- BTC was trading around $60,000 and seemed to be on the verge of a death cross

- Despite the price drop, more than $1.7 billion worth of BTC was withdrawn from the exchanges

Recently, Bitcoin recorded significant price declines, falling below the $60,000 mark – a level long considered a stable and safe range. This unexpected drop caused panic in the market as traders and investors reacted to the sudden shift.

However, in contrast to the general market reaction, the big farmers, often referred to as ‘whales’, seemed to be moving in a different direction.

Bitcoin whales are moving against the market trend

The recent significant declines in Bitcoin’s price have provoked a range of reactions from traders and investors. While many chose to sell their holdings in an attempt to secure profits or limit losses, a notable trend of accumulation was also observed, especially among large-scale investors or ‘whales’.

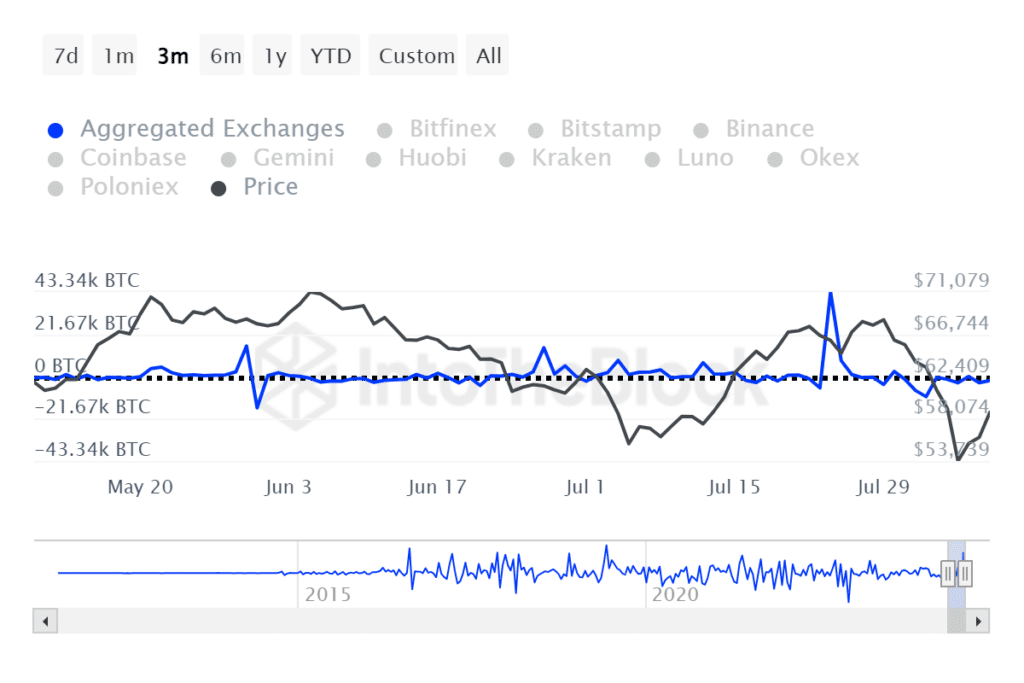

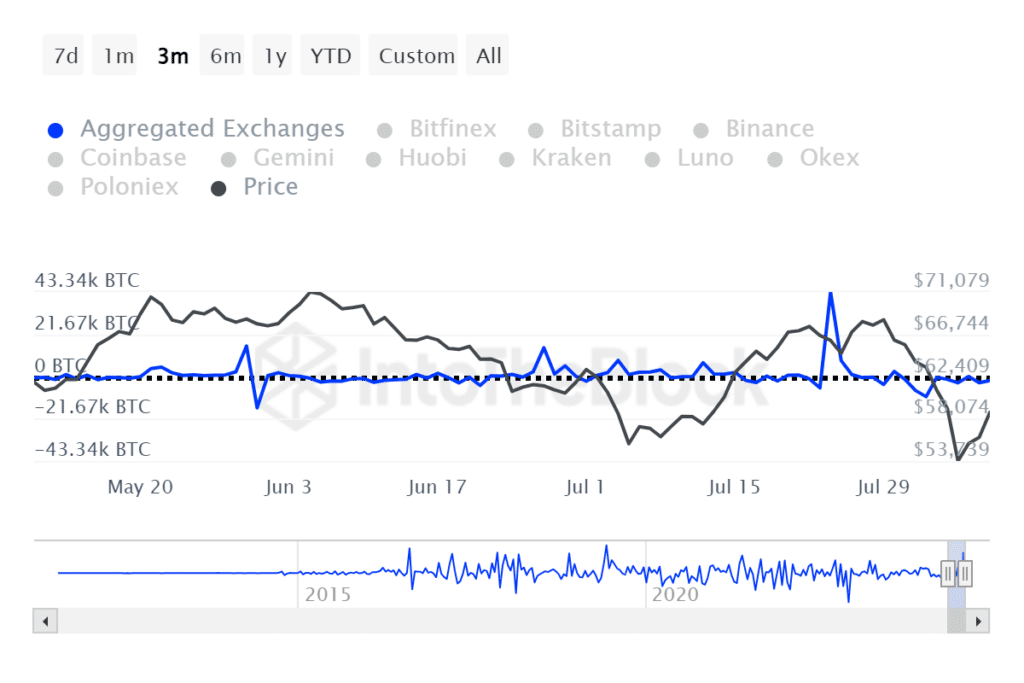

According to Netflow data from InTheBlokBitcoin recorded net outflows from exchanges totaling more than $1.7 billion last week. Here, this figure represents the largest volume of outflows in over a year, underscoring a significant move of BTC away from the exchanges.

Source: IntoTheBlock

Such outflows are typically interpreted as a sign of accumulation as investors move their holdings into private wallets. The move is for long-term holding, rather than leaving them on exchanges for possible selling.

What could this mean for the broader market?

This trend suggests that despite the market downturn, confidence among some investors remains high, with significant buying activity occurring as prices fall. These large holders likely view today’s lower prices as strategic buying opportunities. They expect the market to recover in the long term.

For the broader market, the significant outflows and associated accumulation of whales could stabilize or even push prices back up if this trend continues. It’s a sign of bullish sentiment among some of the market’s most influential players, which could help ease recent bearish pressure.

