- Polkadot inflation sparks debate as DOT continues to tank.

- Some users claim that +10% inflation erodes the value of DOT.

Dot [DOT] has hit the headlines as the debate over alleged high inflation rages. Insiders, who expressed their concerns about Reddit, have called for a change in the network’s inflation rate to increase the altcoin value. One user said:

“Strike rewards are useless to an investor if the currency continues to lose value. The erosion of capital is much greater than the 10% – 14% rewards.”

Another seconded the call, stating that he would rather hold on to his money if it were going to be eroded by DOT inflation.

“I like high betting percentages as much as anyone, but if my DOT continues to lose value versus betting returns… then I’m better off holding cash for the same period.”

Is DOT inflation to blame?

However, another user refuted the strikers’ proposal, stating that the problem is network growth, not inflation.

‘The problem is the adoption of the network, not inflation. If the network grew and people used it, the price would increase. You can reduce inflation to zero and it won’t make any difference.”

For perspective, like Ethereum or Solana [SOL]validators and nominators (less smart players who entrust their DOT to validators) earn rewards for their efforts aimed at securing the Polkadot network.

The rewards range between 8% and 14%, and some believe this is unsustainable for DOT value. Per Polkadot scan factsDOT’s current supply is approximately 1.4 billion tokens, of which almost 60% have been staked.

