- BNB Chain has seen incredible network traction, reaching 463.7 million unique addresses.

- Overall, weak sentiment could drag BNB to $500 or lower.

The Binance [BNB] chain has maintained the lead in key network growth, ranking first in total unique addresses in August. According to recent factsthe chain’s unique addresses reached 463.7 million.

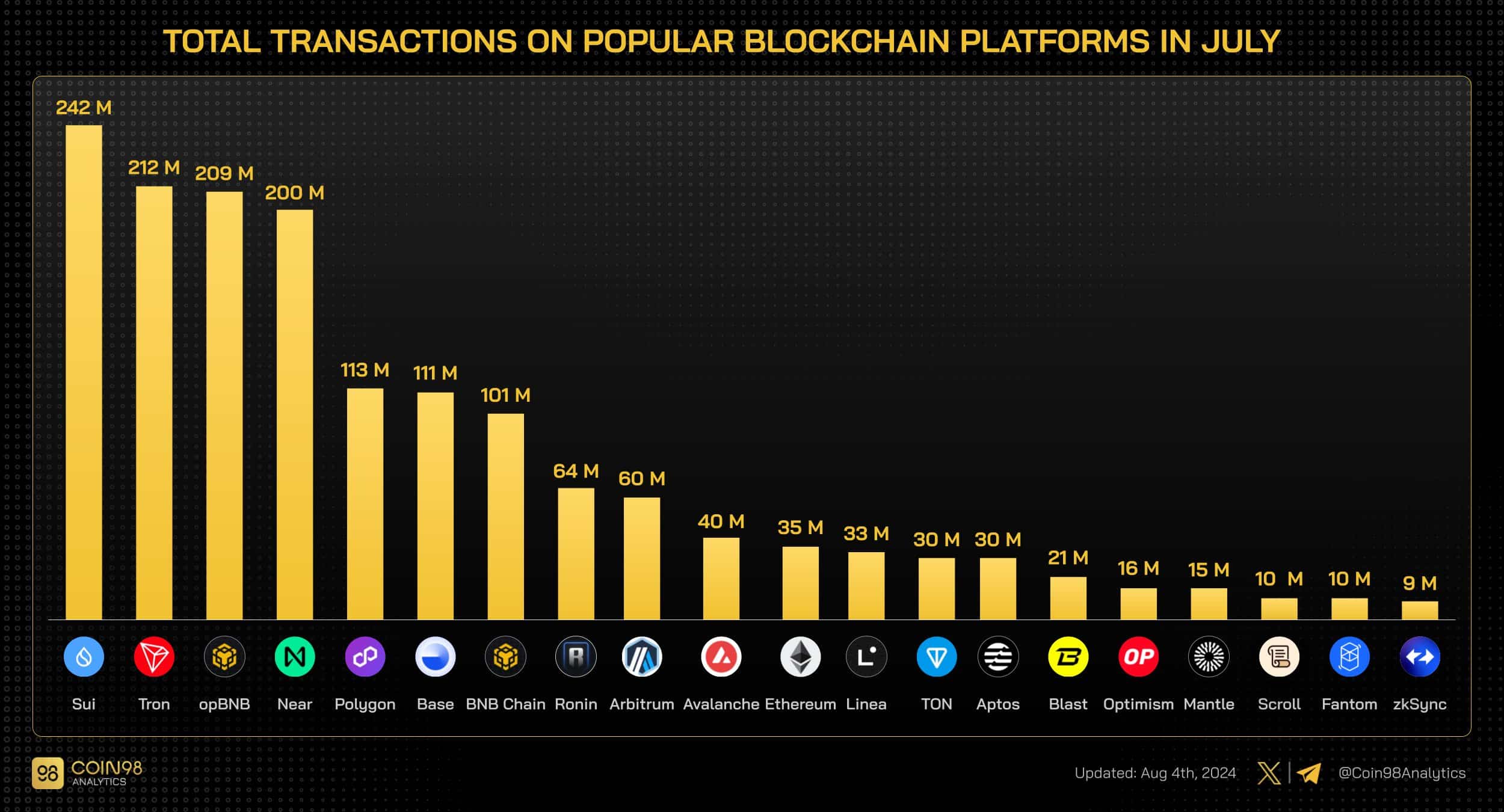

The chain also ranks fourth in terms of total number of transactions, with 209 million transactions in July.

Source: Coin98

This indicated increased network traction, which is not surprising given the chain’s active Binance Launchpool and Launchpad projects. Interestingly, an uptick in the Binance network also coincided with June’s record price of $721.

How has the recent network traction affected BNB’s price performance?

