- XRP entered a relatively high liquidity zone as the recent bull run consolidated.

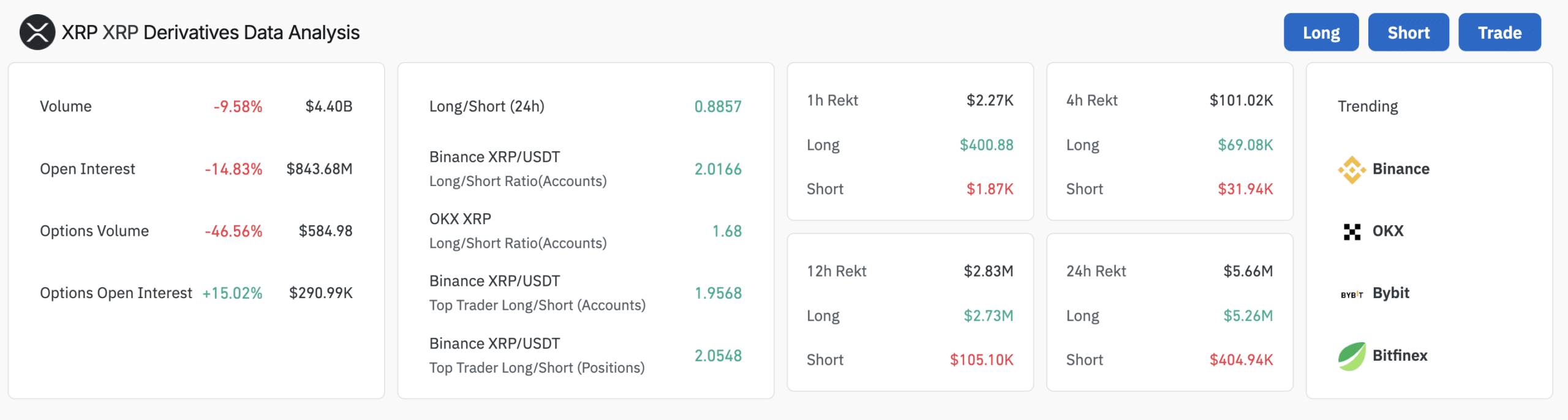

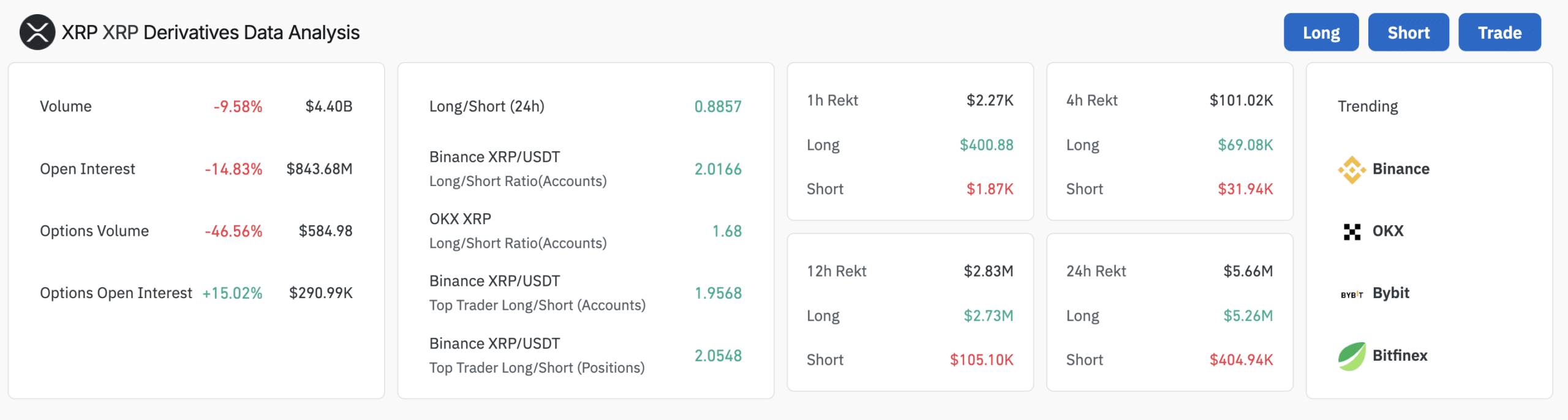

- Altcoin’s long/short ratio on major exchanges showed a slight bullish edge.

