- A dormant wallet transferred 8,000 BTC, worth approximately $536.5 million.

- It signals a renewed interest in BTC as new and former investors enter the market.

The cryptocurrency market is navigating turbulent waters with Bitcoin [BTC] struggles to retest the previous highs.

Currently, Bitcoin is trading at around $67,302, which represents a decline of almost 6% in the past week, and a slight decline of 0.7% in the past 24 hours.

This downturn was part of a broader decline in the crypto market, where the total valuation has fallen to around $2.57 trillion – a drop of 1.3% within a day.

New activity: significant whale movements

Amid this broader market pullback, there is an intriguing development occurred involving a long-dormant Bitcoin wallet. This wallet, which has not seen any activity since December 2018, suddenly transferred 8,000 BTC, worth approximately $536.5 million.

The transaction was initiated from a wallet linked to Coinbase’s cold storage, moving the funds directly to a known Binance deposit address.

The sequence of these transactions raises several questions about the intentions behind them and their potential market impact.

Initially received in multiple tranches in late 2018, when Bitcoin’s price was hovering around $3,750, these coins have increased significantly in value.

The transaction from the dormant wallet did not include any test transfers, which is often unusual for moves involving such large amounts of money.

Historically, dormant wallets with large balances becoming active often indicates potential selling pressure in the market, especially as funds are moved to exchange addresses.

This pattern suggests that the wallet owner could be preparing to cash out, taking advantage of the nearly 1,700% price increase since BTC was first acquired.

Furthermore, the activation of such wallets can sometimes coincide with broader market movements. Chainalysis reports that nearly 1.8 million Bitcoin addresses have been inactive for more than a decade, representing a significant potential market value of $121 billion.

Not all of these wallets will become active (many are likely inaccessible due to lost private keys), but those that do could significantly impact market dynamics.

Increase in participation in the Bitcoin network

The recent transaction coincides with an upturn in overall market activity.

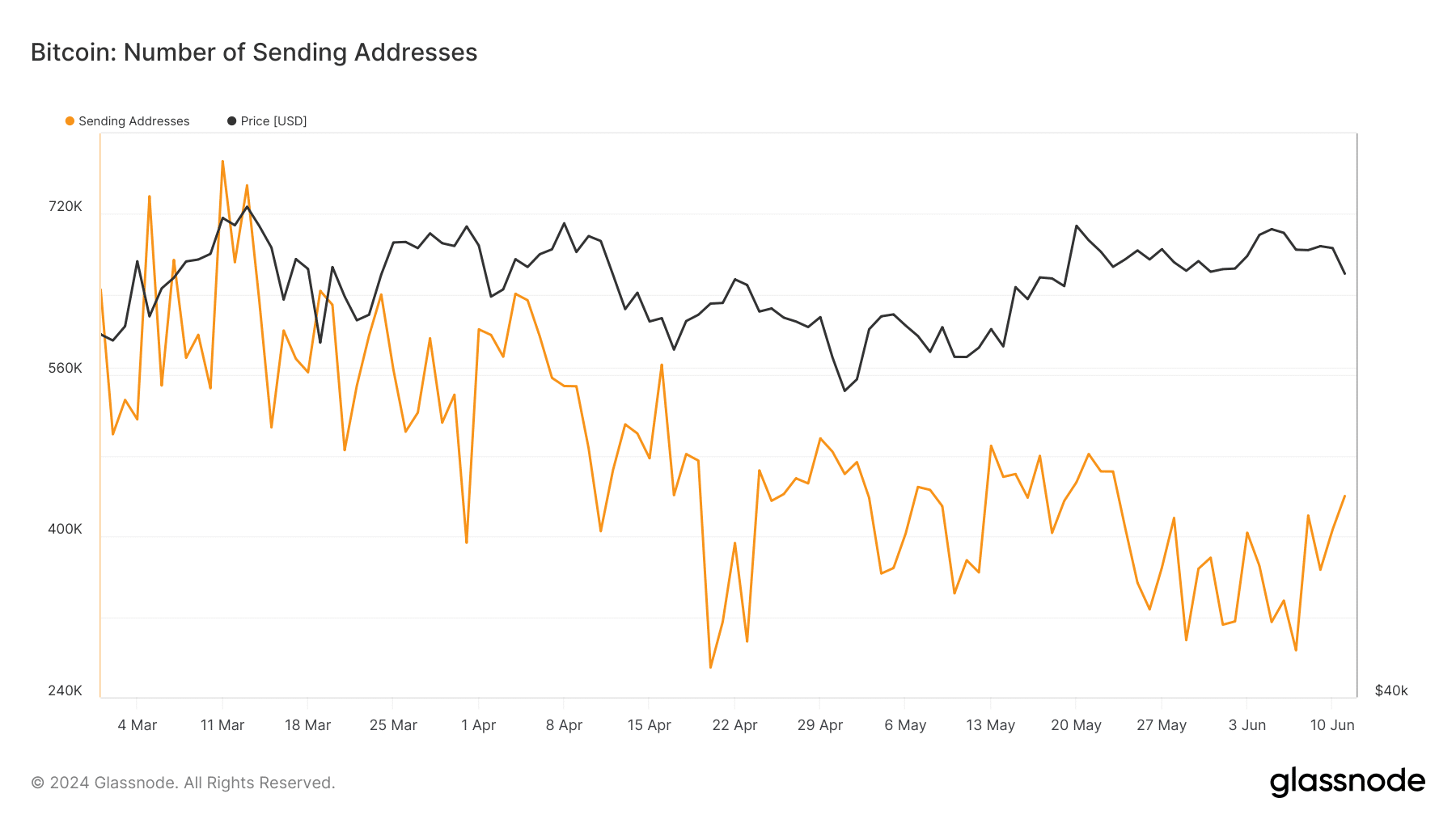

Facts from Glassnode reveals an increase in the number of active sending addresses on the Bitcoin network, from less than 300,000 to recently more than 400,000.

