- The RSI and Bollinger bands showed that NOT will jump higher soon

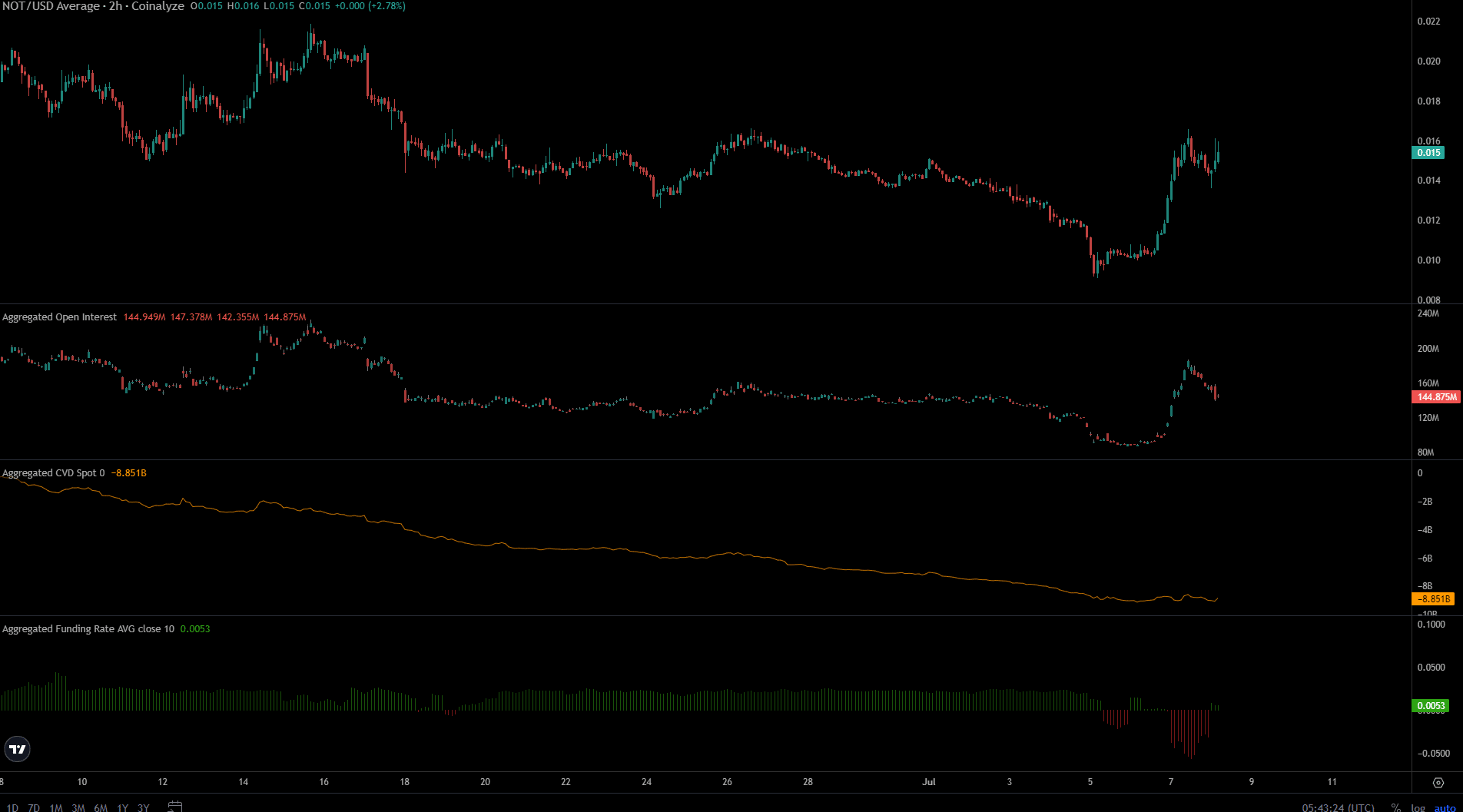

- The rise in OI showed that speculators are eager to go long, but this could also create ideal conditions for a long squeeze

Non-coin [NOT] saw a 62% increase this weekend, after last week’s 40% drop. The price of Notcoin is now higher than on Monday, July 1.

Furthermore, this was accompanied by a large increase in trading volume, with daily volume increasing by just over 300% on Sunday, July 7.

The effect of Bitcoin [BTC] The bearish sentiment of the past week showed strong signs of waning. AMBCrypto took a closer look at the NOT charts to understand if the bulls can take prices back to the $0.03 high.