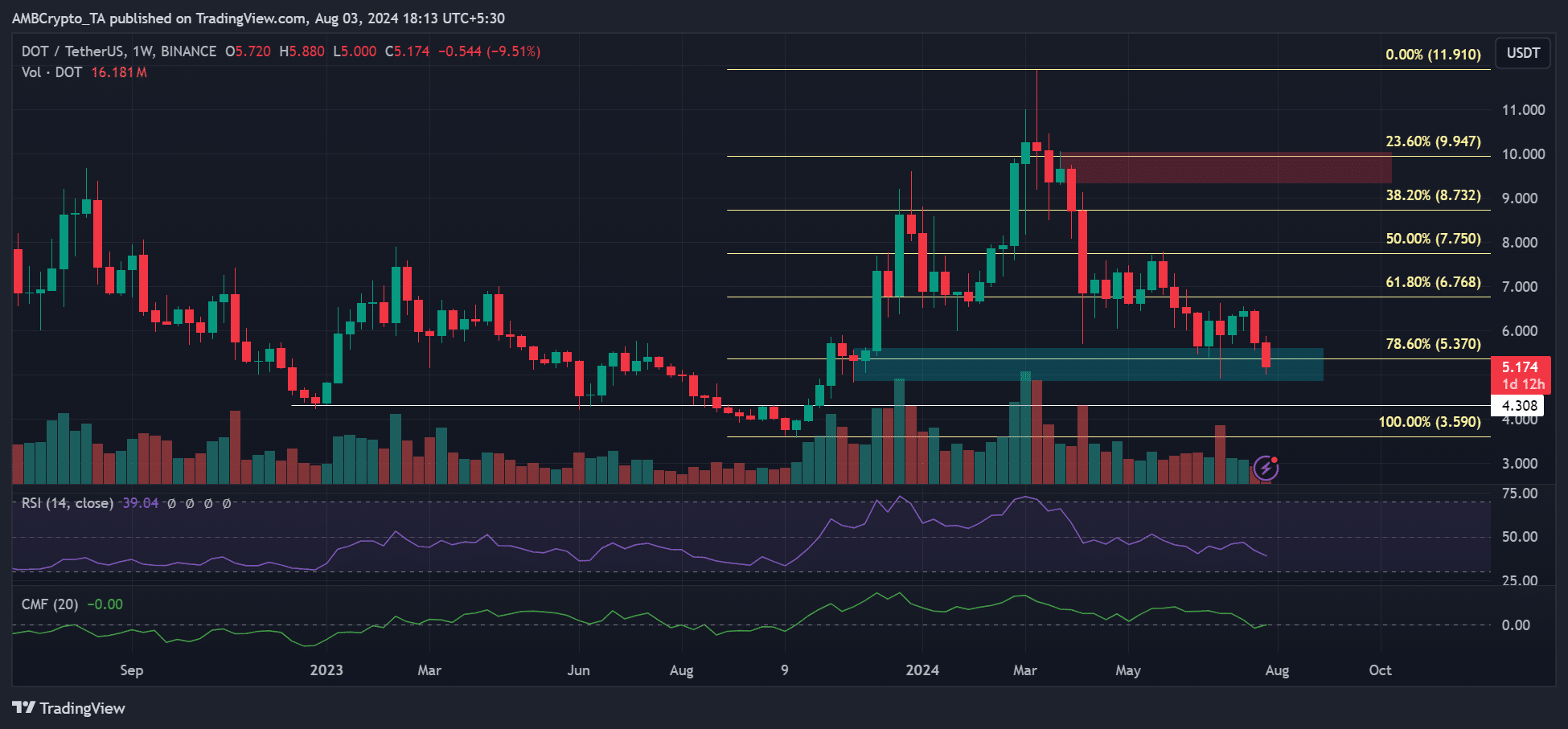

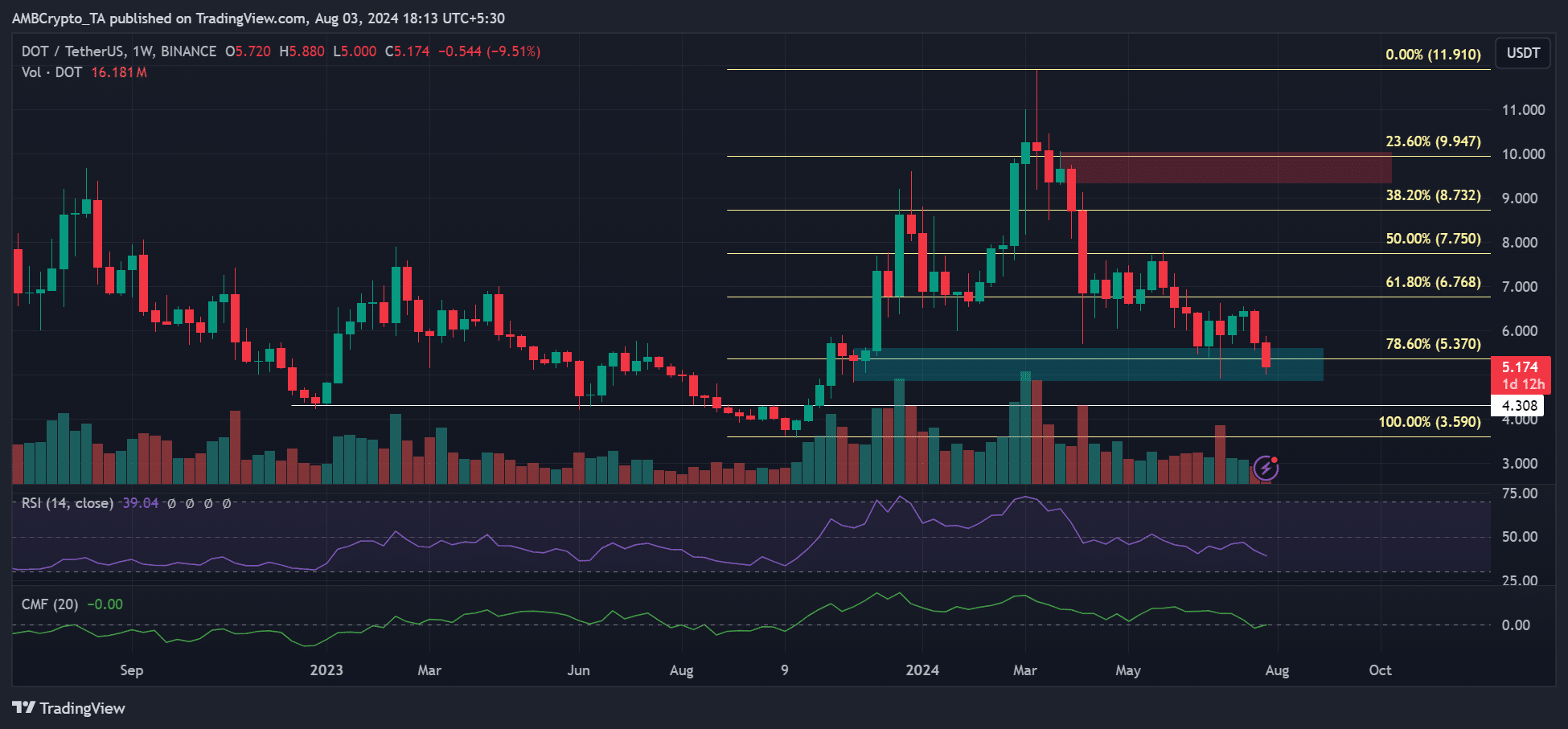

After reaching an all-time high of $11.8 in 2024, the altcoin has lost more than 56% of its value. The price has fallen to $5, exacerbated by market sentiment and inflation. In the last 7 days, 2.8 million DOT tokens have hit the market, worth over $14 million per token unlock facts.

According to a Deribit report from June, downward pressure from inflation on the value was a trend seen across most ETH L2 tokens.

Can DOT rebound?

Now the DOT price has wiped out all 2024 gains and was trading at last November’s values.

Additionally, technical chart indicators on higher timeframe charts underlined a weakening market. The RSI (Relative Strength Index) has been below average since April, underscoring the altcoin’s massive sell-off.

Source: DOT/USDT, TradingView

Some strikers had warned that they would prefer to leave the network if the higher rewards (or inflation) were adjusted or reduced.

