- AAVE has a bearish structure and neutral momentum.

- Short-term holders have likely magnified the price decline through profit-taking, and accumulation has not yet resumed.

Aaf [AAVE] was well-positioned in the DeFi sector and could handle decentralized liquidations effectively. This generated $6 million in sales overnight.

The protocol also had milestones in July, such as the proposed introduction of a ‘fee switch’.

On the price front, AAVE appeared to hold its own despite market-wide losses earlier this month. This idea was thrown out the window during the sale on Monday, August 5.

What is the outlook for the token as of now?

AAVE maintains a bearish promise

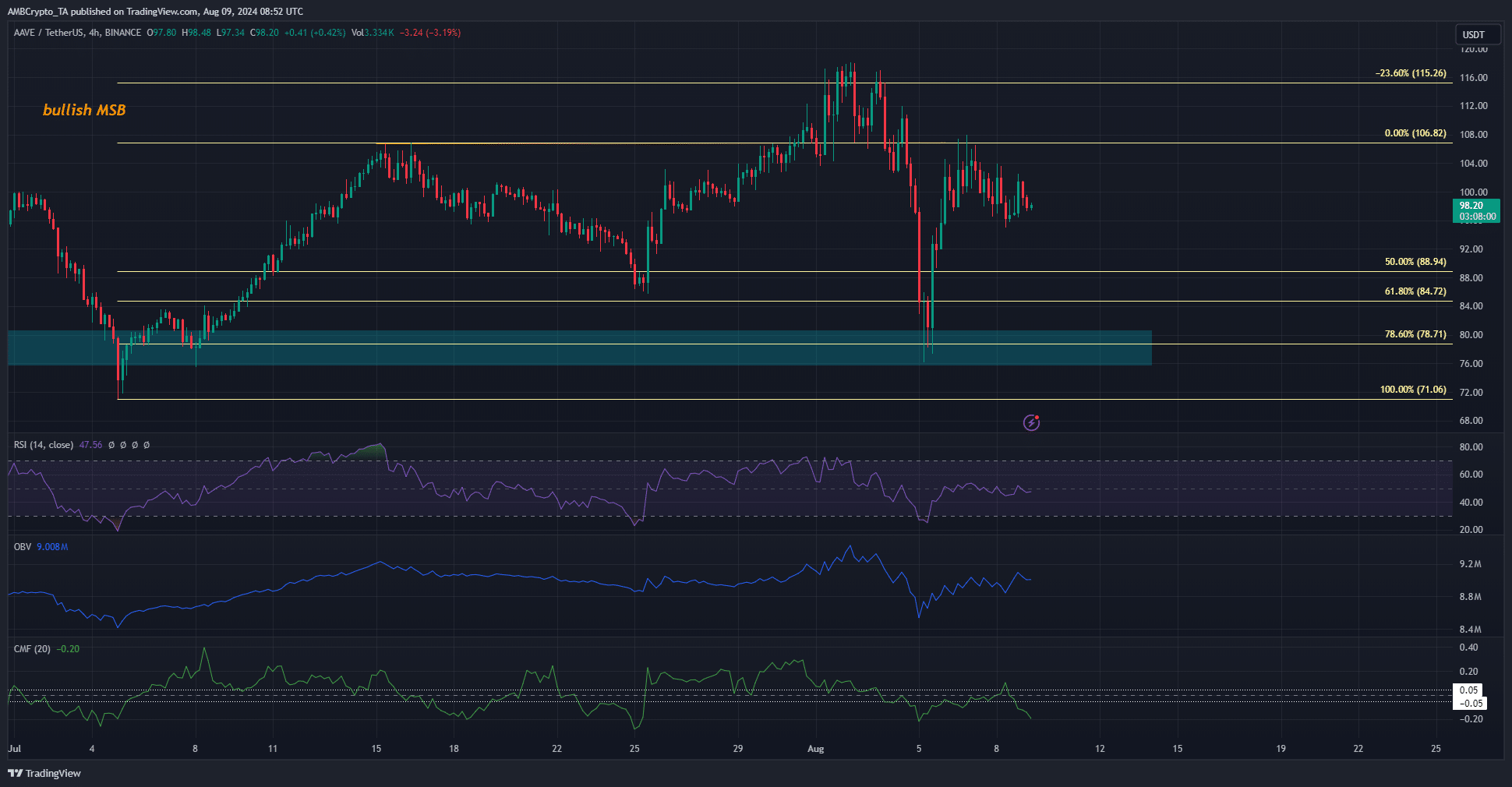

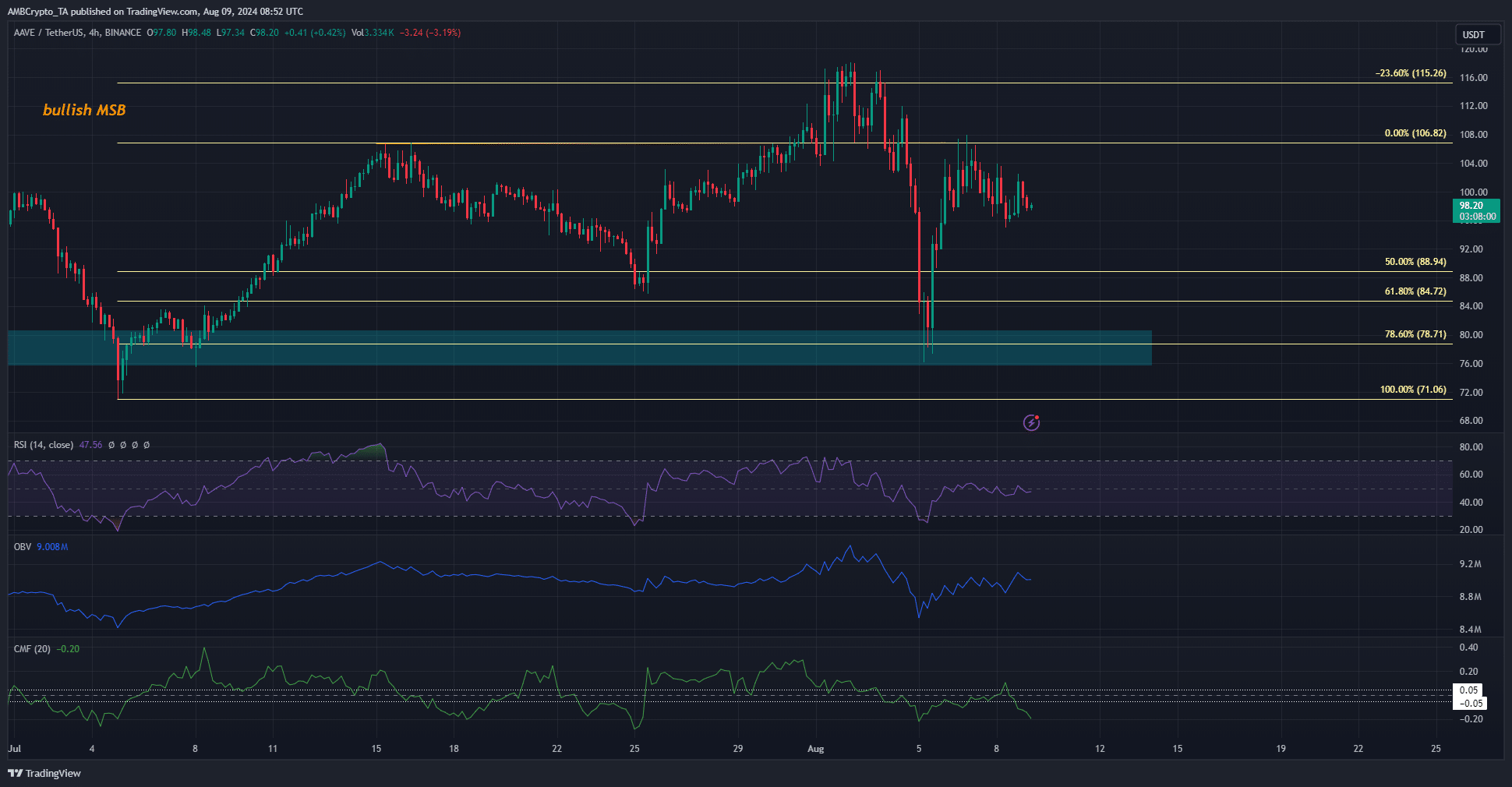

Source: AAVE/USDT on TradingView

AAVE’s market structure remained bearish on the 1-day chart. It fell to the 78.6% Fibonacci retracement level at $78.71 and bounced to the $106 level.

