Bitcoin went into a tailspin in the first week of July, bottoming below $54,000 amid an intensified sell-off by some large holders. Several reports using on-chain data have attributed the sell-off to the German state of Saxony, which sold the bitcoins it seized earlier this year.

Related reading

Despite this significant sell-off, Bitcoin has mostly held its ground and the bulls have managed to prevent further price declines. According to on-chain data, Bitcoin’s impasse can be attributed to some whales as many of them jumped on the price drop to replenish their holdings. Notably, Bitcoin whales added 71,000 BTC to their wallets this week.

Bitcoin Whales acquire 71,000 BTC this week

This week, Bitcoin whales went on an absolute feeding frenzy by amassing a whopping 71,000 BTC through crypto exchanges. While the German state of Saxony was busy unloading its crypto stash, these major players were only too happy to expand their already massive holdings.

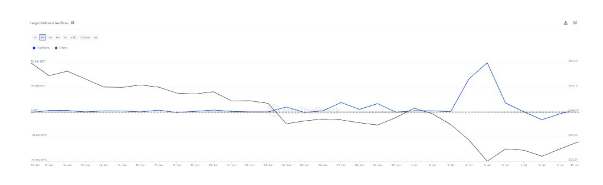

This interesting activity of the whales was first noticed on social media platform X by InTheBlok. A look at the chart below shows that accumulation was at its peak during Bitcoin’s 15% decline from $63,600 on July 1 to $53,905 on July 5.

In addition to the whale accumulation, Spot Bitcoin ETFs witnessed steady inflows throughout the week despite the drop in spot price. The funds recorded positive net flows every day throughout the week, with the largest net flow of $310 million on July 12.

Bitcoin is holding strong

The German state of Saxony sold more than $2 billion worth of Bitcoin last week, flooding the market with a lot of BTC. When this sell-off initially began, many traders and market participants were skeptical about whether an already bearish Bitcoin could survive the selling pressure. Many analysts even expected a price drop towards $47,000. On the other hand, other analysts believed the sell-off was overdone.

Despite this back-and-forth scene, Bitcoin managed to weather the sell-off and absorb the impact of the sell-off better than many would expect. This showed that the cryptocurrency has now achieved stability, preventing further price declines.

It also highlights the growing maturity of the crypto market, which has been characterized by a high degree of volatility over the years. A $2 billion sell-off is very small compared to Bitcoin’s market cap of $1.18 trillion. To break it down, that $2 billion represents less than 0.2% of Bitcoin’s total market cap.

Related reading

At the time of writing, Bitcoin is trading at $59,960. The bulls are now focused on getting back above $60,000. Breaking and holding above $60,000 would pave the way for further price appreciation in the coming week.

Featured image from Getty Images, chart from TradingView