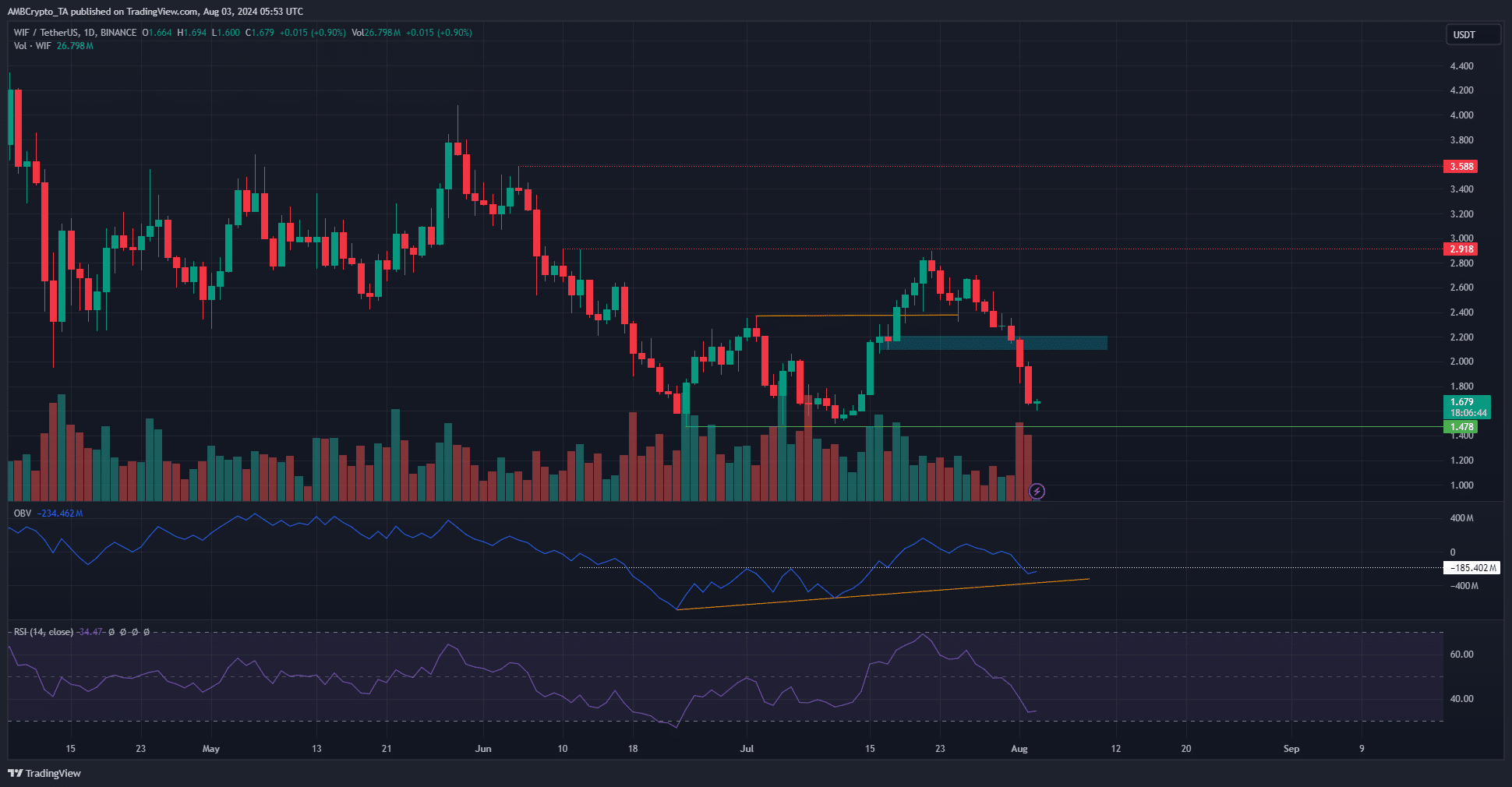

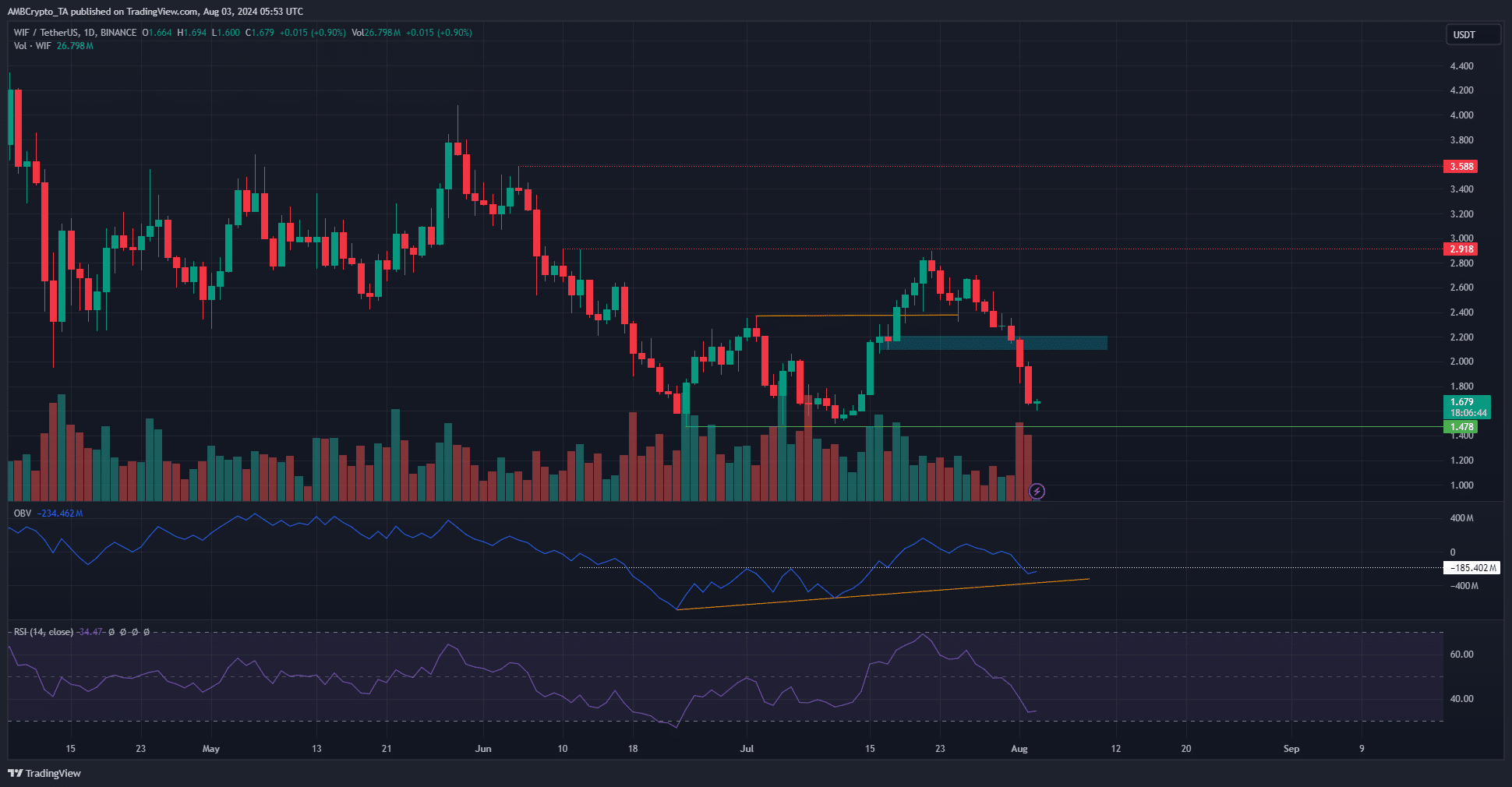

- WIF formed a bearish structure break after falling below $2.32

- Momentum remained bearish, but the OBV gave buyers some hope

dog hat [WIF] recorded a loss of 38.4% last week. It had a bullish outlook two weeks ago when the memecoin bulls hit a bullish structure break. However, Bitcoin [BTC] sharp price losses since Monday, July 29 have hurt the altcoin market.

However, there’s a chance that the recent losses don’t show the whole picture. The volume indicator offered some hope that the recovery would happen quickly. Still, at the time of writing, sentiment was not in favor of the bulls in the short term.

More volatility, but WIF recovery is still possible

Source: WIF/USDT on TradingView

The plunge below the $2.32 and $2.15 levels strengthened WIF’s bearish momentum. The daily RSI fell below the neutral 50 as it cleared the $2.32 level, marking a momentum shift. The value of 34 on the RSI indicated that bears were still dominant.

It seemed likely that the June and July lows of $1.47 would be retested as support. Once the lows are hit, a recovery can happen quickly.

This is because the OBV has shown a higher trend over the past six weeks. At the time of writing, the price was just below the highs of early July. And yet the steady buying volume as prices rose above $2 is not eclipsed by the selling volume over the past ten days.