However, it was unable to reach a new high, and the rejection instead created a lower high.

The daily RSI has been hovering around the neutral 50s in recent days, indicating that momentum was not yet in the bulls’ favor.

The OBV has been on an upward trend since August 5, but the CMF fell to -0.2, signaling heavy capital flows from the market.

AAVE metrics signaled volatility and distribution

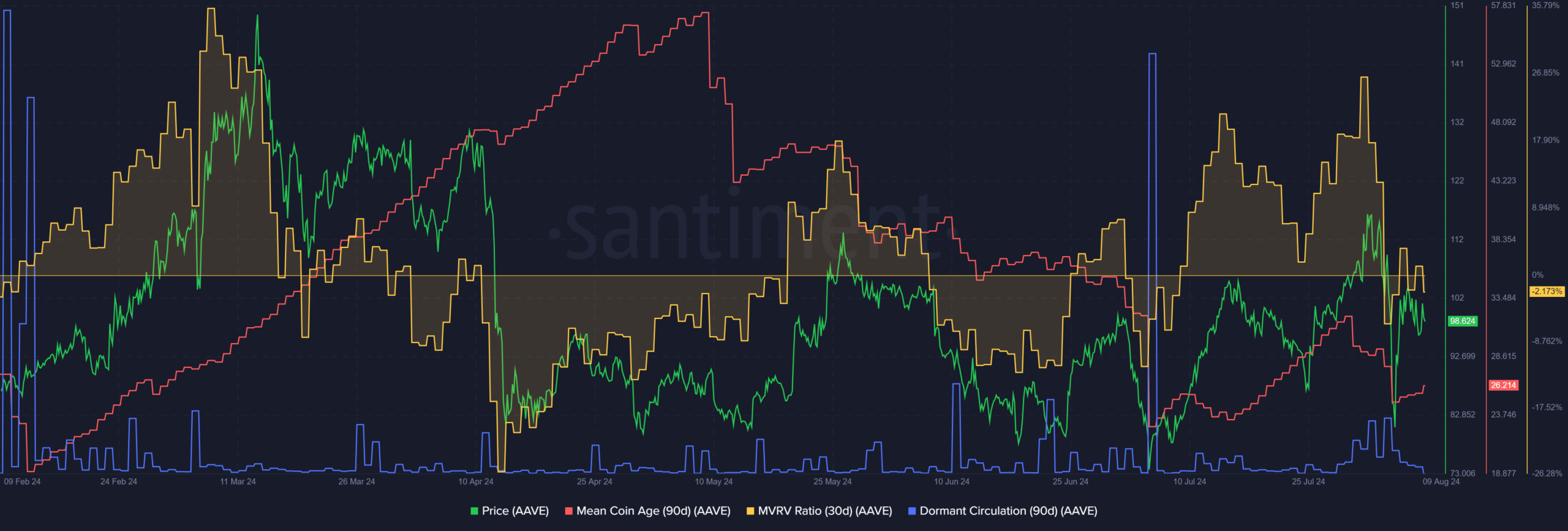

The MVRV ratio fell from almost 30% to -2%, showing that short-term holders made profits before the price fell below $100. During the price drop, dormant circulation experienced a revival.

Together this indicated that the holders had cashed out and likely taken profits. This idea was also supported by the decrease in the average coin age (MCA), which showed an AAVE distribution.

The MCA should go higher to indicate that buyers were accumulating the token.

