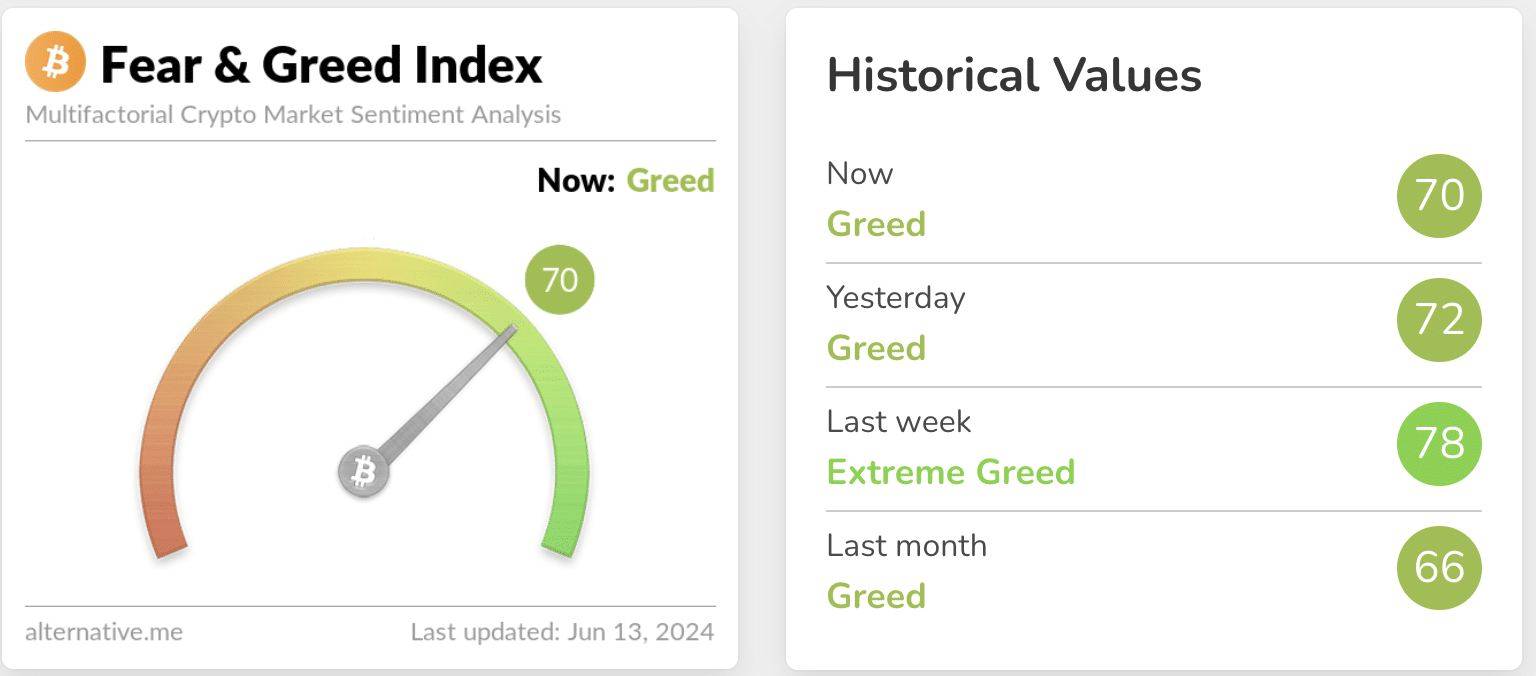

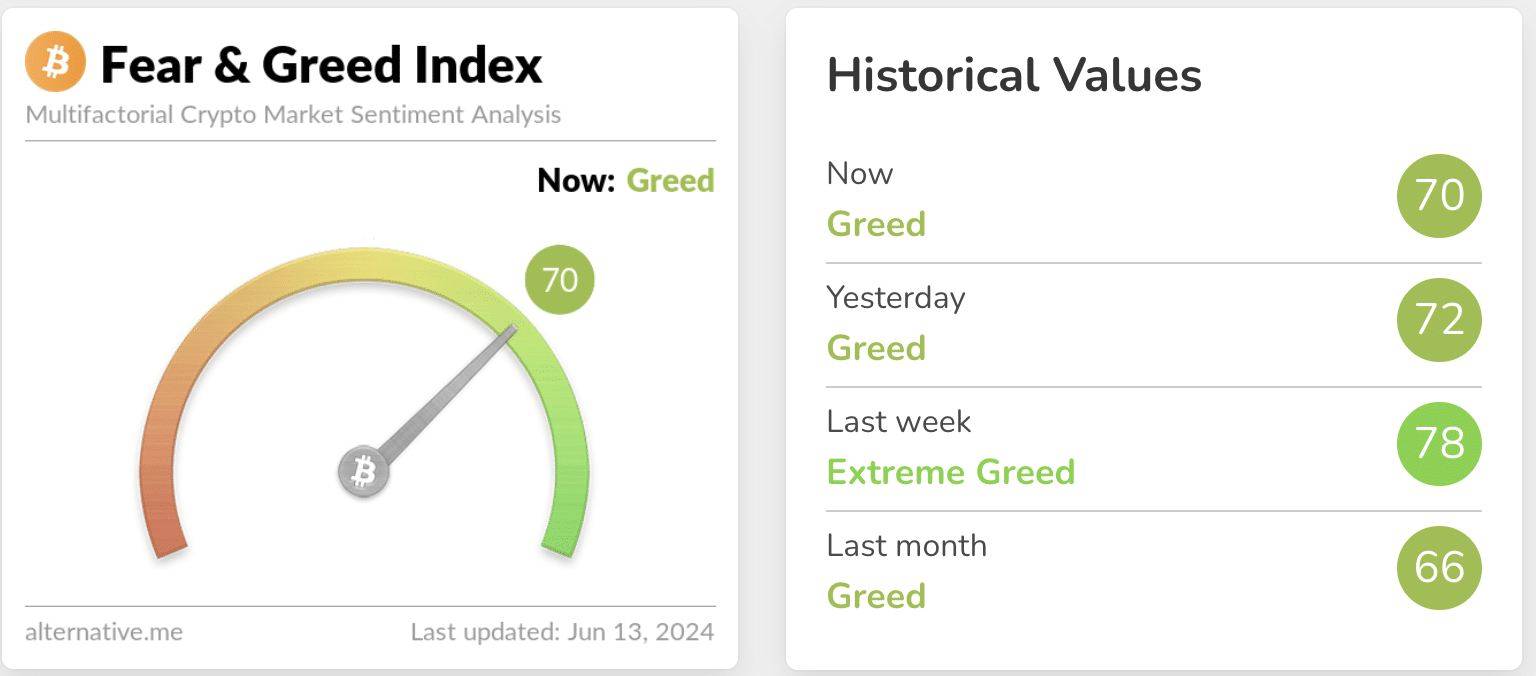

- The Crypto Fear and Greed index suggested that buyers were turning greedy despite falling prices.

- BTC and ETH holders remained profitable, sentiment around SOL fell.

You would expect that the recent price correction for most coins could have a negative impact on overall market sentiment. However, data shows that the market was more optimistic than ever.

The Crypto Fear and Greed index shows that bulls are greedy

The crypto greed and fear index stood at 70 at the time of writing, indicating that most of the market was still eager to buy as prices of several cryptocurrencies fell.