Source: Glassnode

Read Bitcoin’s [BTC] Price forecast 2024-2025

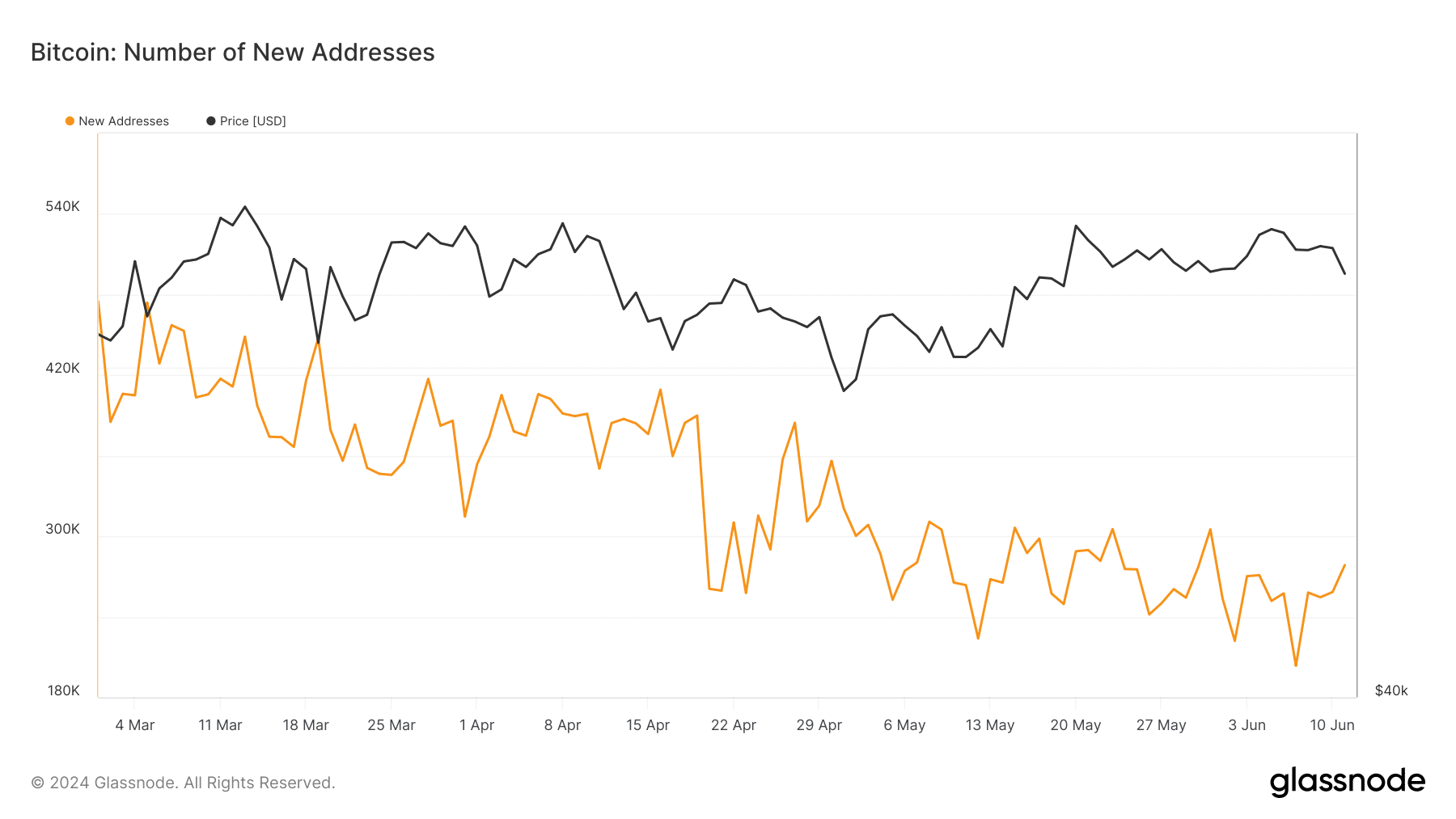

This resurgence in the number of active addresses, coupled with a noticeable increase in the number of new Bitcoin addresses – from 203,000 to 278,000 – signals renewed interest or possibly speculative activity as new and former investors enter the market.

Source: Glassnode

While it is uncertain how this single transaction could impact Bitcoin’s overall market position, AMBCrypto recently highlighted the importance of Bitcoin maintains robust levels of support to maintain an upward trend.