- BTC has retested $67k after a first-week decline.

- Market analysts already anticipate a new ATH next month.

Bitcoin [BTC] retested the $67k target after falling below $64k on July 25, underscoring the cryptocurrency’s resilience despite continued distribution by the Mt Gox estate.

This price resilience could signal another indication: a likely retest of the range high or all-time high (ATH). There is increasing market consensus for the latter.

According to Quinn Thompson, founder of Lekker Capital, an ATH could be hit as early as mid-August due to a likely quantitative easing by the Fed (rate cuts).

“I expect an all-time high for #Bitcoin in mid-August. The Fed is about to return to rock-bottom inflation, and that will be reflected in the price of oil, gold and crypto.”

Macro setup and easing of supply overhang for BTC

According to most market observers, the macroeconomic setup, especially with the Fed’s expected rate cut in September, could attract risky assets, including BTC and cryptocurrencies in general.

That’s the same reason for Thompson’s outlook: BTC could be pricing in a possible September rate cut by mid-August.

According to the Fed Watch toolthe chance of an interest rate cut in September was 87%, which means that more than eight in ten interest rate traders expect an interest rate cut.

However, another macro analyst believed the consensus was too high to be true and suggested the Fed could cut rates next week (the Fed’s next decision on July 31).

Aside from the macro setup, BTC has also responded well to the recent supply gluts, especially Mt.Gox redemptions. This strengthens the confidence that the next step up can come soon.

One of the market watchers, DeFiSquared, noted,

“Bitstamp BTC distributed, Kraken BTC distributed, Germany BTC all sold. Literally a negative spin on the horizon, with FTX later returning $16 billion in cash to crypto residents. New ATH sooner than most expect.”