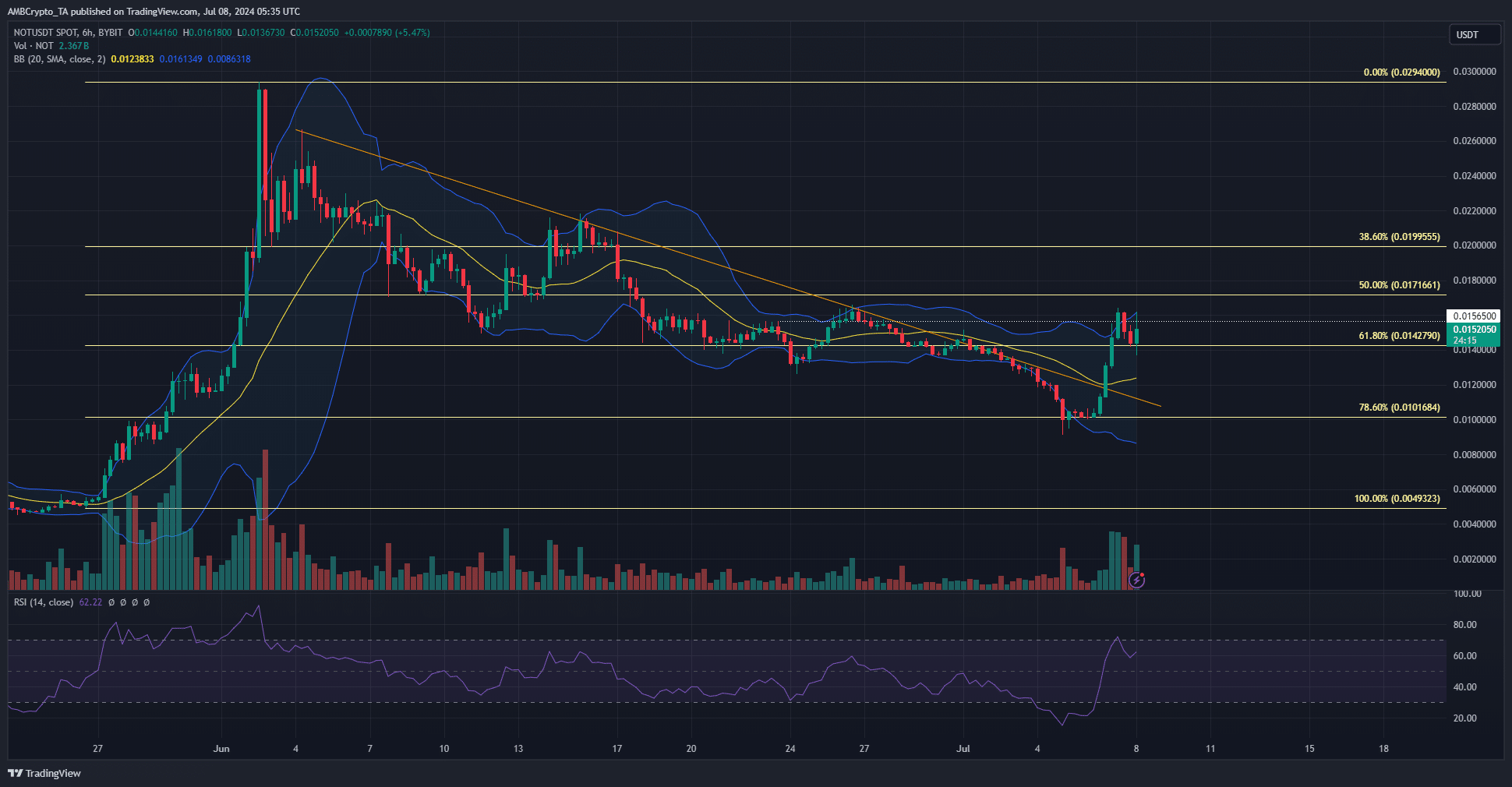

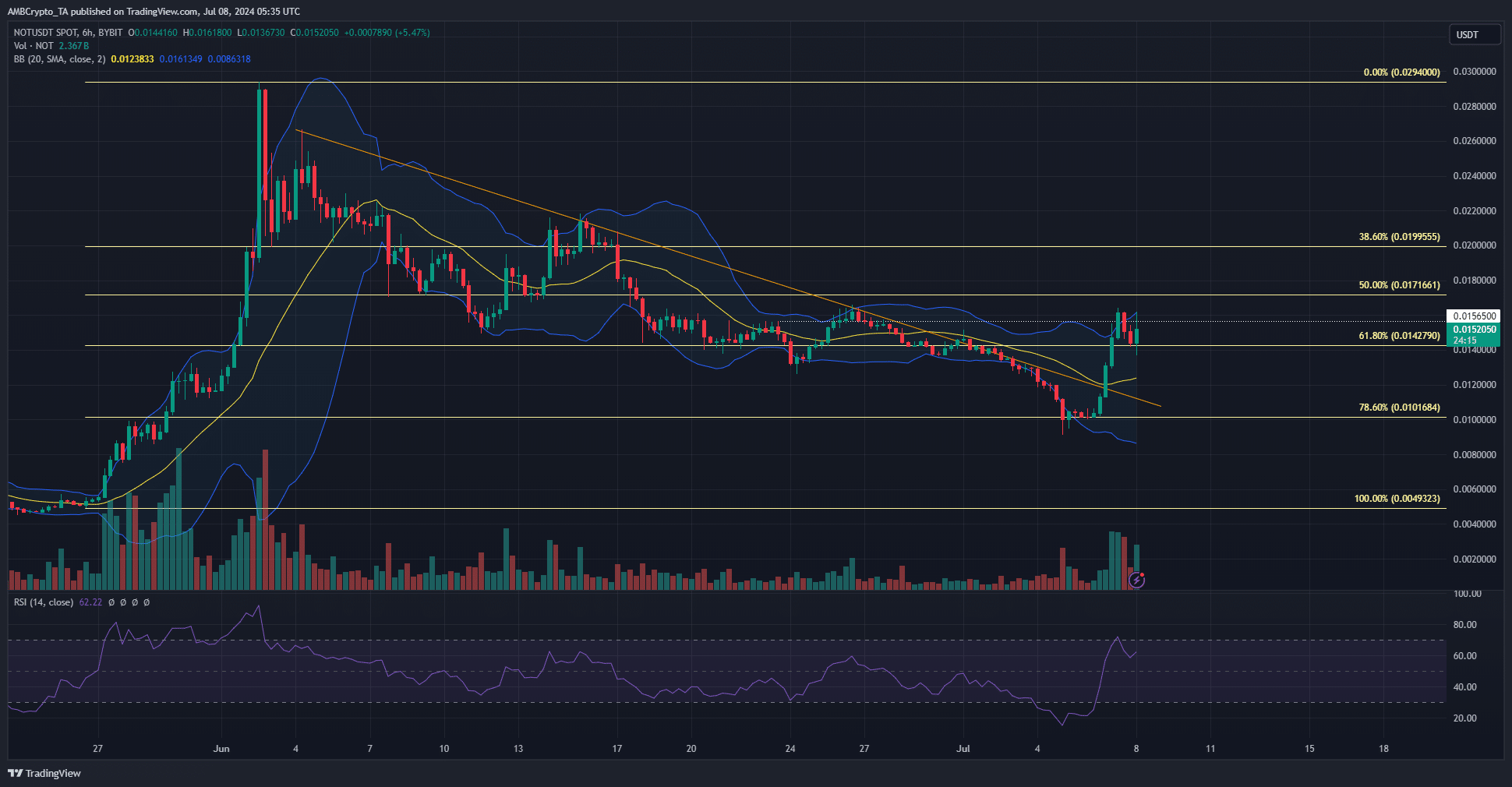

The NOT trendline breakout has been solidly bullish so far

Source: NOT/USDT on TradingView

Notcoin’s 6-hour chart showed that the token has been in a retracement phase since the second week of June. At the Fibonacci retracement levels, the 50%, 61.8% and 78.6% levels were tested as support.

The latter has been defended in recent days, even though market-wide sentiment has been bearish. The increased trading volume during the price rally was also encouraging. This jump made Notcoin break the bearish market structure and also the trendline resistance.

The Bollinger bands started to expand to indicate volatility, and the RSI was above the neutral 50. It is expected that NOT can continue its uptrend to reach $0.03 in July, but this also depends on the trend of BTC.

Other figures disagreed with the sustainability of the recent rally

While price action and volume have been solidly bullish, spot CVD has not increased noticeably after the June slump. This suggested that selling pressure has been so high for so long that the bulls still have an uphill battle ahead of them to turn things around.

Read Notcoin’s [NOT] Price forecast 2024-25

Open Interest rose significantly, indicating bullish sentiment in the short term. However, the financing rate barely rose above zero.

So the two futures metrics disagreed on speculators’ beliefs, but we can conclude that near-term futures traders are becoming increasingly eager to go long Notcoin.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer.