- Bitcoin’s market cycle bottom ROI has hit a new low, signaling the start of a bullish cycle.

- There was a massive liquidation above $72,000 when MicroStrategy completed a stock split.

The return on investment (ROI) from the bottom of the last Bitcoin [BTC] The market cycle has reached a new low. In addition, Bitcoin’s win rate also fell to the lowest level since October 2023.

When prices surpassed $54,000, 71% of holders made a profit. The last time this happened, Bitcoin cost $28,000.

So the market has cooled from overheated levels to yearly lows, but at double the previous price. This phase in the Bitcoin market cycle matches typical patterns from previous cycles.

Understanding the current cycle can help investors make better decisions as history indicates we are on track. Staying informed and flexible is crucial as the market changes.

Source: IntoTheCryptoVerse

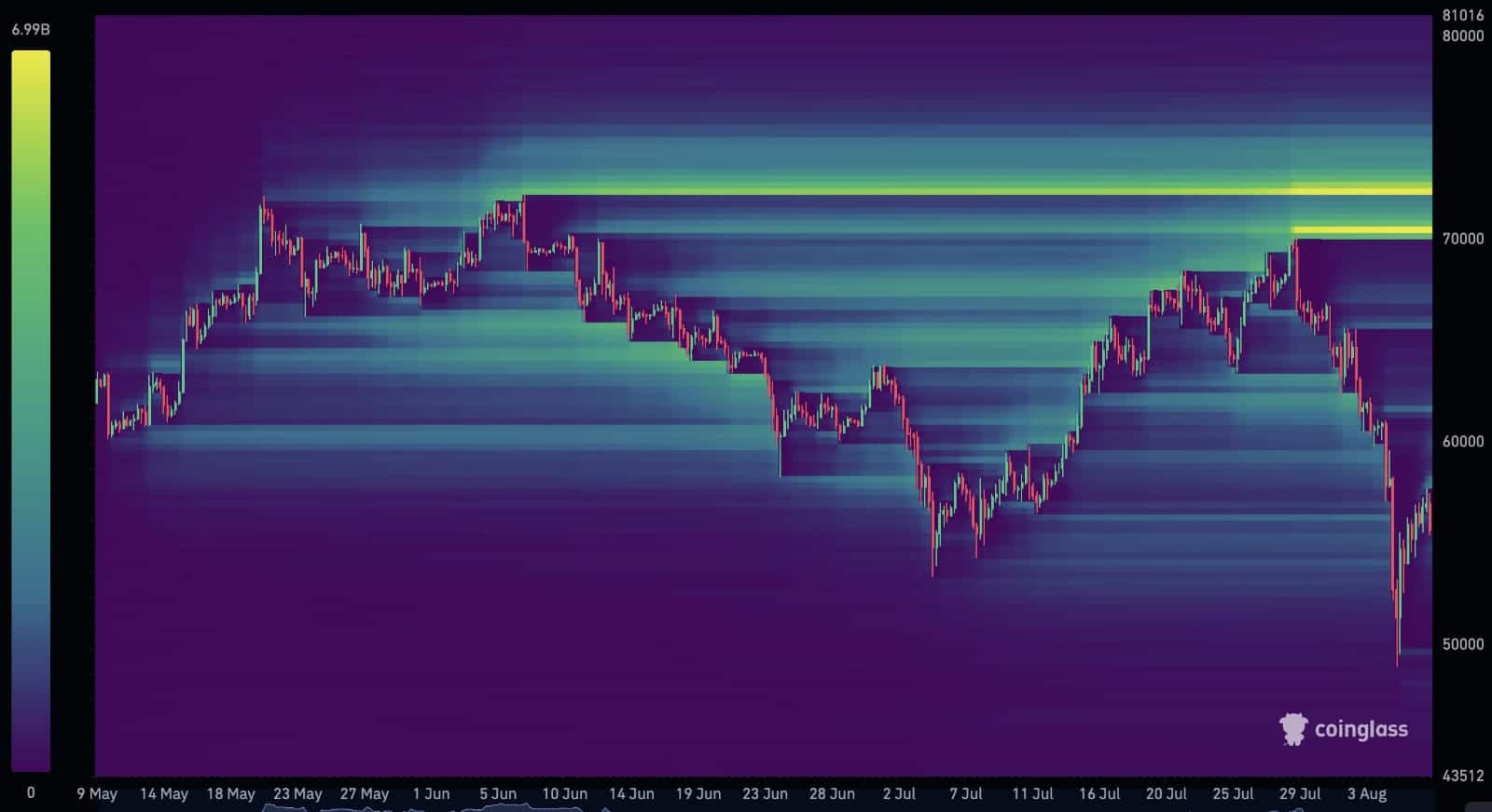

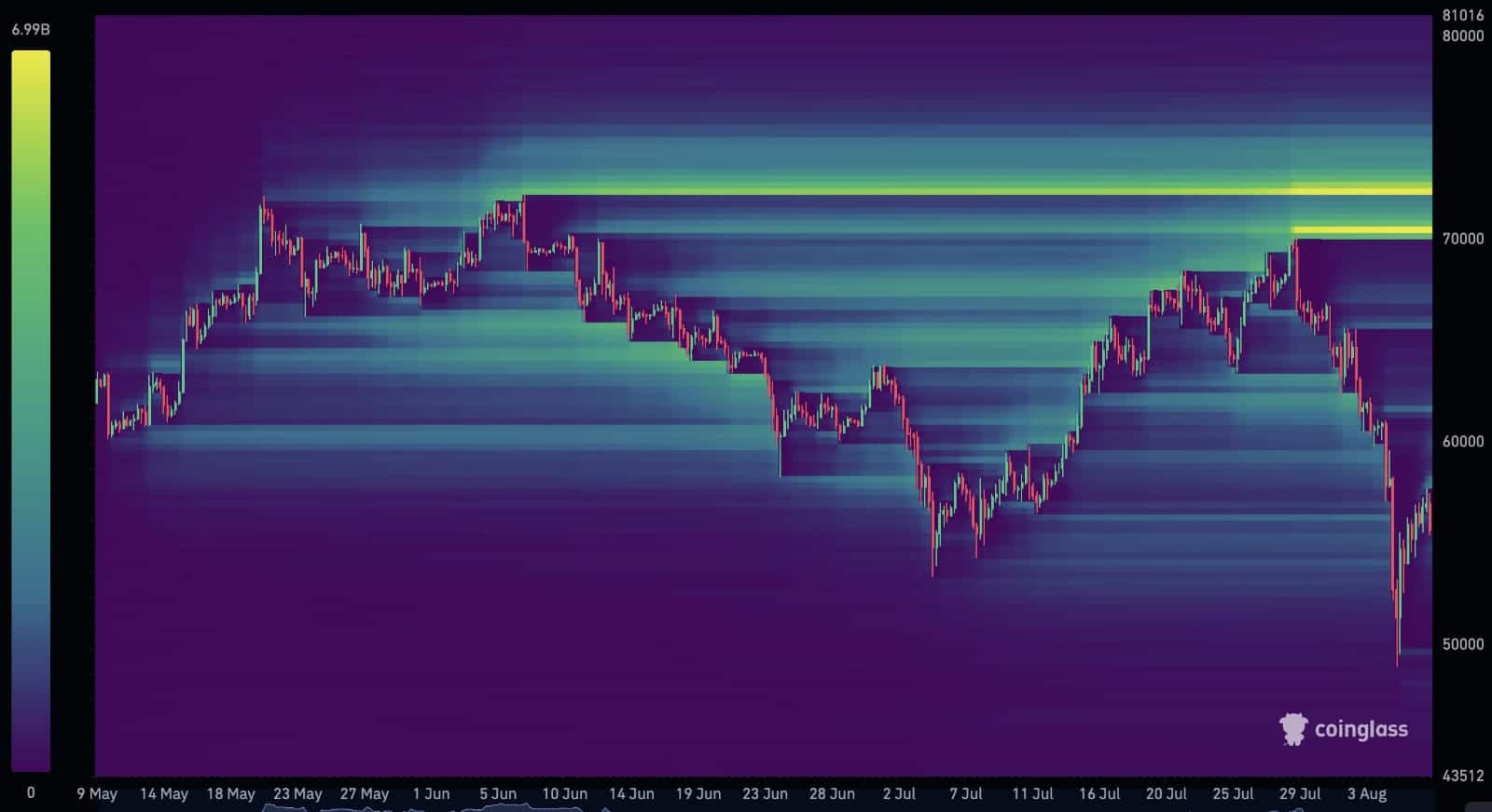

Huge liquidation above $72,000

According to AMBcrypto’s look at Coinglass data, more than $15 billion worth of short Bitcoin positions between $70,000 and $72,000 will be liquidated.

This suggests that the next Bitcoin market cycle could begin soon as the price approaches the critical resistance level at $72,000.

Traders and investors should keep a close eye on this metric as it could influence decisions on their long-term views on Bitcoin, which appeared bullish at the time of writing.

Source: Coinglass

Bitcoin’s bull flag still holds

Bitcoin’s bull flag pattern remained intact at the time of writing. The longer it lasts, the greater the chance of a significant outbreak. If the pattern continues to consolidate, we could see a big price increase.

This is an exciting time for those following Bitcoin. The best-case scenario in this situation would be for Bitcoin to break the $72,000 mark, indicating strong upside momentum.

Source: TradingView

MicroStrategy completes stock split

Additionally, MicroStrategy recently completed a 1:10 stock split, making the stock 10 times more accessible to investors noted.

The company plans to sell $2 billion worth of shares to invest more in Bitcoin and support its business.

Is your portfolio green? Check out the BTC profit calculator

This move can be a great opportunity to diversify your portfolio. While a stock split doesn’t change the fundamental value of the company, it can make the shares feel more affordable.

The market’s recent recovery has boosted shares of Coinbase and MicroStrategy, with gains of 7.5% and 9%, respectively.

Source: Crypto Rover on X