- Traders who purchased AVAX in the last 30 days have seen the highest increase among all holder categories.

- Technical analysis showed that the token’s price could rise to $30.05.

Unlike many other altcoins is Avalanche [AVAX] has been trading sideways for the past seven days. But according to AMBCrypto’s analysis, this could change.

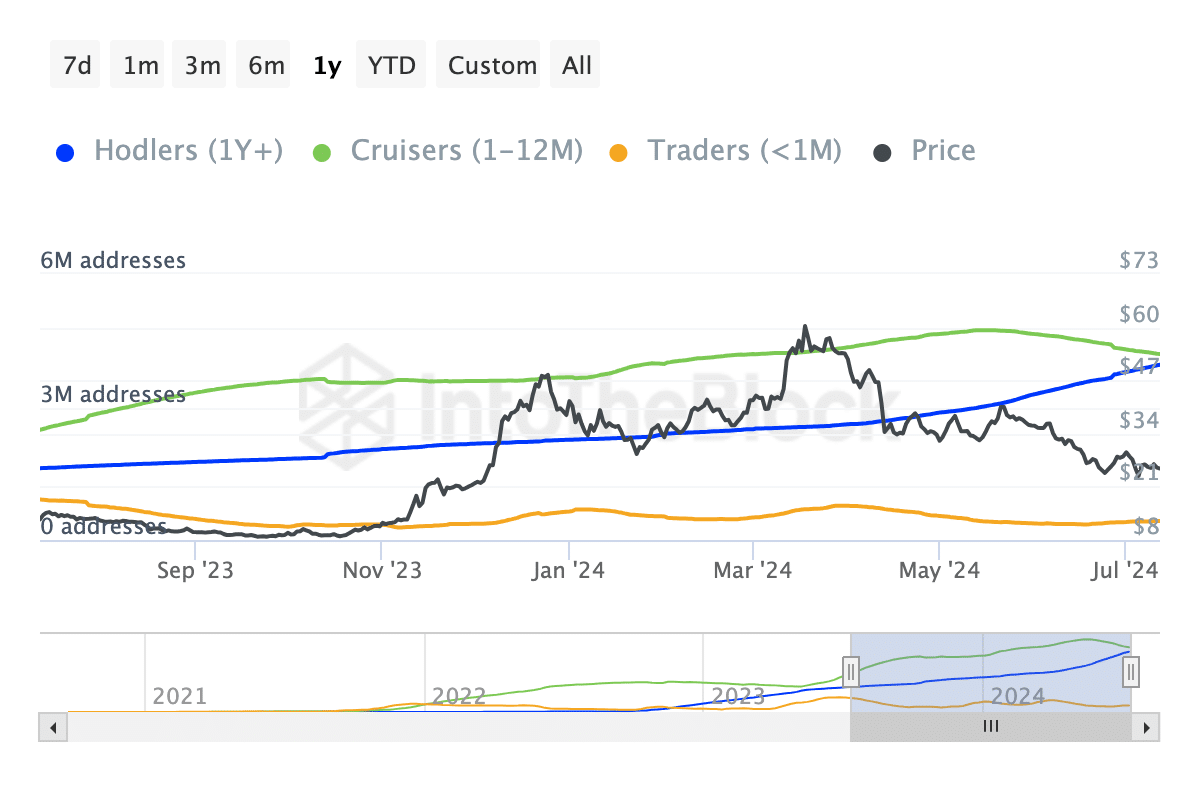

One reason for this prediction is the observation we saw from the Addresses of Time Held. This metric shows whether holders are purchasing more of a token in the short, medium, or long term. or do otherwise.

It is the demand of traders over the confidence of the holders

To achieve this, the blockchain analytics platform groups them into three. The first are holders who have owned the token for more than a year. Second in the group are Cruisers.

Cruisers are passive investors who hold a token for between one and twelve months. Last on the list are traders who have purchased something in the last 30 days.

At the time of writing, traders had the highest increase of the three. This implies that short-term holders are optimistic about AVAX potential.

