- Altcoin’s dominance has declined by 15% in the past month.

- Demand for ETH remained significantly low, leaving the altcoin at risk of a further price decline.

Altcoin’s dominance has fallen by double digits over the past month. At 9.88% at press time, it has fallen 15% in the past 30 days, according to Trading view.

Altcoin’s dominance refers to the relative market share of all cryptocurrencies, excluding Bitcoin [BTC]. The decline means that the overall market capitalization of altcoins decreased compared to that of BTC.

This may be because investors are moving their money from altcoins to BTC, which they consider a safer and more stable investment asset.

Altcoin dominance is declining?

In times of market consolidation like this, altcoins’ dominance may decline, while Bitcoin’s dominance may increase, as altcoins lose value or fail to attract investors.

However, BTC’s dominance has not yet shown significant growth within the month under review. At the time of writing, it stood at 55.36%, down 1.03% in the past month and 0.69% in the past seven days.

AMBCrypto reported rather that this gradual decline in BTC dominance is due to the strong resistance the coin is facing at the $70,000 price level.

ETH remains at risk of falling

At the time of writing, Ethereum [ETH] traded at $3,561. According to CoinMarketCapthe value of the altcoin has increased by 14% in the last 30 days, despite the general decline in altcoin dominance in the crypto market.

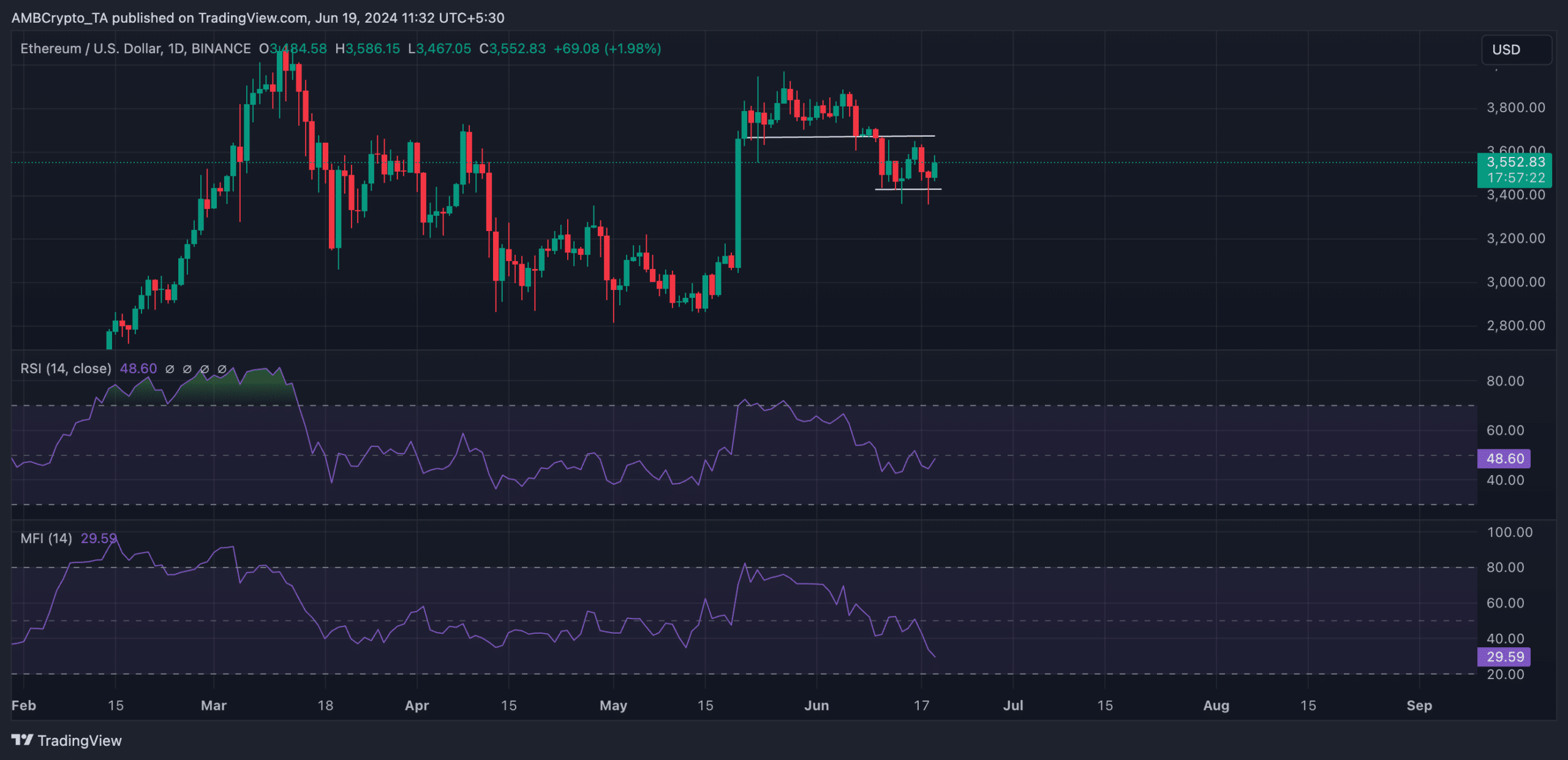

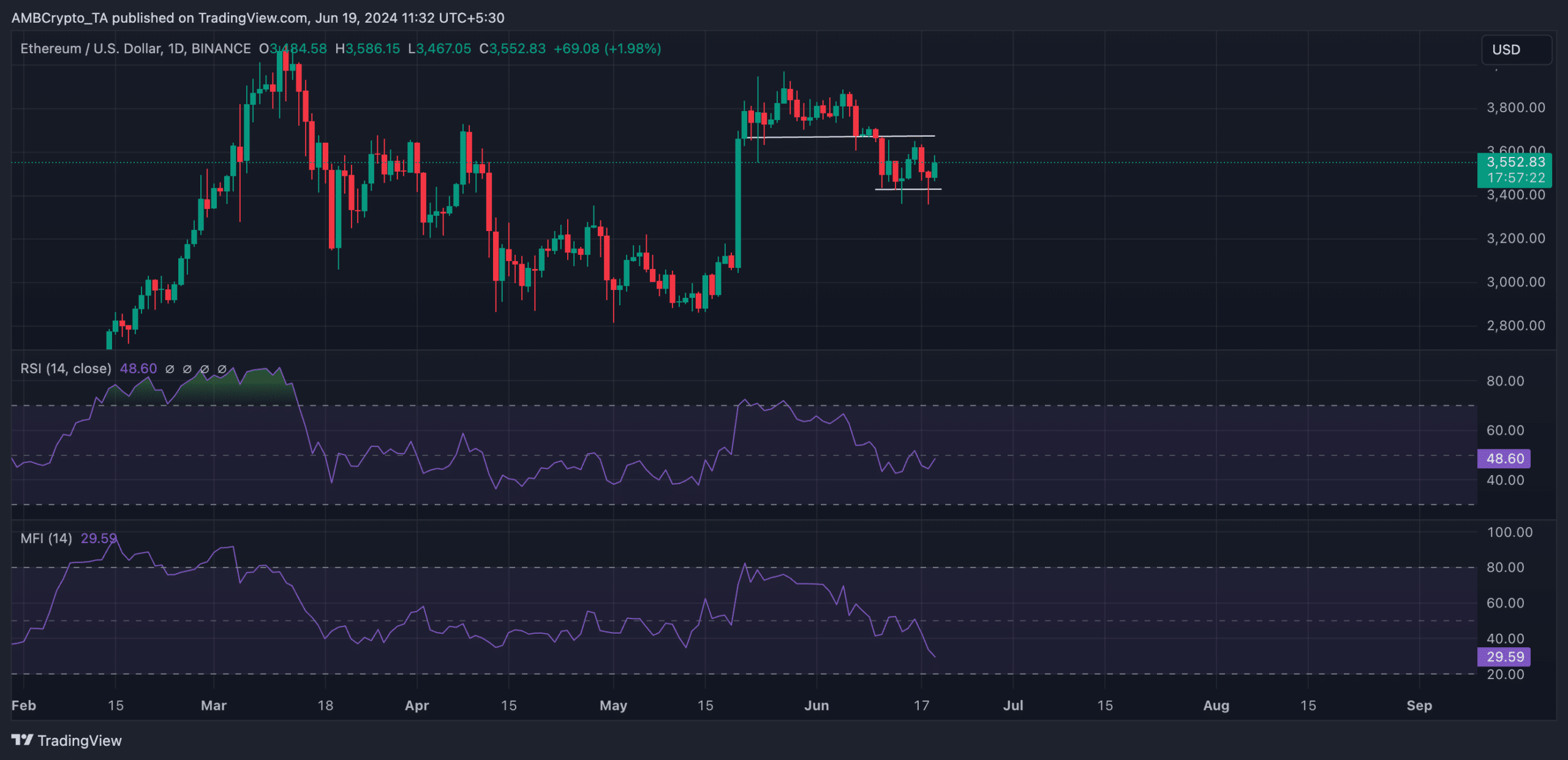

A review of the coin’s performance on a daily chart showed that it broke below the $3693 support level on June 10 and has since turned into resistance.

Although the price of ETH has only increased by 1% over the past week, the price of ETH has been fluctuating within a range since then, with new resistance emerging at the $3693 price level and support being found at $3428.

The key momentum indicators for ETH among market participants confirm the general decline for ETH and were below their respective midlines at the time of writing.

For example, ETH’s Relative Strength Index (RSI) was 48.60, while the Money Flow Index (MFI) was 29.59.

Source: TradingView

These indicators measure oversold and overbought market conditions by tracking the price changes of an asset.

Based on their values at the time of writing, they suggested that selling pressure was significantly higher than buying activity.

Read Ethereum’s [ETH] Price forecast 2024-2025

If the decline continues, ETH risks falling to $3496.

Source: TradingView

However, if the rate is declared invalid, the price could rise to $3658.