Source: alternative.me

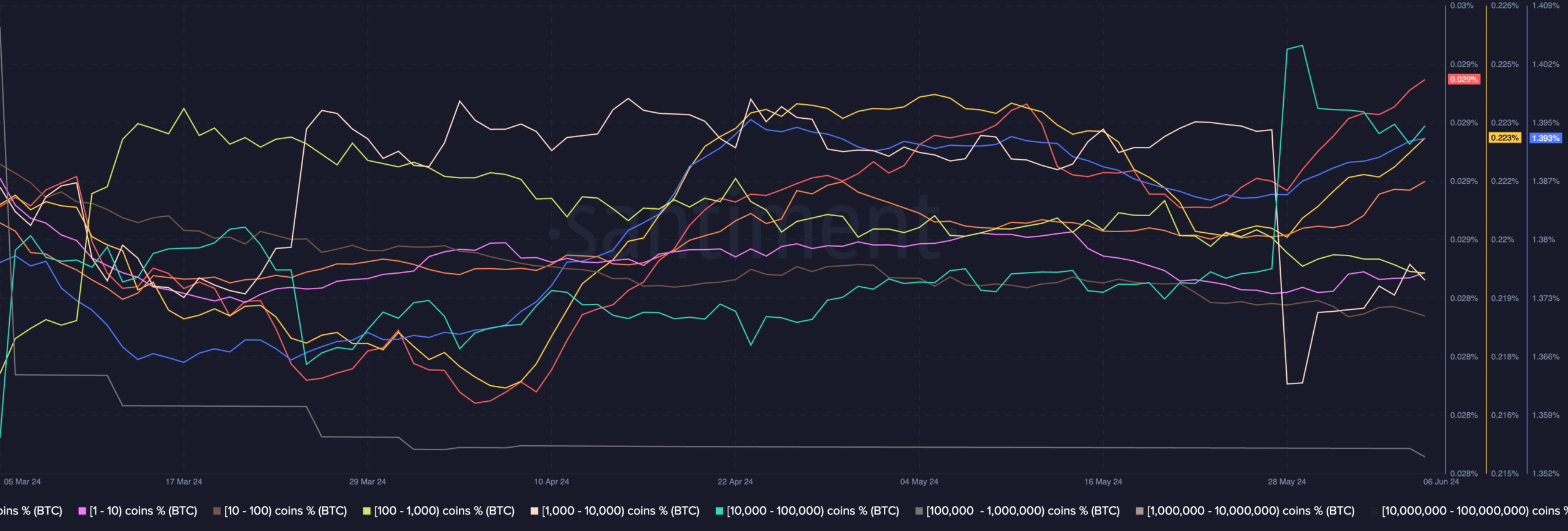

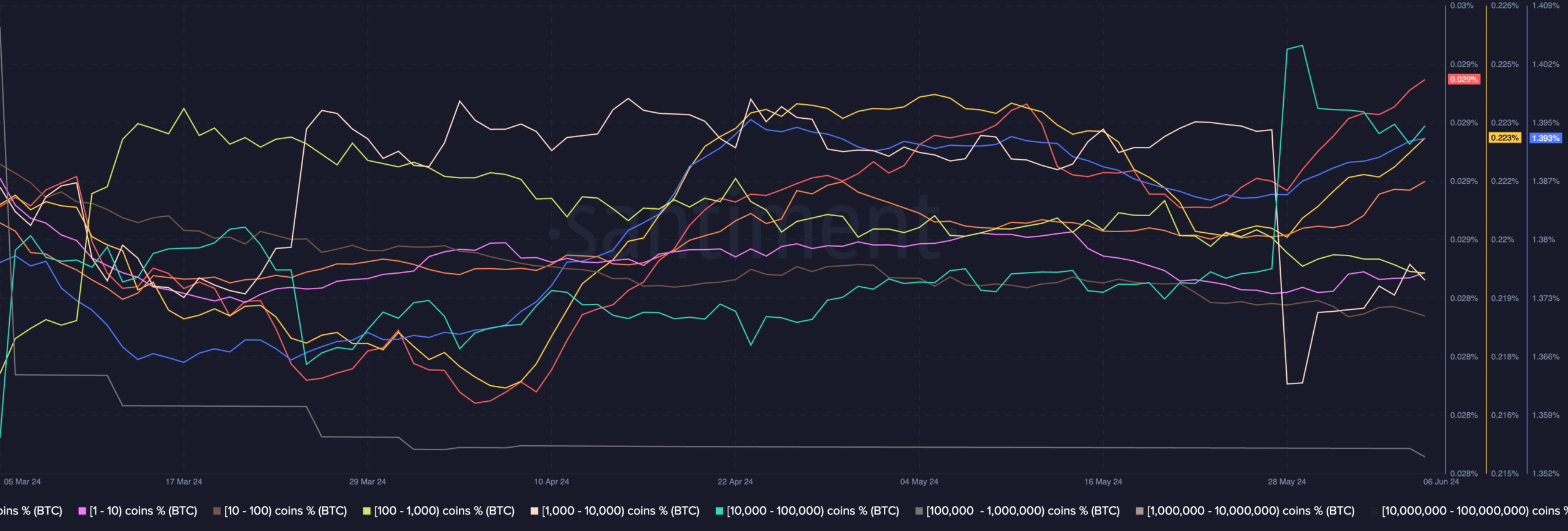

One of the most telling indicators of interest shown by the addresses is the behavior of whales and private investors.

AMBCrypto’s analysis of Santiment’s data indicated that whale addresses were beginning to accumulate large amounts of BTC. In combination with this, private investors also showed interest in the royal coin.

Source: Santiment

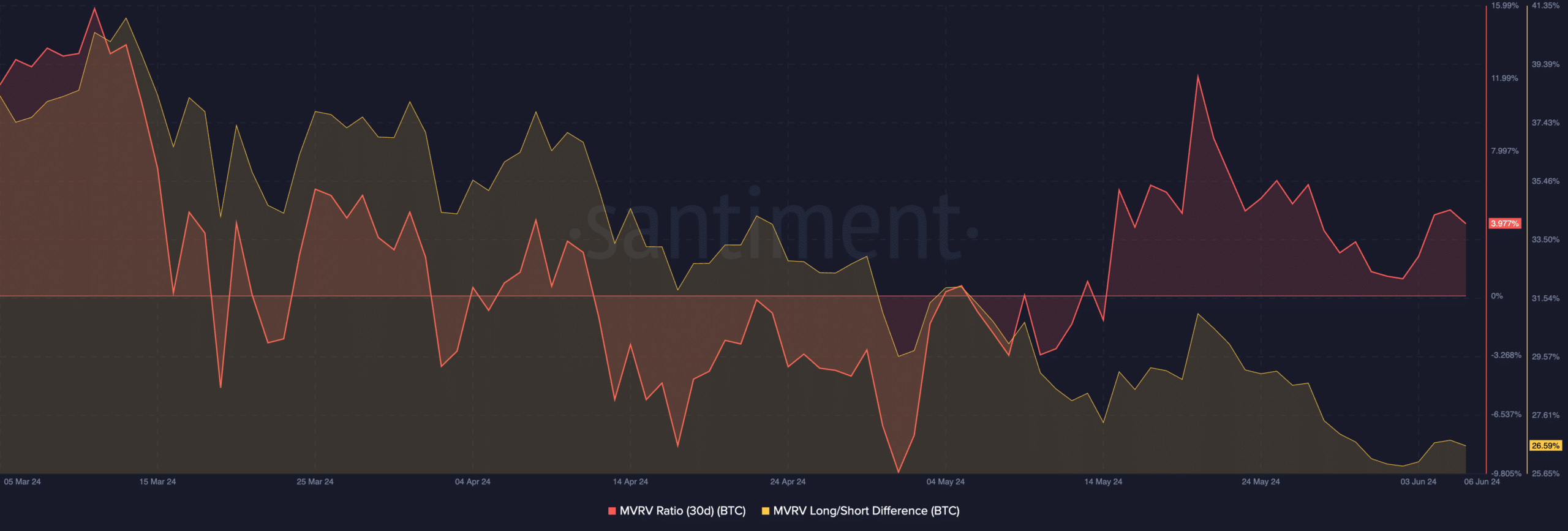

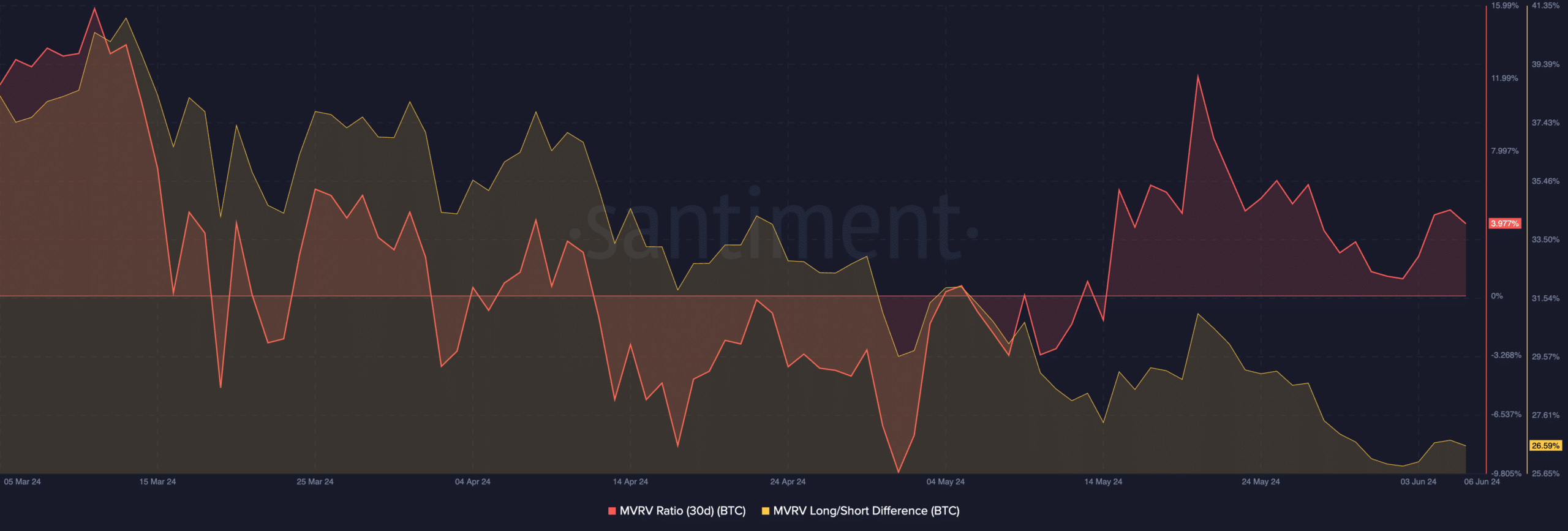

Despite BTC’s recent price correction, total addresses remained largely profitable, as evidenced by the MVRV ratio. While high profitability helps with sentiment around the king coin, it also increases the chances of profit-taking and future sell-offs.

The long/short differential for BTC had also narrowed significantly during this period, implying that long-term holders of BTC had fallen, increasing the likelihood of a sell-off.

