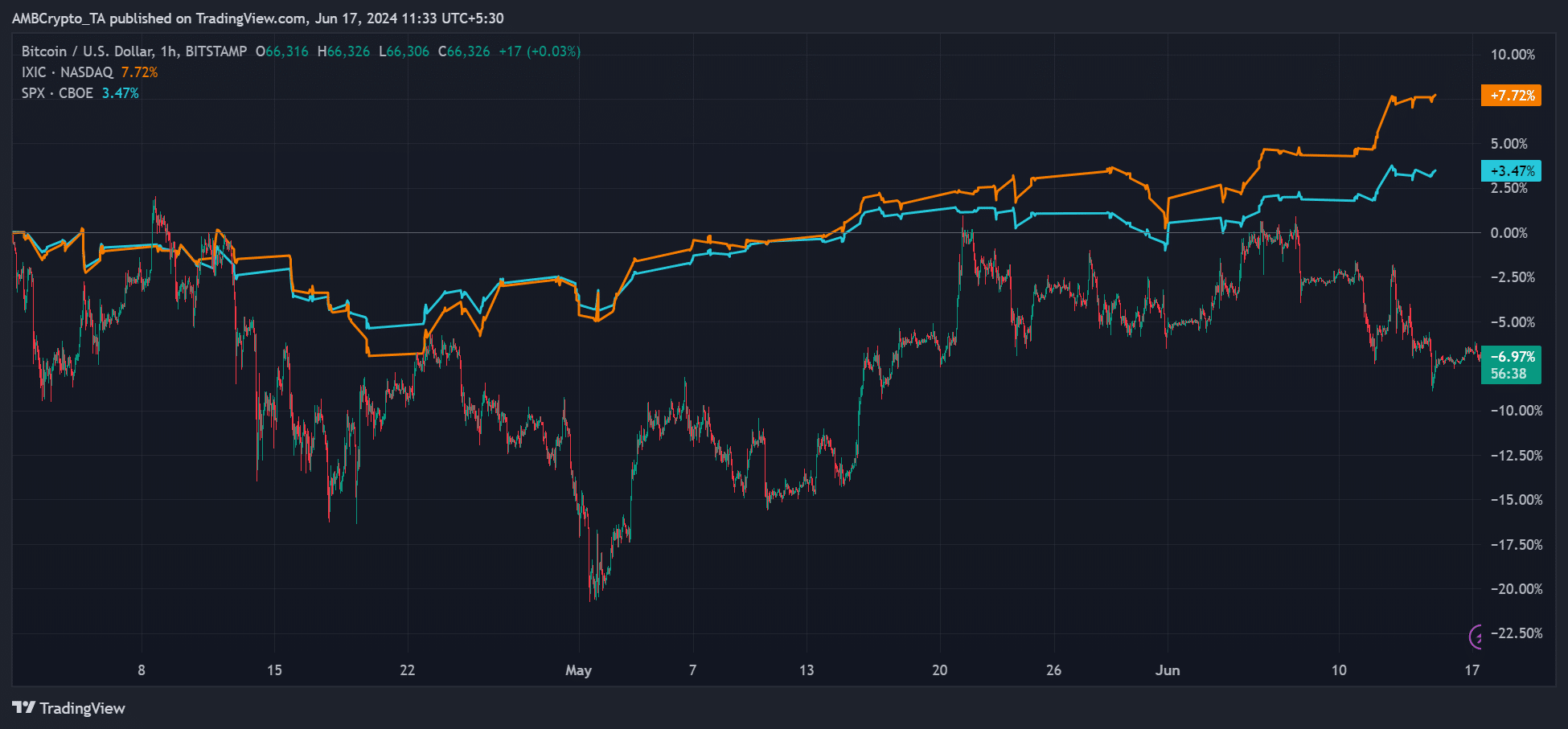

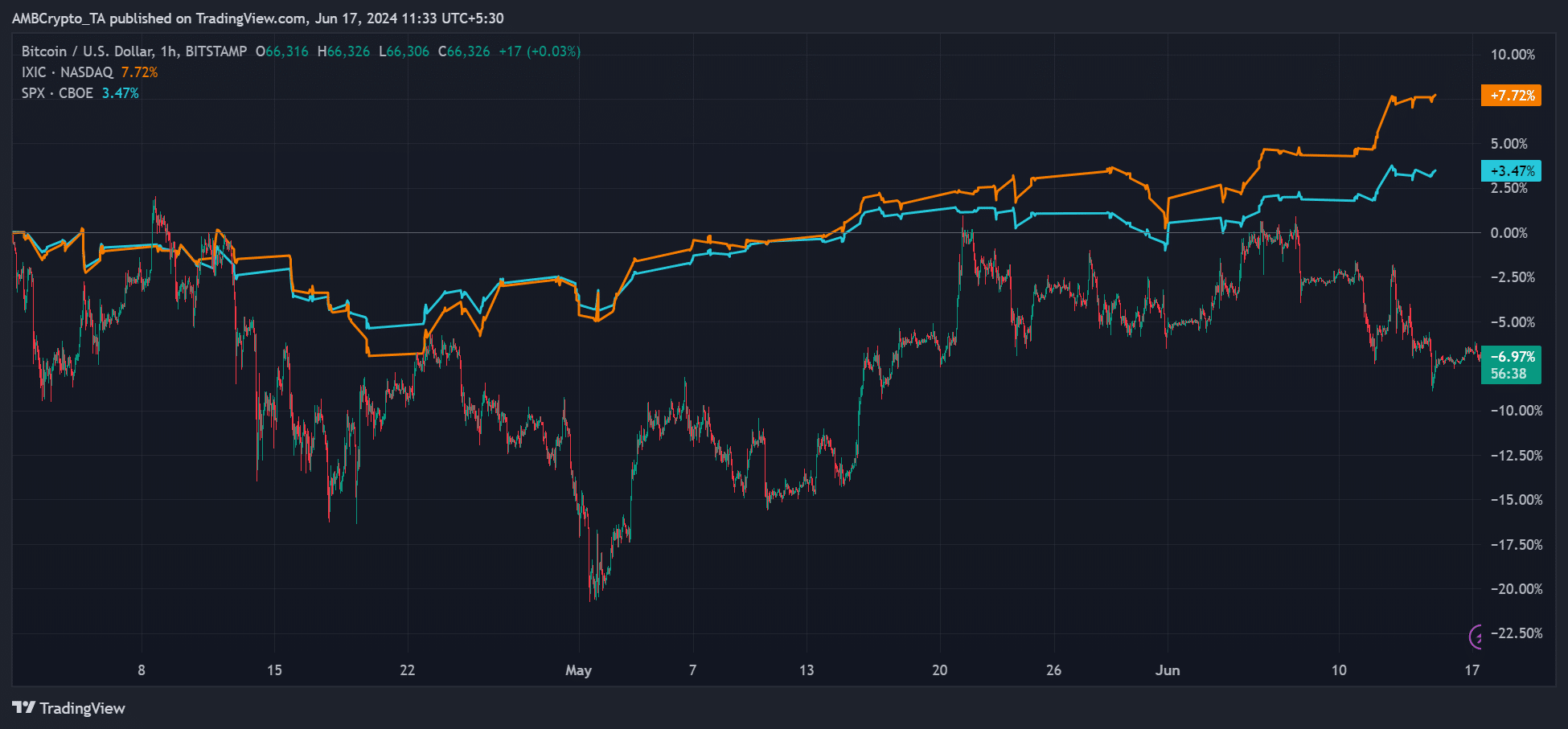

- US technology stocks, based on the Nasdaq Composite, rose 7%, while BTC fell 7% in the second quarter.

- Crypto fund hedge exec predicted that BTC could extend its dismal performance into the third quarter.

Bitcoin [BTC] has underperformed US stocks in the second quarter, and this trend could continue in the third quarter.

According to Quinn Thompson, founder and CIO of crypto hedge fund Lekker Capital, BTC is negative correlation with major US tech stocks could intensify in the coming weeks.

“I suspect we’ll get one of those in the next four to six weeks.”

Source: X/Quinn Thompson

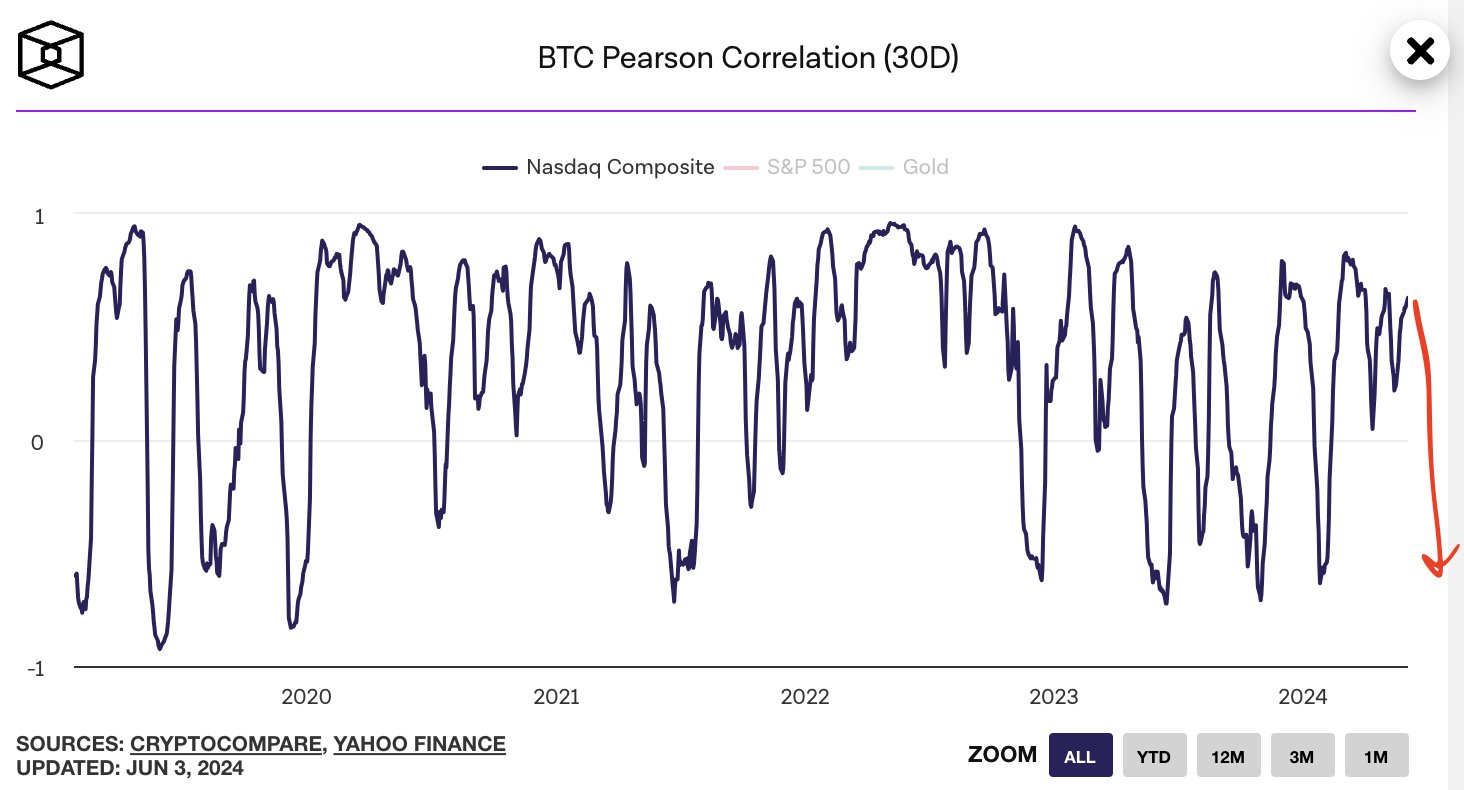

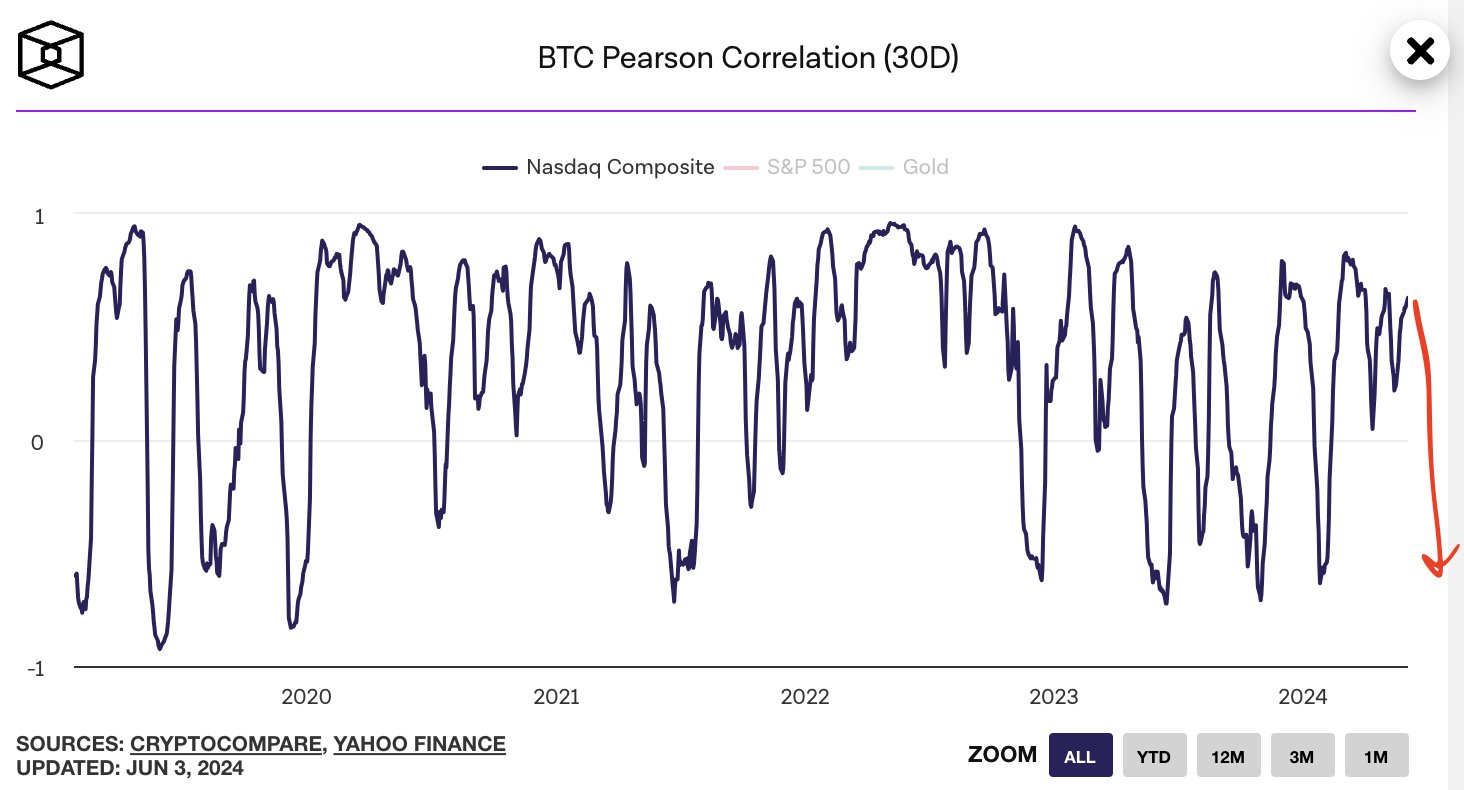

The Nasdaq Composite tracks the major US technology stocks. The correlation between the index and BTC is usually followed by the BTC Pearson Correlation.

Interestingly, the Index set a new record high while BTC fell to $65K. According to Thompson, the correlation could be lower (highlighted by the red arrow) due to unfavorable macro conditions based on the Fed’s “hawkish” stance.

Should you bet on US stocks or BTC?

Overall, BTC has outperformed US stocks over the past seven years. The king coin also maintained its victory in the first quarter of 2024, rising by 67%.

However, in the second quarter of 2024, gold and US bonds ‘beat’ the largest digital assets.

According to recent Bloomberg reportJPMorgan analysts were “skeptical” about the current pace of cryptocurrency inflows that will continue through the remainder of 2024.

At the time of writing, BTC was down almost 7% in the second quarter. On the contrary, the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) rose 7.7% and 3.4% respectively, according to data from TradingView revealed.

Source: BTC vs. US Stock Performance in Q2

So according to Thompson’s projection, a further decoupling between BTC and US tech stocks could indicate that US tech stocks could maintain their lead over the king coin in the coming months.

However, on a year-over-year (YTD) basis, BTC rose double digits compared to the single-digit gains of the US indices.

Quinn Thompson had done that before named that the Fed’s recent stance could spell trouble for BTC in the third quarter.

However, Deribit Insight’s facts suggested that post-FOMC bearish sentiment improved after clearer sentiment timeline for approval of spot Ethereum ETF, tentatively before July 2.

If the improved sentiment continues into the new week, BTC could rebound from its press-time value of $66K.

However, CrypNuevo, a BTC technical analyst, was less convinced of short-term upside potential. He predicted a possible retest of the low before BTC would see the $73.5K level, which doubled as a major liquidity cluster.