Source: IntoTheBlock

Should this number continue to rise, AVAX price could trade higher. At the time of writing, the price was $25.81. Can the price of the token reach $30?

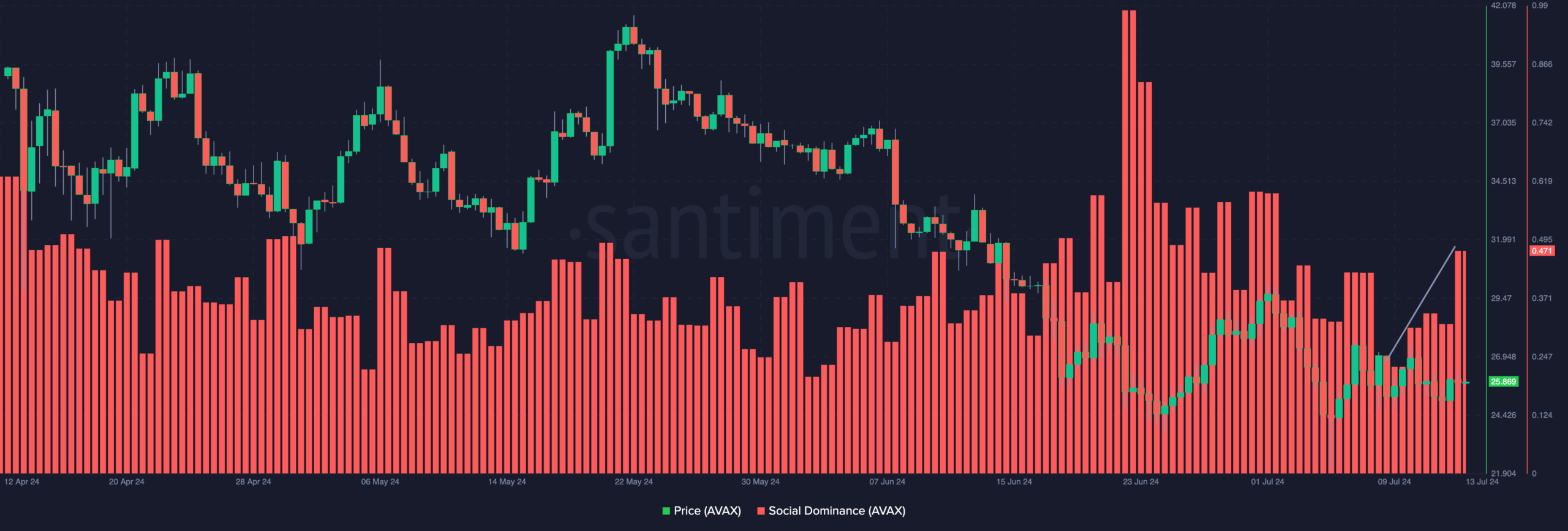

One of the ways we can predict this is by looking at the demand for the token. A measure that can provide insight into this is social dominance.

Social dominance measures the rate of discussions about a token compared to other cryptocurrencies in the top 100. If social dominance decreases, it means that searches and conversations related to the token decrease.

However, an increase in statistics suggests otherwise. At the time of writing: Santiment data showed that dominance had increased to 0.471. This means that there was a surge in AVAX-related discussions.

Source: Santiment

Outbreak on the cards?

