- Analysts claim that miners’ price impact on BTC has decreased.

- However, the total supply to miners was over $100 billion, making it an important price factor.

Bitcoin [BTC] was back to a three-month low of almost $60,000, amid compounded negative sentiment resulting from several factors.

Market observers have cited macro uncertainty, the Bitcoin miner crisis, and the supply glut of several entities, including planned Mt. Gox redemptions.

However, one analyst, Fred Krueger, did downplayed the impact of Bitcoin miners on BTC price action based on the amount of money the top miners hold and the monthly supply. He said,

“These miners are no longer important to the price of Bitcoin. The top 5 together own 34K BTC. Even if they sell half of everything they have, that’s only $1 billion, or 0.1% of the asset’s value. In terms of new supply, these generate 5 2K BTC per month. It doesn’t matter anymore.”

No, BTC miners still matter

Marathon Digital, Clean Spark, and Riot Blockchain are among the top public BTC miners by market cap. However, other analysts refuted Krueger’s argument.

One of them, James Van Straten, underlined that most of the miners’ selling pressure came from unprofitable private miners.

“Public miners only have 20-25% of the hash rate. Many private companies that own BTC are going bankrupt or outsourcing BTC. This is one of the main reasons why BTC struggles after every halving.”

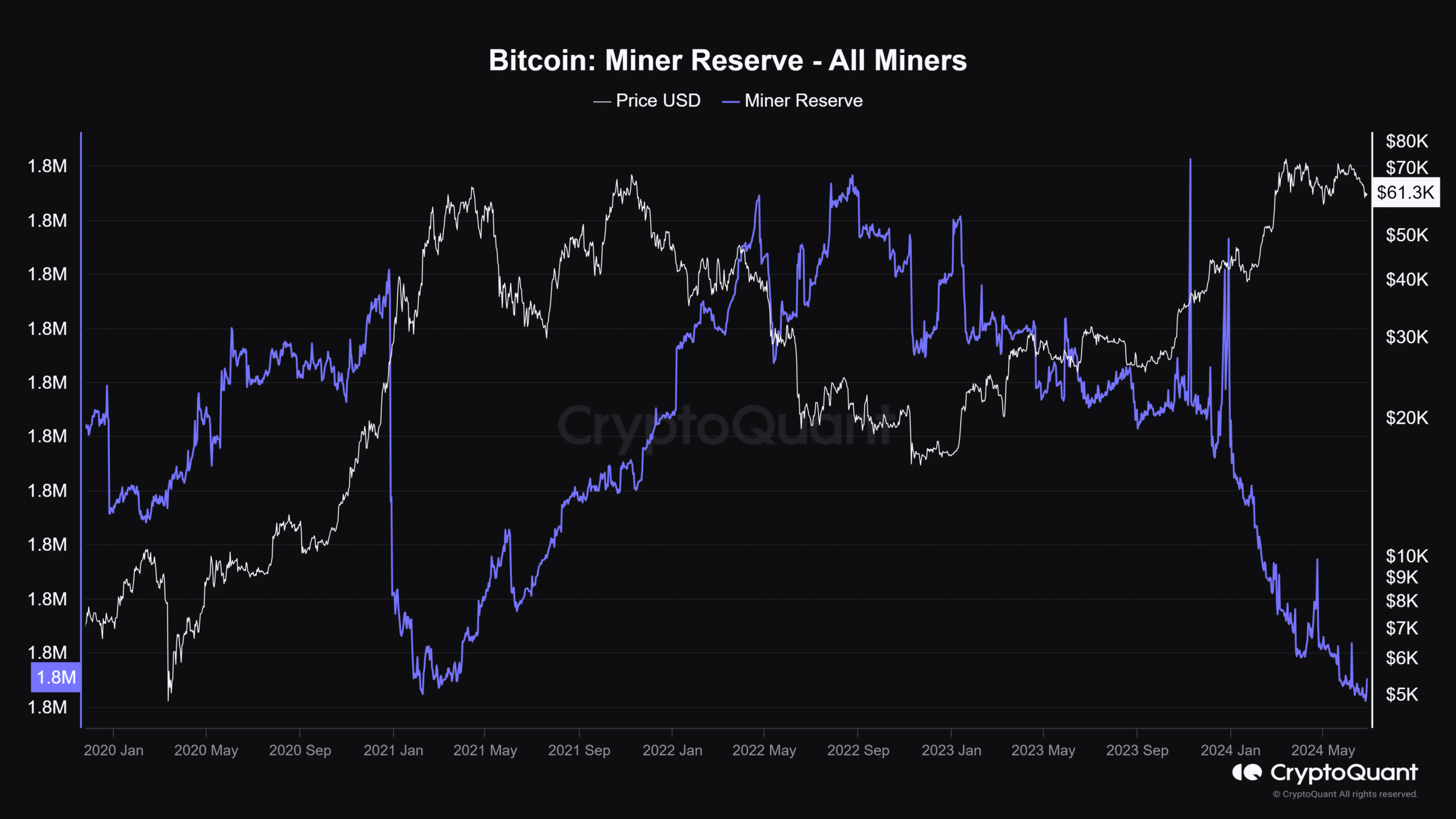

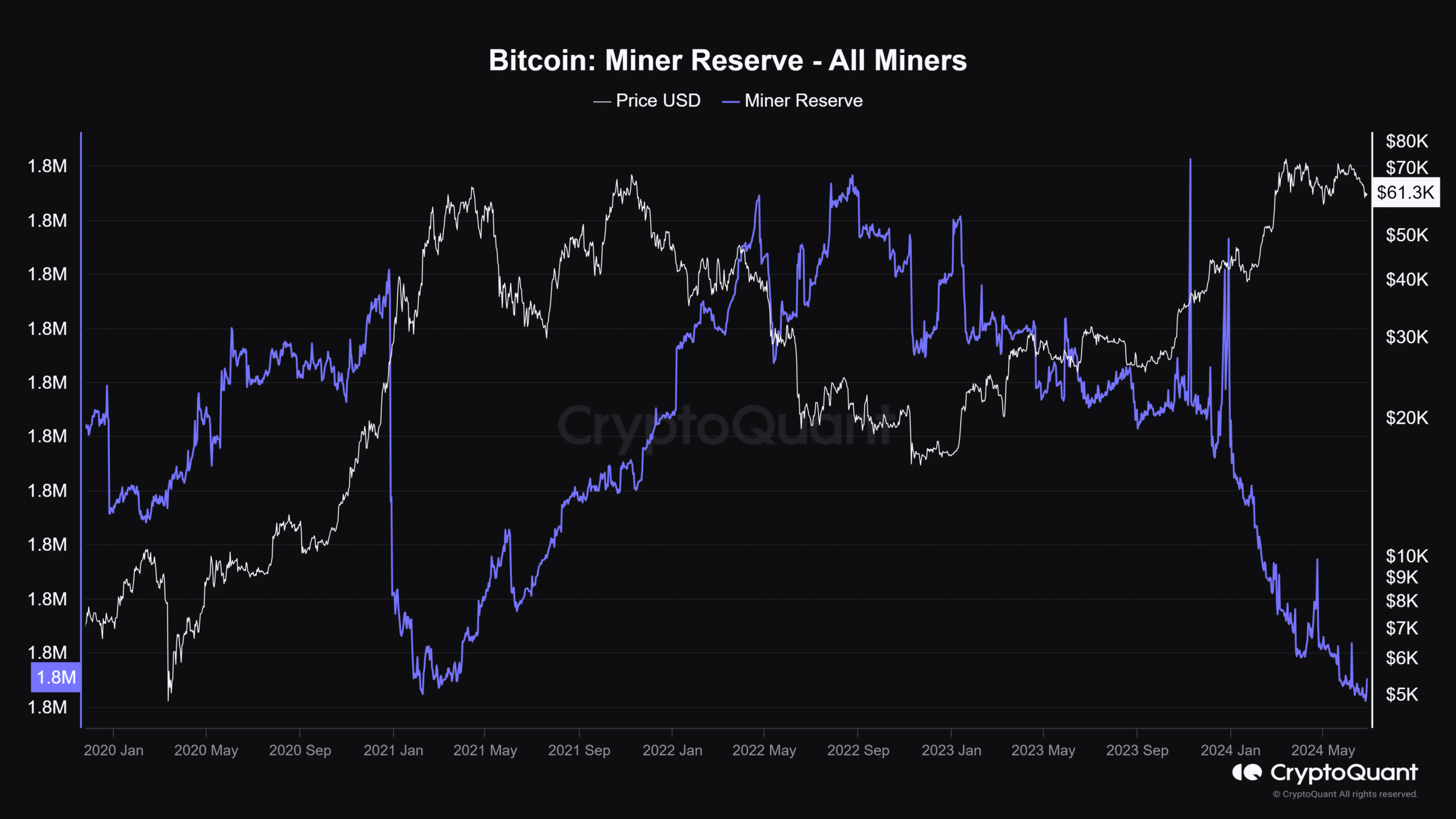

According to Straten, the total supply from miners amounted to a whopping 1.8 million BTC, which is worth approximately $109.8 billion at current market prices.

The analyst added that despite a drop in total supply from miners, the staggering amount was still “constant selling pressure.”

