- BlackRock bought ETH worth $109.9 million, spurred by the latest price drop.

- Some slight accumulation has been seen, especially in whales, but retail is still scary.

Featuring the latest discounted Ethereum [ETH] prices, you would expect buyers to return to the market.

Unless there was an expectation that there would be more pressure on the sell side in the coming days. ETFs have increased the demand for ETH, which is why it is essential to track their activity.

Recent data indicated that the bears were pulling back after their aggressive attack on the market last week. A little bit of Bitcoin [BTC] ETFs are taking advantage of this, such as BlackRock, which bought ETH worth $109.9 million on August 6.

This was a significant increase, compared to the amount Blackrock had purchased the day before.

Source: farside.co.uk

Blackrock had previously halted accumulation on August 2 as selling pressure increased. It resumed on August 5, adding $47.1 million to ETH.

There was net buying pressure of $98.4 million that day, compared to $48.8 million the day before.

This increase over the past two days signals the return of confidence after the recent crash. It also indicates that the ETFs are benefiting from the ETH price discount.

Nevertheless, most other ETH ETFs have been on the sidelines or adding smaller amounts.

The most notable at the other end of the spectrum was the Grayscale ETHE ETF, which saw outflows. It also happens to be the ETF with the highest annual fee at 2.5%.

It contributed $39.7 million in selling pressure during the August 6 trading session.

Outflows have decreased significantly compared to the last week of July, indicating that there is no interest in selling at discounted prices.

Is ETH Accumulation Gaining Ground?

ETH has undoubtedly experienced a resurgence of selling pressure over the past two days. But how much buying pressure is there right now?

We compared the ETH concentration before and after the crash, and this is what we found.