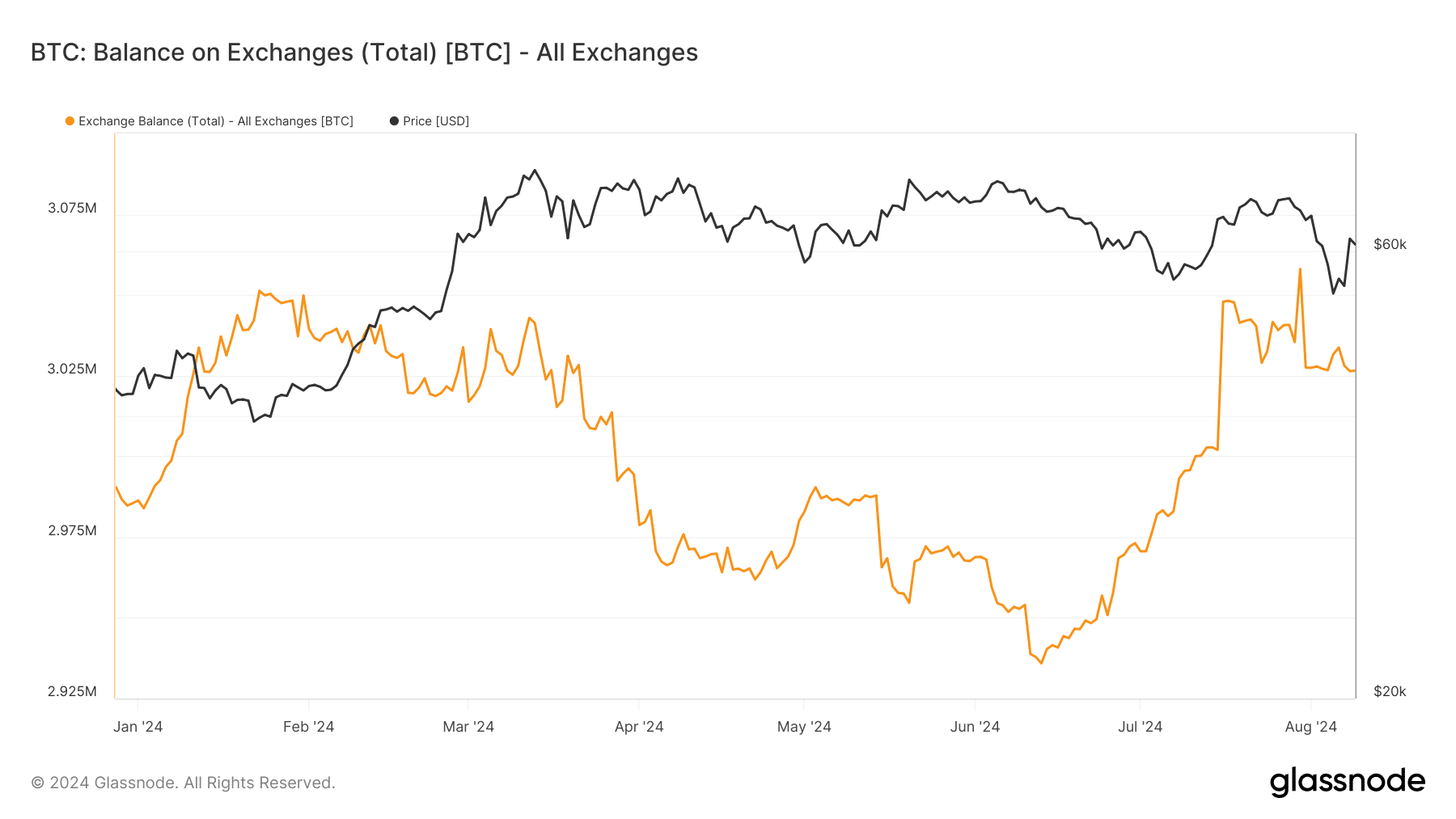

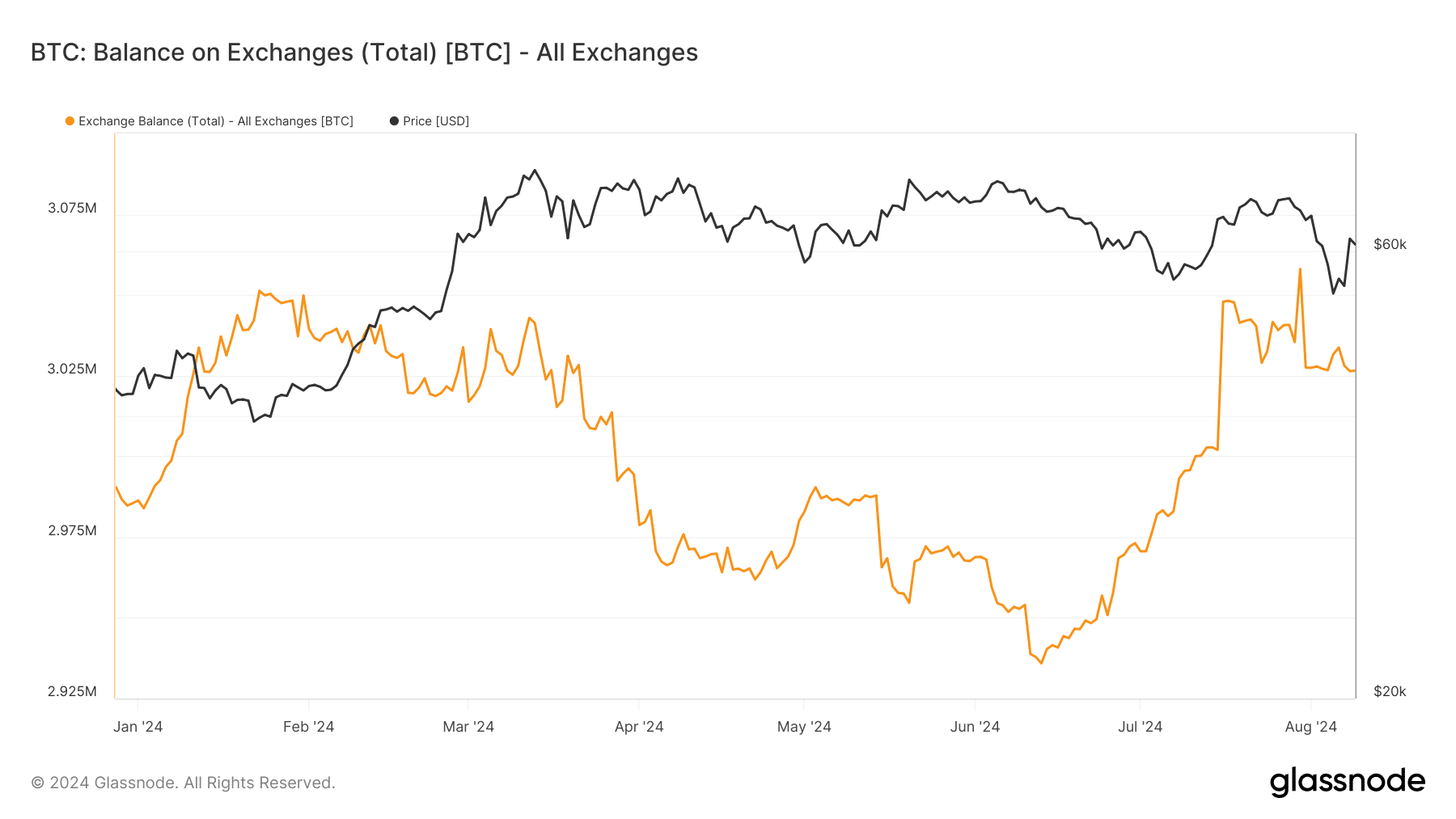

Bitcoin balance trend on exchanges

An analysis of Bitcoin’s balance on the exchanges, according to data from Glassnode, revealed a significant drop in recent weeks. Despite the fact that it has been fluctuating around 3 million for some time, there has been a sharp decline in the balance on the stock exchanges.

Specifically, the balance as of July 30 was approximately 3.057 million BTC. However, at the time of writing, this dropped to approximately 3.026 million BTC.

Source: Glassnode

This reduction in Bitcoin balances on exchanges is consistent with findings from Netflow analyzes in recent weeks, which have indicated that there is a trend of BTC retreating from exchanges.

Such moves are generally interpreted as a sign of accumulation among investors.

