- LINK has depreciated by 3.21% in just 24 hours

- However, despite the price drop, market sentiment remained largely positive

In recent weeks, altcoins have fallen significantly on the price charts. During the same period, LINK recorded a sustained consolidation phase. However, the altcoin has not been immune to periods of depreciation, with the crypto down 3% in the last 24 hours alone. Nevertheless, market sentiment remains positive across the board. Is there a reason why?

What drives LINK’s market optimism?

Amid the market volatility, several developments have attempted to push LINK’s price action in a positive direction. To start, Coinbase Derivatives has filed to list LINK-regulated futures contracts with the CFTC. As expected, these reports have made everyone optimistic.

Another factor that plays a crucial role in changing market sentiment is the speculation surrounding LINK ETFs. According to Chainlink red pillLINK ETFs could be on the horizon. He shared,

The road to a $LINK ETF is being constructed. In terms of timing, this could work out well. We want Tradfi to have an easy way to buy $LINK when Sergey starts dropping the huge Chainlink usage for RWAs. It all comes together.”

These two developments have played a crucial role in shaping market sentiment. By extension, many in the community are also predicting higher price targets for LINK. Popular crypto analyst Wave Tony is among those betting big on the altcoin. According to him,

“$LINK can realistically go to 0.0009 $BTC this cycle. $75k BTC would put LINK above $67. $150k BTC would put LINK at $135.”

What do the basics of LINK suggest?

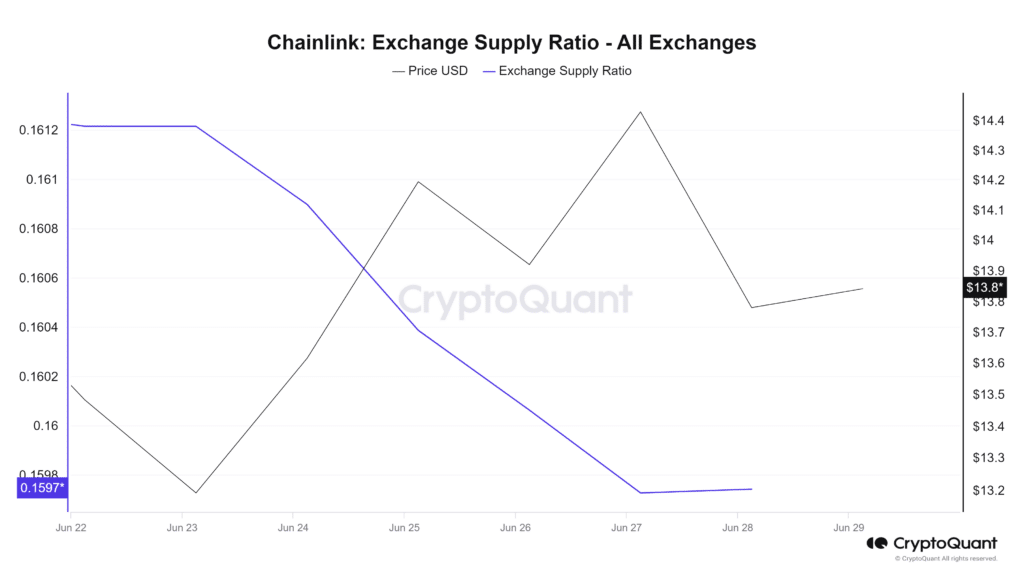

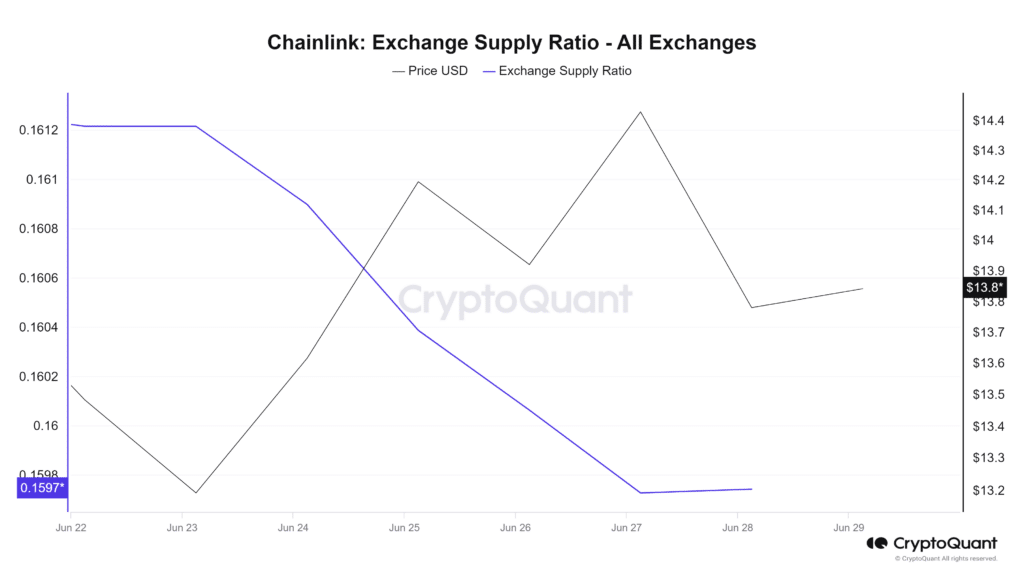

AMBCrypto’s analysis of CryptoQuant revealed that the market has seen some positive growth on the charts. In fact, LINK’s currency supply ratio recorded a sustained decline from 0.161 to 0.159 over the course of just one week.

A drop in the exchange offer ratio means holders are moving assets to external wallets, indicating confidence in LINK’s future value. It also means reduced selling pressure, causing prices to rise.