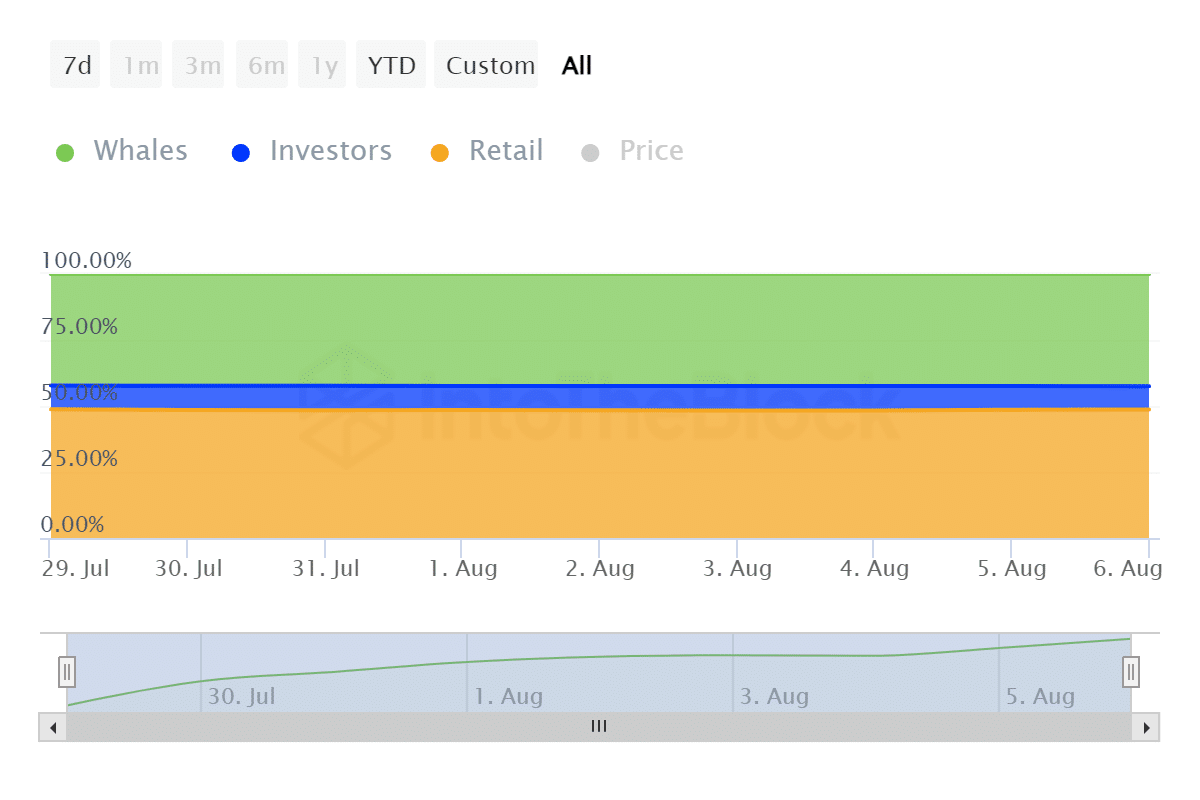

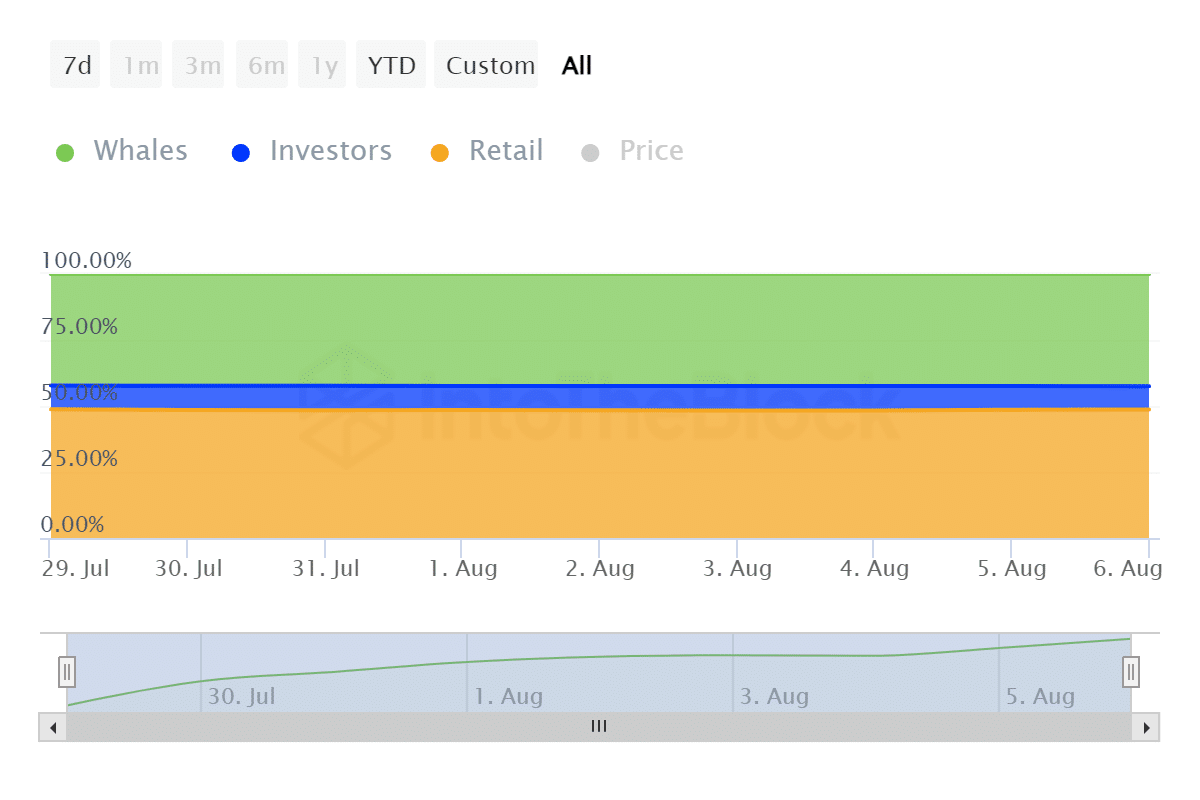

Just seven days ago, whales owned 56.66 million ETH, investors owned 12.2 million ETH, and retailers owned 65.43 million ETH. This represented 42.19%, 9.09% and 48.72% respectively.

The latest data shows that whales held 57.13 million ETH, investors held 11.93 million ETH, and retail held 65.39 million.

Source: IntoTheBlock

The above findings indicated that whales expanded their holdings during the dip. Investors and retail traders held less ETH at the time of writing than they did a week ago.

