- Addresses holding 10 to 100 BTC have started collecting more of the coin.

- With increasing volatility, Bitcoin could reach $80,000 before the end of the third quarter.

Since Bitcoin [BTC] failed to regain March’s record highs, there is speculation that the bull run is over. However, AMBCrypto discovered that this was not true.

Instead, it looks like Bitcoin is gearing up for the second leg. One thing a bull cycle has in common is the active participation of retail investors.

If we go back to the 2017 and 2021 cycles, Bitcoin only reached the top when there were many small investors in the market.

Small investors are showing strength

But in March the increase to $73,750 was fueled by institutional capital. However, the billions of dollars that powered BTC at that time have been declining for several months. Therefore, the price has been corrected and consolidated.

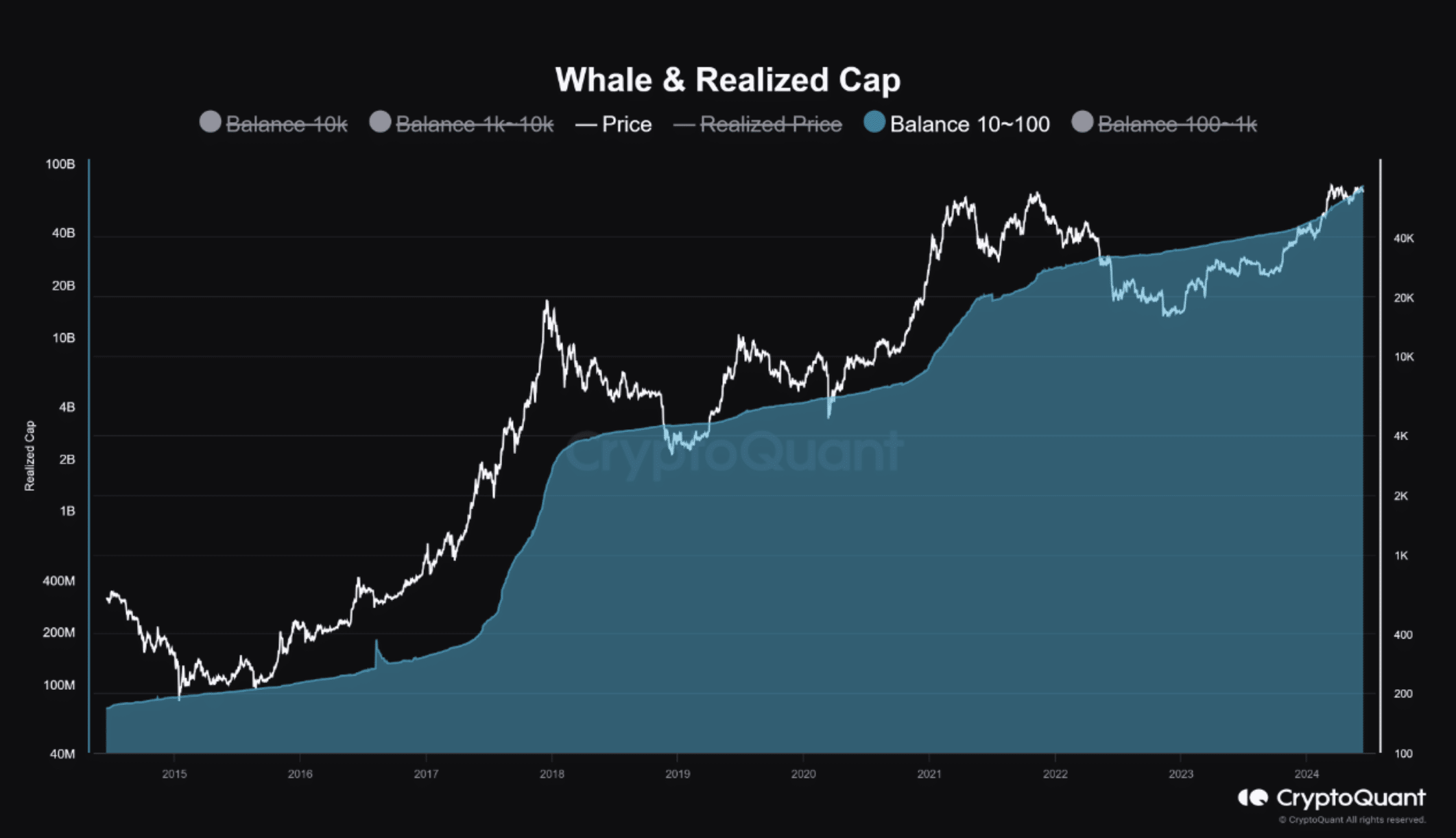

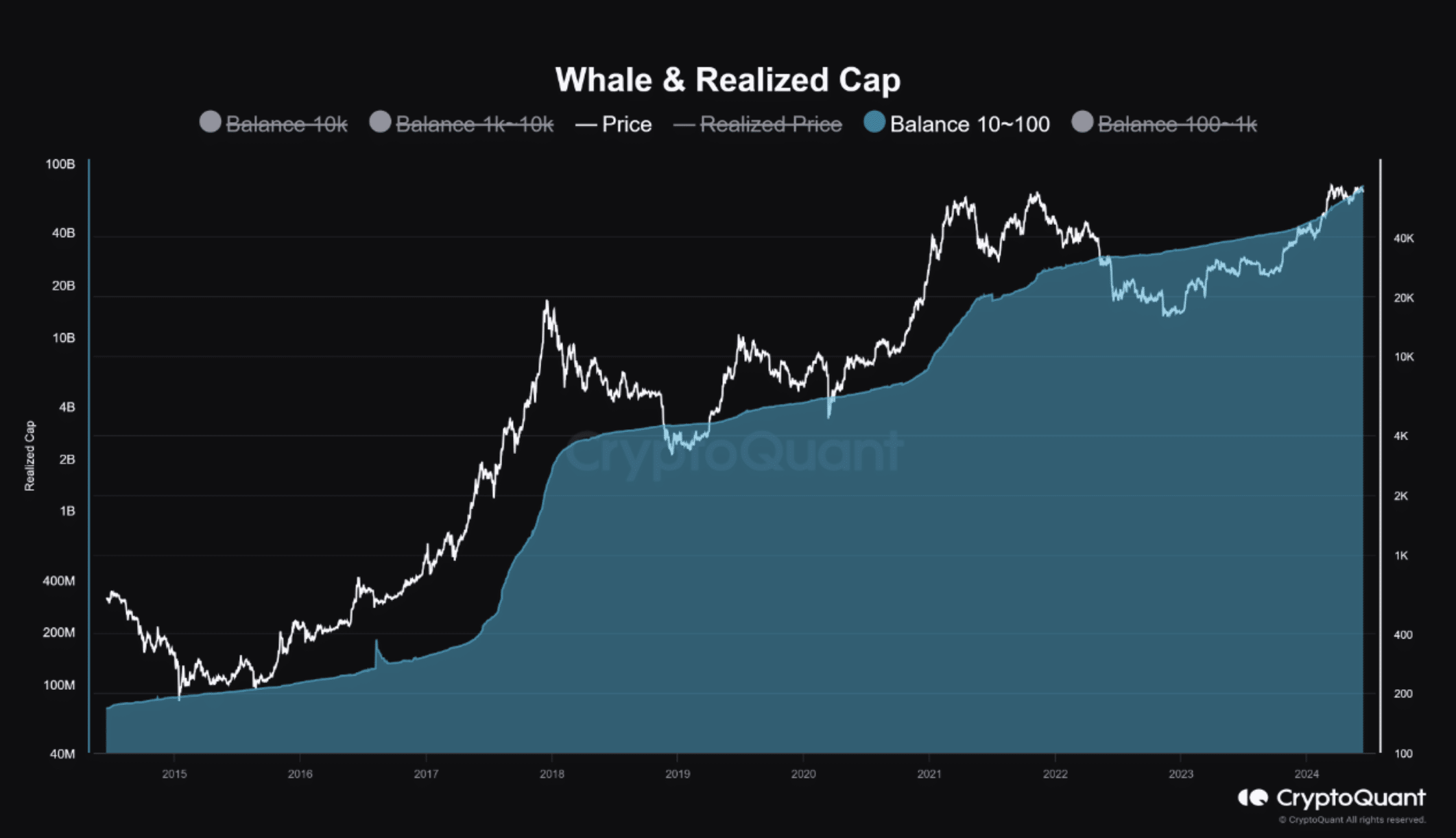

However, according to the data from the Whale and Realized Cap metric, this could be about to change.

Source: CryptoQuant

This capitalization model looks at the flow of money from smaller whales and private investors. Recently, AMBCrypto reported that the big fish in the market have benefited from the dip.

Now it seems others have joined in, as evidenced by the increase in the balance of the 10 to 100 BTC cohort. In previous cycles, a situation like this acted as the first phase of a new rally after Bitcoin might have undergone a 20% to 30% correction.

Crypto Dan, an on-chain analyst and author of CryptoQuant, shared a similar view. In his analysishe explained that,

“Since 2024 is the time when the inflows of small whales and general investors began to increase rapidly, and the second half of the bull market has only just begun, the possibility of additional capital inflows and a surge in Bitcoin may be seen as open considered. the near future.”