BNB price analysis

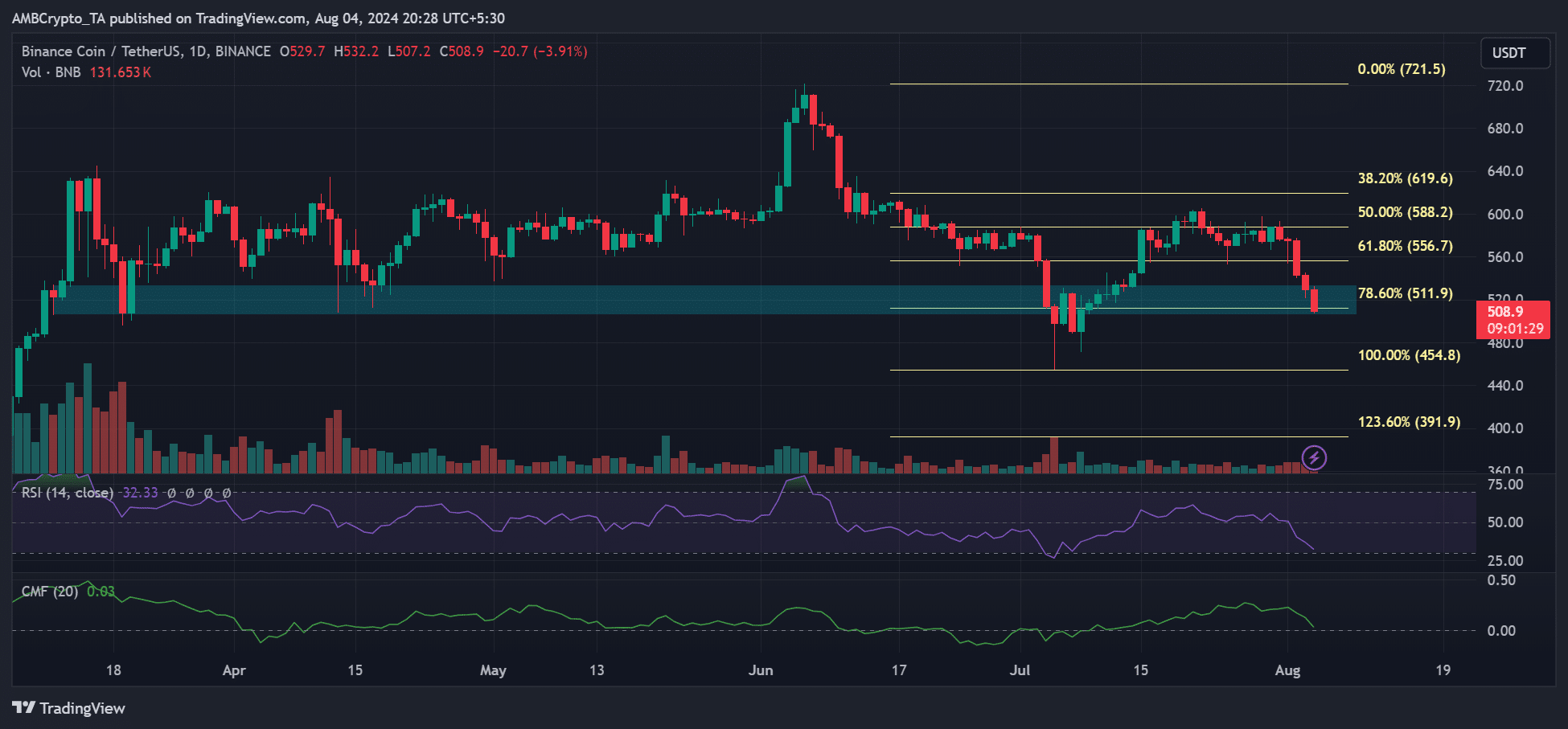

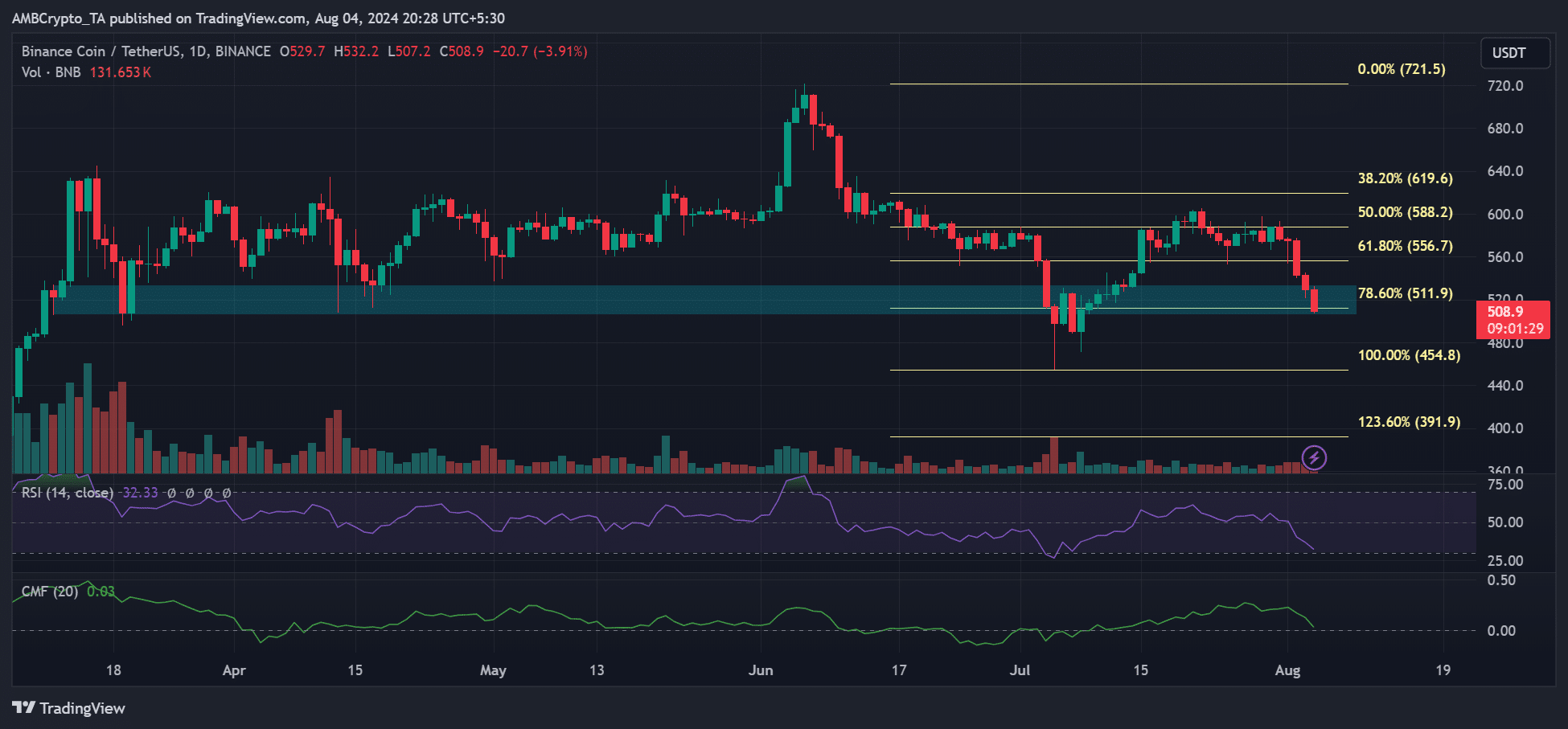

Source: BNB/USDT, TradingView

In the past week, BNB lost more than 12%, falling from $598 to almost the psychological level of $500.

BNB’s downward pressure was part of a market-wide bloodbath caused by fears of the US recession and tensions in the Middle East.

As such, recent network traction failed to alleviate BNB’s recent price dump. If the carnage continues, BNB could break the daily order block, marked in cyan, above $505.

Should support break, BNB could be dragged to the July low of $454.

Interestingly, the RSI (Relative Strength Index) has fallen into oversold territory, meaning selling pressure could peak and reverse.

Similarly, the CMF (Chaikin Money Flow) fell but had not fallen below average levels, indicating that outflows from the BNB markets were increasing.

However, if the price does not fall below the average level, especially if market sentiment improves, this could be a sign of a likely price reversal.