Source: CryptoQuant

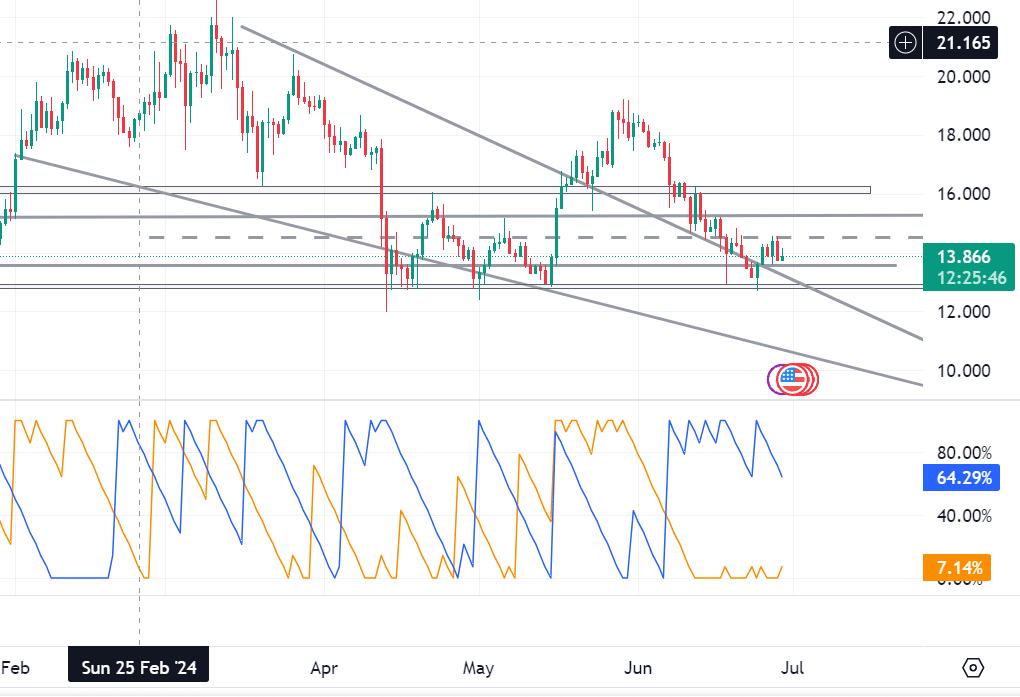

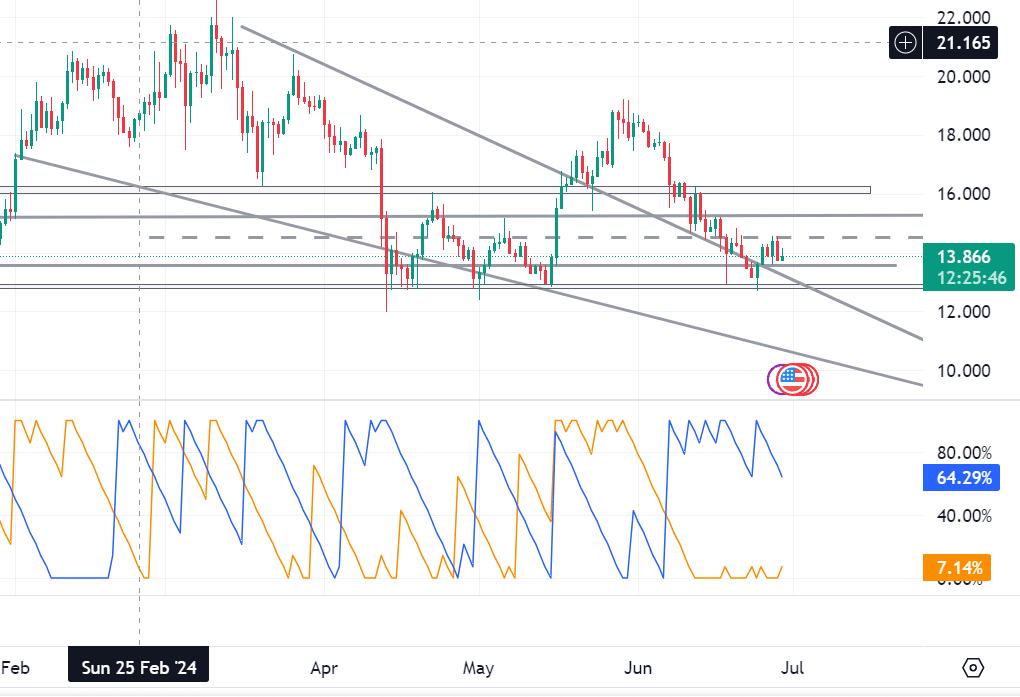

Moreover, our analysis showed that the Aroon Up line was above zero at 7.14%. Here Aroon Up lines measure the strength of a trend and help understand where the price will reverse. 7.14% means that the prevailing trend is gaining strength.

The Average Directional Index (ADX), which measures trend momentum, also underlined a continued uptrend.