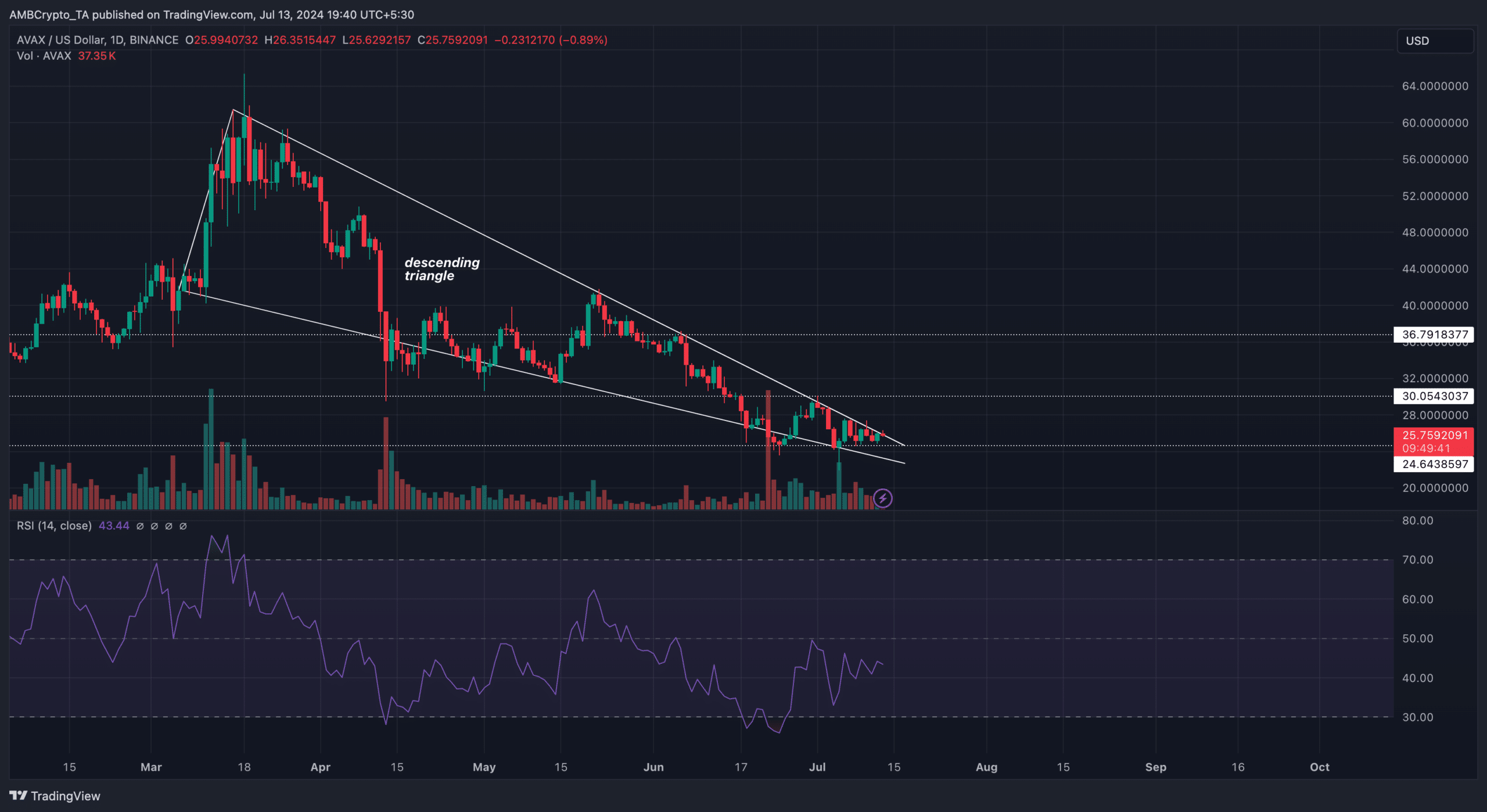

From a technical perspective, the AVAX/USD daily chart showed the formation of a descending triangle. The descending triangle chart pattern appears when the price of a token reaches lower highs and lower lows, and it is a bearish pattern.

However, this pattern helps identify seller exhaustion. According to the chart below, this was the case with AVAX, where the pattern indicated a breakout.

Furthermore, the Relative Strength Index (RSI) revealed that the token had exited the July 4 oversold territory. RSI measures momentum.

Values below 30.00 indicate oversold levels, while values below 70.00 or higher indicate overbought levels. Therefore, the rising value implies increasing momentum for the altcoin.

Source: TradingView

Is your portfolio green? Check the AVAX Profit Calculator

If this continues, AVAX’s short-term target could start from $30.05. That would only be the case if the bulls defend the support at $24.64.

Should market conditions become intensely bullish, the price could rise to $36.79. However, this prediction may not come true if selling pressure returns.