- Whale transactions on the Polygon network spiked due to price fluctuations

- Despite institutional interest, MATIC’s price could fall below $0.47

Polygon [MATIC] Interest in whales was a topic of discussion a few days ago due to a spike in the number of transactions. Normally, transactions with a value of $100,000 or more are considered whale transactions.

According to IntoTheBlock, MATIC whale transactions increased by more than 1000% and were valued at more than $100 million. When things like this happen, it’s a sign of institutional interest in a token. And usually this affects the price of the token.

More than 100 million dollars were exchanged, but MATIC remains down-to-earth

For MATIC, the price at the time of writing was $0.49. This marked a drop of 4.19% in the past 24 hours. However, earlier this week the value of the token climbed to $0.52 on the charts. Therefore, the decline implies that holders of the token have made profits on the initial rise.

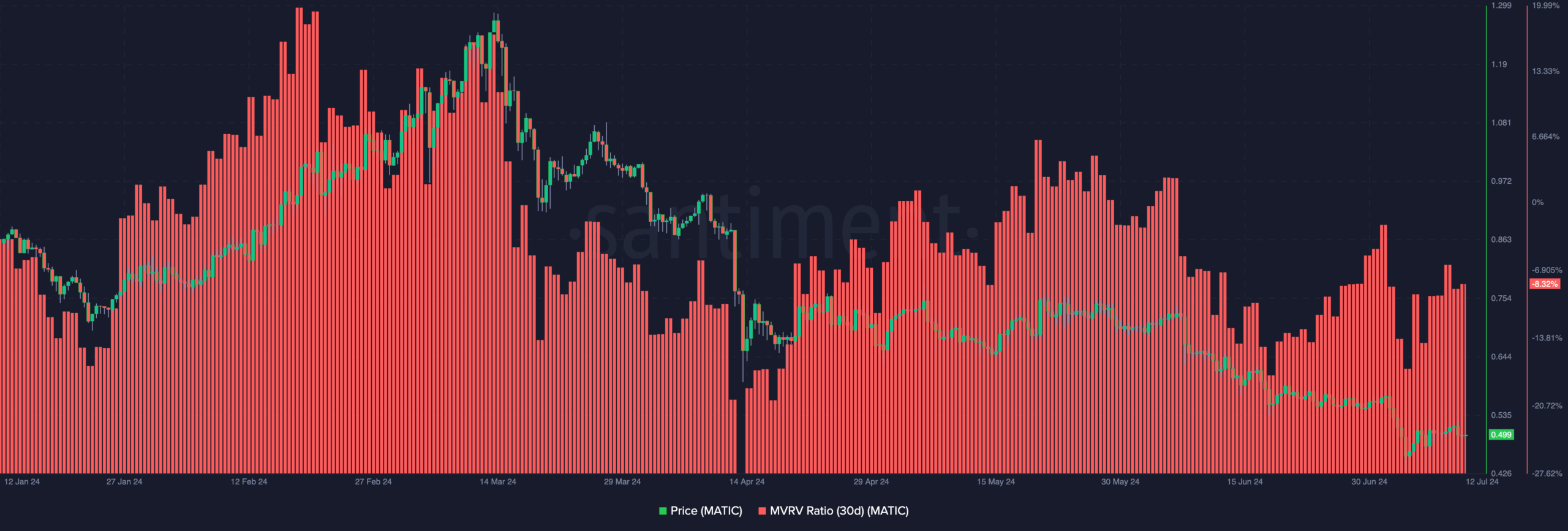

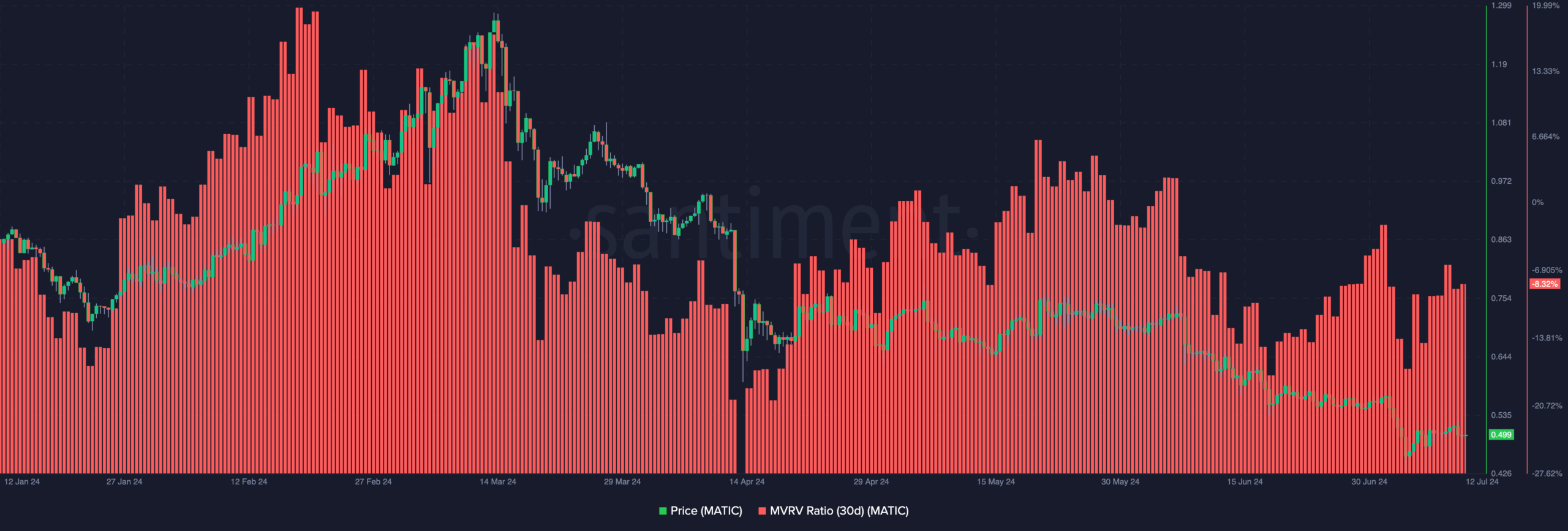

Hence the question: will MATIC’s price rise if there is another round? interest in whales appears? Let’s start by looking at market value to realized value (MVRV).

This ratio used profitability to measure whether a cryptocurrency has reached its peak or is at the bottom. In most cases, the higher the average gain, the closer a token is to the top.

However, if there are many unrealized losses, it means that the bottom has almost been reached. At the time of writing, MATIC’s 30-day MVRV ratio was -8.32%. This simply means that if holders of the crypto sell at the current price, the weighted return will be a loss of 8.32%.

