- There are growing expectations about the possible approval of spot Ethereum ETFs on July 23.

- The price of ETH rises 0.08% and trades at $3,499, with bullish momentum indicators.

Amid growing anticipation surrounding the possible adoption of spot Ethereum [ETH] Exchange Traded Funds (ETFs) on July 23, there was a lot of buzz in the cryptocurrency space.

Impact of Ethereum ETF

It is also estimated that ETH ETF is likely to attract significant interest from investors, potentially funneling more capital into the broader altcoin market.

Shedding light on the same, a crypto researcher on X, using the handle @wacy_time1said,

“Approximately $5 billion is expected to flow into the ETH ETF within the first six months.”

This estimate is based on the Bitcoin market capitalization ratio [BTC] and Ethereum, which is about 75% to 25%.

Since investors have put $59 billion into the BTC ETF, after taking into account $10 billion already invested in Grayscale’s ETHE, the proportional estimate for the ETH ETF is about $5 billion.

This influx of investments is expected to have a substantial impact not only on ETH, but also on the broader altcoin market.

Steps taken by BlackRock

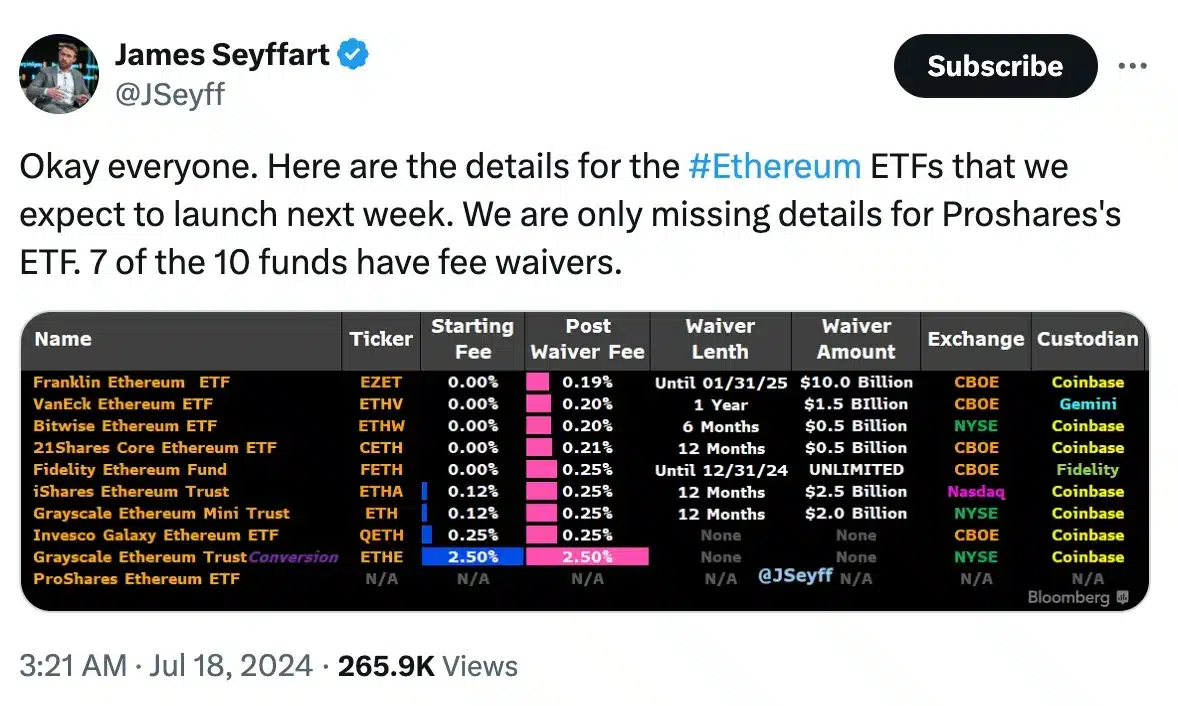

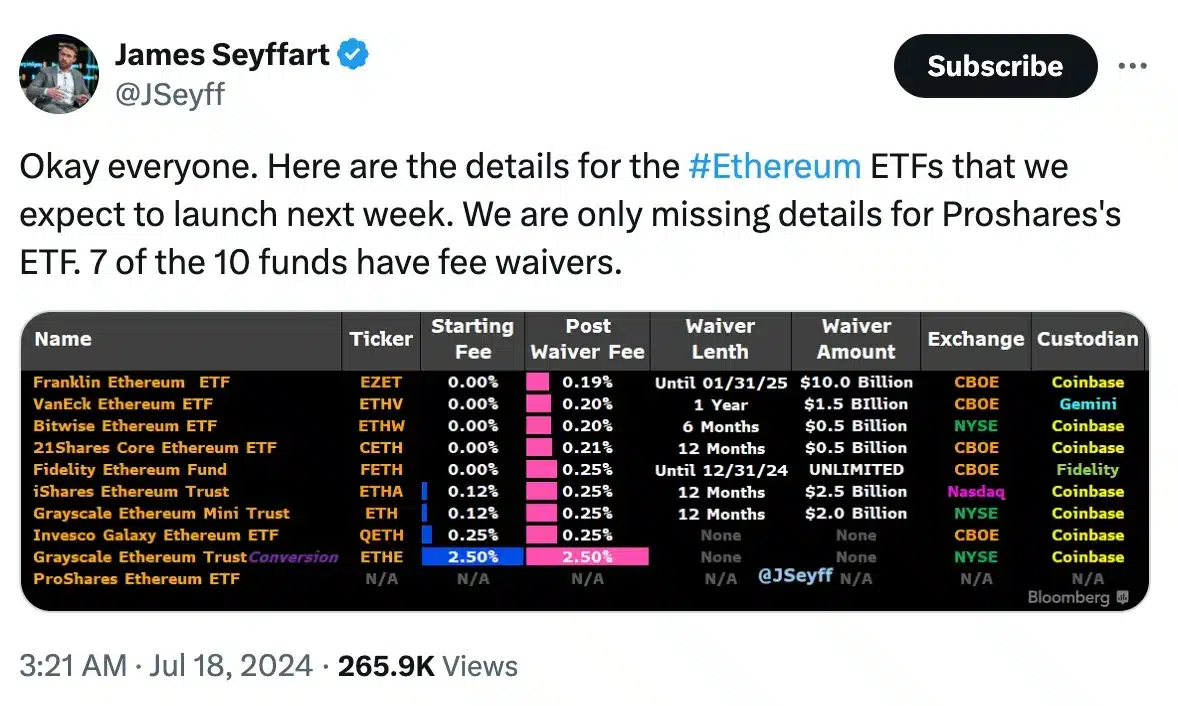

Furthermore, asset managers, including BlackRock, are actively preparing to launch their ETH ETFs. In his S-1 registration statement submitted on July 17, BlackRock detailed the fee structure for its Ether ETF.

“The Sponsor Fee accrues daily at an annual rate equal to 0.25% of the Trust’s net asset value and is payable at least quarterly in arrears in U.S. dollars or in kind or a combination thereof.”

This strategic move underlines BlackRock’s commitment to creating a competitive presence in the emerging Ether ETF market, positioning itself alongside other companies that each offer varied fee structures to attract investors.

Source: James Seyffart/X

According to reports, BlackRock has announced that its spot Ether ETF will charge a 0.12% fee for the first year or until it reaches $2.5 billion in net assets.

Other asset managers are following suit

Franklin Templeton’s spot Ether ETF offers the lowest fee at 0.19%, while both the Bitwise and VanEck Ethereum ETFs charge a 0.20% fee.

The 21Shares Core Ethereum ETF has a fee of 0.21%. Meanwhile, Fidelity and Invesco Galaxy ETFs each offer a 0.25% fee, which matches BlackRock’s standard rate after the initial period.

Amid the positive developments surrounding ETH ETFs, the price of Ether has also had a positive impact. According to CoinMarketCapETH is up 0.08% over the past 24 hours, trading at $3,499.

Furthermore, technical indicators such as the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) suggest that bullish momentum is present, indicating continued optimism in the market.

Source: trading view