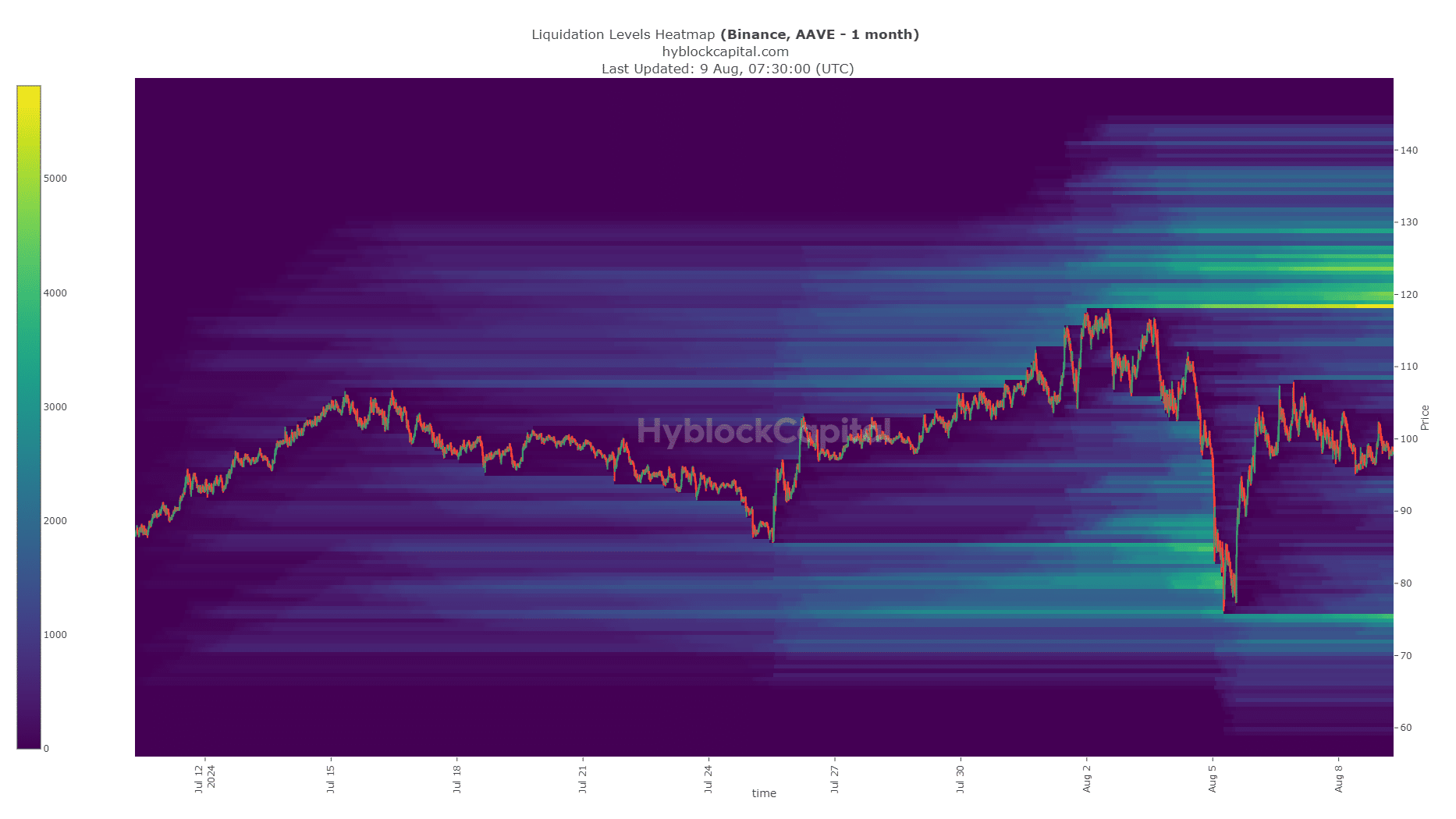

The liquidation heatmap highlighted a short-term target of $108.5, and a much stronger liquidity pool of $118-$120. This could serve as a short-term target for the AAVE token before a pullback.

Realistic or not, here is AAVE’s market cap in BTC terms

Overall, this is a show of relative strength against Bitcoin [BTC] was quickly destroyed, which did not strengthen investor confidence.

Still, the protocol’s performance during this network stress period has been positive and could be reflected in AAVE prices once market sentiment starts to change.