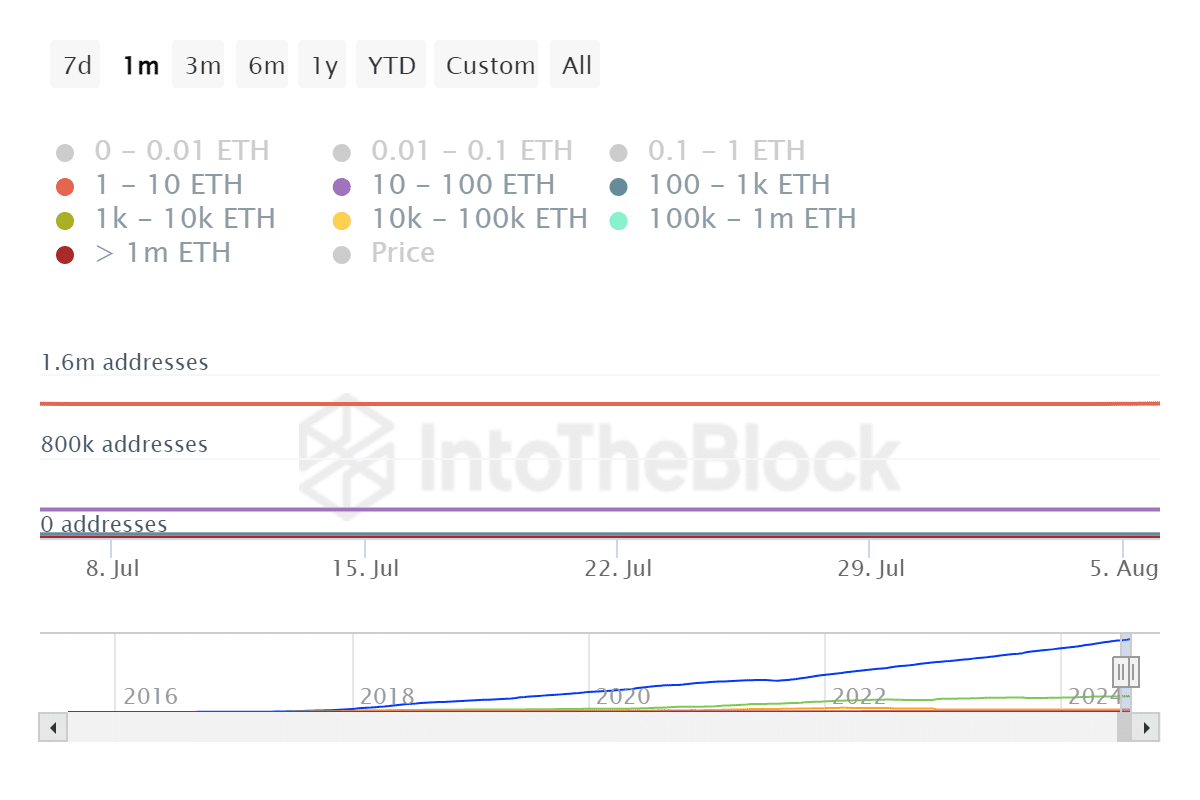

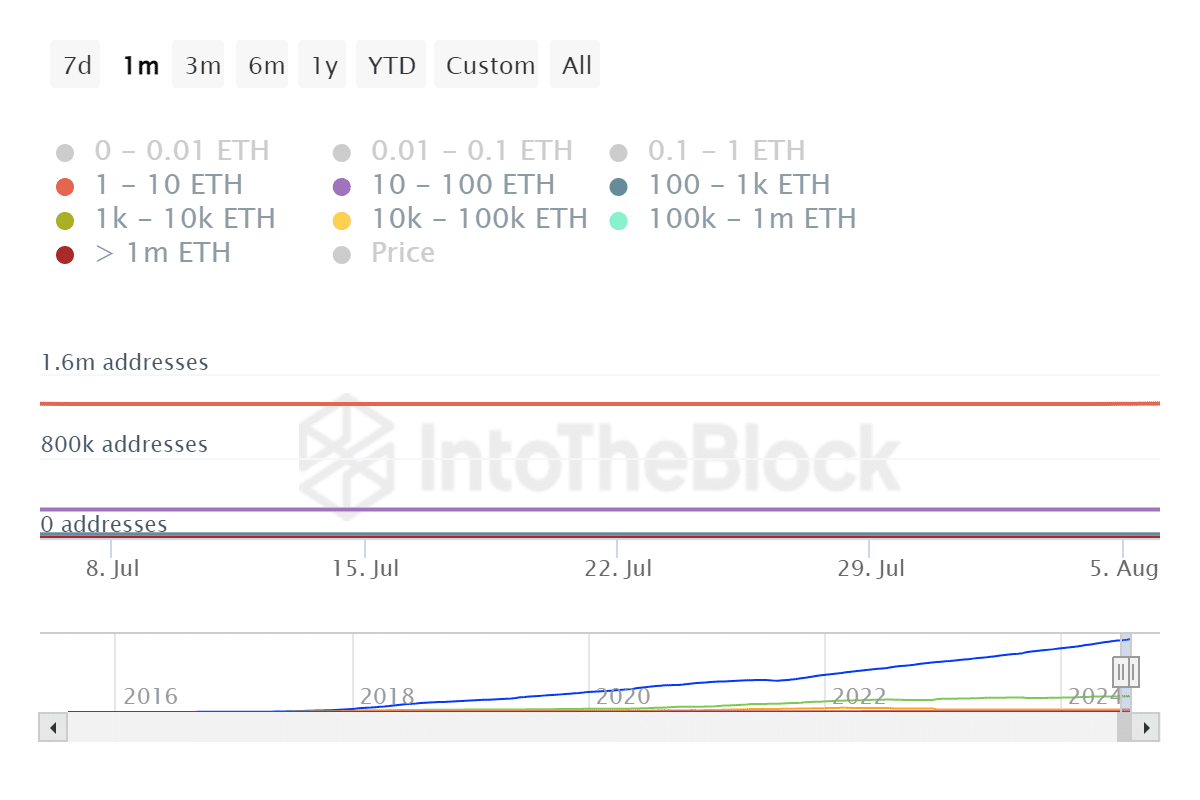

We also decided to examine address data to determine which class of whales were gathering.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price forecast 2024-25

Our findings showed that there were five addresses that held more than 1 million ETH in the last 30 days. Addresses holding between 100,000 ETH and 1 million ETH dropped from 93 to 92.

Those in the 10,000 to 100,000 ETH range dropped by 32 addresses. The category of addresses with between 10 and 100 ETH had a net positive result from 281,750 addresses to 282,530 addresses.