- Mount Gox has transferred $2.7 billion worth of BTC to a new address.

- The transfer has caused panic, with fears of massive sell-offs.

Like Bitcoin [BTC] posted a two-month low after dropping 11,715 in the past seven days to trade at $54k, but the market continued to see a massive sell-off.

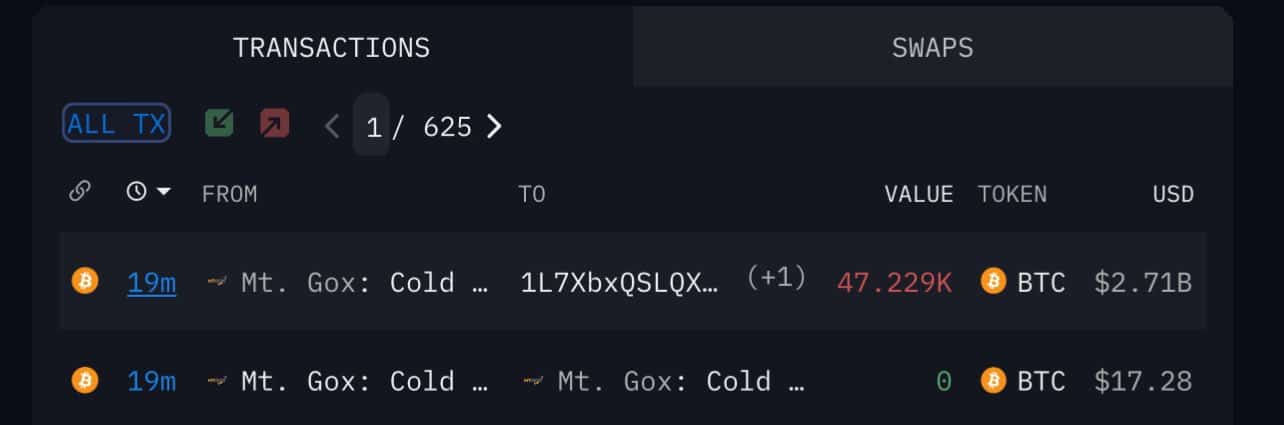

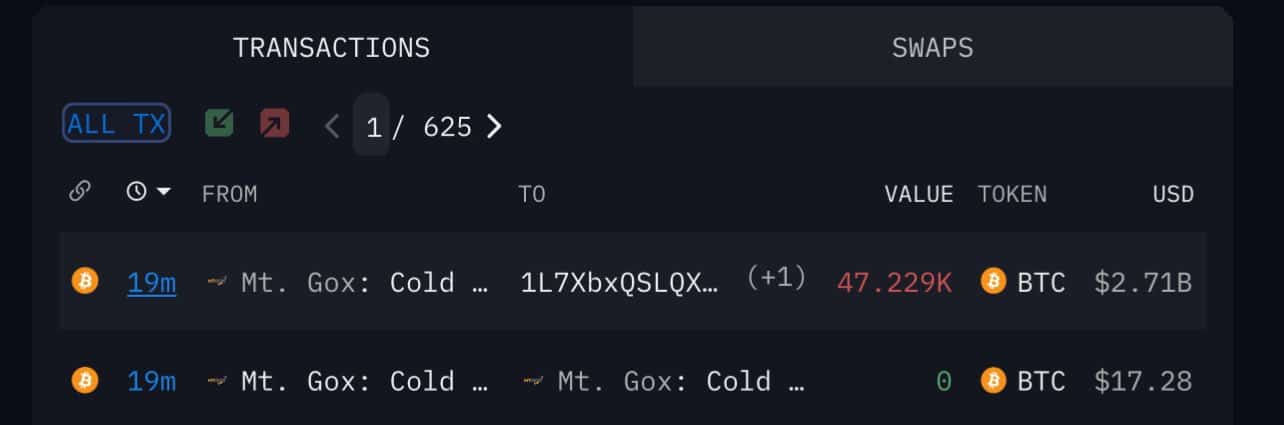

According to Arkham Intelligence, the bankrupt Japanese exchange Mt. Gox transferred $2.7 billion worth of Bitcoin to a new address.

Arkham announced the transfer on their official X page (formerly Twitter), stating:

“Mt Gox moves 47,228 BTC ($2.71 billion) from cold storage to a new wallet.”

Source:

According to Lookonchains post on X, Mount Gox has been preparing to pay its creditors in recent days. In the post they stated:

The #MtGox wallet transferred 47,229 $BTC ($2.71 billion) 30 minutes ago, possibly in preparation for the reimbursement in July.”

Why does Mount Gox transfer money?

Mount Gox was the world’s largest crypto holder before its collapse in 2014, trading more than 80% of BTC in USD at the time. However, it filed for bankruptcy after a series of robberies that resulted in 950K BTC.

Ten years later, the company is preparing $9 billion in BTC to pay the victims of the robberies. Therefore, the recent transfer is a glimpse of hope for victims who have waited years for compensation.

Last month, the company announced it had completed all necessary steps to initiate refunds, following delays and legal battles.

The refund means that creditors who lost their Bitcoin when it was trading at $600 in 2014 will enjoy the huge value added after 10 years of steady appreciation.

Concerns about a possible sell-out

Following the refund news, several players have raised concerns, arguing that Mount Gox is dumping, mirroring the same actions Germany took days ago.

According to analysts, this is causing panic, resulting in selling pressure, which has caused BTC prices to fall.

Angelo shared her concerns about X, arguing that the market is likely to see more price declines, noting:

“The entire market is dumping and may continue to dump as mtgox makes the original BTC holders whole.”

Undoubtedly, the transfer will increase the BTC volume in the market, which will lead to inflation. Moreover, most people who receive the compensation will sell their assets after a long wait.

Such a sell-off would have a significant negative impact on BTC prices.

General market implications

This negative price action will particularly impact the market as Mount Gox customers will sell their BTC to take advantage of the crypto’s accumulated profits.

Read Bitcoin’s [BTC] Price forecast 2024-25

As creditors get their tokens back, crypto prices will come under extreme pressure this month. In addition to Germany’s move to transfer $310 million worth of BTC, the market will suffer from the dump.

However, all forecasts point to a recovery from August onwards, where these losses will be short-lived and market forces will keep them in check.