Status of the futures market

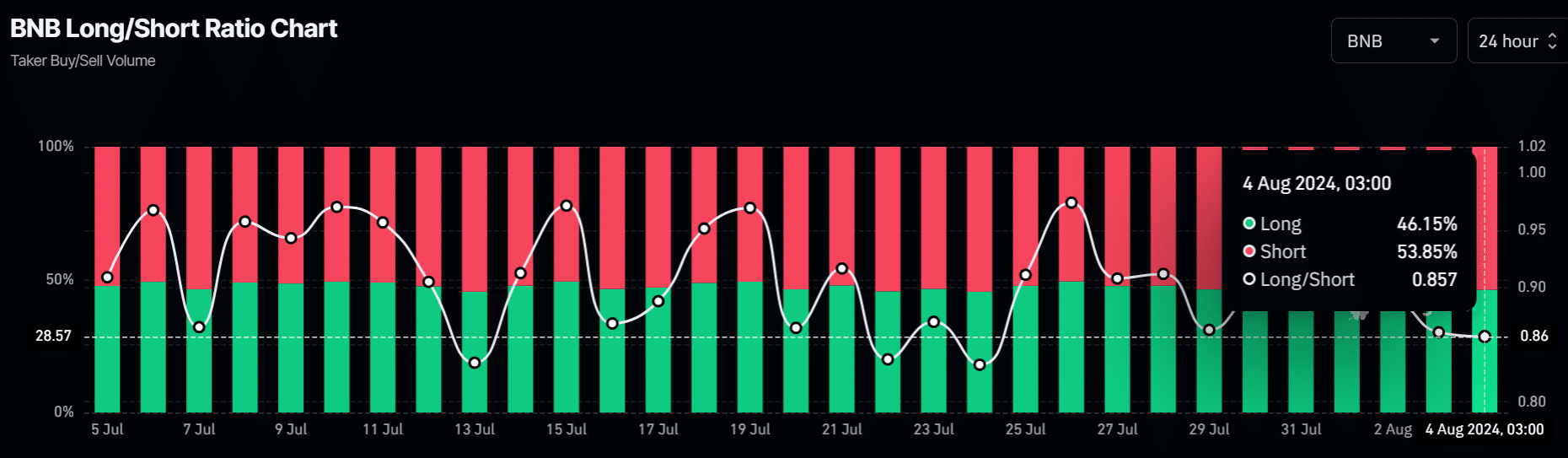

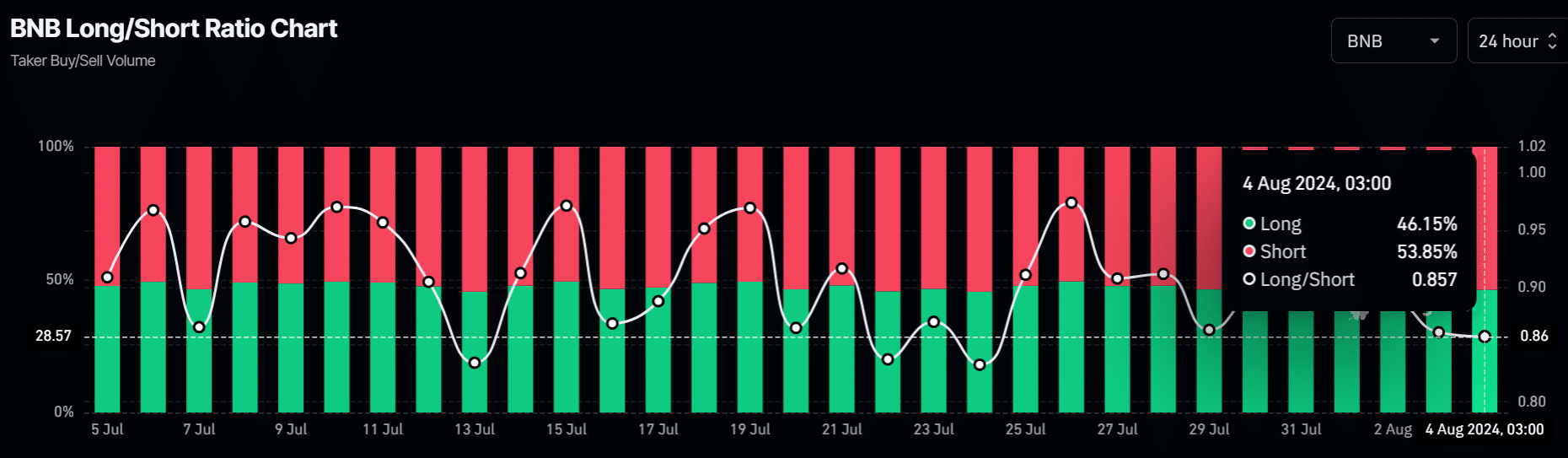

Similar to the massive dump in the spot markets as evidenced by the price charts, the futures markets were also bearish on BNB. At the time of writing, 53.8% of leveraged traders were short the altcoin, compared to 46% of speculators who went long.

Source: Coinglass

Meanwhile, reports claim that tensions in the Middle East could escalate on August 5. If so, the crypto market would react to the developments.

That said, there was extreme fear in the market, which under normal circumstances some would see as an opportunity to get in on the carnage.

However, measuring developments in the Middle East and the US could be crucial before any steps are taken.