- Bitcoin miners recently sold over $83 million worth of BTC.

- BTC has fallen to the $67,000 price level.

Bitcoin [BTC] has seen a decline in recent days, with the most notable drop occurring on June 11. In response to this decline, miners have sold their assets to make some profit.

However, these sales are not reflected on the stock exchanges. Despite these circumstances, open interest continues to maintain a respectable volume.

OTC selling depletes the Bitcoin miner’s reserve

An analysis of key Bitcoin miner metrics revealed a decline in miner ownership. The miners reservewhile maintaining a volume of approximately 1.8 million, has experienced a slight decline.

However, tracking miner outflows showed a decline, indicating that the volume sent from mining portfolios to exchanges has decreased.

The statistics may be confusing at first because the flow of BTC from miner wallets is not visible, but still the reserve has fallen.

However, the situation becomes clearer when analyzing Over the Counter (OTC) sales.

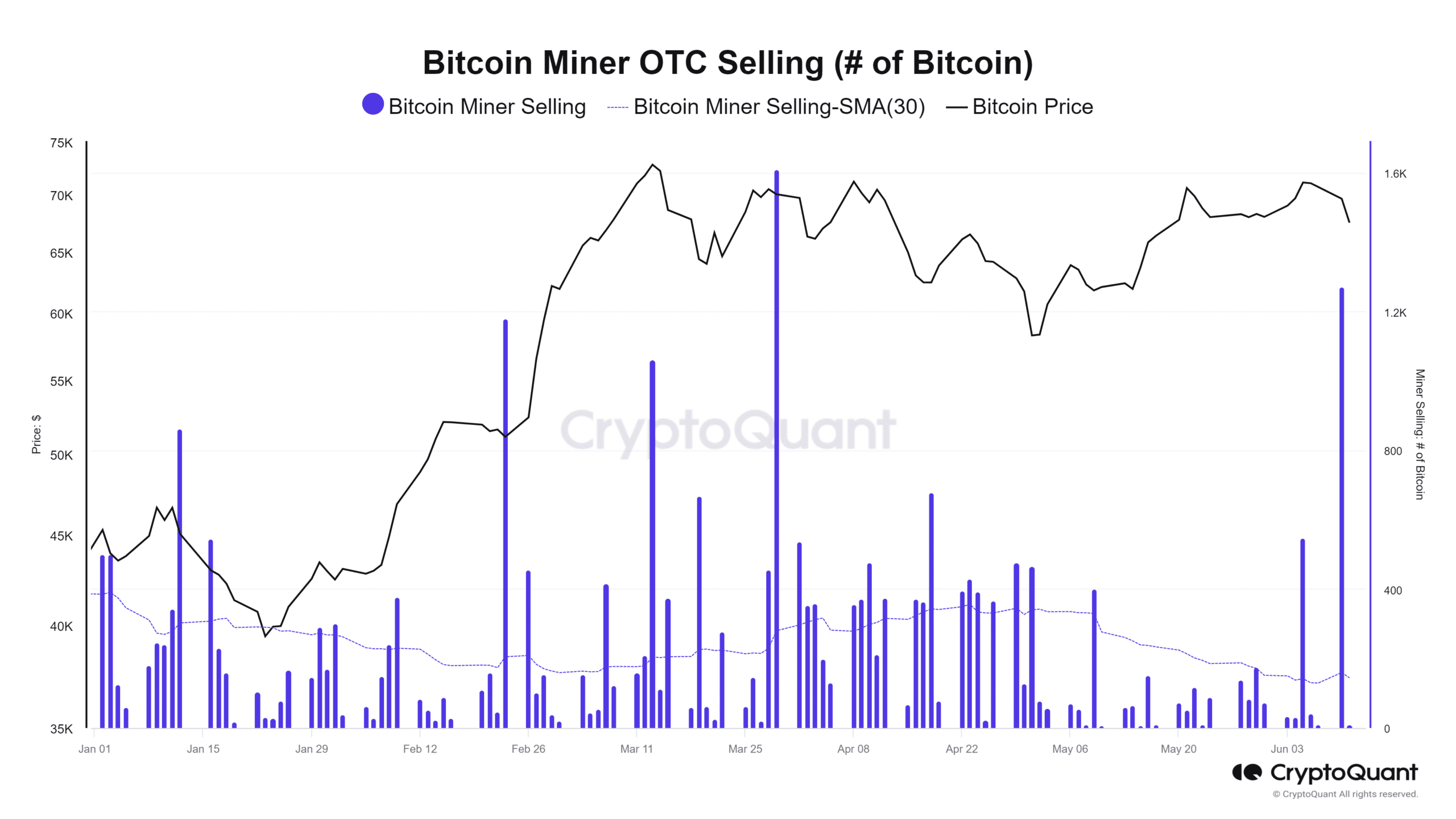

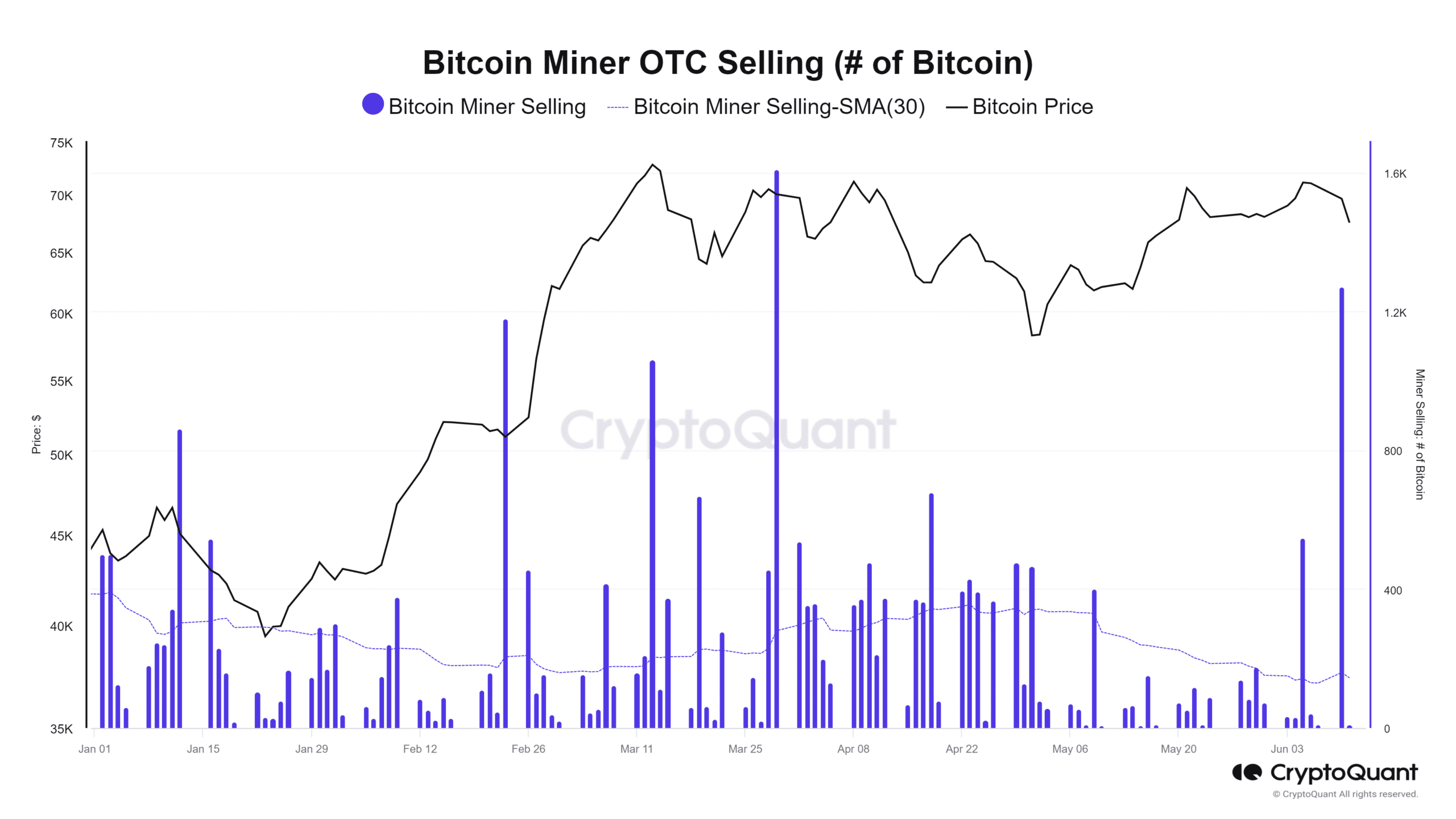

Source: CryptoQuant

An analysis of BTC Miner’s OTC sales showed that some major mining companies have sold their assets. According to a chart on CryptoQuant, there was recently the largest OTC sale since late March, with around 1,200 BTC sold.

This is a sign of miner capitulation, indicating that miners are selling their BTC holdings, possibly due to financial pressure or to preserve profits amid market declines.

These types of transactions do not immediately affect exchange volumes, but still reduce the total reserve.

How has BTC developed during the sell-off?

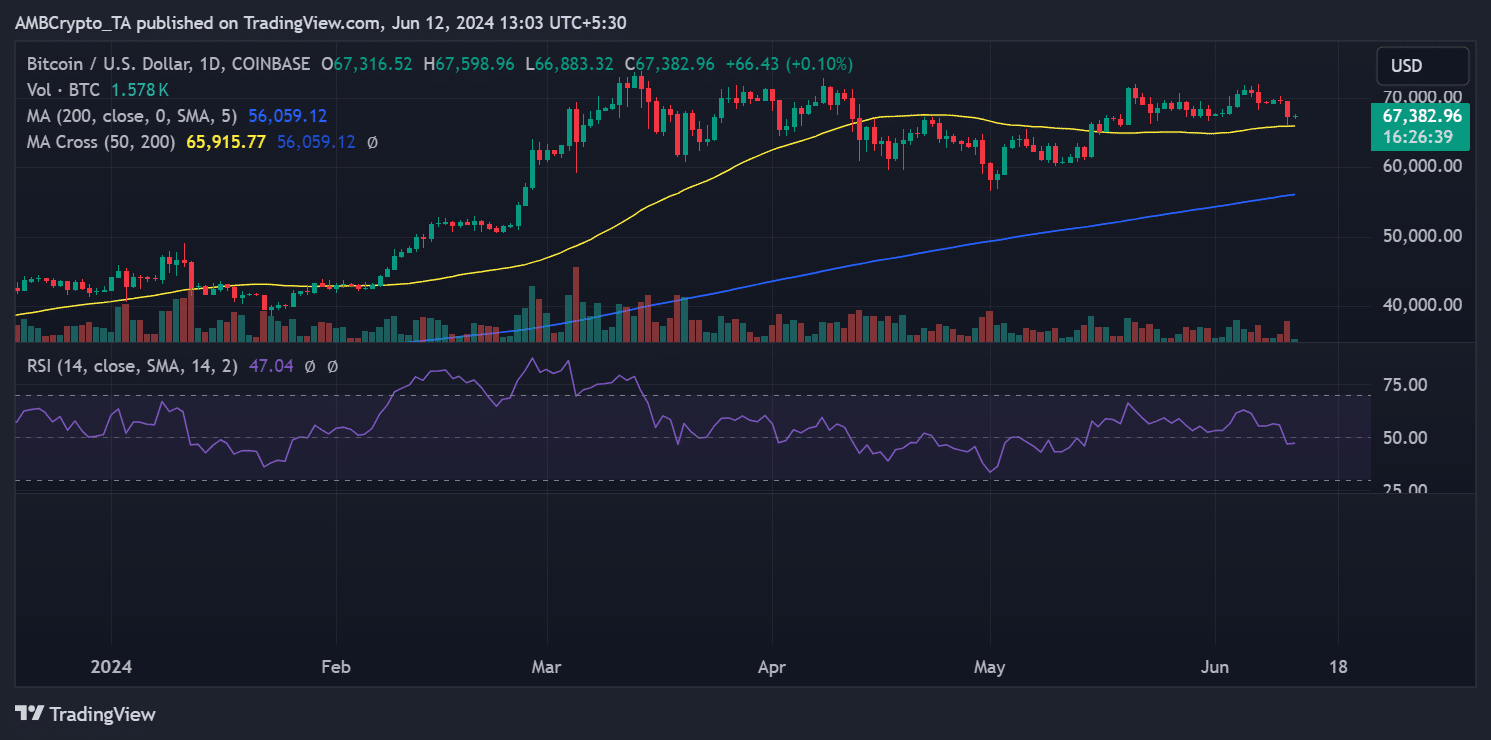

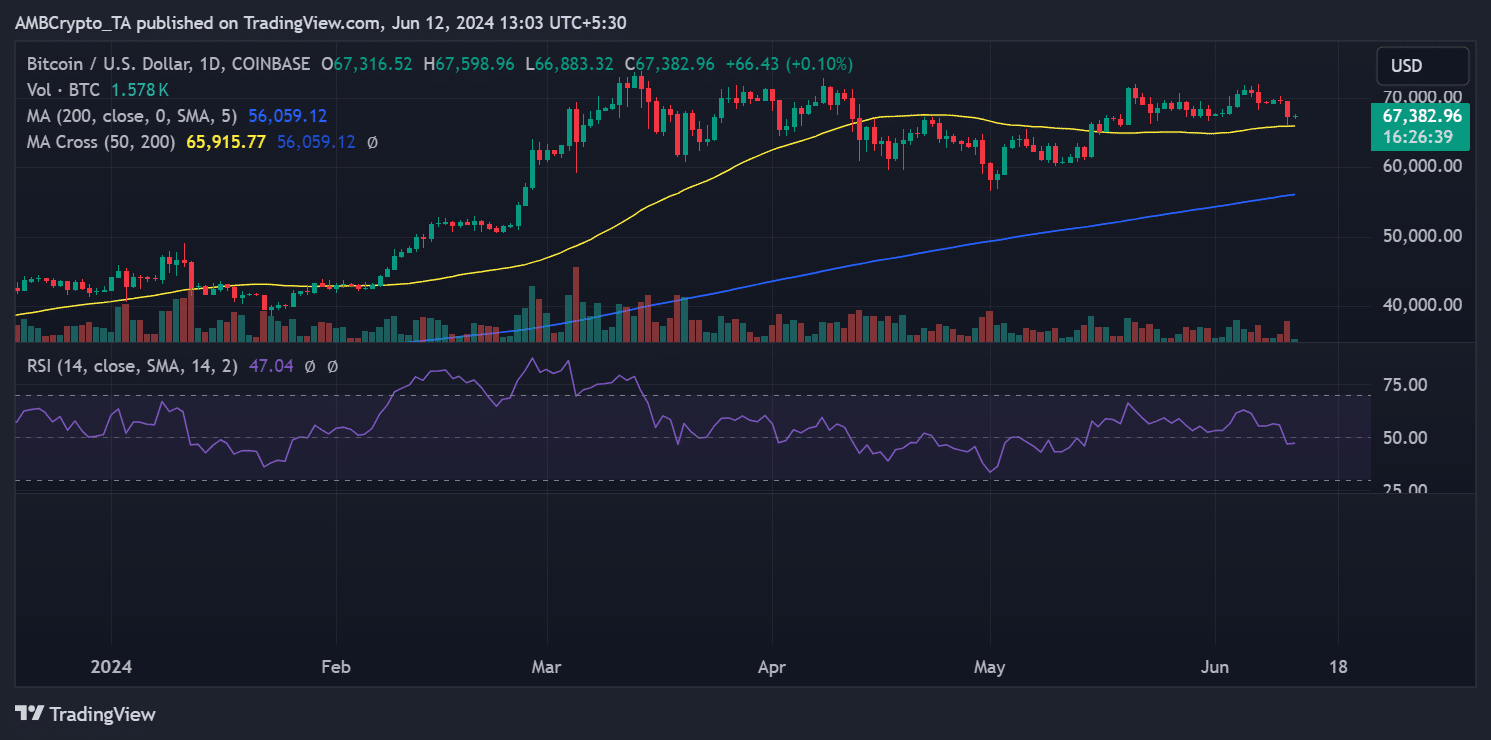

An analysis of Bitcoin on a daily timeframe showed a negative trend over the past seven days. AMBCrypto’s price trend analysis indicated that Bitcoin’s price fell from $70,000 to around $68,000 between June 6 and 7.

However, BTC saw another big drop on June 11, causing its price to drop. Analysis of the chart showed that it fell by over 3%, causing the price to drop to $67,000.

At this pace, Bitcoin has been moving dangerously close to its short-term moving average (yellow line), which has served as support around the $65,000 price range.

Source: TradingView

At the time of writing, BTC was trading around $67,400, with a small attempt at an uptrend.

Analysis of the Relative Strength Index (RSI) showed that it is now below the neutral line, with the RSI at around 47. This indicates that BTC is currently in a bear trend.

