- Metaplanet increases BTC positions during price recovery, strengthening the reputation of “Asia’s MicroStrategy”.

- The post-announcement surge boosts Metaplanet’s share price by 25.81%, marking a bold Bitcoin investment strategy.

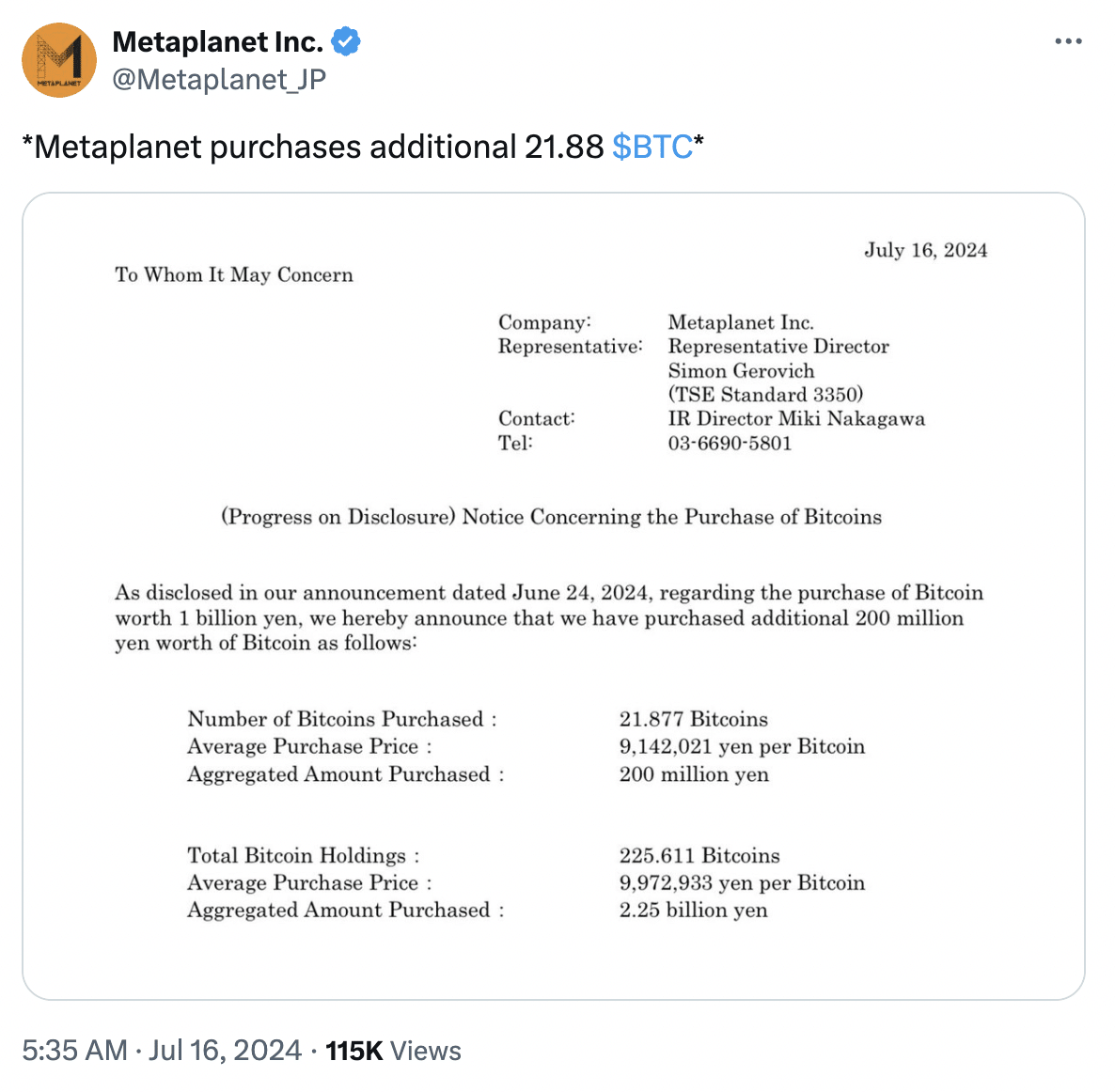

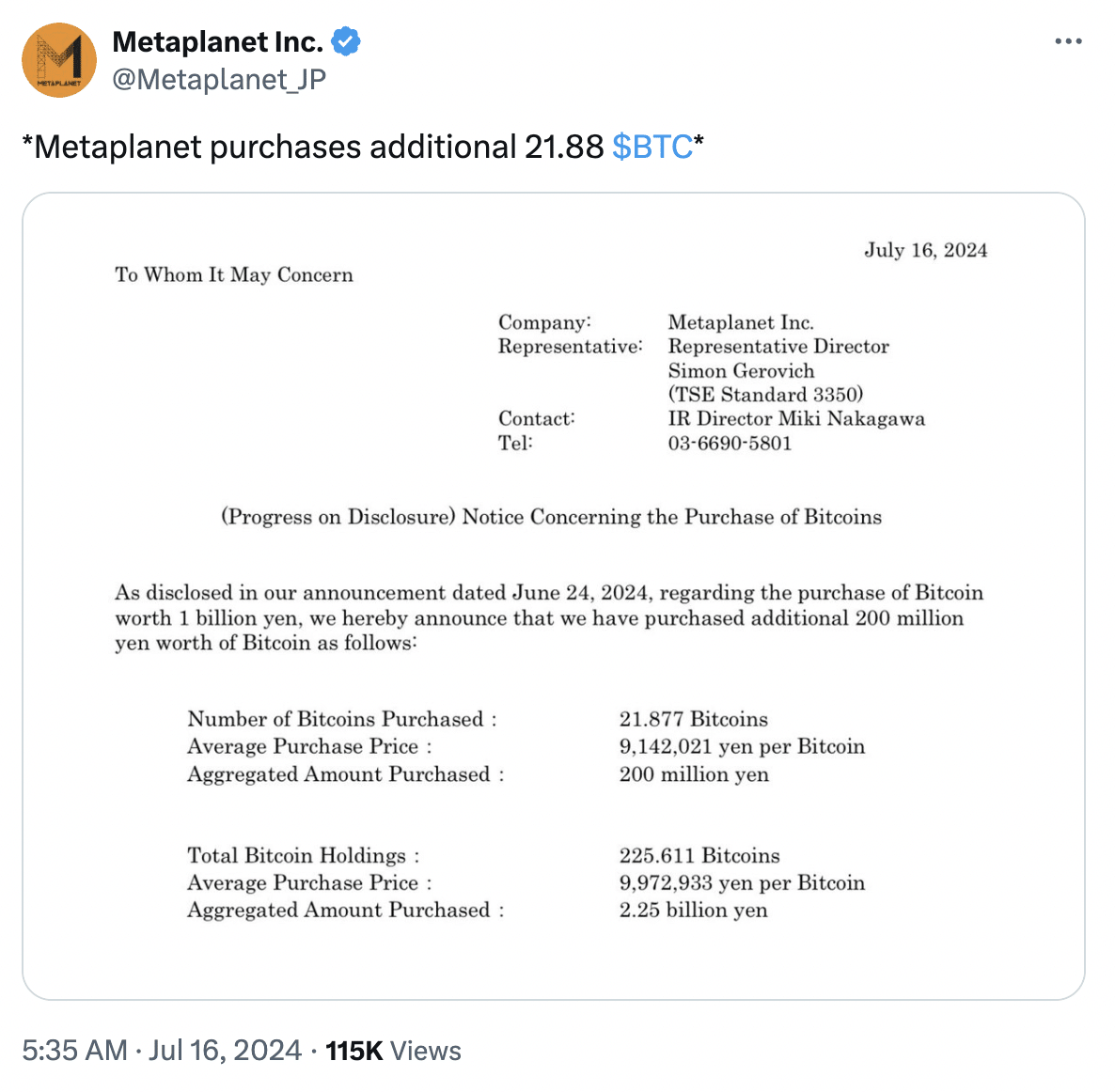

Metaplanet, a prominent publicly traded investment and advisory firm headquartered in Japan, has significantly increased its Bitcoin holdings. [BTC] possessions.

Metaplanet’s BTC holdings

Recently, the company acquired another 21.88 BTC, worth over $1.2 million (approximately 200 million Japanese yen).

Source: Metaplanet Inc/X

This move matches Bitcoin’s recent surge to around $65,000, marking a notable 4.5% gain after weeks of continued decline.

At the time of writing, BTC was showing bullish signs on the daily chart, up 1.94% in the past 24 hours.

Metaplanet takes signals from MicroStrategy

Interestingly, Metaplanet is often referred to as the “MicroStrategy of Asia” due to its tendency to follow MicroStrategy’s investment strategies.

For context, Metaplanet finances its Bitcoin purchases through bond sales, similar to MicroStrategy’s approach. This highlights the growing institutional adoption of BTC.