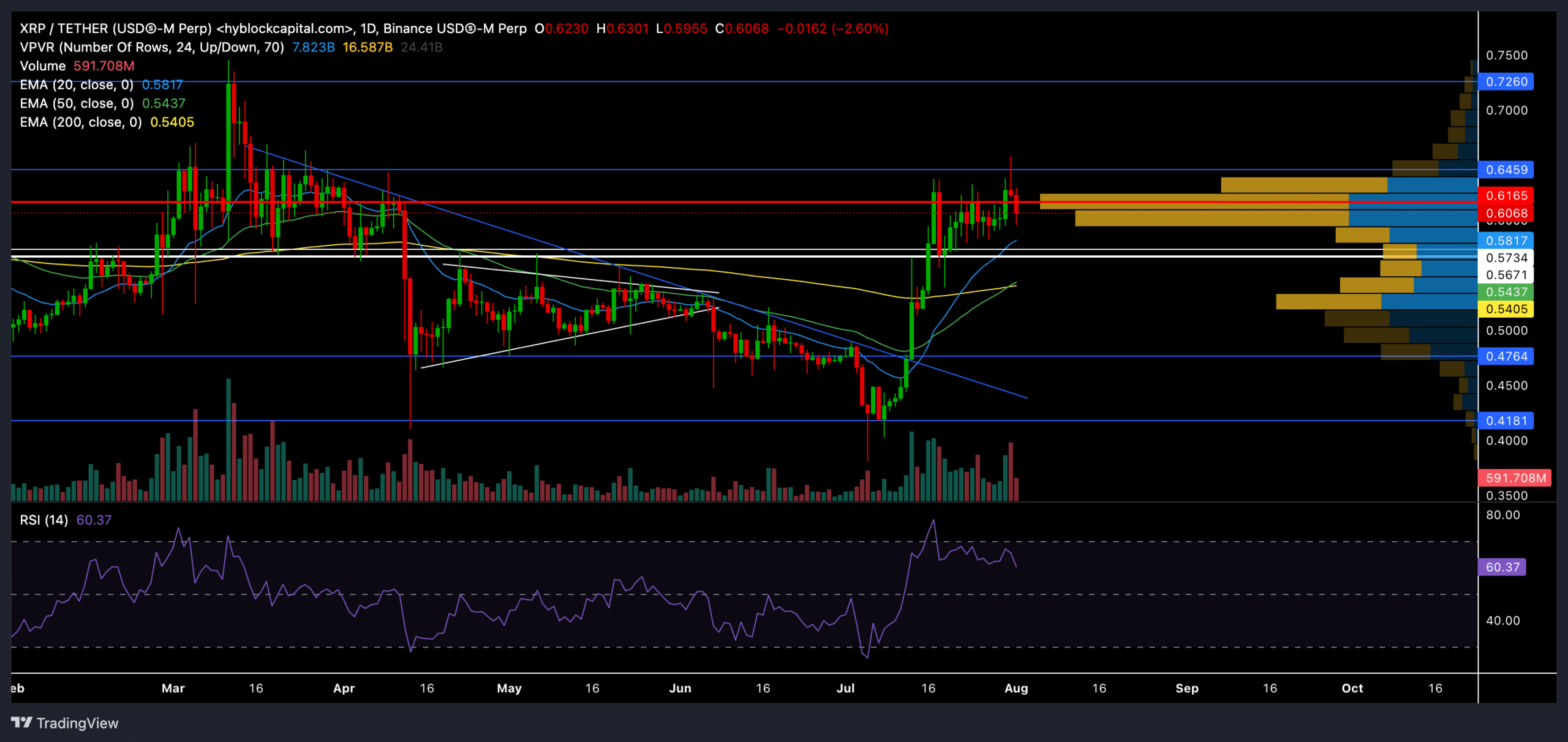

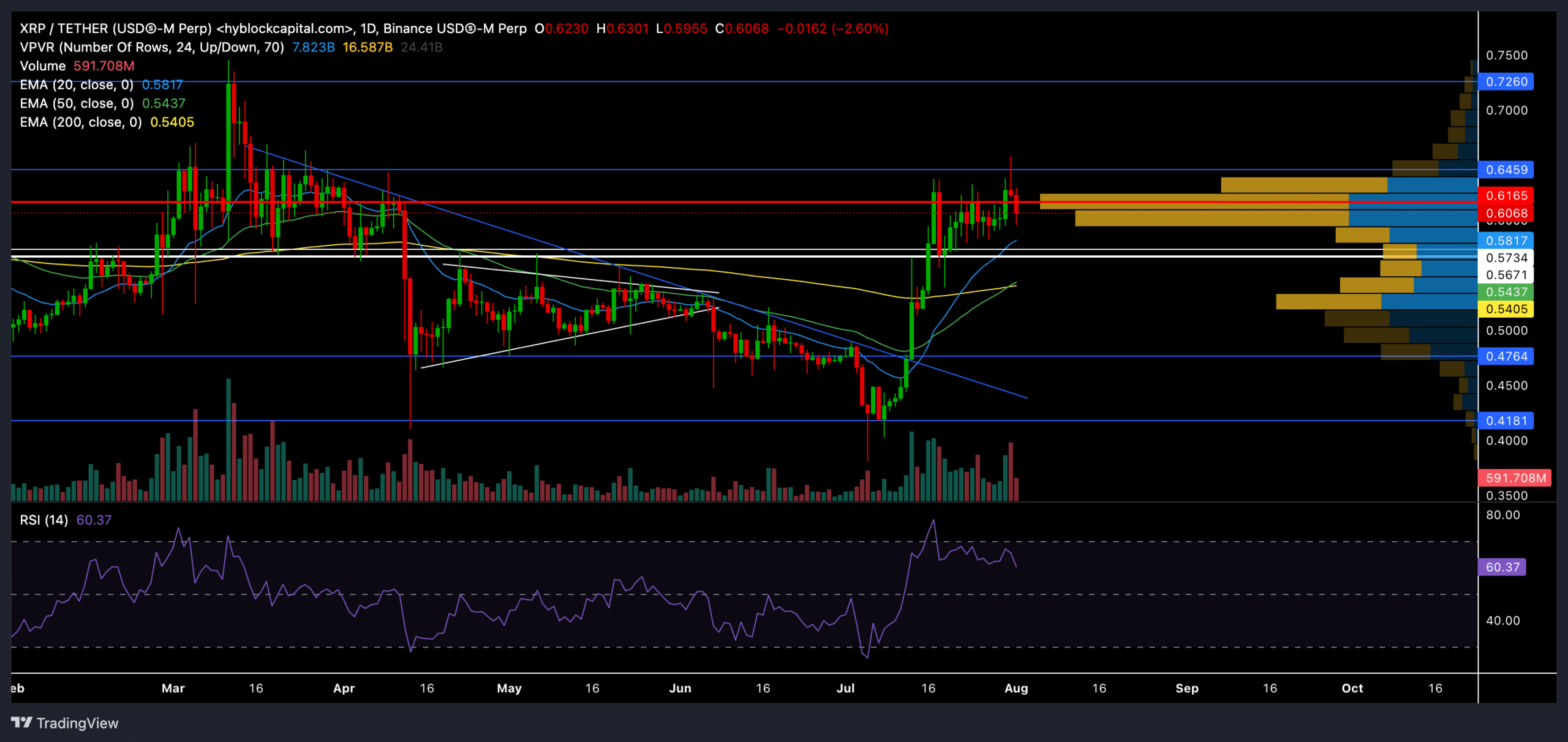

Bulls eventually managed to regain a spot above the 20, 50 and 200 day EMAs after triggering a series of green candles in early July.

Meanwhile, XRP climbed above the crucial support level at $0.57 after posting an ROI of over 46% in the past three weeks.

With the price action hovering near a relatively high liquidity zone, XRP could see a consolidation phase before the uptrend is likely to continue. At the time of writing, XRP was trading at $0.61.

XRP jumps above EMAs to show a bullish edge

Source: TradingView, XRP/USDT

XRP has been in a fairly long-term downtrend after clearing the $0.72 resistance in March 2024. The bears intervened and sparked a bearish rally, and XRP lost more than 40% of its value over the next three months.

It also fell below the crucial 200-day EMA, confirming a strong bearish edge. But the tide turned after the bulls re-entered the market at the $0.41 support level.

This set the stage for the buyers to regain a spot above the 20, 50 and 200 day EMA as altcoin recouped its earlier losses in a month-long rally.

However, the price action had now reached the Point of Control (POC, red) of the VRVP indicator. This level typically represents a level with the highest trading volumes over a period of time.

So, buyers would likely face immediate resistance near the $0.61-$0.64 range.

With the 50 EMA recently crossing above the 200 EMA, buyers could continue to apply more pressure in the coming weeks. Any close above the USD 0.64 resistance could set the stage for buyers to test the USD 0.73 resistance.

Any immediate decline is likely to find support at the $0.57 level or near the 20 EMA.

The Relative Strength Index (RSI) was in a slight downward trend after returning from overbought territory at the time of writing.

TThe indicator is likely to return to the 50 mark as near-term buying pressure subsides before a bullish reversal occurs.

Inferred data reveals THIS

Source: Coinglass

Read Ripple’s [XRP] Price forecast 2024-25

Despite the 6% price drop over the last day, the data showed somewhat bullish sentiment in the derivatives market – with more longs than shorts on major exchanges and higher liquidations for short positions.

This could indicate that traders are anticipating a possible reversal or are defensively positioned against further downside.