- The price of Dogecoin fell by more than 7% last week

- However, there are clear signs of a trend reversal

Dogecoin [DOGE] Investors have been having a tough time lately, mainly due to the memecoin’s many price corrections on the charts. Things could get worse, however, as some data sets suggest investors may have to wait longer for DOGE to rise again.

Let’s take a closer look at what’s going on.

Dogecoin investors under pressure

CoinMarketCaps facts revealed that the price of the world’s largest memecoin has fallen by more than 7% in the past seven days. In the last 24 hours alone, the memecoin’s price fell by more than 4%. At the time of writing, DOGE was trading at $0.1363 with a market cap of over $19.7 billion.

Thanks to the latest price drop, only 77% of DOGE investors continue to make a profit, according to IntoTheBlock’s facts.

Meanwhile, KNIGHT $INJ TO 100$, a popular crypto analyst, recently revealed that the price of the memecoin is still in the accumulation phase. In doing so, the analyst hinted at a few more slow weeks ahead. However, once the memecoin leaves this phase, investors may witness a massive price increase on the charts.

If this analysis is to be believed, a breakout above the accumulation zone could also allow Dogecoin to reach $1.

Volatility could increase sooner

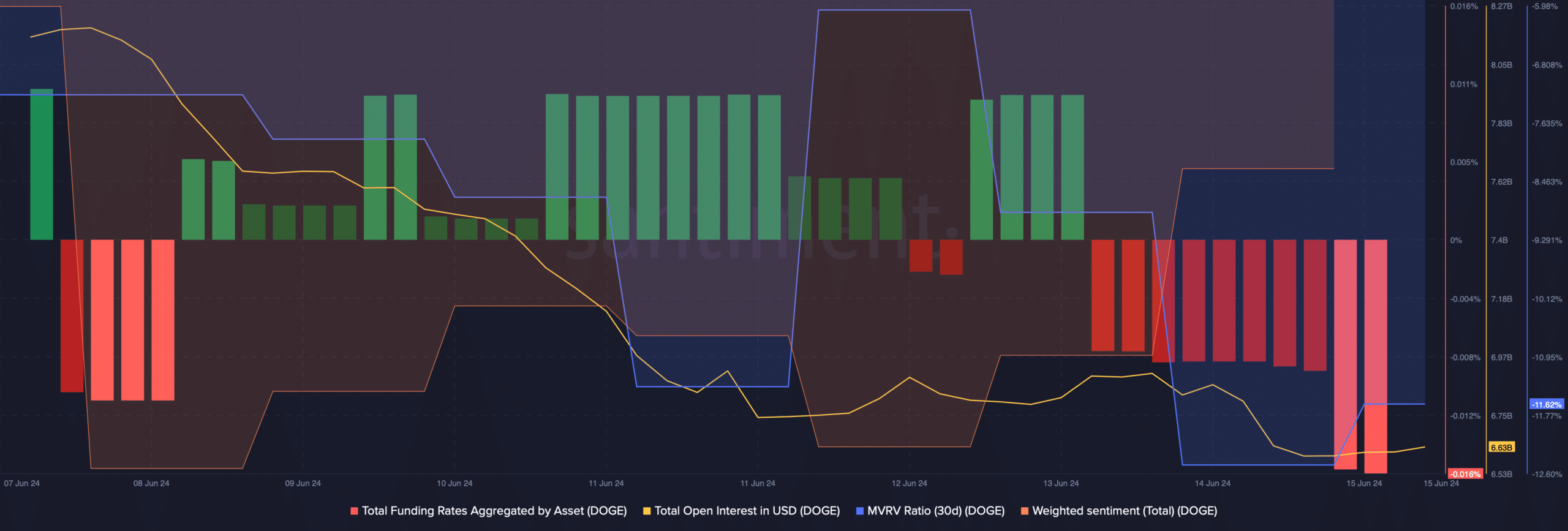

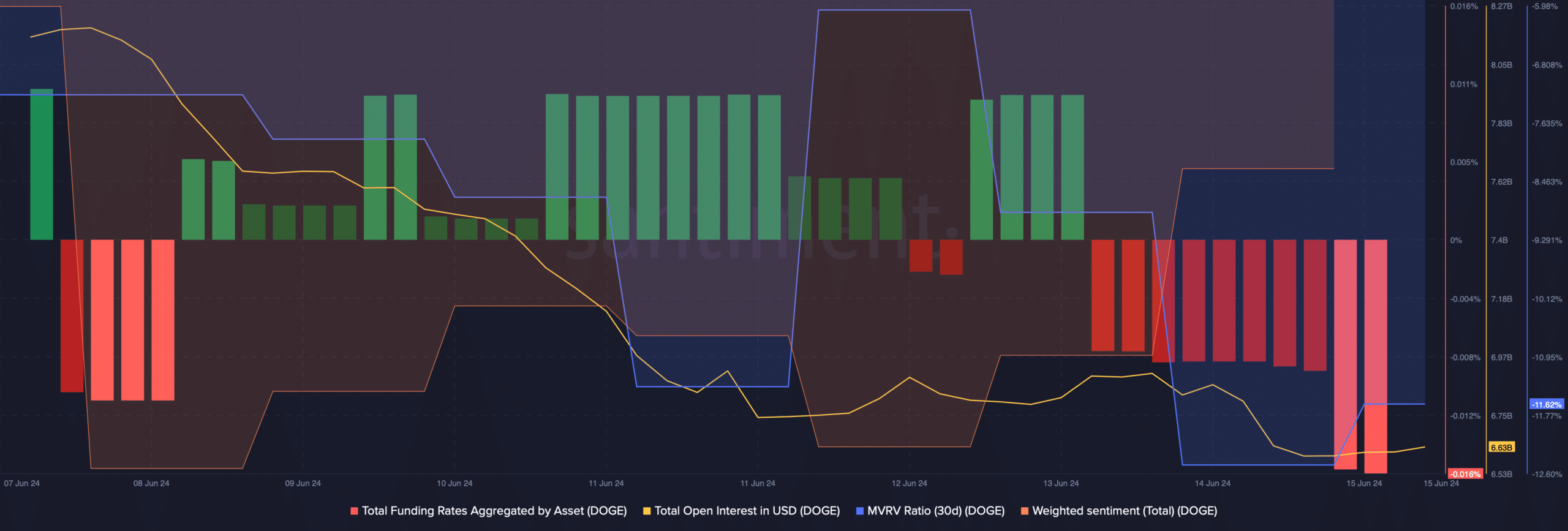

While the aforementioned assessment suggested a slow few days ahead, AMBCrypto’s analysis of Santiment’s data revealed that the bulls could soon take over. For example, DOGE’s funding rate has dropped significantly in recent days. In general, prices tend to move in the opposite direction to funding rates, indicating a bull rally.

Furthermore, DOGE’s open interest dropped along with the price. A decline in this measure is a sign that the ongoing price trend could end soon. The memecoin’s MVRV ratio also registered a slight improvement on June 15, indicating a possible trend reversal.

Apart from this, Dogecoin’s weighted sentiment chart also went up – a sign that the bullish sentiments in the market are outweighing the bearish sentiments.

