- Ethereum took first place as the top-earning blockchain

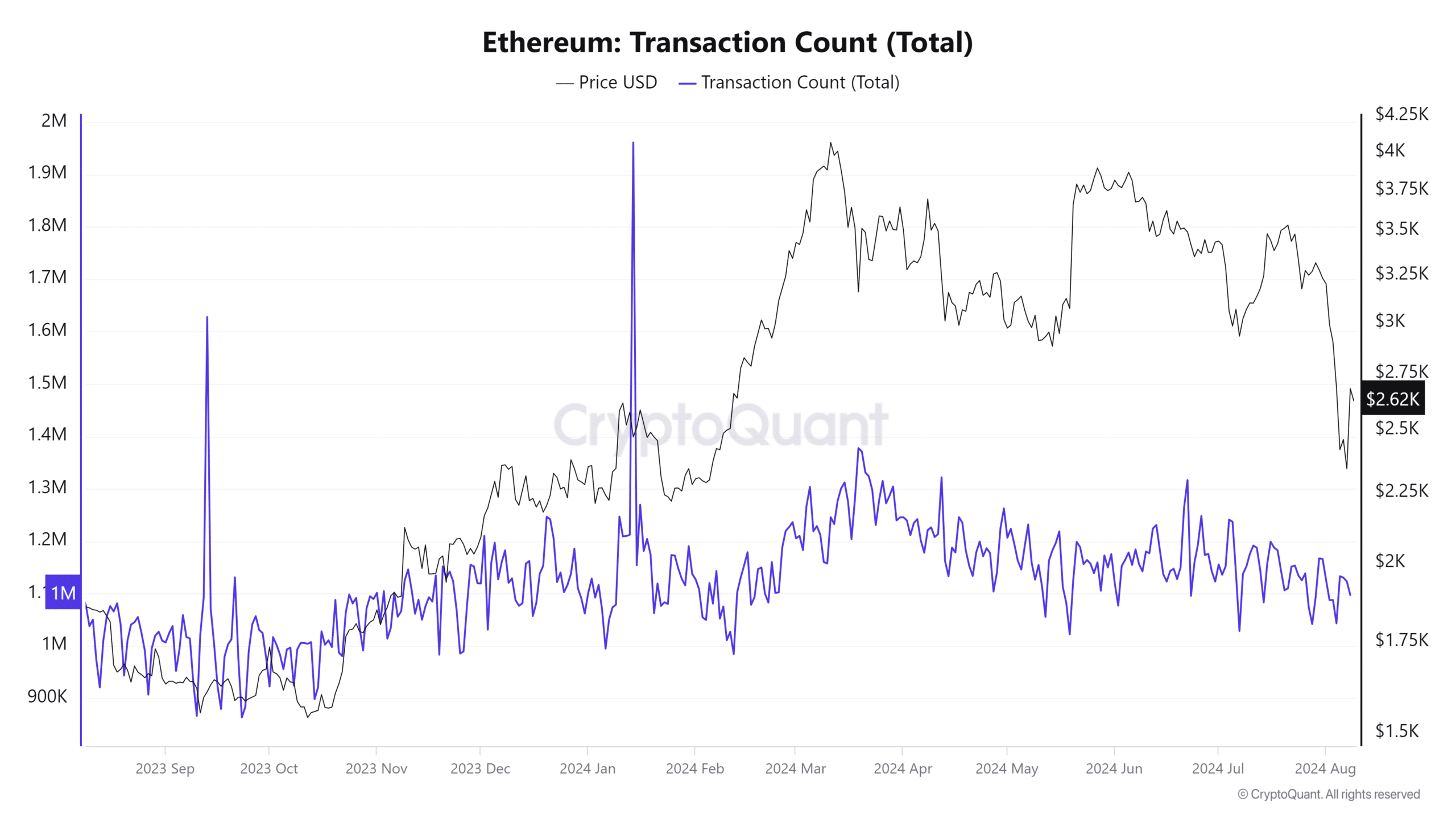

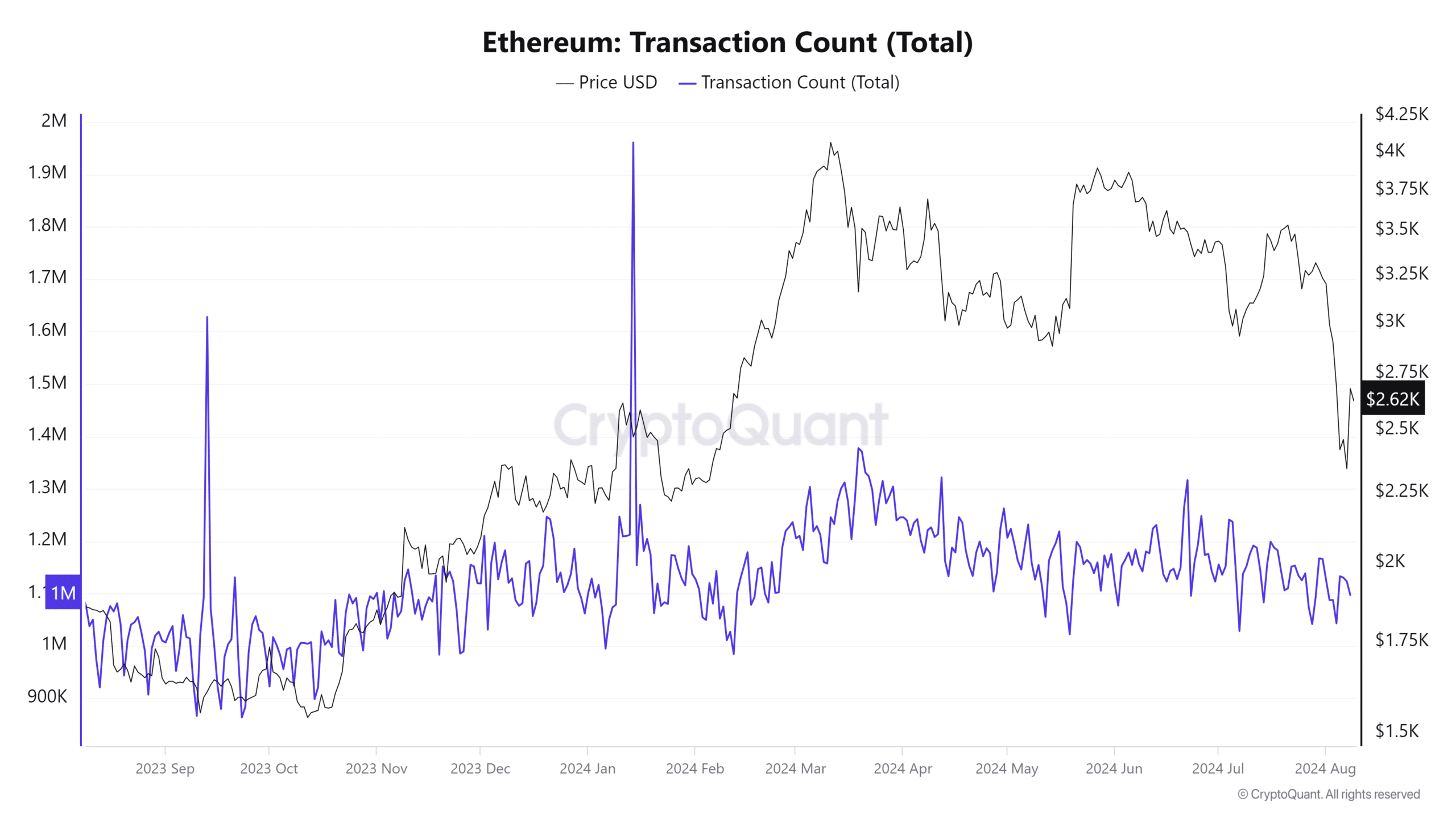

- There remains a close relationship between fees and transactions

The latest blockchain revenue statistics are out and the Ethereum network is at the top, despite growing competition. Not only that, but a clear indication confirmed that it is still the most dominant blockchain out there today.

According to the reportEthereum has collected an impressive $2.7 billion in fees over the past twelve months. The network was ahead of the Bitcoin network, the number two with $1.43 billion. This indicated an impressive lead, which made it clear how far ahead the competition is.

Ethereum’s dominant position in fees is a sign that it will remain the most preferred smart contract network in 2024. Its first-mover advantage on that front has allowed it to remain the network of choice for most dapps and users.

It could also be a signal that layer 2 networks have properly addressed the shortcomings of the Ethereum mainnet.

What Drives Ethereum Fees Up?

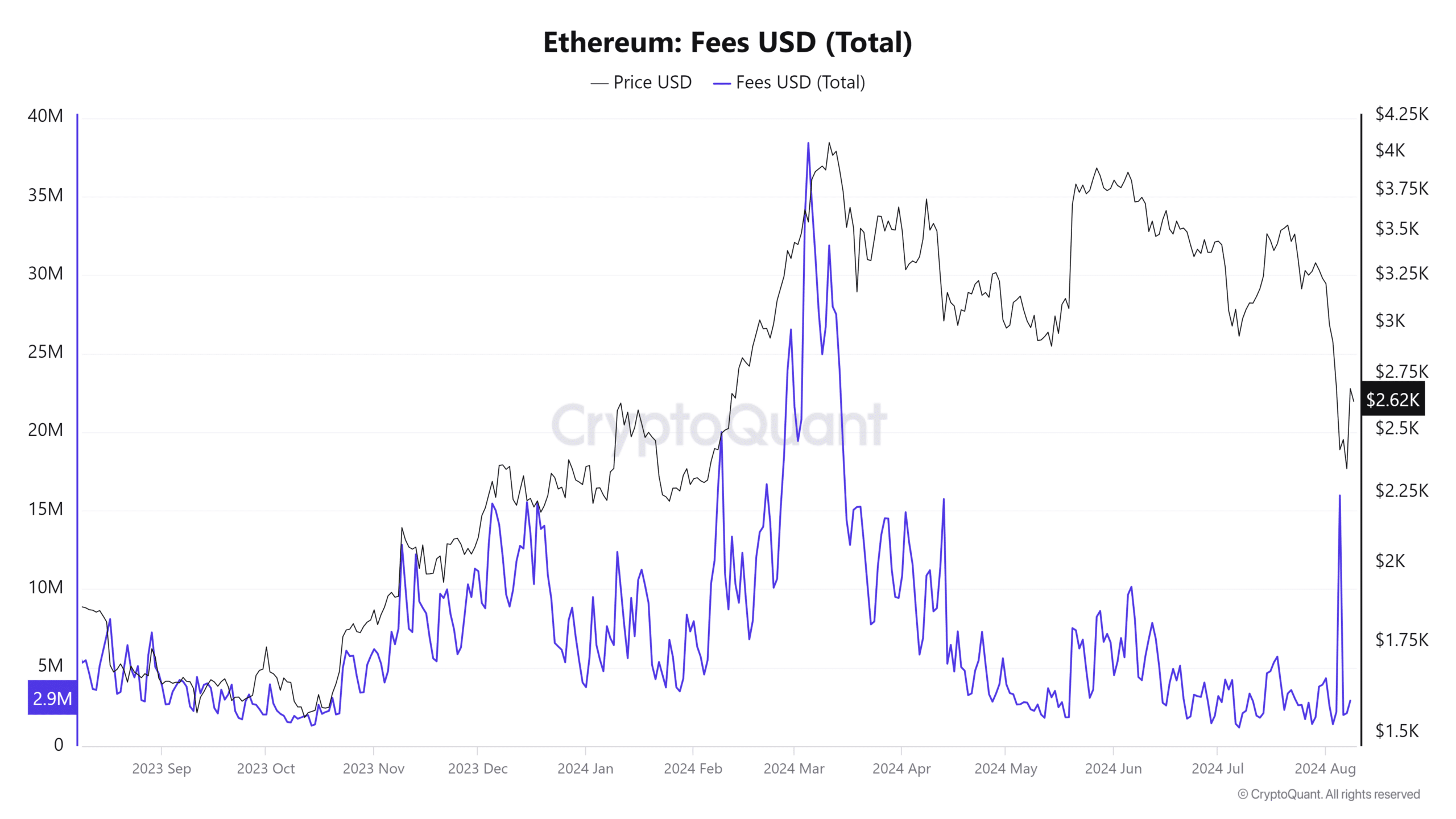

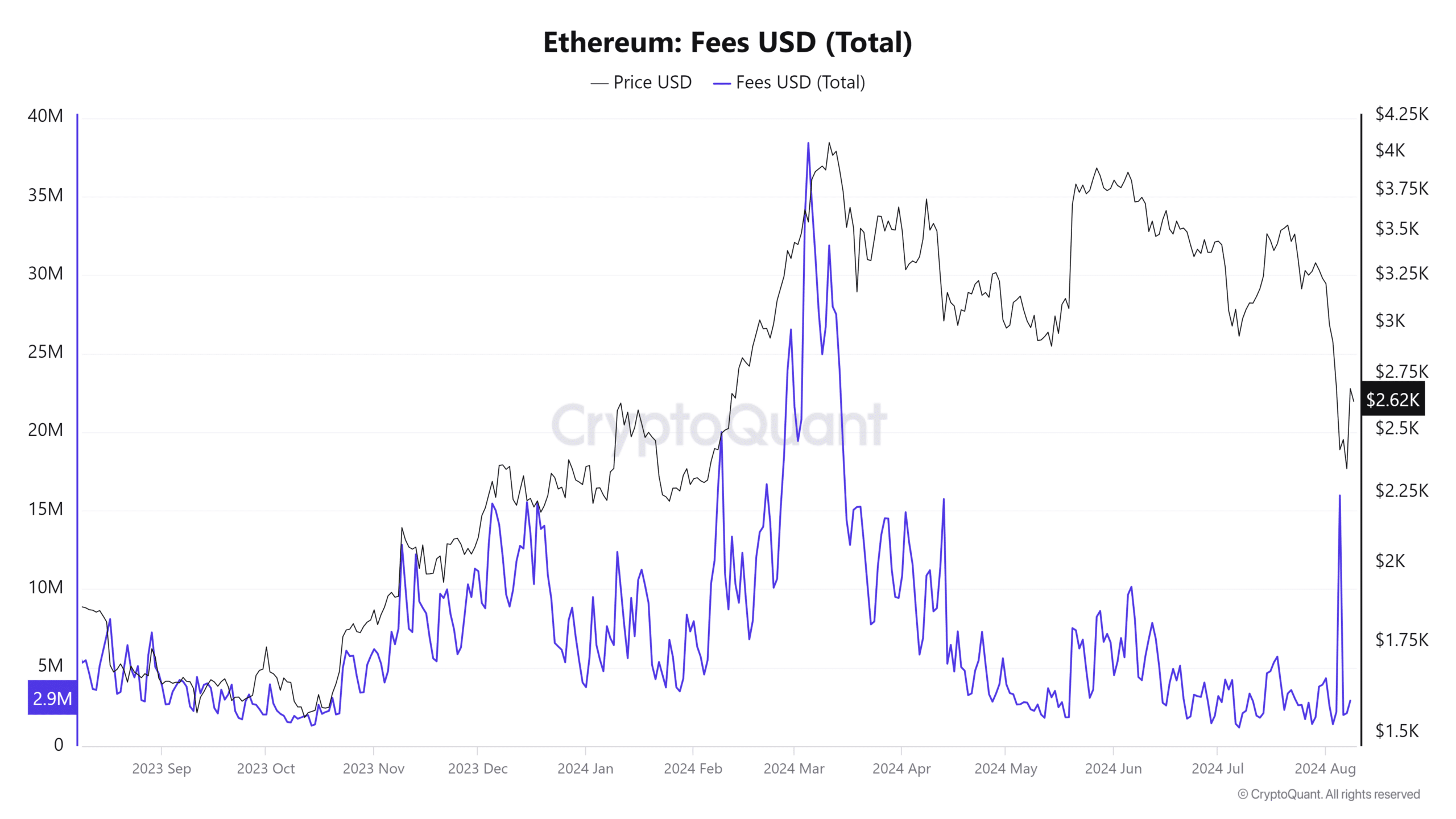

After exploring Ethereum’s daily cost chart over a 12-month period, it is clear that Ethereum’s cost is directly correlated with the price of ETH.

For example, the highest amount of fees the network earned in a single day in the last 12 months was $38.42 million on March 5.

Source: CryptoQuant

Ethereum has been in a strong bullish trend in recent weeks and this peak occurred near ETH’s current top in 2024. This is consistent with observations that demand for ETH within its ecosystem tends to rise during a bull market, indicating robust utility. It also happened on one of the market’s most volatile days.

Similarly, we also recently observed the second highest increase in Ethereum rates, at the height of the last market crash. Fees peaked at $15.97 million on August 5. This was the same day that the market was marked by high volatility, with the bulls coming out to cancel the bearish trend.

The lowest amount of network charges in a single day was $1.19 million on July 7.

Fees go hand in hand with transactions and this is how transactions on the Ethereum network played out: The highest daily number of transactions observed in the past twelve months peaked at 1.96 million transactions on June 14. Meanwhile, the lowest figure for the same period was just over 863,000 transactions on September 23.

Source: CryptoQuant

Unlike the correlation with price, the trades did not show a high correlation with fees. This was largely because the highest fees were observed on days when ETH prices were high.