The once vibrant crypto market continues to sputter, with Bitcoin, the undisputed king of the digital realm, leading the retreat.

After a euphoric climb that saw it breach the $73,000 level earlier this year, Bitcoin has shed its royal mantle, plummeted to new lows and dragged the entire crypto ecosystem into a period of icy uncertainty.

Related reading

Exodus from the empire: investors rake in billions

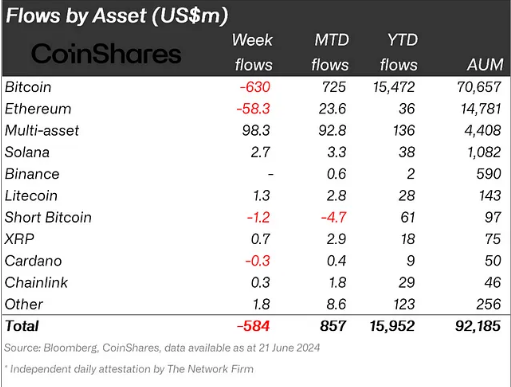

The past few weeks have been marked by a mass exodus from Bitcoin. Investors, spooked by the prolonged price decline, have fled en masse from the flagship cryptocurrency. A recent report from Coin shares paints a bleak picture, revealing a staggering $630 million outflow from Bitcoin last week.

This follows an equally large outflow of $631 million the week before, marking a brutal two-week stretch for Bitcoin. The bleeding extends beyond Bitcoin, while other prominent cryptocurrencies like Ethereum are experiencing their own investor exodus.

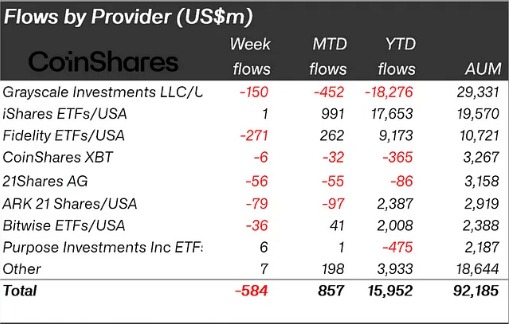

The sale is not limited to individual companies. Bitcoin exchange-traded funds (ETFs), which allow traditional investors to dabble in crypto without directly owning it, have also been hit hard.

Major issuers like Fidelity and Grayscale have witnessed six-day outflows, wiping out hundreds of millions of dollars from their coffers. This mass exodus from both Bitcoin and Bitcoin ETFs paints a clear picture: investors are losing confidence and seeking shelter from the crypto storm.

A chink in the armor? Not quite

While the overall sentiment is undeniably bearish, there are a few glimmers of hope amid the gloom. Short positions, which essentially bet on a price drop, have seen a surprise drop of $1.2 million.

This could be interpreted as a decline in bearish bets, signaling a possible shift in investor sentiment. Moreover, some altcoins like Solana, Litecoin and Polygon have defied the downtrend and posted healthy gains. This suggests that not all bets are off, and some investors may be looking for opportunities in other corners of the crypto market.

A crypto winter thaw or avalanche?

The crypto market is no stranger to dramatic swings. Bitcoin itself has a history of epic boom-and-bust cycles. However, the current downturn raises concerns about a prolonged “crypto winter” – a period of continued decline.

Related reading

Meanwhile, the long-awaited approval of an Ethereum ETF, initially seen as a potential market catalyst, appears to be doing little to dispel the current chill.

Will investors regain their appetite for digital assets, leading to a Bitcoin-driven thaw? Or will the current outflow turn into a full-blown avalanche, burying the crypto market under a blanket of red? It remains to be seen how this crypto winter will unfold.

Featured image of Silktide, chart from TradingView