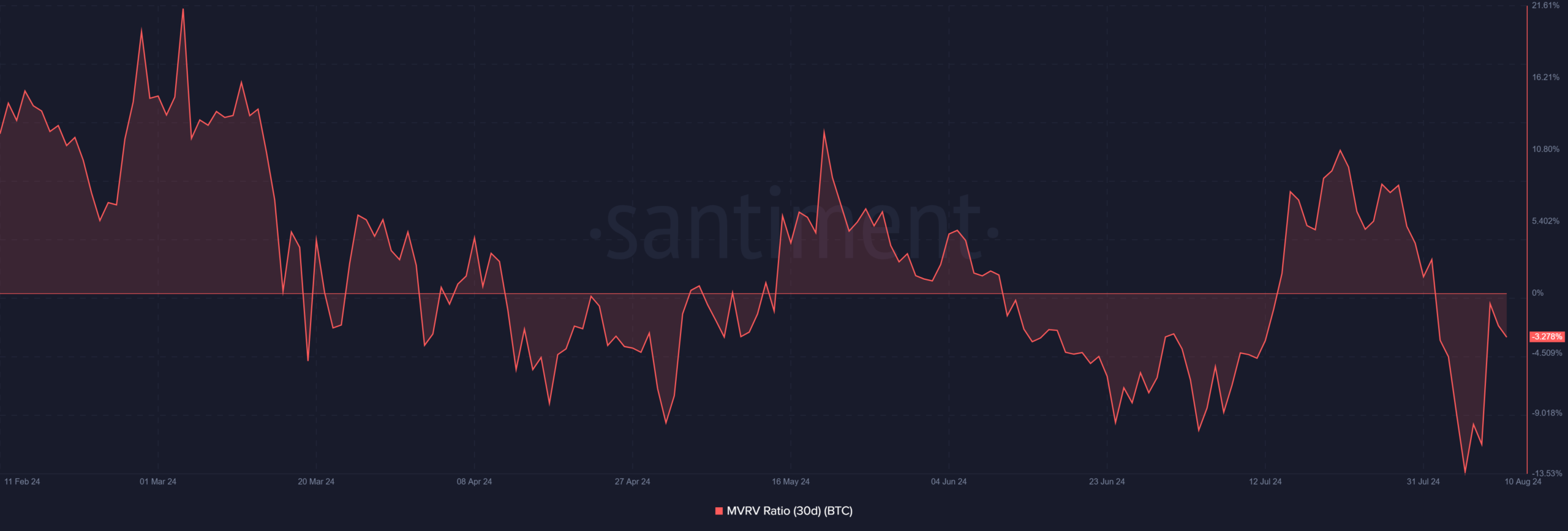

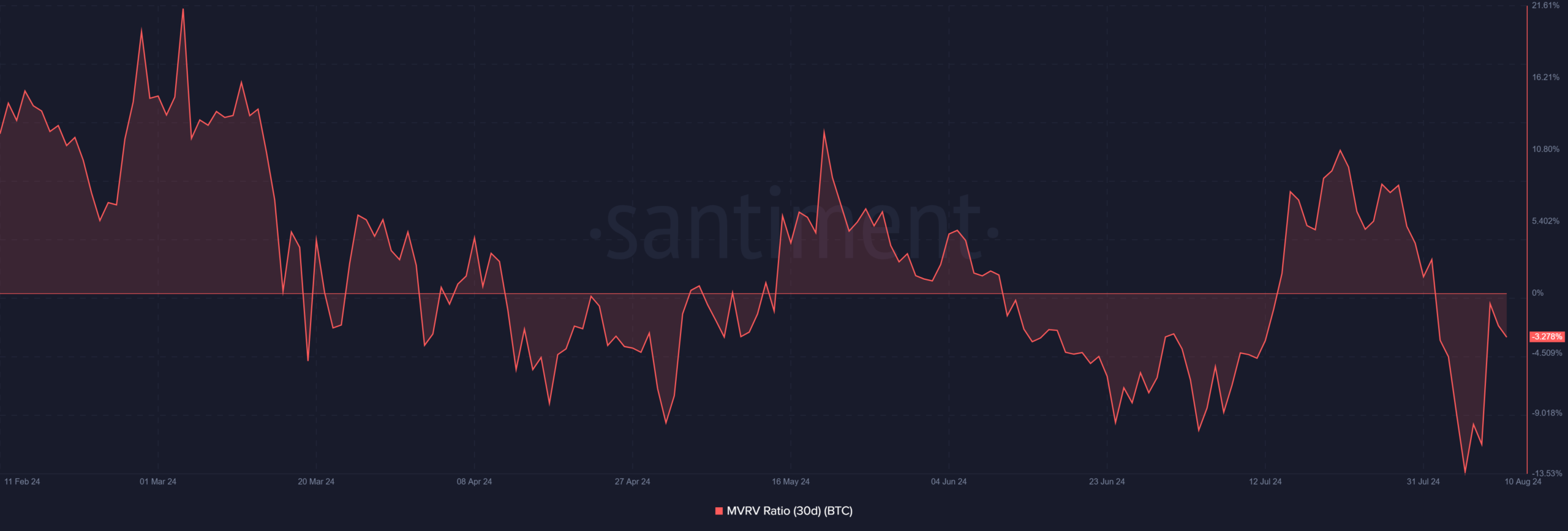

MVRV shows a negative trend

Finally, an analysis of the MVRV ratio chart showed that Bitcoin’s 30-day MVRV was -3.278% at the time of writing.

This indicates that the average holder has suffered a loss in the past month. This negative value also means that BTC may be undervalued as holders maintain prices lower than their purchase costs.

Source: Santiment

– Read Bitcoin (BTC) price prediction 2024-25

Historically, such low MVRV levels have often been seen as potential buying opportunities. The chart is consistent with the recent trend of large investors accumulating Bitcoin during market downturns.

Overall, this means that current market sentiment may be shifting towards accumulation in anticipation of a future price recovery.