- Solana surpassed Bitcoin and Ethereum in gains, marking a strong start to the third quarter.

- VanEck and 21Shares filed for Solana ETFs, impacting market sentiment.

The crypto market started the first day of the third quarter on a positive note, with Bitcoin [BTC] and several altcoins on a bullish trajectory.

Solana in the spotlight

Solana [SOL]Notably, it stole the spotlight with a remarkable 7.50% increase in the past 24 hours at the time of writing. This increase surpassed both BTC and Ethereum [ETH]. SOL prices have also risen 18% over the past seven days.

Interestingly, the Solana memecoin market also showed strong bullish momentum. According to Coin geckoSolana memecoins’ market capitalization reached $7.73 billion on July 1, reflecting a 10.4% increase in the past 24 hours.

Saying the same about this, an Borovik (formerly Twitter) commented:

“Welcome to the Solana cycle.”

Solana ETF in the pipeline

This coincides with recent filings from two asset managers, VanEck and 21Shares, both of which filed last week to launch a spot Solana ETF.

According to reports, on June 27 VanEck has taken an important step by applying for a Spot Solana ETF with the US Securities and Exchange Commission (SEC).

The next day, June 28, 21Shares have also filed for their own Spot Solana ETF, increasing investor hopes for an upcoming SOL ETF.

Impact on the upcoming US elections

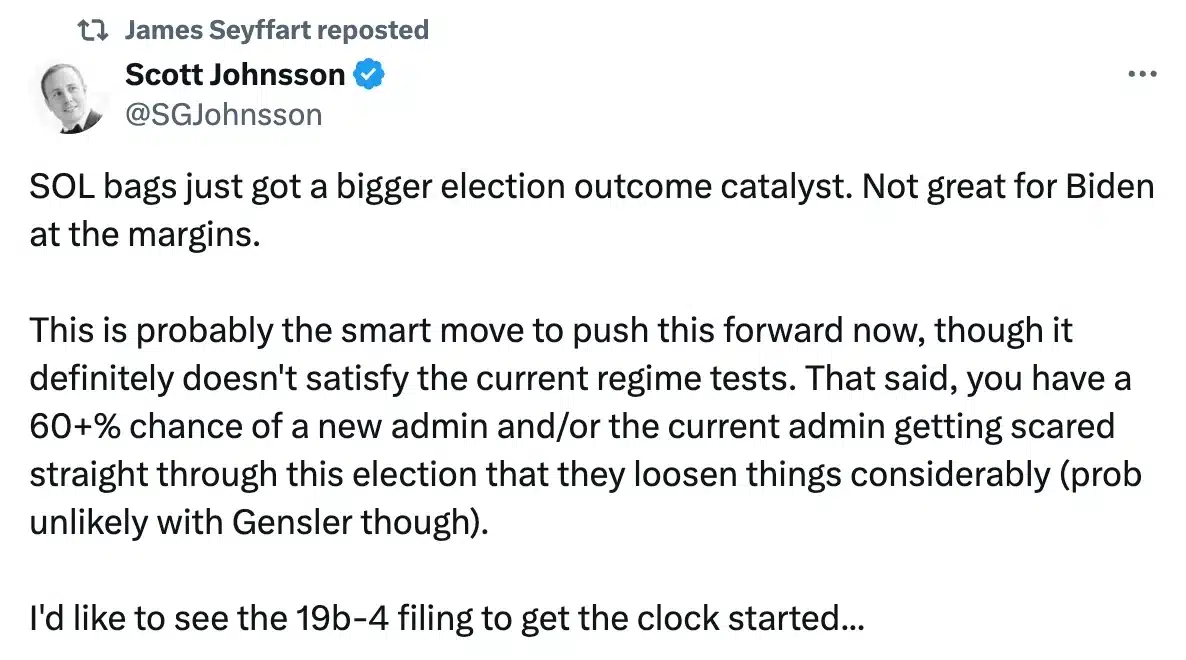

This news received a lot of appreciation, especially in the context of the upcoming presidential elections, where the two candidates had opposing views on crypto.

Former President Donald Trump has been outspoken about his pro-crypto stance and often expressed support for the industry. In contrast, President Joe Biden has shown a relatively anti-crypto stance, with fewer instances of him favoring digital currencies.

The general partner of Van Buren Capital says: Scott Johnson, noted that news of an upcoming Solana ETF may not be good for President Biden’s chances in the election, especially among undecided or marginal voters. He said,

Source: Scott Johnsson/X

Not everyone was on the same page, however, as James Seyffart, ETF analyst at Bloomberg Intelligence, said during an interview conducted before 21Shares became the second Solana applicant.

“I think VanEck’s filing is kind of a call option for the November election.”

He added,

“Under the current SEC administration – based on years of pre-approval and denial orders for crypto ETFs – a Solana ETF would have to be denied because a federally regulated futures market does not exist. But a new admin in the White House and a new SEC admin more receptive to crypto policy could change that calculus.”

SOL’s price action

Despite mixed feelings, news of a potential Solana ETF drove SOL’s share price gains into double digits.

Current data trends also indicate that SOL’s future remains promising, supported by the Bollinger Bands indicating reduced volatility and continued bullish sentiment.

Moreover, the RSI above the neutral level and an upward trend further confirmed this trend.

Source: TradingView