Bitcoin continues to receive a lot of interest

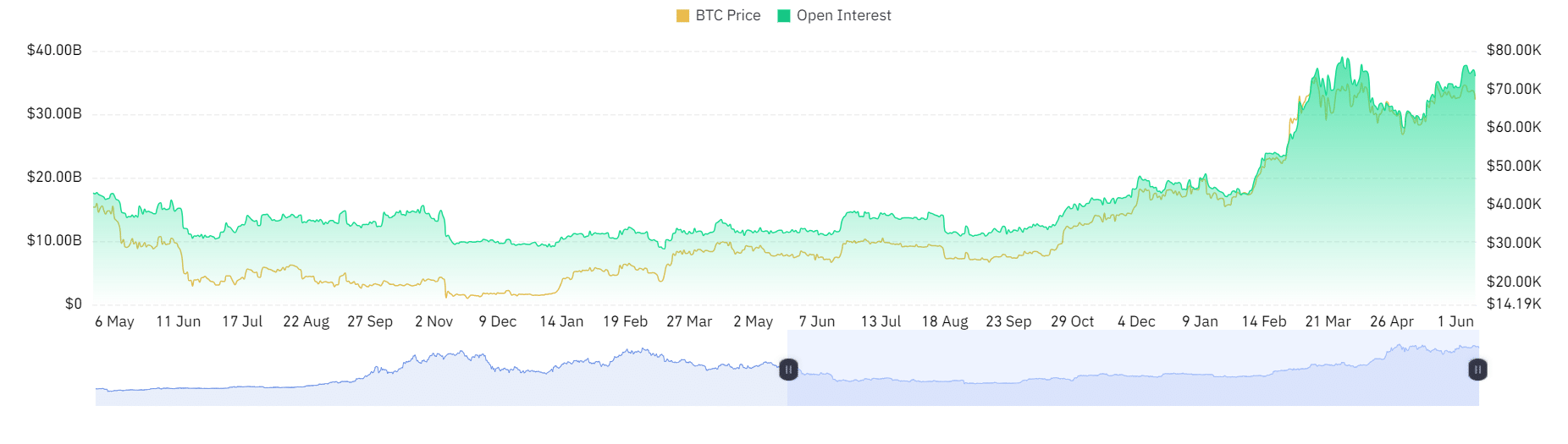

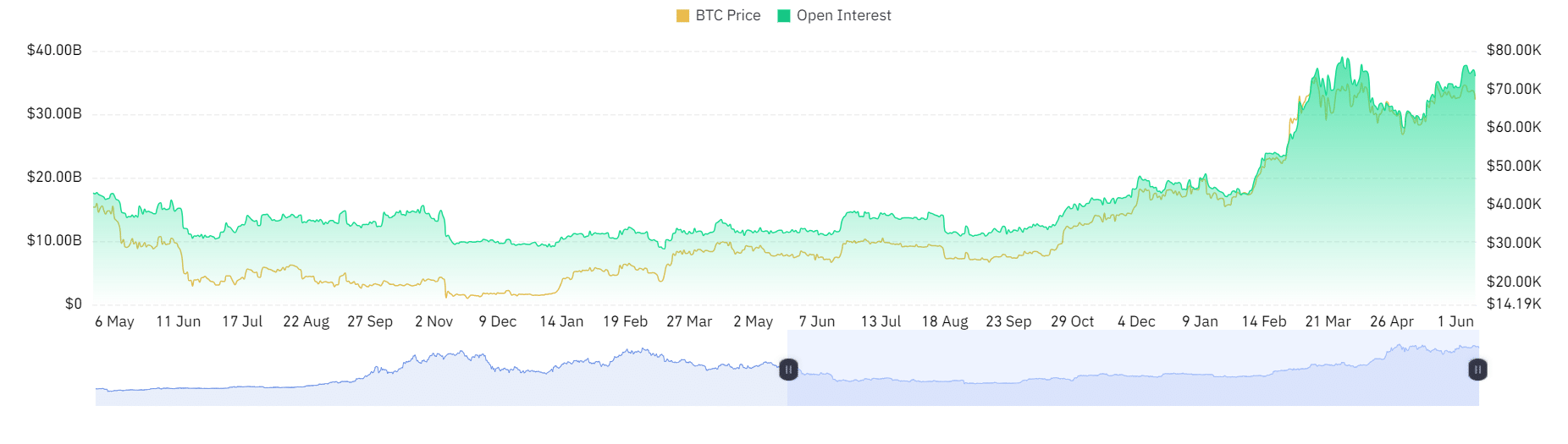

An analysis of another key metric found that despite the miner sell-off and price drop, Bitcoin is still seeing strong interest.

This suggests that, even in a bear trend, there is significant commitment and potential optimism in the market.

A look at the Open Interest chart of Mint glass showed it was about $34 billion at the time of writing.

Analysis of the chart indicated that the all-time high (ATH) was around $39 billion, a level reached in March when the BTC price exceeded $70,000.

This suggests that the cash inflow has not stopped and many traders are buying due to the price drop.

Source: Coinglass

Read Bitcoin (BTC) price prediction 2024-2025

Furthermore, comparing the current open interest (OI) to its all-time high (ATH) shows that there has not been a significant loss of positive sentiment around the price of BTC.

Despite the recent declines, traders remain engaged and optimistic about Bitcoin’s potential.