- The price of BTC has risen 2% over the past seven days despite remaining below $60,000

- Selling pressure remained relatively weak in the cryptocurrency market

Investors have been keeping a close eye on the German government for some time now as it is constantly selling Bitcoin [BTC]. This may not be the case for long as according to the latest updates, the government has sold off all its BTC holdings.

Hence the question: will this put more selling pressure on BTC?

Contains ZERO BTC

AMBCrypto had reported previously about the German government selling its BTC shares in batches. The state Criminal Police Office (LKA) seized 49,857 BTC from the operator of Movie2k.to in January. Since then, the government has been dumping these BTCs on the market.

Arkham has one tweet who described the last such dump less than 12 hours ago. According to the same, the German government sent 3846.05 BTC worth $223.81 million to Flow Traders and 139Po. This latest transaction has caused all BTCs to disappear from government assets. Currently, the German government owns 0 BTC.

Since the sell-off was worth millions, AMBCrypto investigated whether selling pressure on BTC was increasing. AMBCrypto’s analysis of CryptoQuant facts revealed that the net deposit of BTC on the exchanges was higher compared to the average of the past seven days, meaning selling pressure increased.

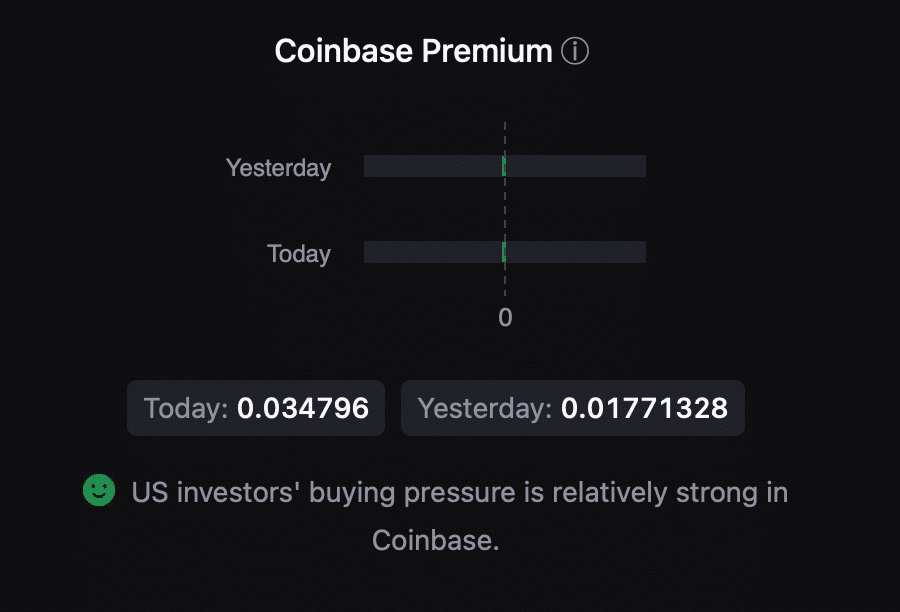

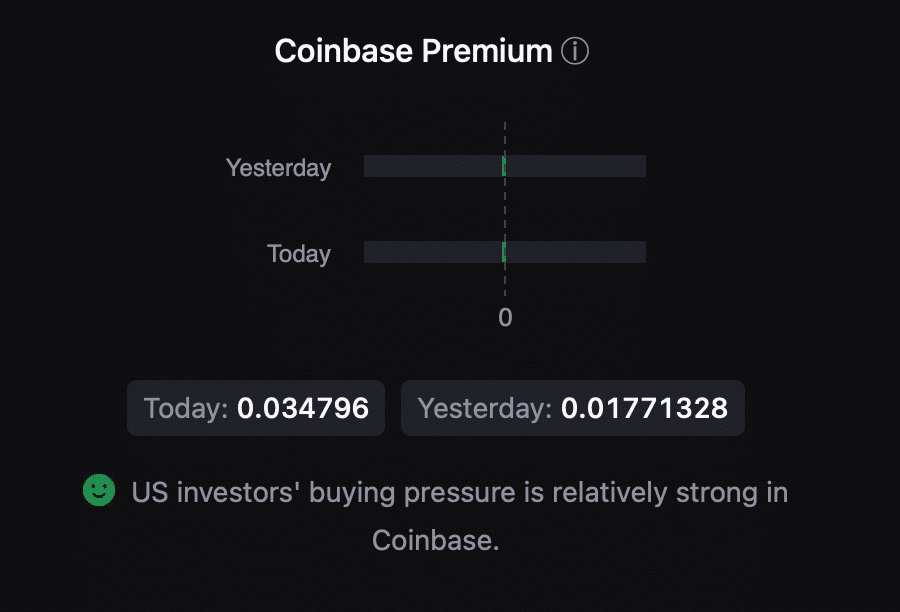

However, BTC’s Coinbase premium showed that buying sentiment among US investors was strong. Moreover, the Korea bounty was also green. Simply put, buying pressure from Korean retail investors has been relatively strong.