Source: Santiment

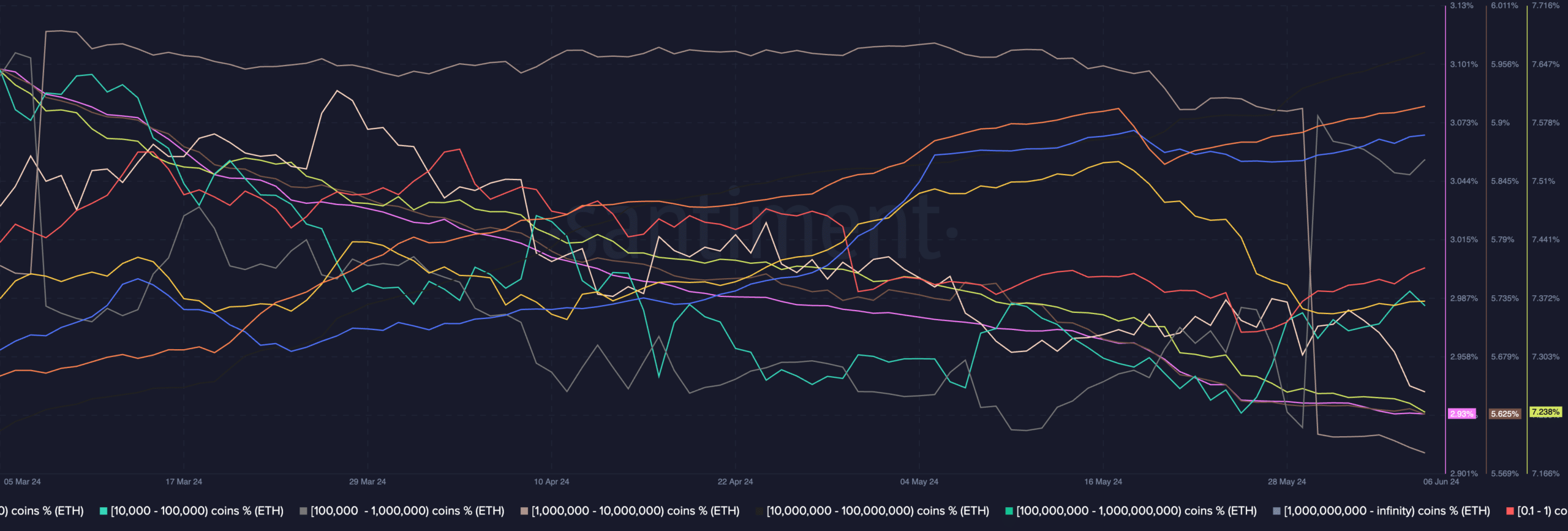

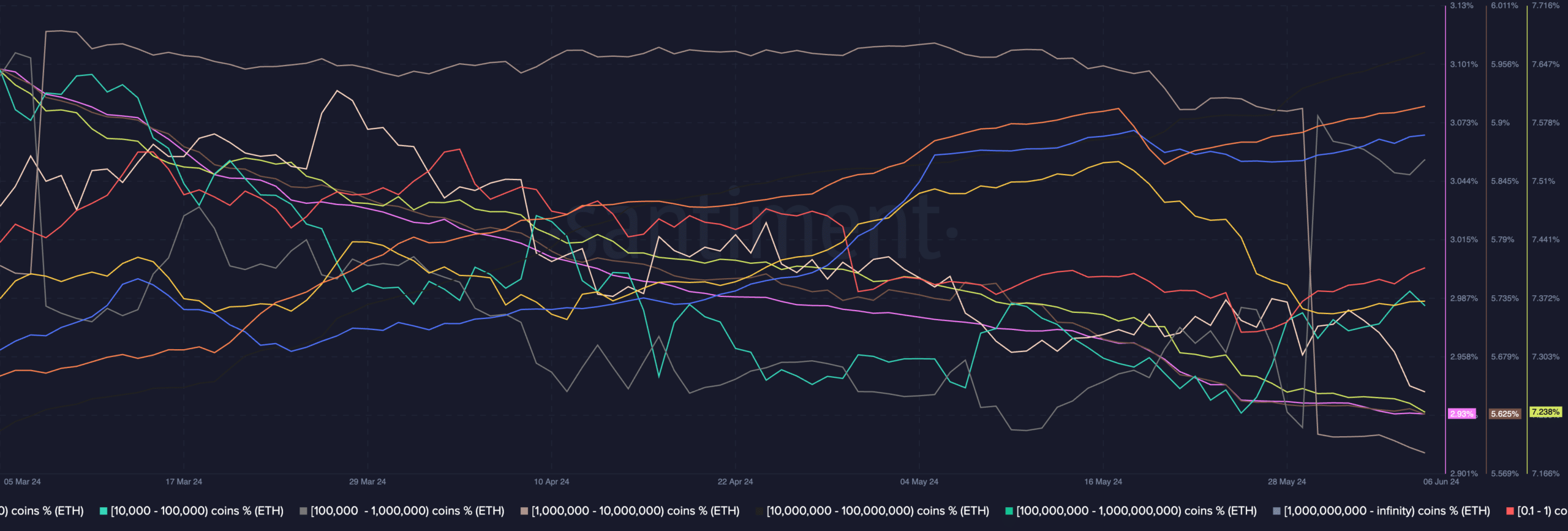

However, Ethereum did not see the same level of behavior from addresses. Retail investors have shown more greed in recent days and engaged in significant accumulations.

However, the same cannot be said for whales who actually sold their possessions.

