuant

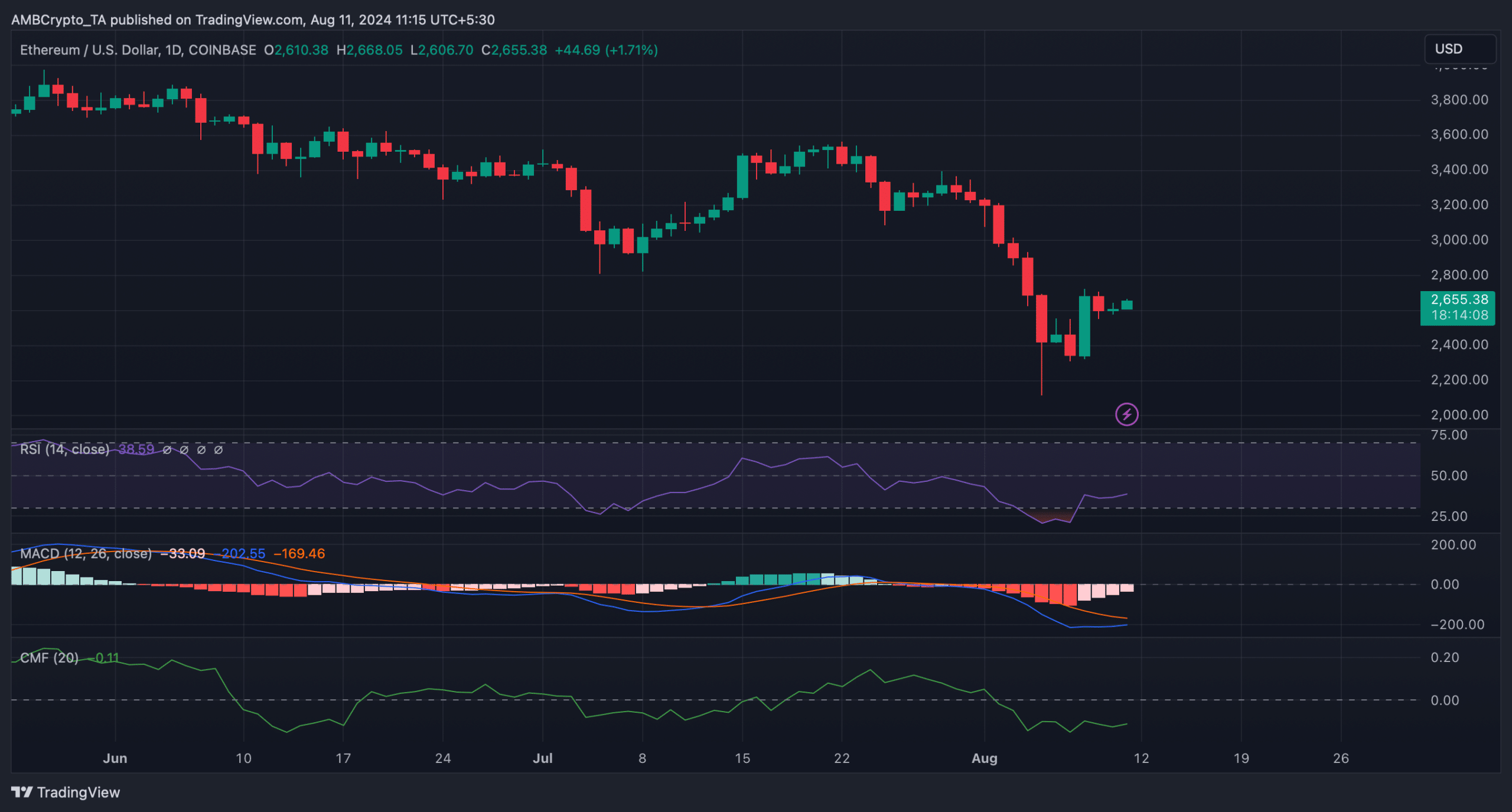

The technical indicator MACD also showed the possibility of a bullish crossover, further indicating continued price appreciation.

Read Ethereum (ETH) Price Prediction 2024-25

However, the Relative Strength Index (RSI) moved sideways.

The Chaikin Money Flow (CMF) had a value of -0.11, meaning it was well below the neutral line. Both the RSI and CMF indicated that investors could see a few slow days in the coming days.

Source: TradingView