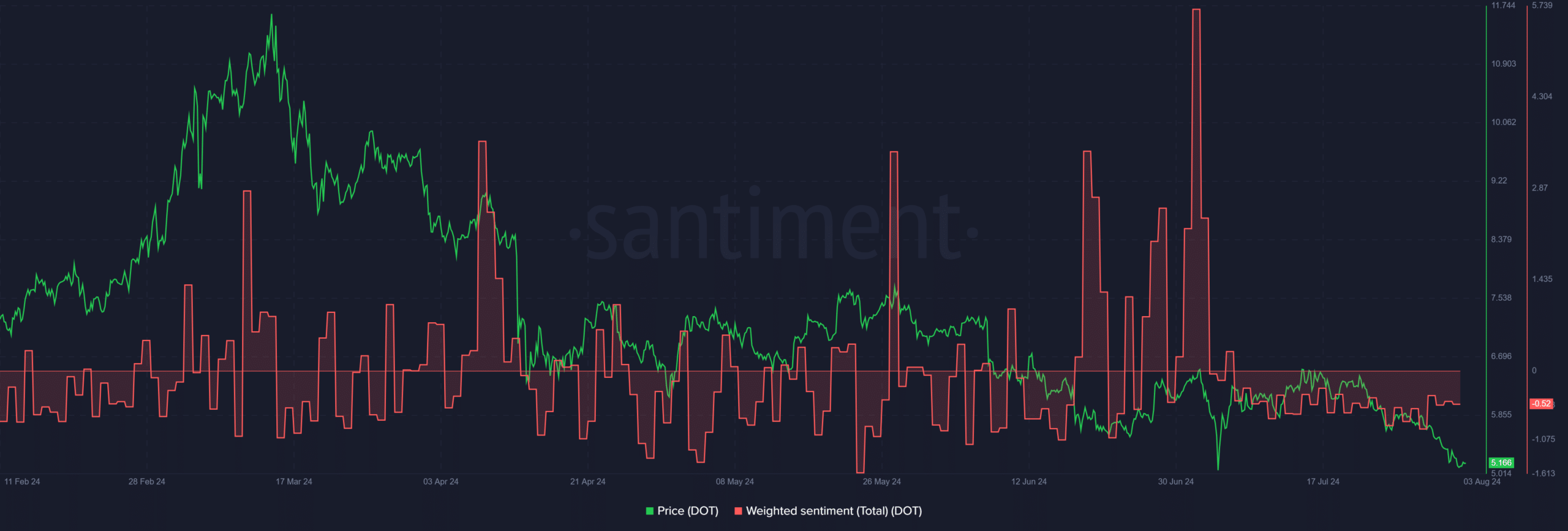

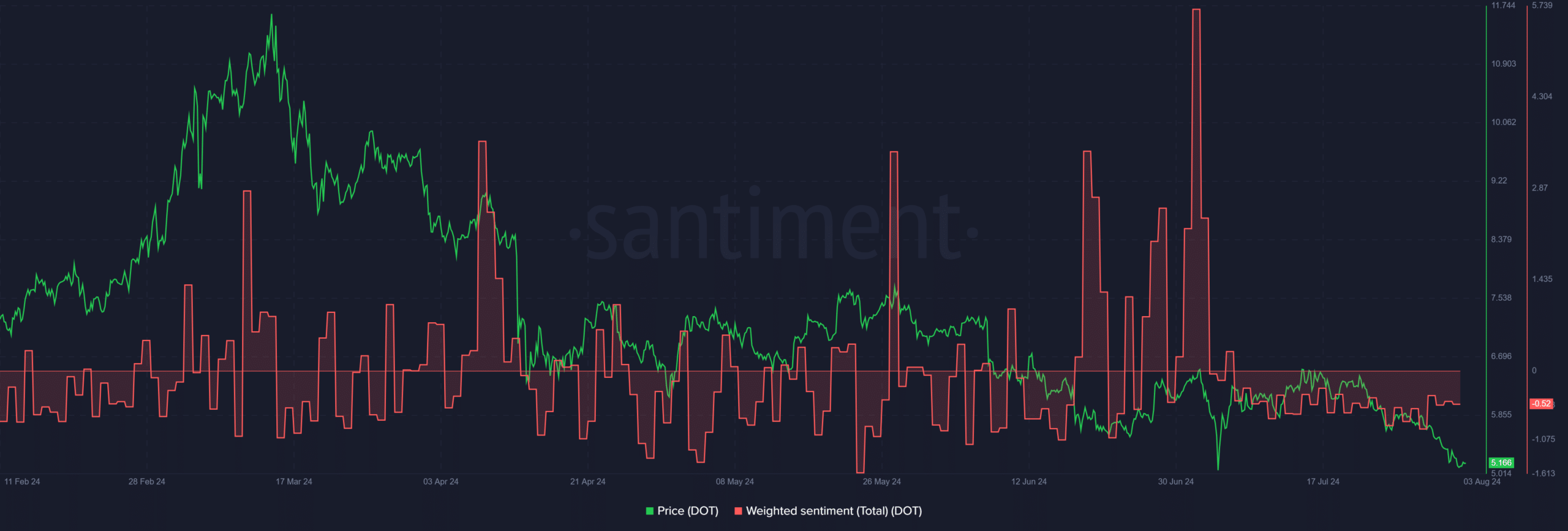

However, overall sentiment on DOT has been negative since April, apart from the end of June. It meant that speculators on the altcoin did not expect any upside potential for DOT.

Source: Santiment

It meant that DOT’s muted price action could be extended unless the ongoing debate reaches an agreement that no longer puts pressure on the altcoin value.