- Trading volumes on crypto exchanges fell for the third month since March.

- According to CME data, institutional interest in ETH dropped significantly in June.

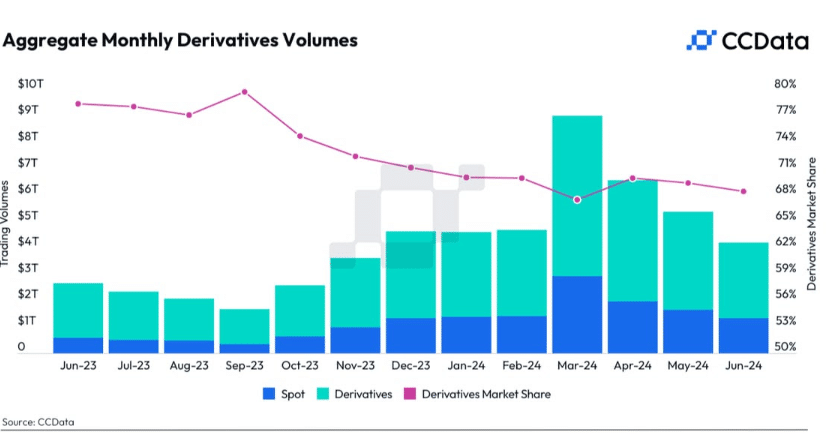

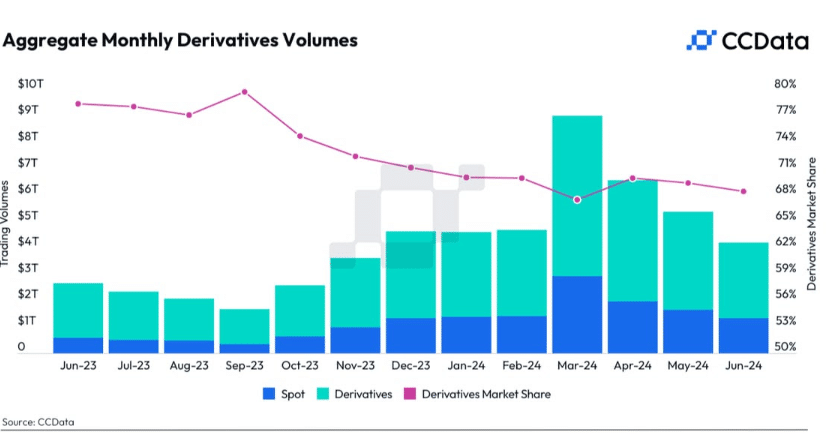

Trading volumes on crypto exchanges fell further in June, maintaining a trend that started after March 2024.

According to the CCData reportCombined trading volumes fell for the third month in a row, falling 21.8% to $4.22 trillion.

The report attributed the decline to overall sideways movement and losses for the leading assets, Bitcoin [BTC] And Ethereum [BTC].

“Combined trading volume fell 21.8% to $4.22 trillion as major crypto assets, including Bitcoin and Ethereum, remained largely in range and showed major downsides in June.”

ETH is falling faster than BTC as spot invades the derivatives market

Trading volume in derivatives fell more in June than in the spot sector. According to the report, spot market trading volume fell 19.3% to $1.33 trillion.

This was also a three-month decline from a record high of $2.94 trillion in March.

However, the decline was stronger on the derivatives market. Derivatives volumes fell 22.8% to $2.89 trillion. On site versus derivatives volumes, the report read:

‘Derivatives volumes have also fallen relative to spot volumes, as evidenced by the declining market share of derivatives instruments. The derivatives market now represents 68.5% of the entire crypto market (compared to 70.1% in January).”

Source: CCData

The decline was also reflected by a significant drop in liquidity within the derivatives market, as tracked by open interest rates.

In June, a drop in OI of almost 10% was recorded, with Coinbase taking the biggest hit due to massive liquidations.

“Open interest on derivatives exchanges fell 9.67% to $47.11 billion, following a series of liquidations triggered by a significant drop in cryptocurrency prices observed in June and continuing into July.”

Coinbase’s OI fell 52.1% to $18.2 million. However, despite a 9.93% drop in OI for Binance, it reached $19.4 billion in open interest on centralized exchanges.

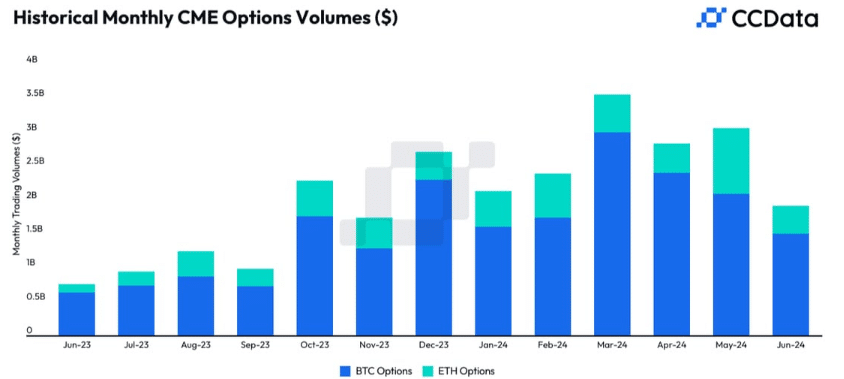

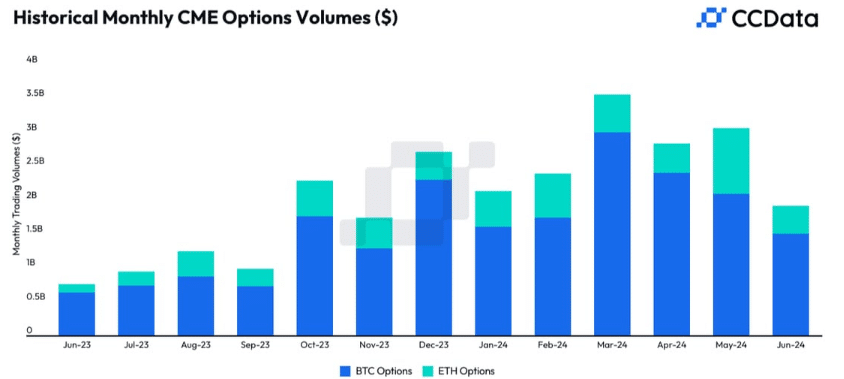

The June withdrawals also wiped out significant option volumes that surged in May, especially for ETH after surprise partial approvals of ETH ETFs.

CME data shows that institutional interest in ETH, based on options volume, fell significantly in June.

‘The volume of BTC options on the exchange fell significantly in June, falling 28.2% to $1.50 billion. ETH options volume saw an even bigger decline, falling 58.0% to $408 million.”

Source: CCData

However, analysts have hinted at the final approval and launch of ETH ETFs next week. It could boost trading volumes in the spot and derivatives markets.

But it remains to be seen how the market will react to this development.