BTC could soon reach $80,000

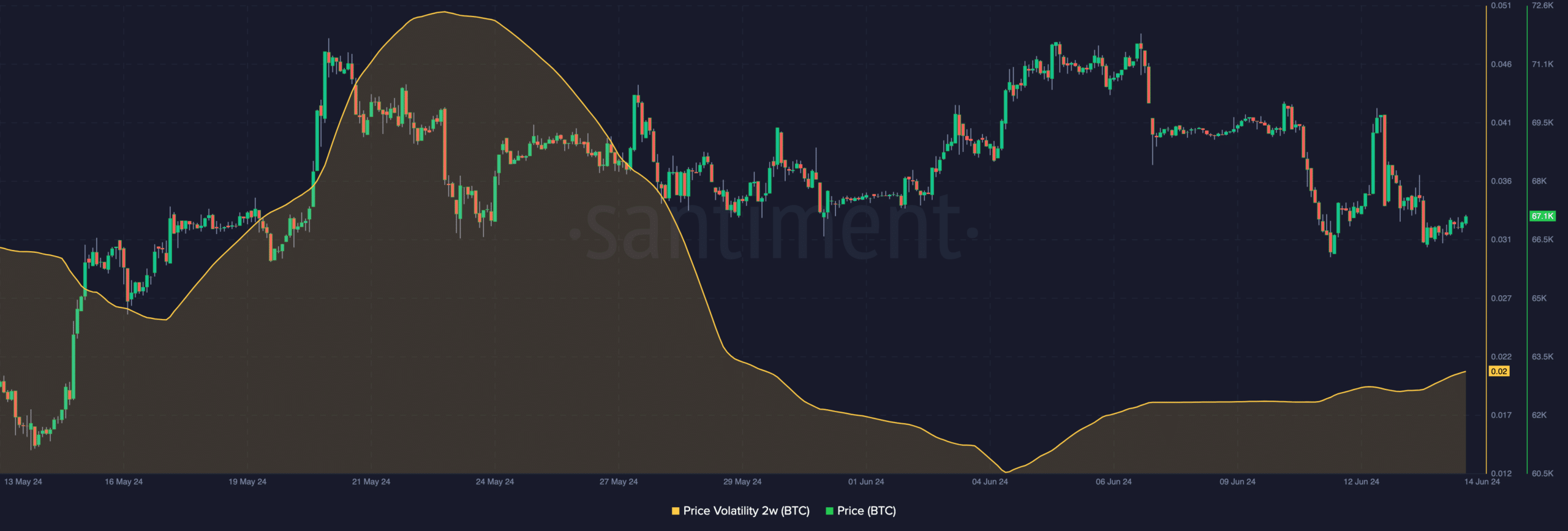

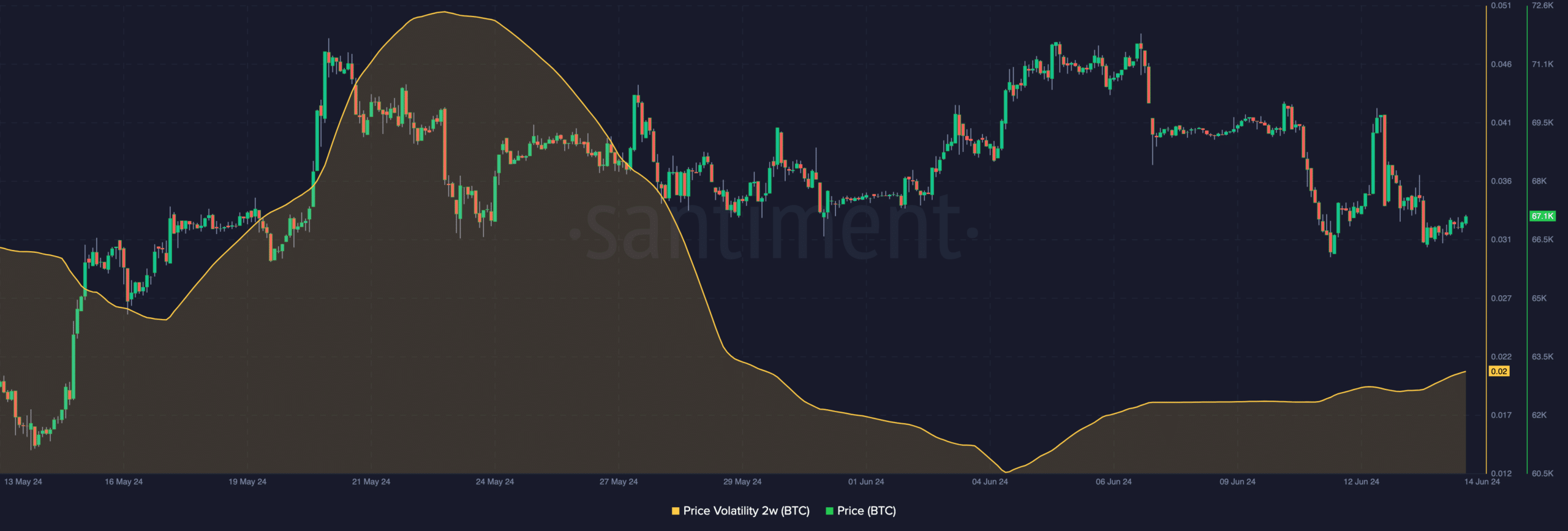

Still, this does not mean that BTC would not reach a lower value before a new rally begins. To further validate this potential rally restart, AMBCrypto examined the volatility surrounding Bitcoin.

At the time of writing, on-chain data showed that the Two-week volatility was up to 0.02. Volatility shows the potential for upward or downward movement. If the value is low, it means that a cryptocurrency can be traded within a tight range.

On the other hand, increasing volatility implies that prices can experience significant fluctuations. However, this depends on the buying or selling pressure in the market.

Source: Santiment

For Bitcoin, the price could soon experience a significant increase. But that would depend on the consistency that retail investors have in accumulating the currency.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Should buying pressure increase, Bitcoin’s price could rise to $80,000 around the start of the third quarter (Q3).

However, this forecast may not see the light of day if selling pressure continues until then.