Source: CryptoQuant

Which way is Bitcoin heading?

Here it is worth pointing out that at the time of writing, BTC had finally made some gains, however insignificant they may be, after weeks of corrections. It charted at just under $57,850, after rising slightly by 2% in over seven days.

We then looked at other data sets to better understand whether cryptocurrencies would build on this rise or whether the German government’s sell-off would lead to another correction.

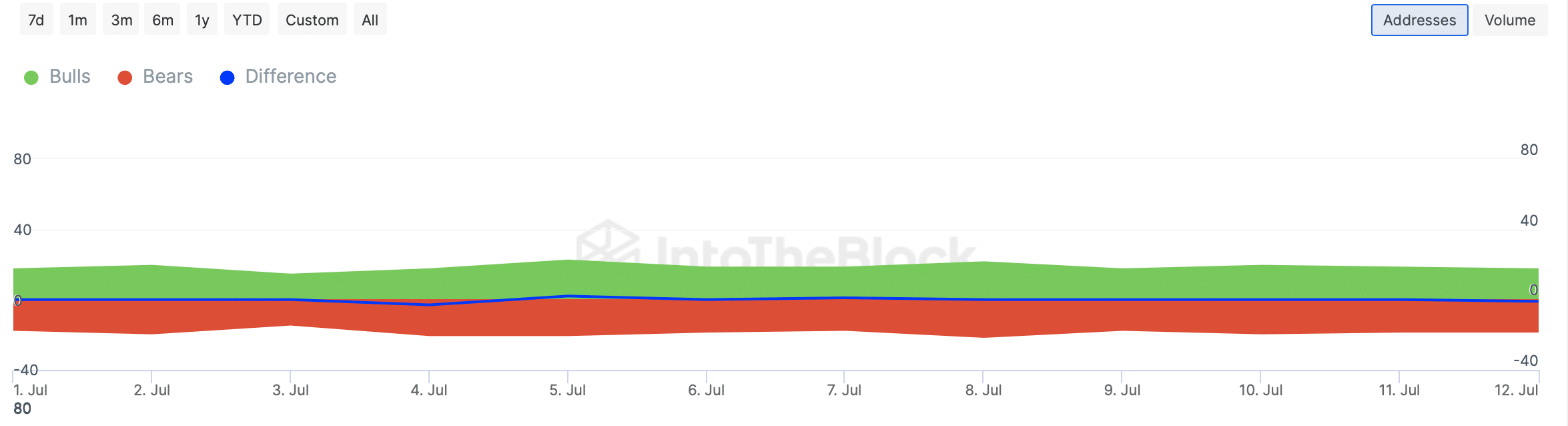

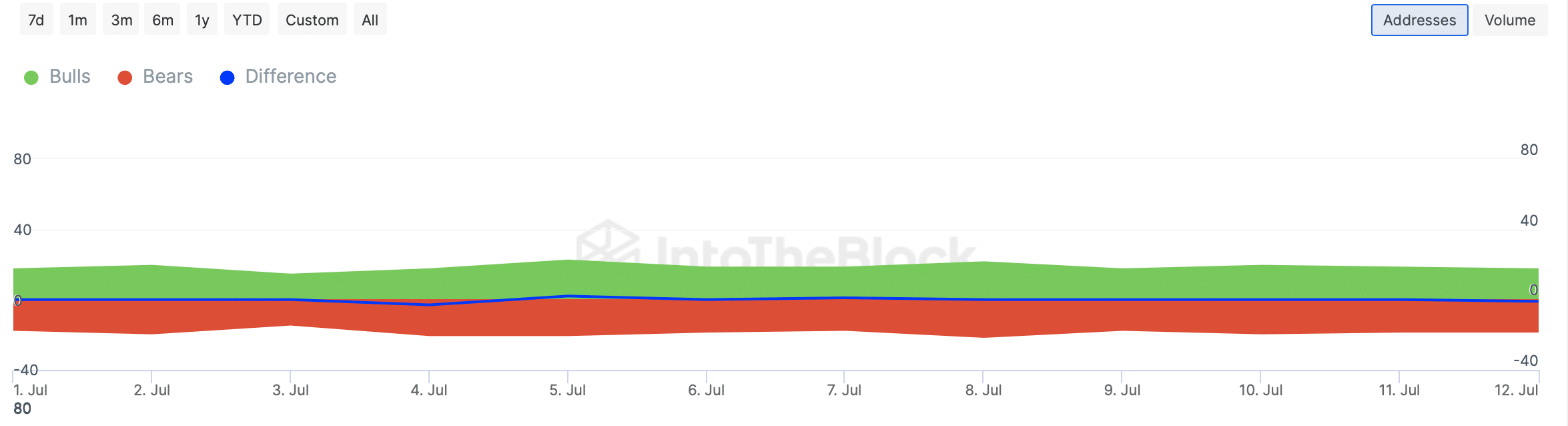

Our analysis of IntoTheBlock’s data showed that both the bulls and bears competed equally with each other last week. This can be supported by the fact that their number of trades, accounting for 1% of trading volume, remained the same.