WIF bulls may hold on to this slight encouragement to faith in the coming days, which will likely lead to losses.

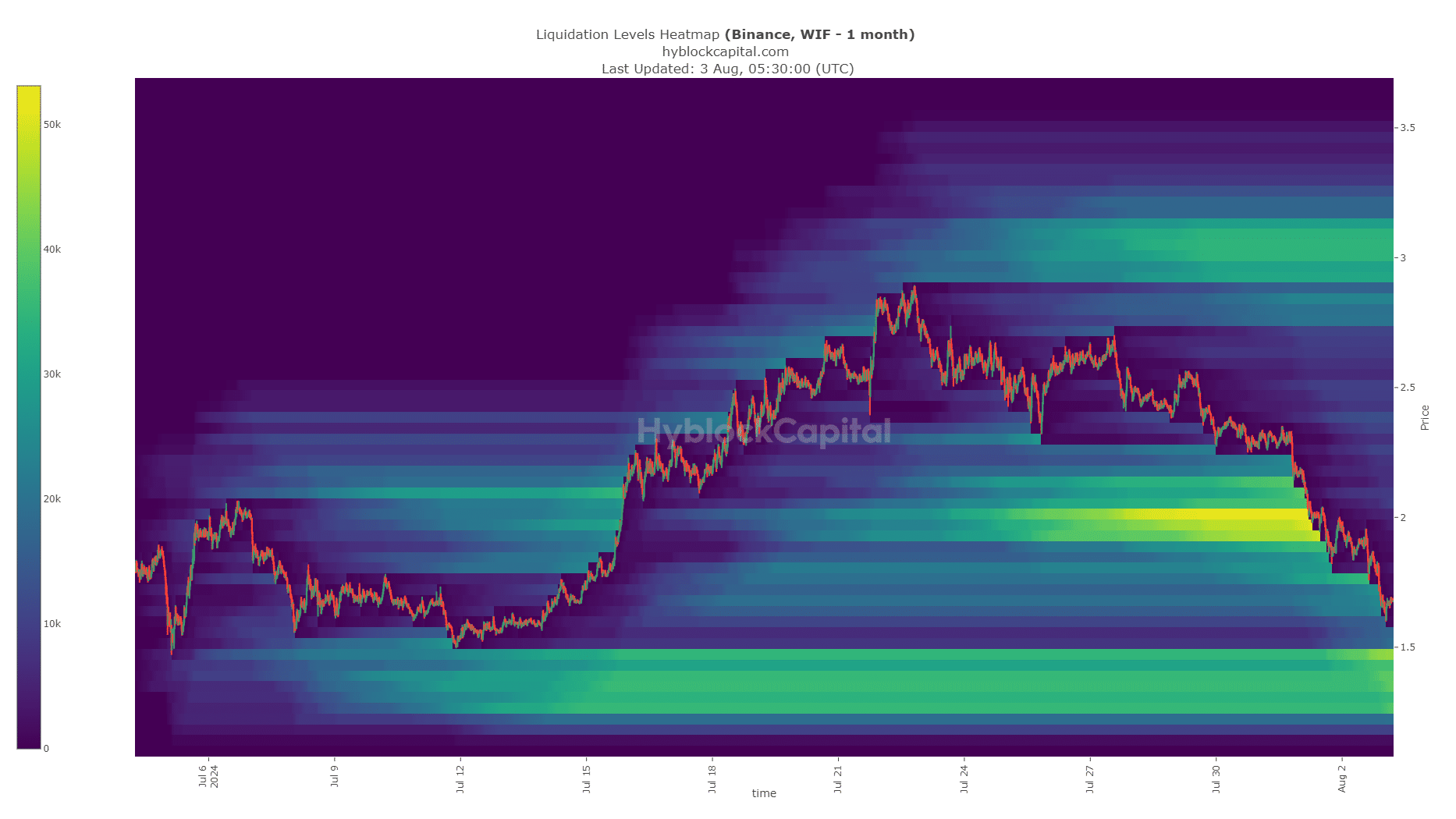

Liquidation heatmap supported price move below $1.5

The large cluster of liquidation levels at $2 failed to keep the bears at bay. The continued negative market sentiment saw WIF fall to the next liquidity pool at $1.4-$1.5.

Realistic or not, here is the market cap of WIF in terms of BTC

This zone coincides with the previously highlighted support level. It is possible that a bullish reversal could begin from this zone, provided Bitcoin manages to hold the $60,000 demand zone.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer.