- BNB has struggled with gains and losses in recent hours.

- The price has remained in the $590 price zone despite the fluctuations.

Binance coin [BNB] saw a strong performance during the previous trading session, reaching one of the highest price levels in months.

However, when looking at a shorter time frame, the data indicated that BNB was on a decline, indicating a temporary pullback or consolidation after recent gains.

Despite this short-term decline, the profits that BNB has built up over the longer term are still intact.

Binance glides over a smaller time frame

The analysis of Binance Coin (BNB) on different time frames revealed clear market behavior and trends. On a daily time frame, BNB has done that demonstrated strong performance, up more than 3% in the last 24 hours and gaining more than 10% in the last week.

These numbers indicate a solid medium-term bullish trend, indicating positive sentiment and buying interest among investors.

Conversely, a more detailed view based on the one-hour time frame showed a slight decline, with BNB falling by almost 1%. While this decline may seem small, it could be indicative of short-term profit-taking or market corrections after recent gains.

A comprehensive overview of Binance’s price development

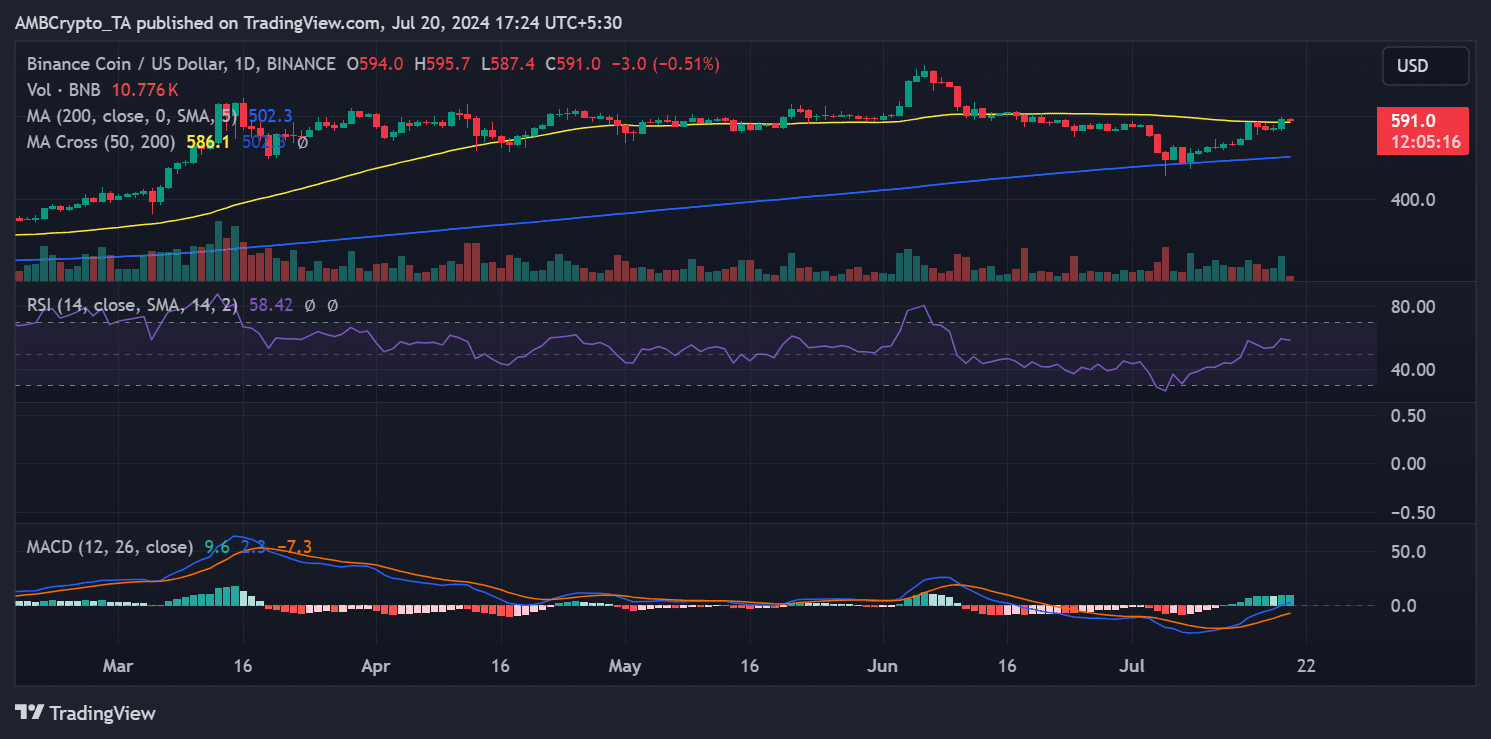

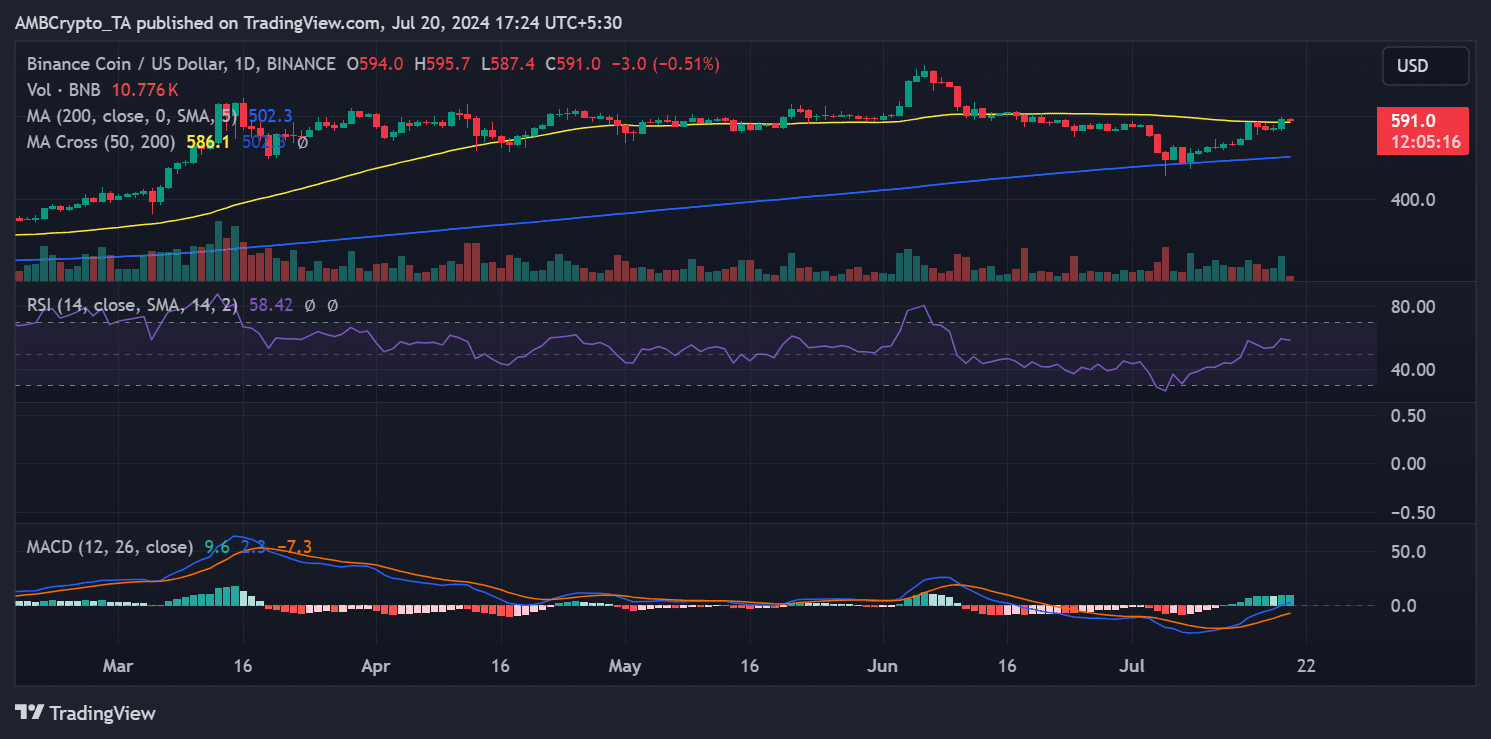

Binance Coin’s daily time analysis revealed a significant increase during the last trading session. The chart showed a 3.86% increase, bringing the closing price to around $594, compared to an opening price of around $572.

This peak approaches the price level that BNB reached a month ago when it reached around $599 before subsequently falling.

At the time of writing, BNB is down slightly to around $591. This small drop of less than 1% allows BNB to still maintain its position in the $590 price range.

This indicated that recent gains were largely maintained despite this small pullback.

Source: TradingView

Moreover, technical indicators continued to support a bullish outlook for BNB. The Relative Strength Index (RSI) was above the neutral line, signaling continued buying pressure.

Furthermore, there was no apparent drop in momentum at this point. This positioning of the RSI suggests that market sentiment remains positive and the bullish trend is still in force.

BNB could recoup its profits

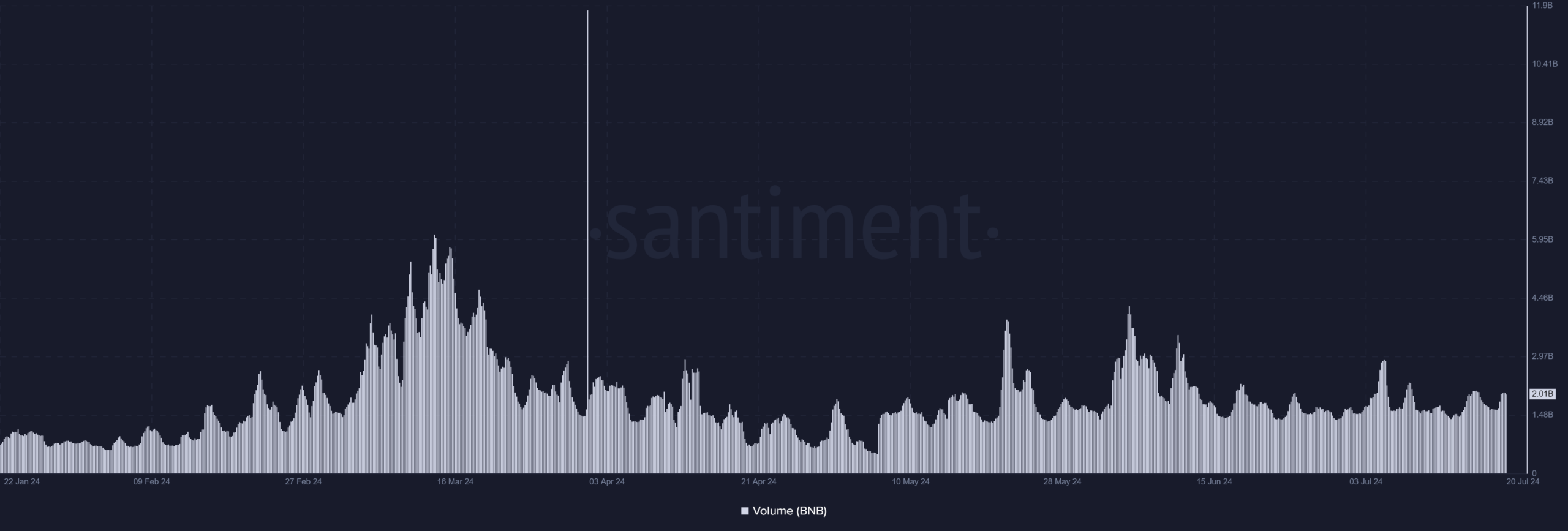

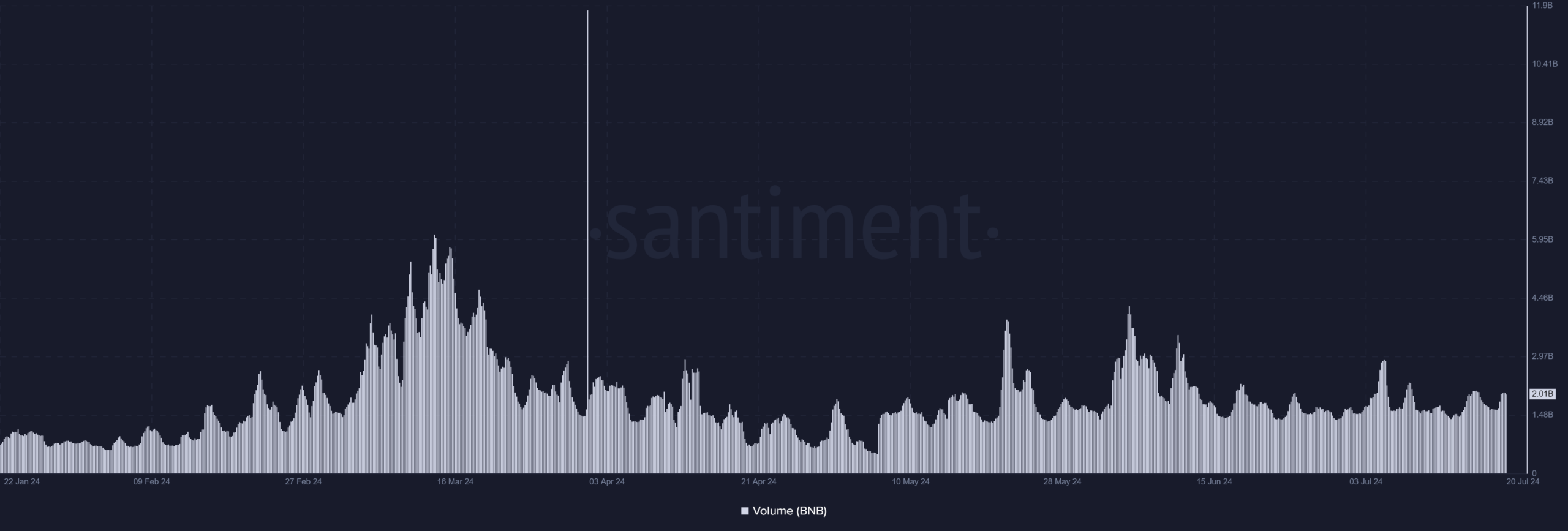

Santiment’s Binance Coin (BNB) trading volume analysis shows consistent activity, with volumes remaining robust across consecutive trading sessions.

On July 19, BNB’s trading volume exceeded $2 billion, and similar levels are observed during the current session. This stability in trading volume indicates that market engagement has not declined, indicating continued interest and participation from traders.

Source: Santiment

Read Binance (BNB) price forecast 2024-25

It is particularly striking that the volume has remained high despite the slight price drop of less than 1%. Such volume stability often acts as a buffer against significant price declines, as it indicates a balanced dynamic between buying and selling pressure.

The continued strong volume could support BNB in maintaining or even increasing its market value as the trading day progresses.