Source: IntoTheBlock

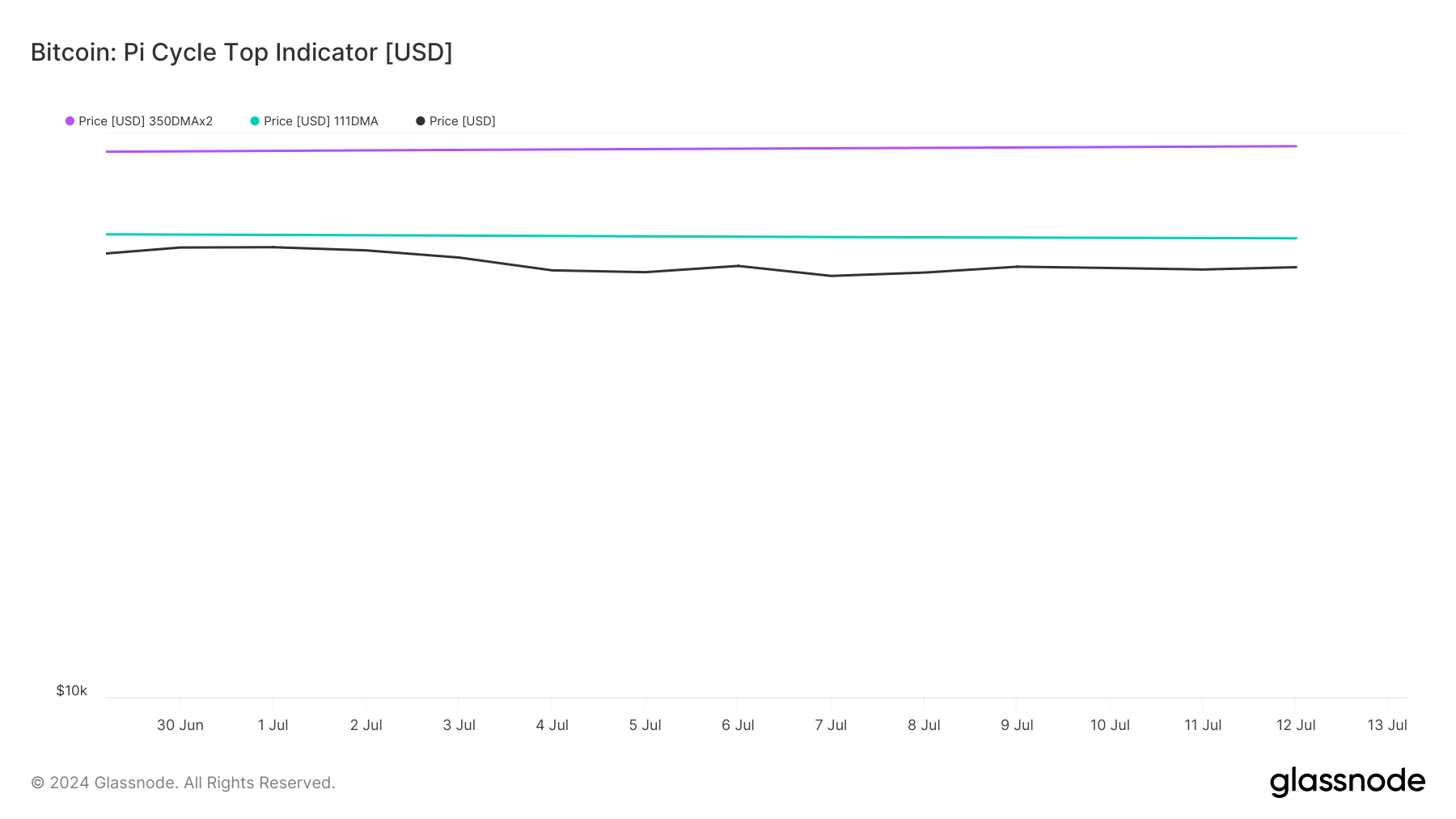

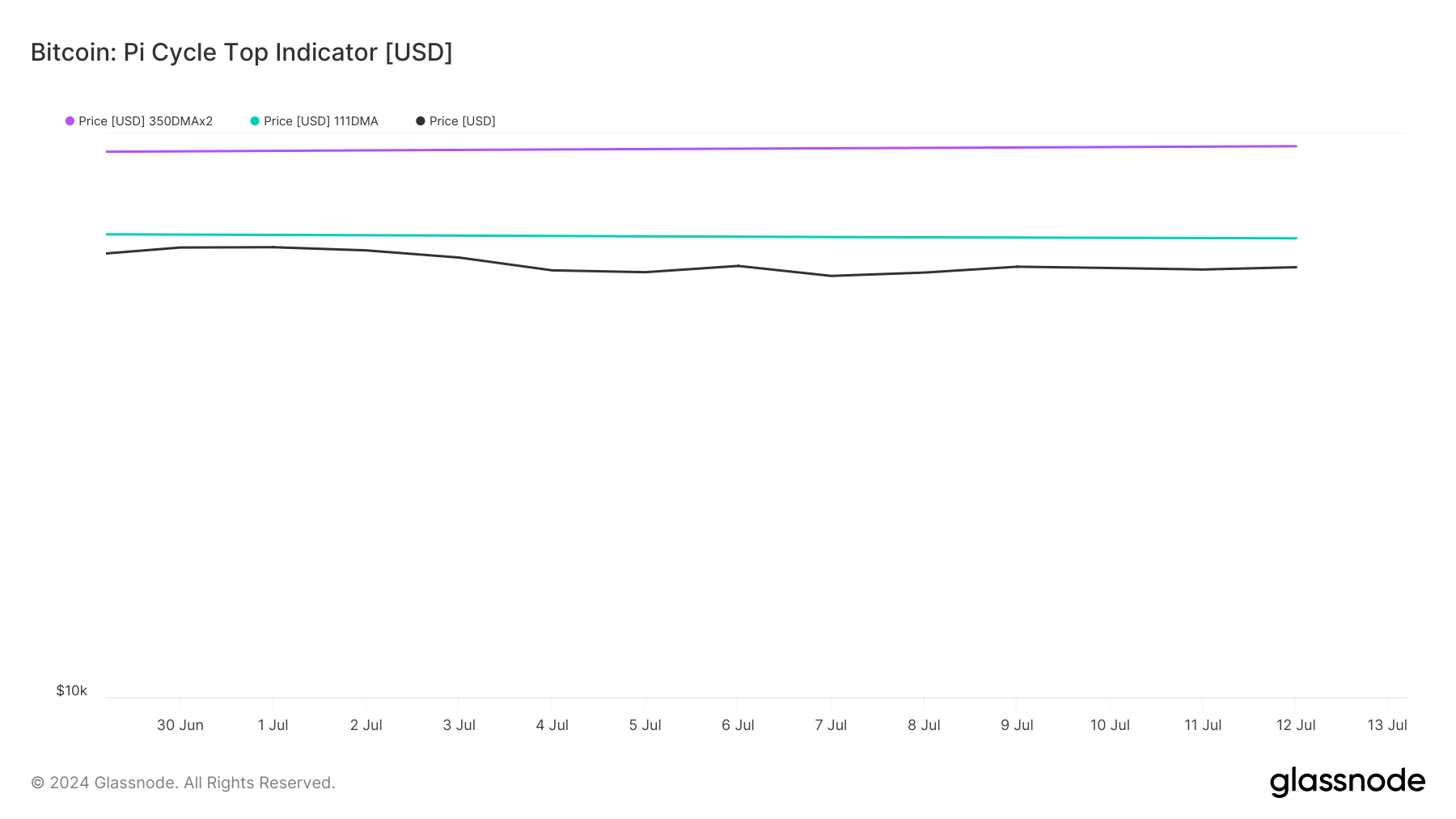

On the contrary, Glassnode’s data showed that BTC is still trading below its possible market bottom. According to the PI Cycle Top indicator, BTC is priced below the market bottom of $65,000. If the indicator is to be believed, it is feasible that BTC will reach $94,000 in the coming weeks.

Source: Glassnode

Read Bitcoins [BTC] Price prediction 2024-2025

Finally, we checked Bitcoin’s daily chart to better understand whether BTC would continue its uptrend. We found that the MACD showed a bullish crossover on the charts.

Both the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF) recorded gains, underscoring the possibility that Bitcoin’s bull rally would continue.