AMBCrypto analysis of the total BTC miner reserve confirmed Straten’s opinion. The stat had dropped to 1.8 million BTC, matching the 2021 lows.

Source: CryptoQuant

A recent AMBCrypto report found that BTC Miner to Exchange Flow has decreased, indicating that less BTC is open to exchanges for sell-offs.

However, this also meant that future price increases would encourage miners to unload at higher profits.

So does another analyst, Willy Woo to maintain that the miners still matter.

“Take that away to get the real long-term demand and real supply. New investors, OG sellers, miners selling new supply on impulse. It turns out they still matter.”

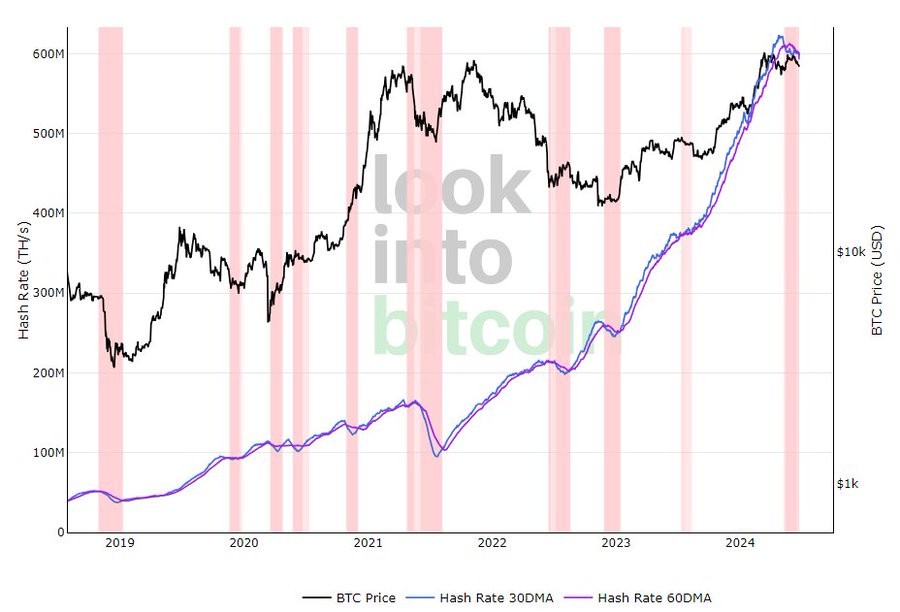

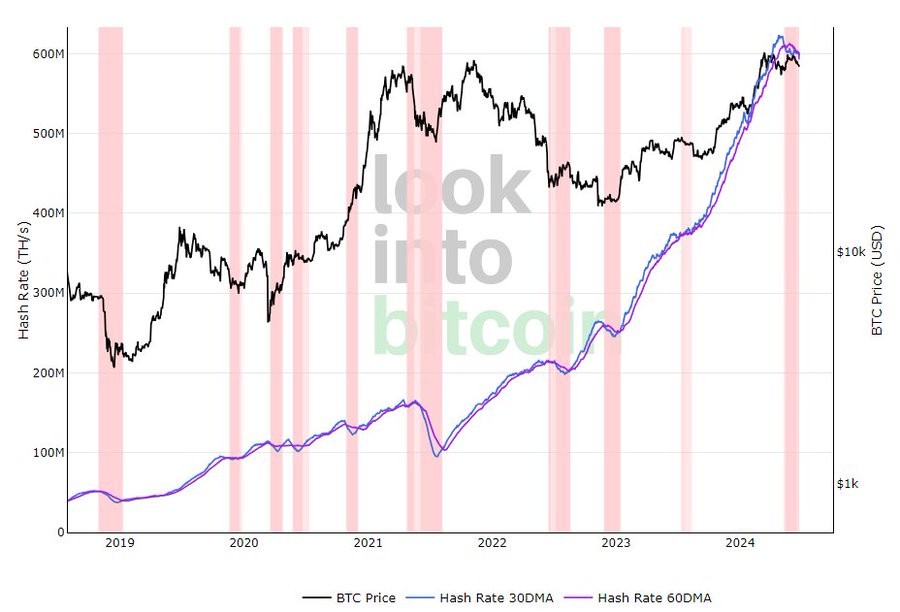

Meanwhile, the miners’ capitulations were far from over and hashrates remained low. An user noted that the current capitulation was the longest capitulation since the crypto winter of 2022.

“Hashrate continues to decline. This is now the longest capitulation of #bitcoin miners since the bottom of the 2022 bear market.”

Source: Look at Bitcoin

Historically, BTC prices bounce back when hashrates rise. If this trend continues, it could reinforce the idea that miners still have a say in BTC prices.