Source: Santiment

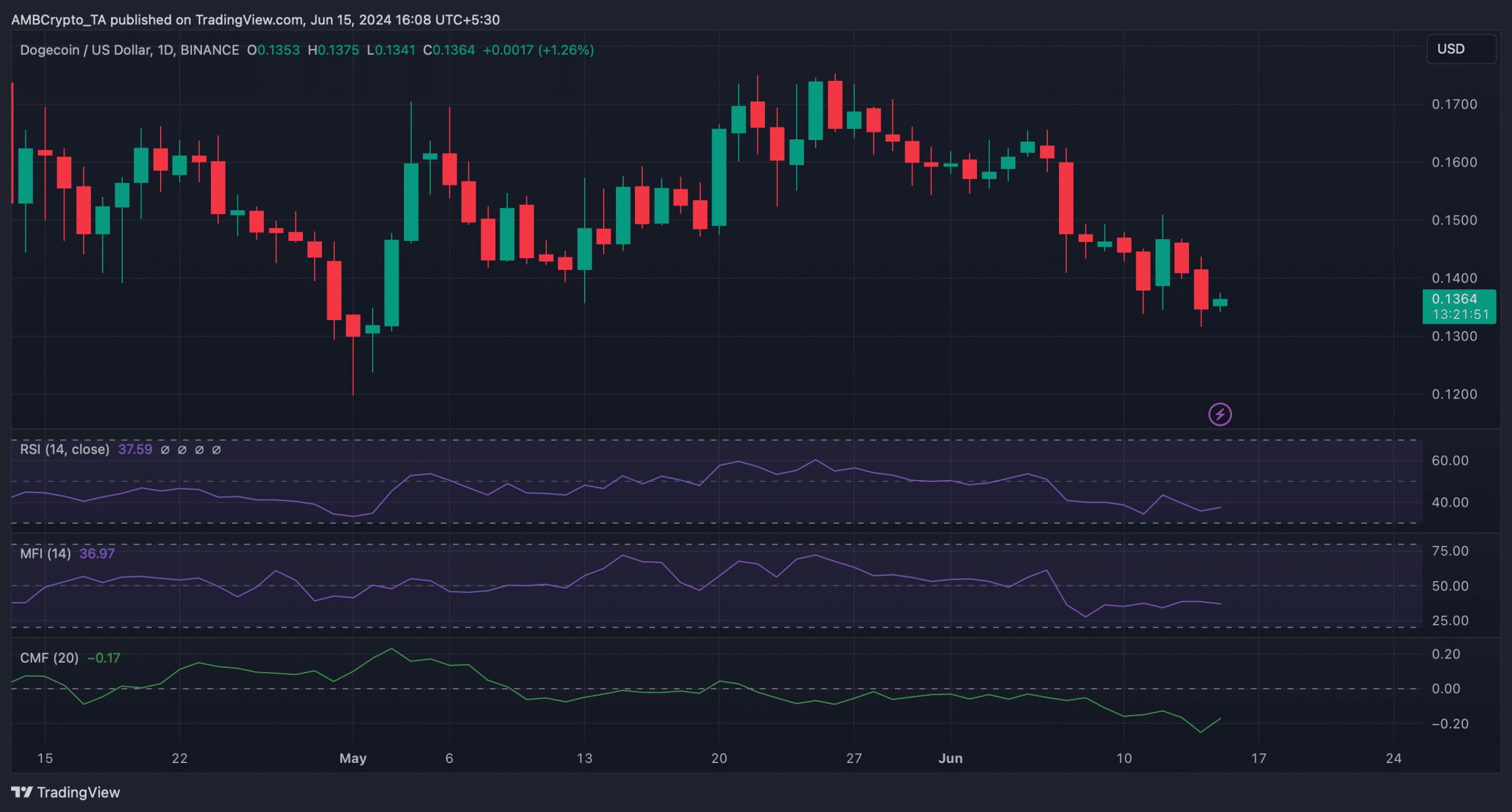

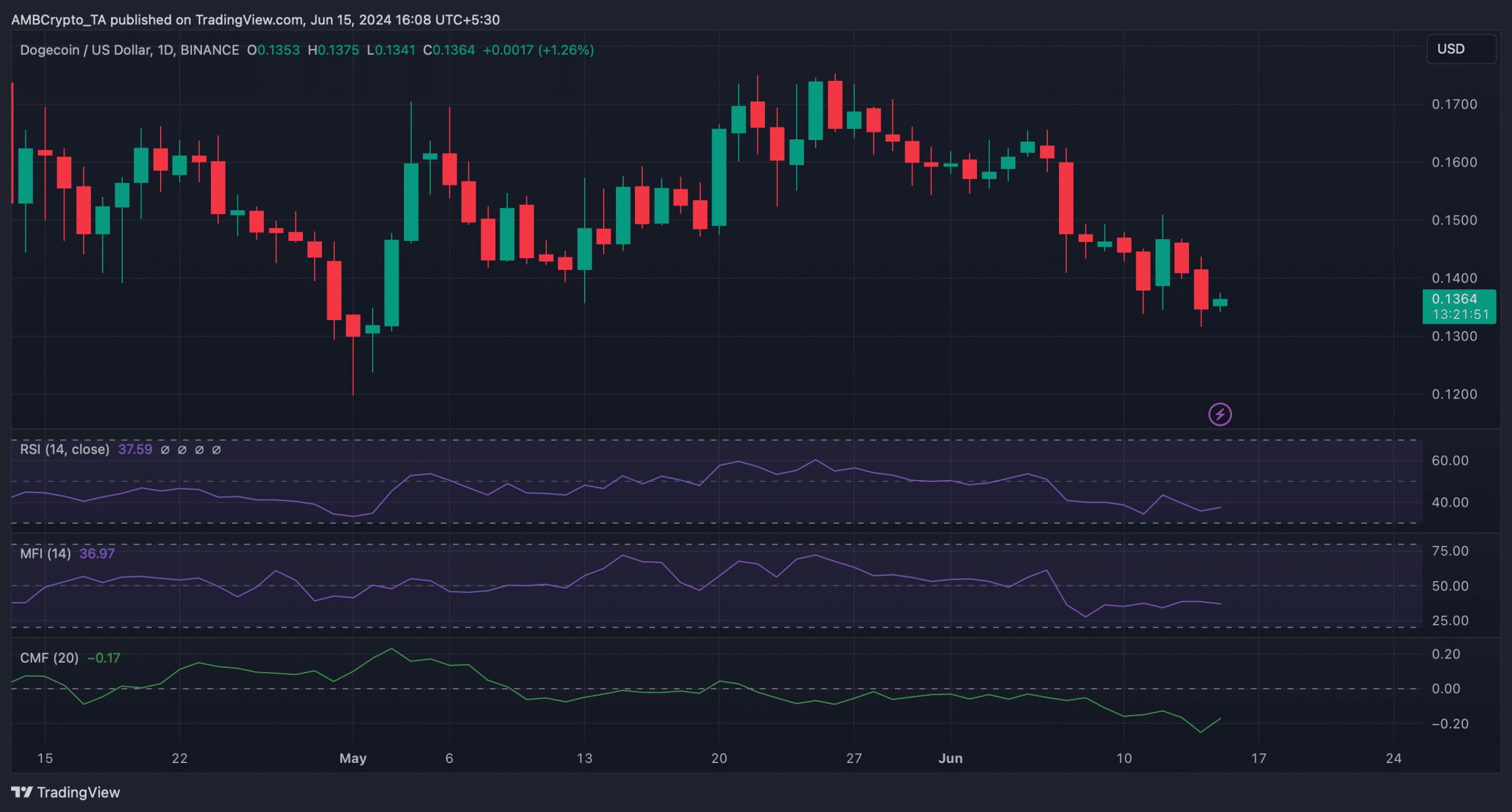

Like the above statistics, some market indicators also seemed quite optimistic.

For example, both DOGE’s Chaikin Money Flow (CMF) and Relative Strength Index (RSI) recorded increases, indicating an imminent price increase.

On the other hand, the Money Flow Index (MFI) remained bearish as it headed south on the charts.