Source: Santiment

Considering the performance of other altcoins, MATIC could be considered near rock bottom. If the price recovers, the ratio will drop and better buying opportunities may arise.

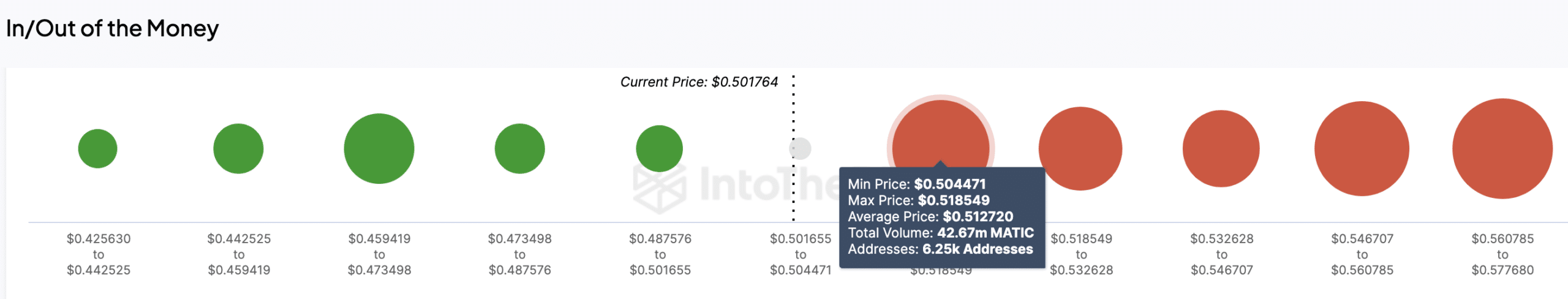

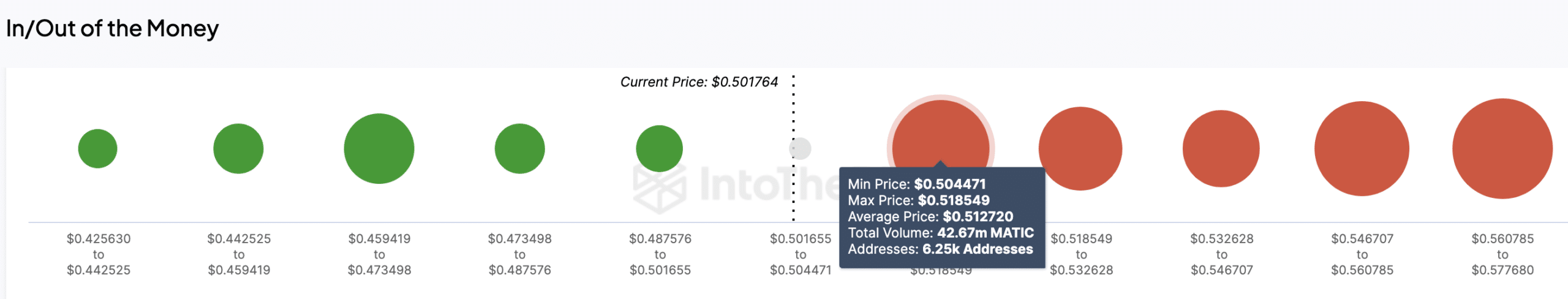

However, apart from the above ratio, the In/Out of Money Around Price (IOMAP) is a factor that can determine whether the MATIC price will increase or not. The IOMAP classifies addresses based on the price they purchased and whether they make a profit or not.

No more procrastination?

As a result, this measure can act as support or resistance. When there are a large number of addresses buying in a certain price range, the region will be the support or resistance.

If the larger addresses run out of money, that would be resistance. On the other hand, if they are in the money, it would be support.

According to IntoTheBlock, 6,250 addresses purchased 42.67 million MATIC at an average price of $0.51. This cohort is currently without money. On the other hand, 1,060 bought 58.97 million tokens for around $0.49.

Source: IntoTheBlock

Realistic or not, here is the market cap of MATIC in ETH terms

As a larger number of addresses appeared to be above the press time price, this meant that MATIC faces resistance on the charts. Therefore, there is a chance that holders of $0.51 will decide to break even once the price comes back to the level.

If that happens, MATIC could pull back and the next decline could be below $0.48.