Source: Santiment

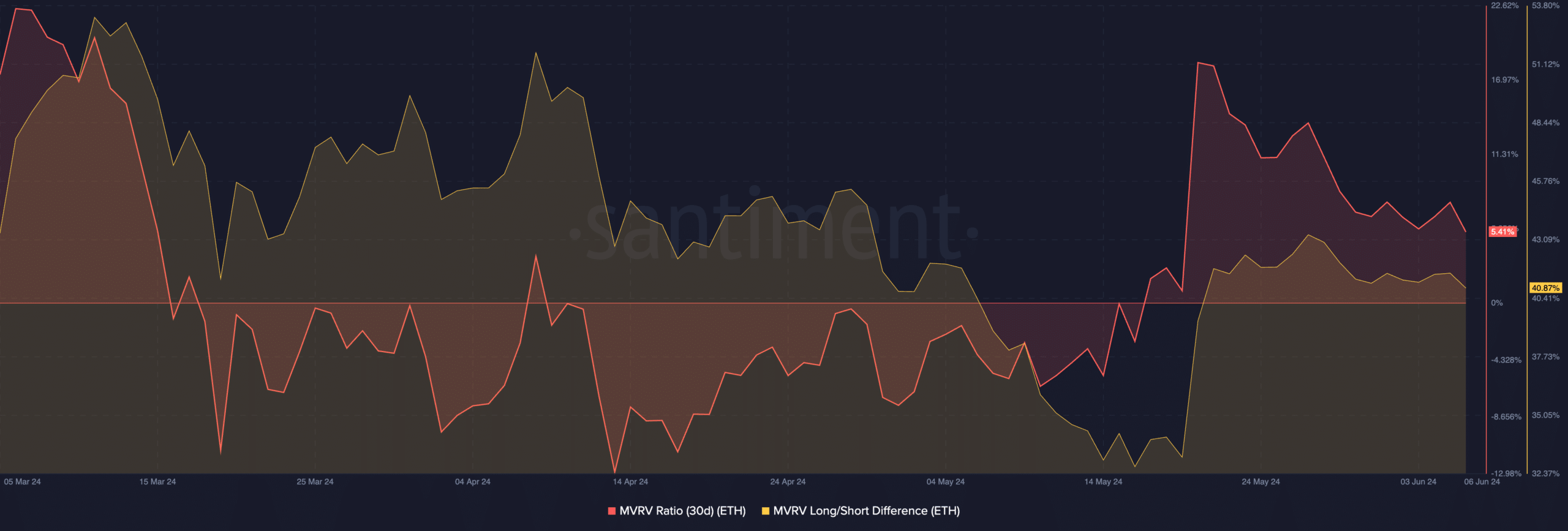

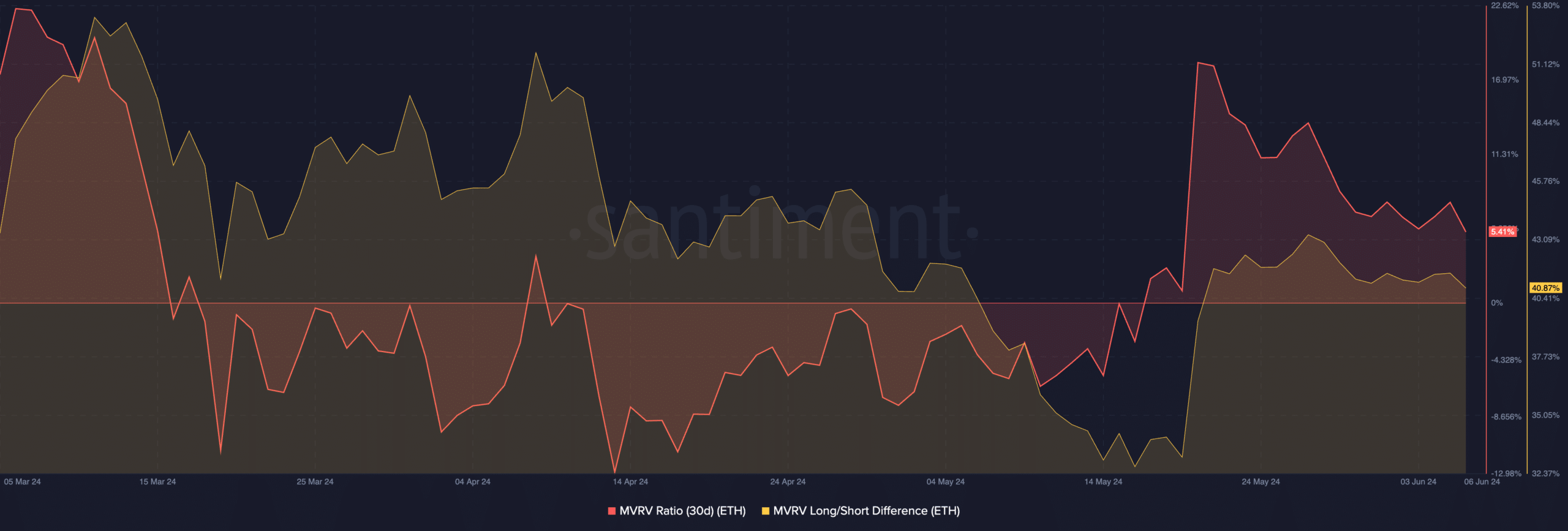

In terms of the state of holders, ETH holders were seen to be extremely profitable, just like BTC holders.

However, the presence of long-term holders for ETH was significantly higher compared to BTC addresses. The long-term holders could grow ETH sustainably in the future.

Source: Santiment

Negative outlook for SOL

Another coin that was hit hard by the recent change in tides was SOL. Last week, the price of SOL fell by more than 12%.

Is your portfolio green? View the SOL Profit Calculator

Social volume around SOL also dropped, indicating the token’s declining popularity.

Moreover, the weighted sentiment around the SOL token also dropped, implying that the number of negative reactions around the SOL at the time of writing outweighed the positive ones.

Source: Santiment