Source: Tradingview

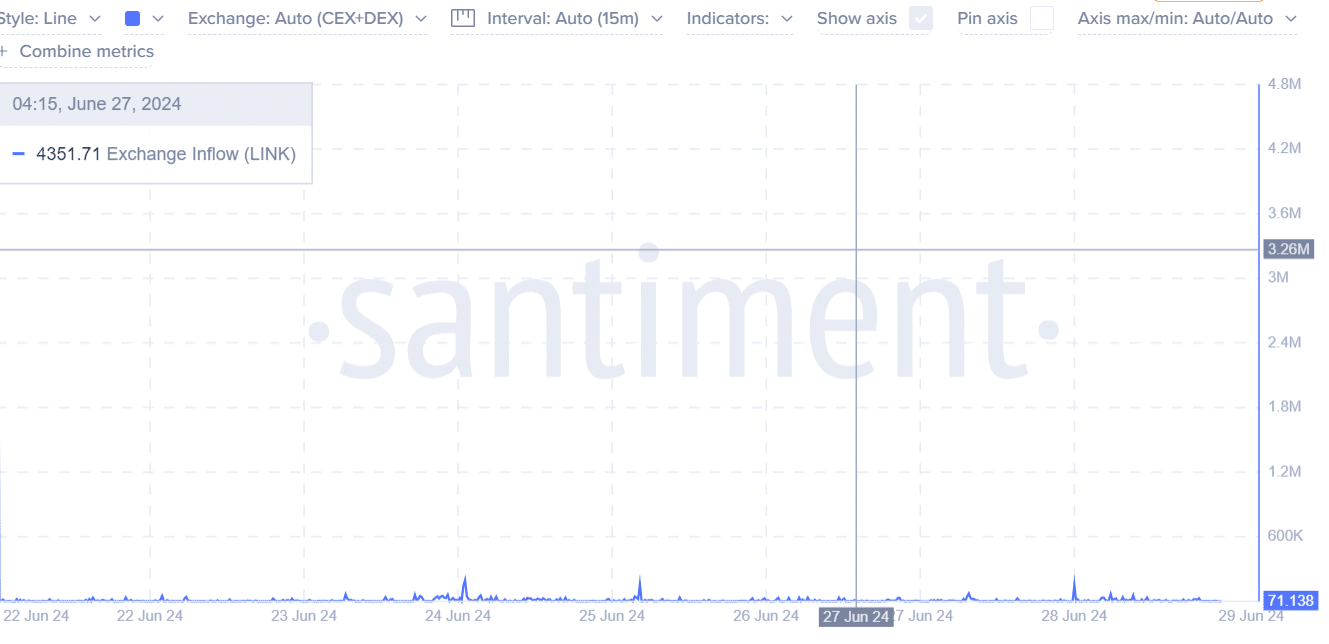

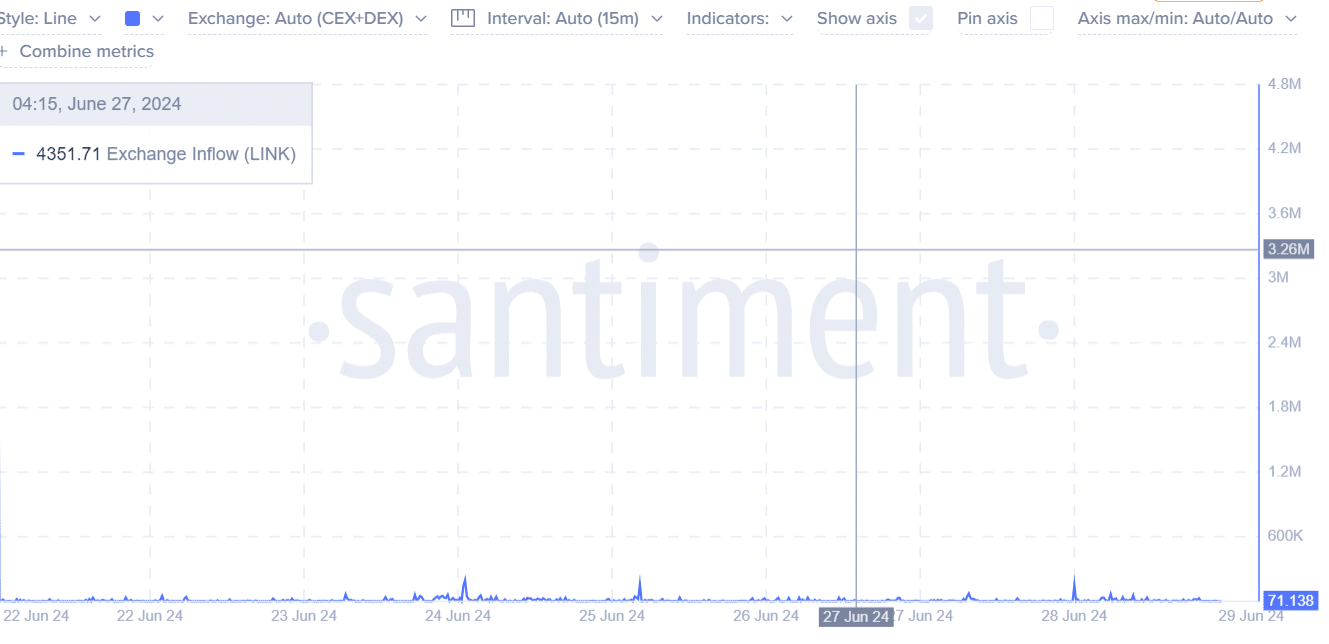

Finally, according to Santiment, currency inflows have declined over the past seven days. In fact, it fell from a high of 209k to 71,138k. This can be seen as a sign of a high accumulation rate, and by extension, reduced selling pressure.

Source: Santiment

What next for LINK?

At the time of writing, LINK was trading at $13.83, after breaking through $13.624. LINK will reach the next resistance level around $14.52 if positive market sentiment continues.

In a very bullish scenario, a break of this level will challenge the $15.26 level it attempted previously. However, if the market sees a correction, it will fall to the critical support level of around $13.54. Here, a further decline would push the price towards the local support level of around $12.72.