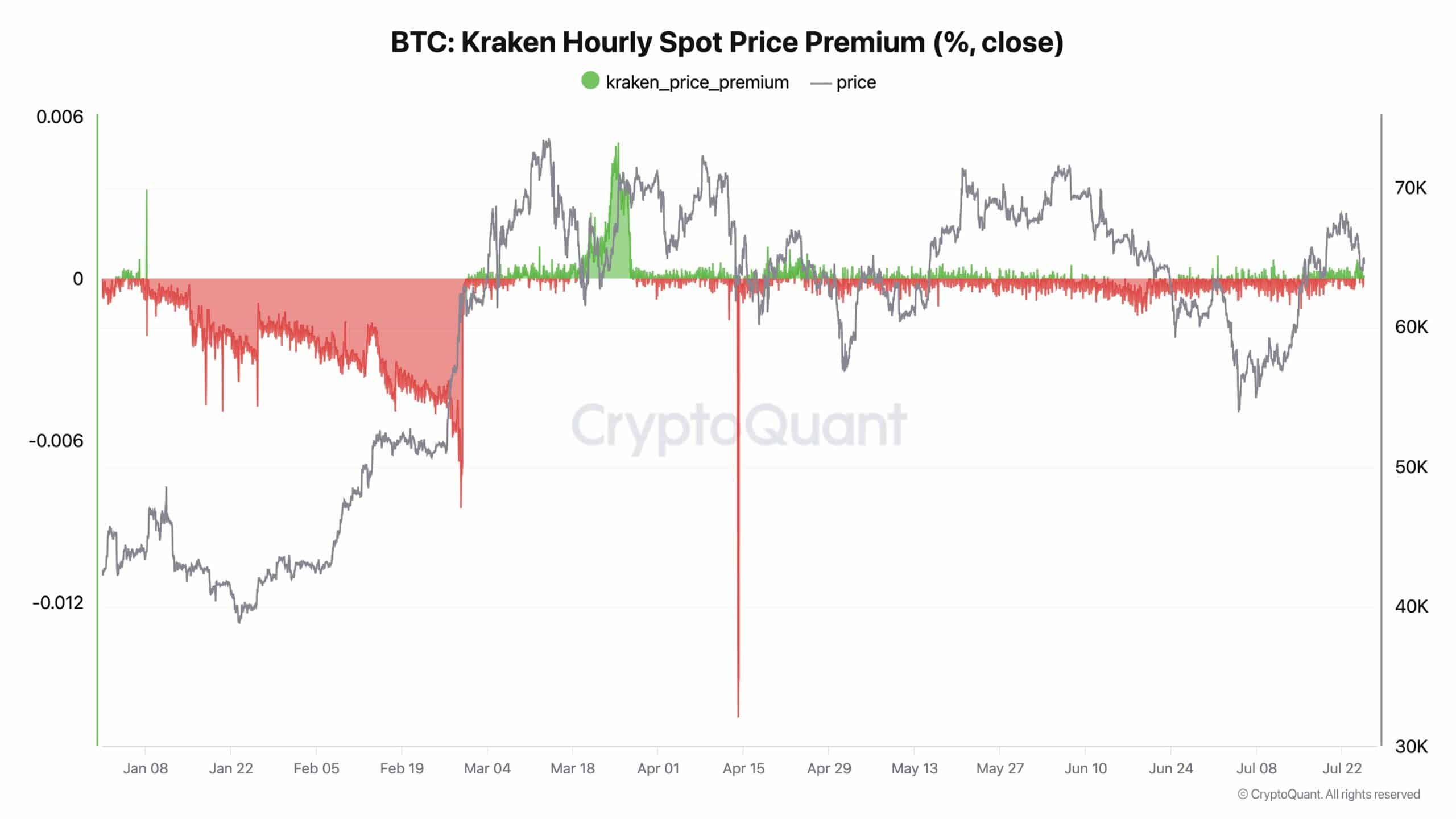

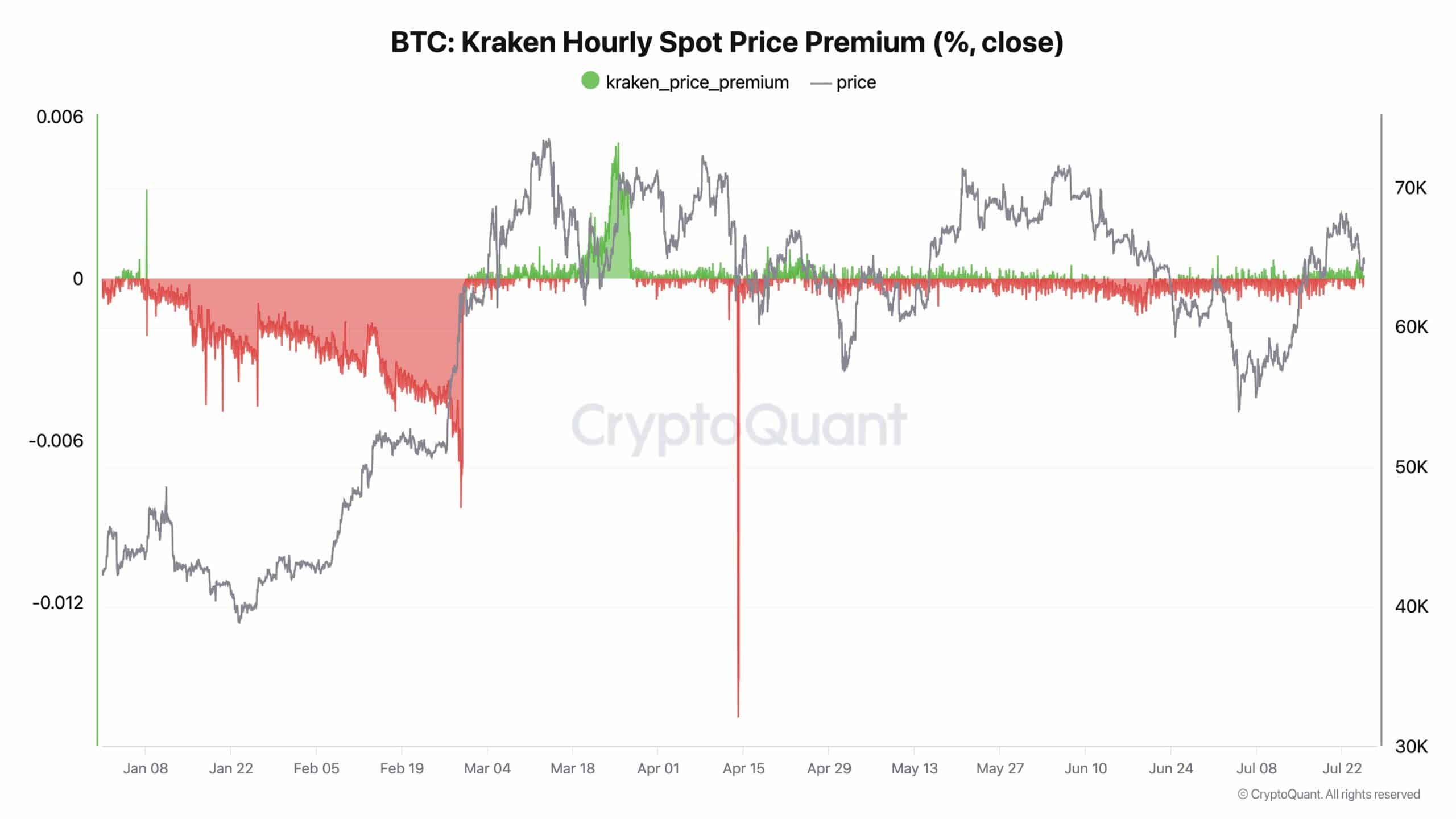

CryptoQuant facts also confirmed that Mount Gox’s redemptions, as seen on the Kraken exchange, had no impact on the recent BTC dip.

“No price difference or volume increase at Kraken; inflow and outflow are normal. Recent price drop not related to Gox’s creditors.”

Source: CryptoQuant

However, the US government could be a crucial selling pressure for BTC.

The US recently sold some of his holdings, which sparked fears, but still owned more than 200,000 BTC worth $14.3 billion, according to Arkham Intelligence facts. With three months before the elections, this offer could not be overlooked.

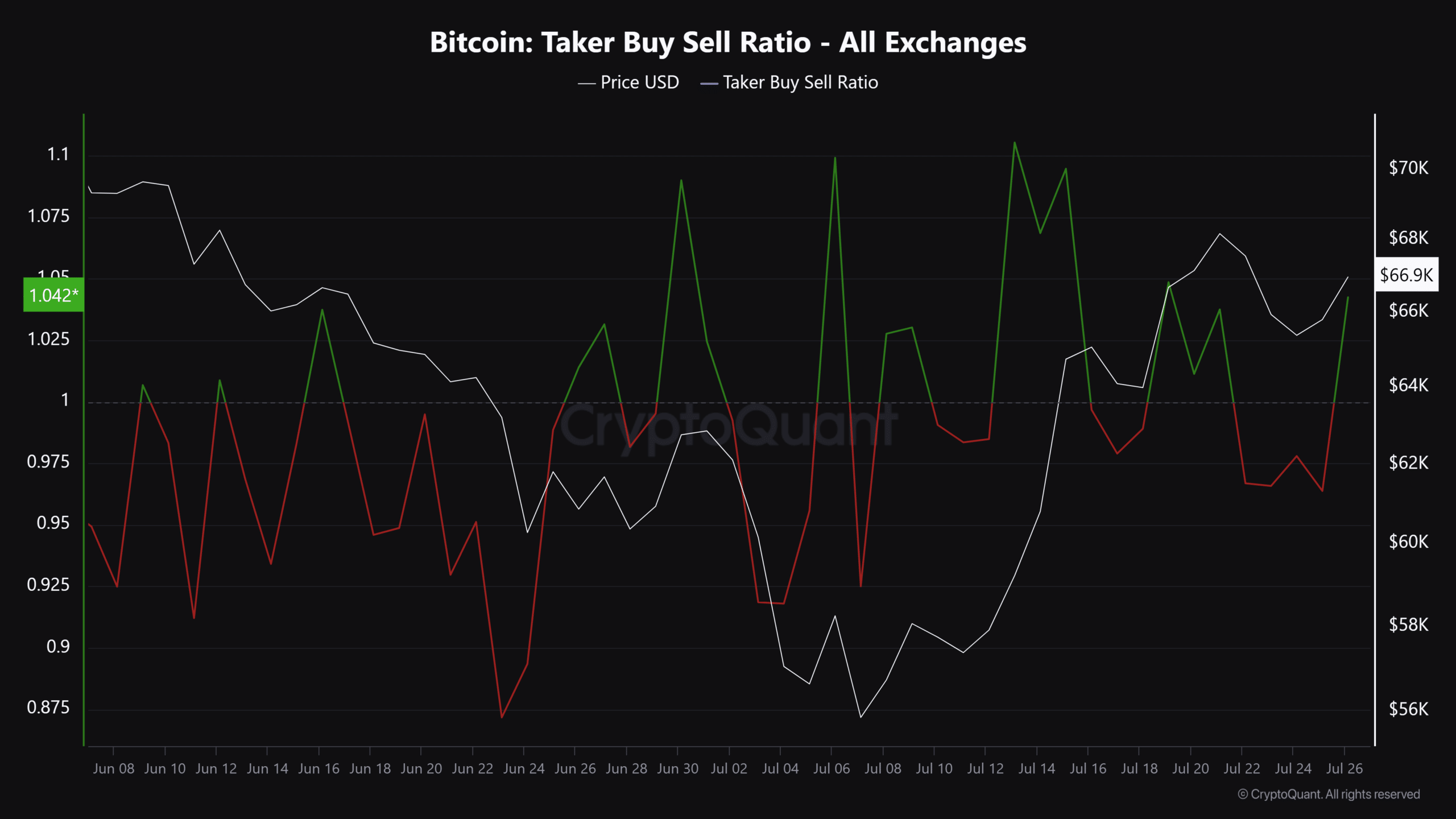

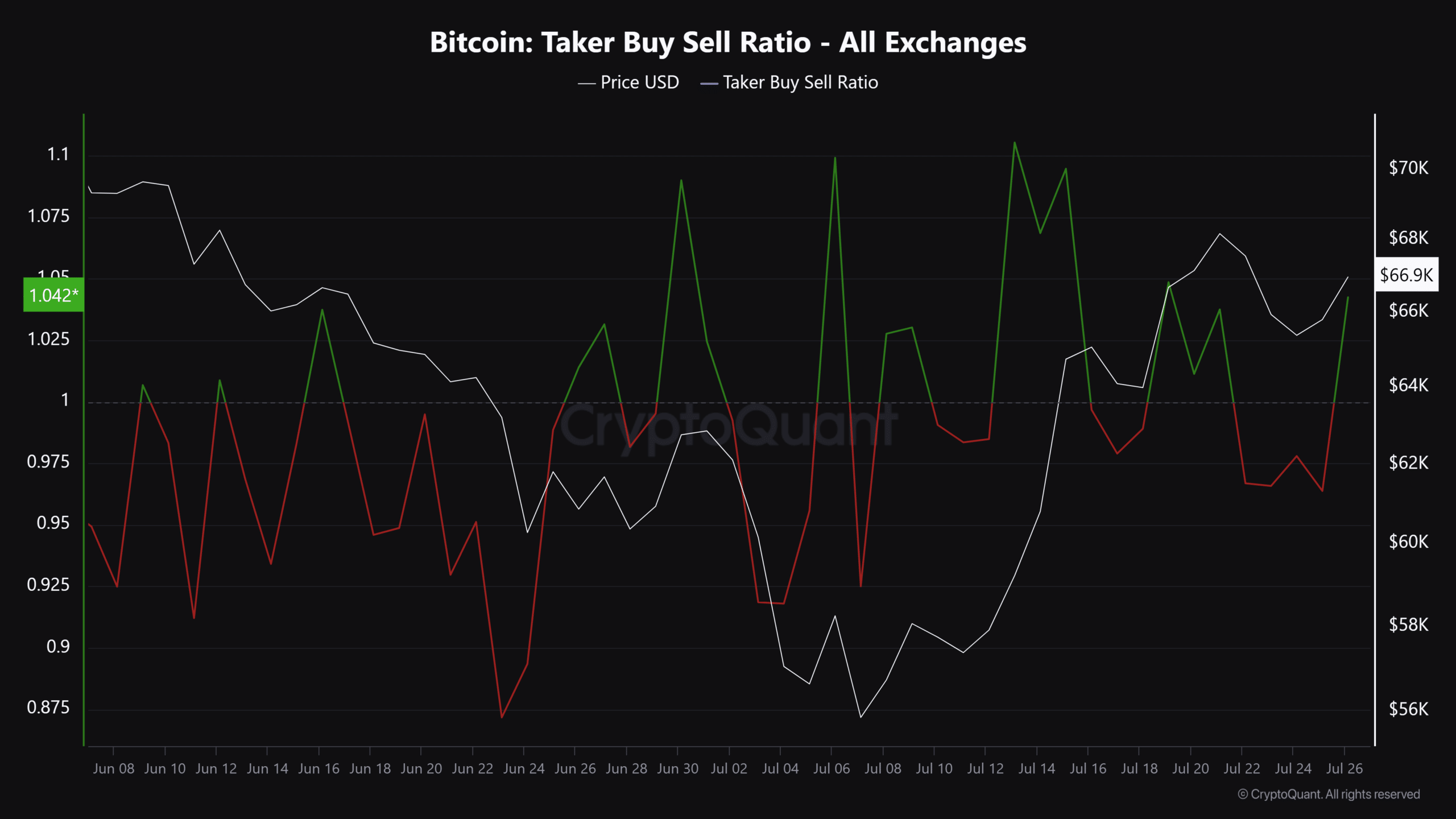

Meanwhile, overall market sentiment was optimistic, especially in the derivatives sector, as evidenced by the positive Taker Buyer Sell Ratio. It meant that buying volume overshadowed selling orders.

Source: CryptoQuant

However, given the significant liquidation cluster at $68.9k it was a prime target for BTC bulls to watch.