That said, on July 16, Metaplanet increased its Bitcoin holdings to over 225 BTC, worth approximately $14.55 million at current prices.

Furthermore, Metaplanet’s recent announcement to expand its BTC holdings led to a notable increase in its share price, which rose by an impressive 25.81% to 117 JPY.

This increase reflects investor confidence in the company’s strategic adoption of Bitcoin, which has seen its shares rise as much as 631% since the beginning of the year.

Source: Google Finance

What else is going on?

As of the last update, Metaplanet’s current market cap is 17.5 billion JPY, while its balance sheet BTC holdings are valued at 2.25 billion JPY.

As BTC’s share of total assets continues to rise steadily, analysts speculate that it could surpass 100% in the near future. This shows Metaplanet’s bold stance in embracing cryptocurrency as a core part of its investment strategy.

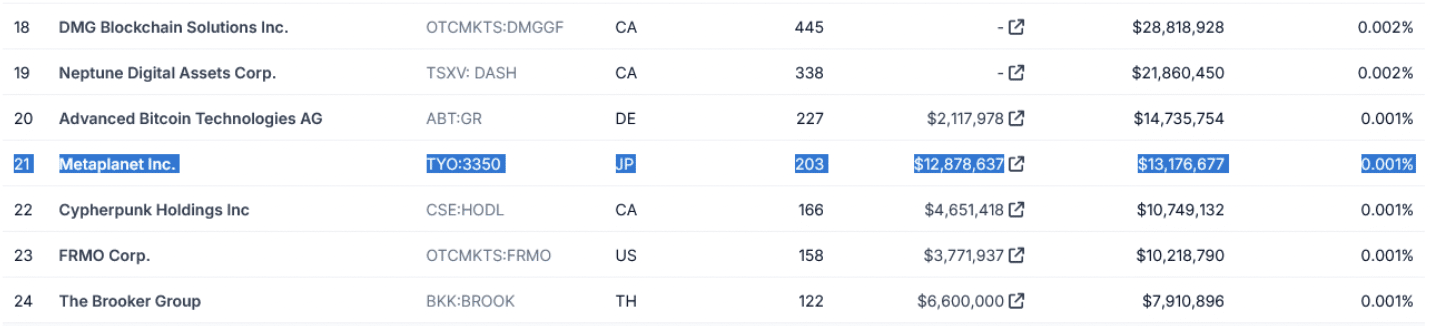

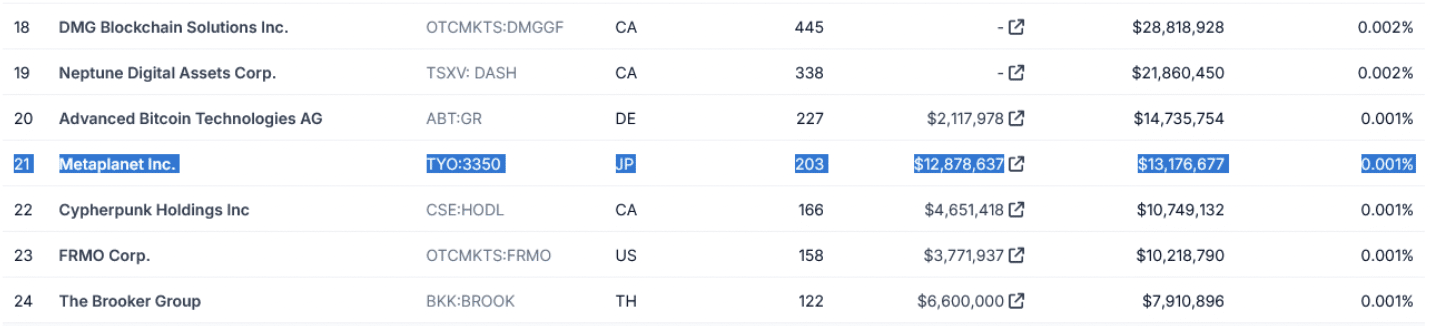

This was further confirmed by CoinGecko’s data, which shows that Metaplanet is currently the 21st largest corporate holder of Bitcoin in the world.

Source: CoinGecko

This underlines Metaplanet’s proactive stance in hedging against the escalating Japanese debt crisis and the depreciating Japanese yen.

With the yen down nearly 54% against the US dollar since January 2021, BTC has emerged as a robust alternative, appreciating over 145% against the yen in the past year alone.

In conclusion, Metaplanet’s strategy reflects a growing trend of institutions using Bitcoin alongside traditional assets for hedging and diversification.