Source: TradingView

Is your portfolio green? Check the Dogecoin profit calculator

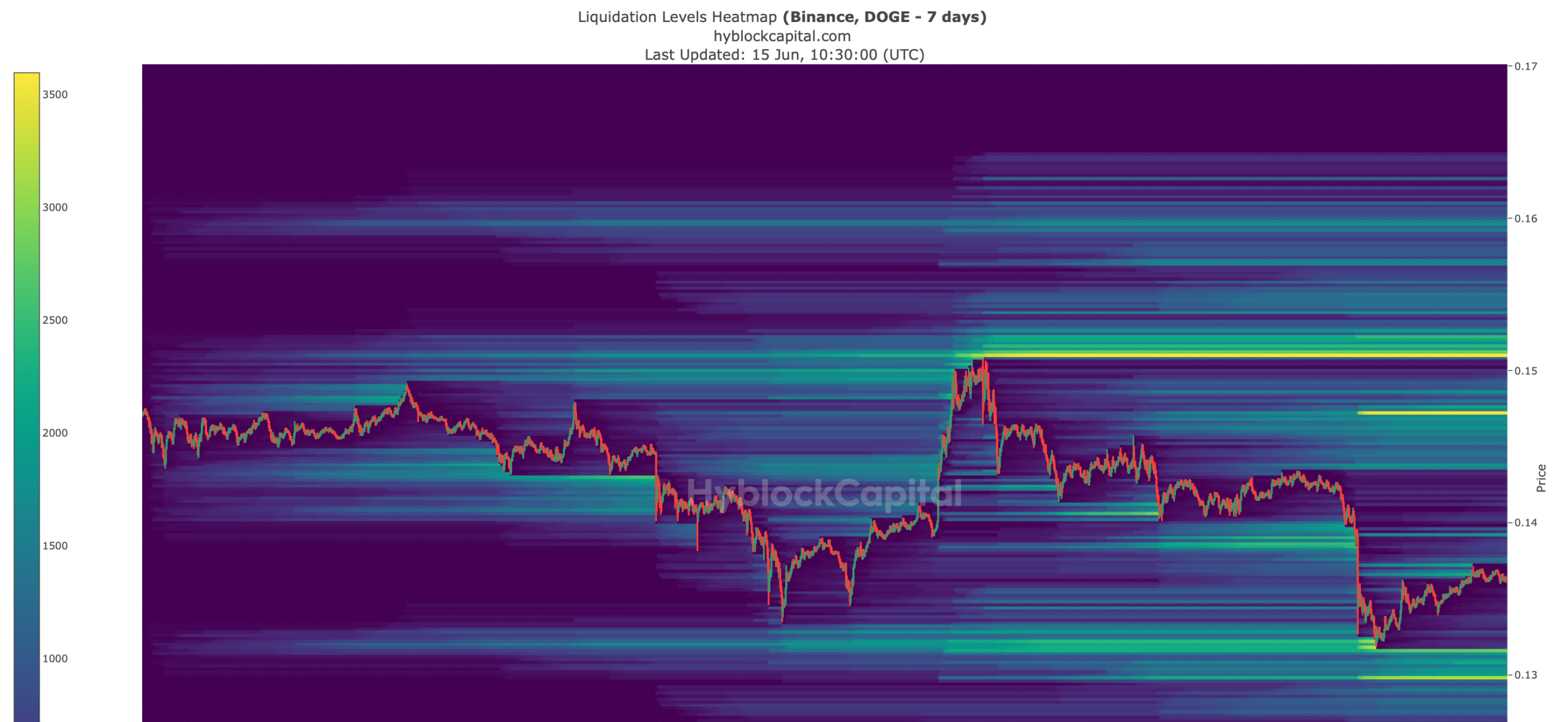

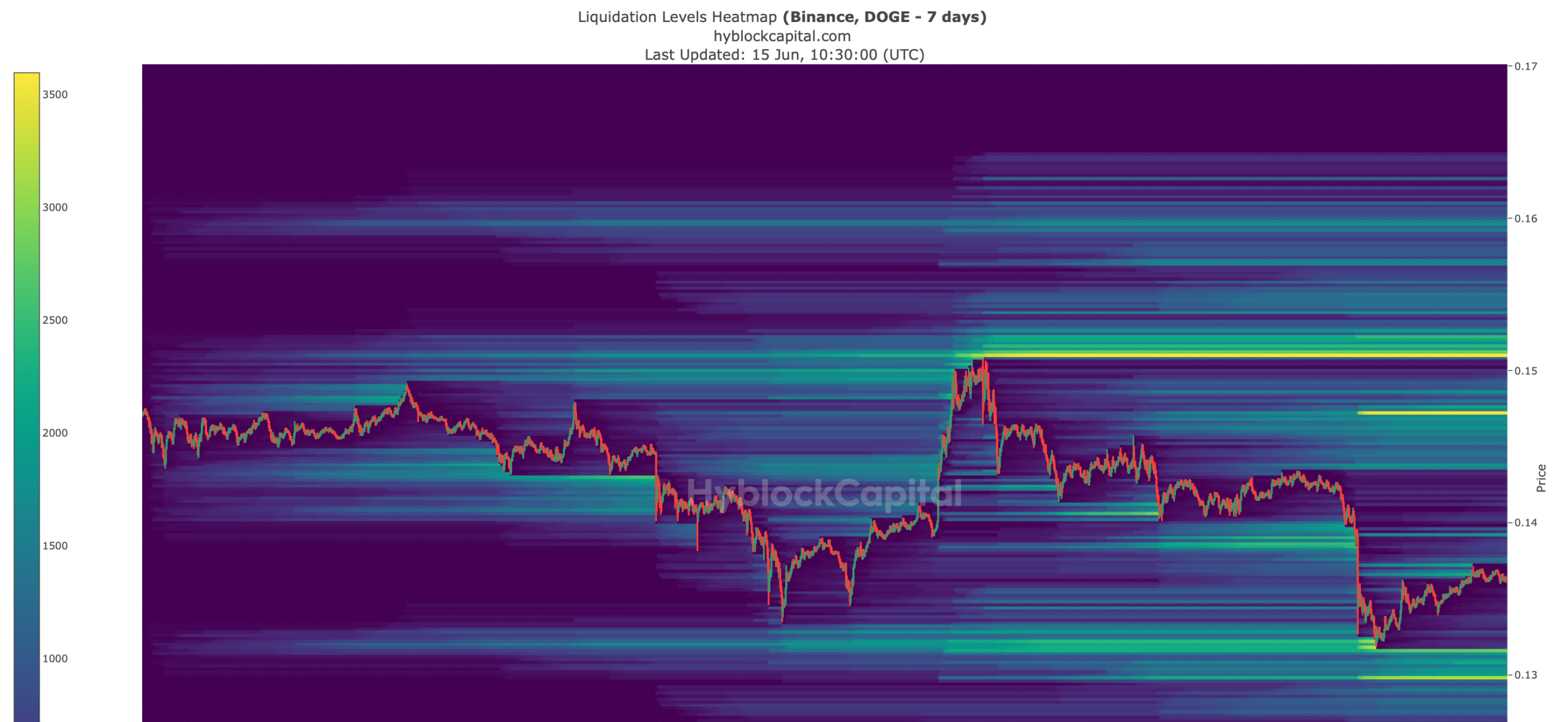

Finally, AMBCrypto’s analysis of Hyblock Capital’s data revealed that if DOGE turns bullish, the price could first reach $0.147 as liquidations would rise.

A successful breakout above that level would allow DOGE to reach $0.15. Nevertheless, if the bearish trend continues, DOGE could drop towards the support level near $0.131.

Source: Hyblock Capital