- The crypto market maintained its capitalization at over $2 trillion.

- Anticipation of the FOMC and CPI reports contributed to the cryptocurrency’s decline.

The crypto market has suffered a massive decline in the past 24 hours, wiping millions of dollars off the market capitalization.

Bitcoin declines [BTC] and ether [ETH] have played an important role in this recession.

More specifically, the upcoming US Federal Open Market Committee (FOMC) meeting and the Consumer Price Index (CPI) reports have largely contributed to the decline of the two largest crypto assets.

The reason why crypto no longer works today

AMBCrypto’s crypto market cap analysis on CoinMarketCap showed a significant drop in recent days.

In the last 48 hours, the market cap has fallen from over $2.5 trillion to around $2.47 trillion at the time of writing.

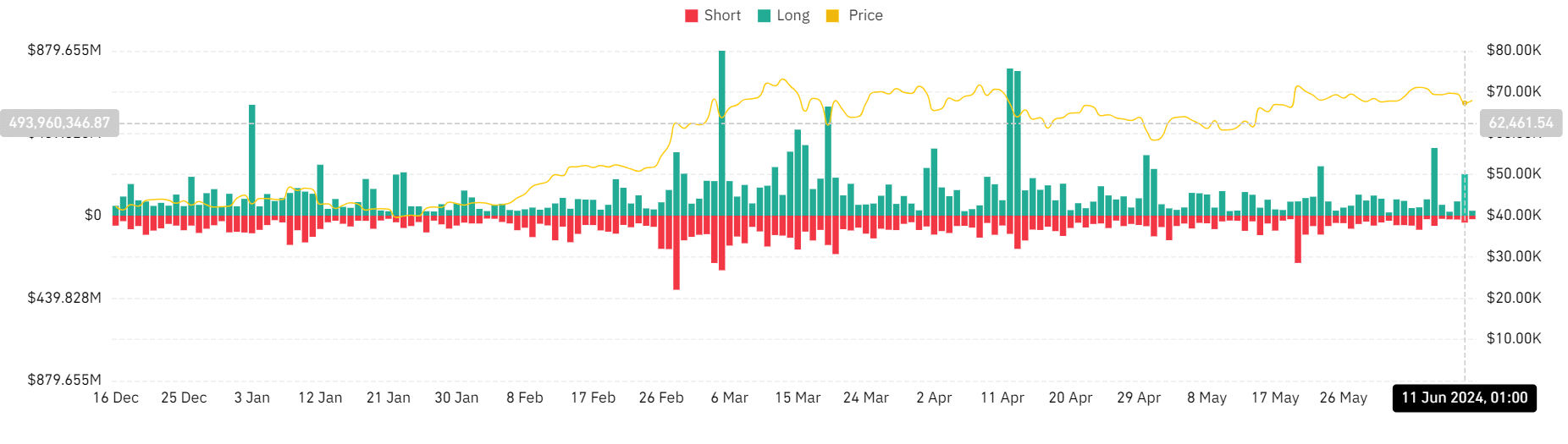

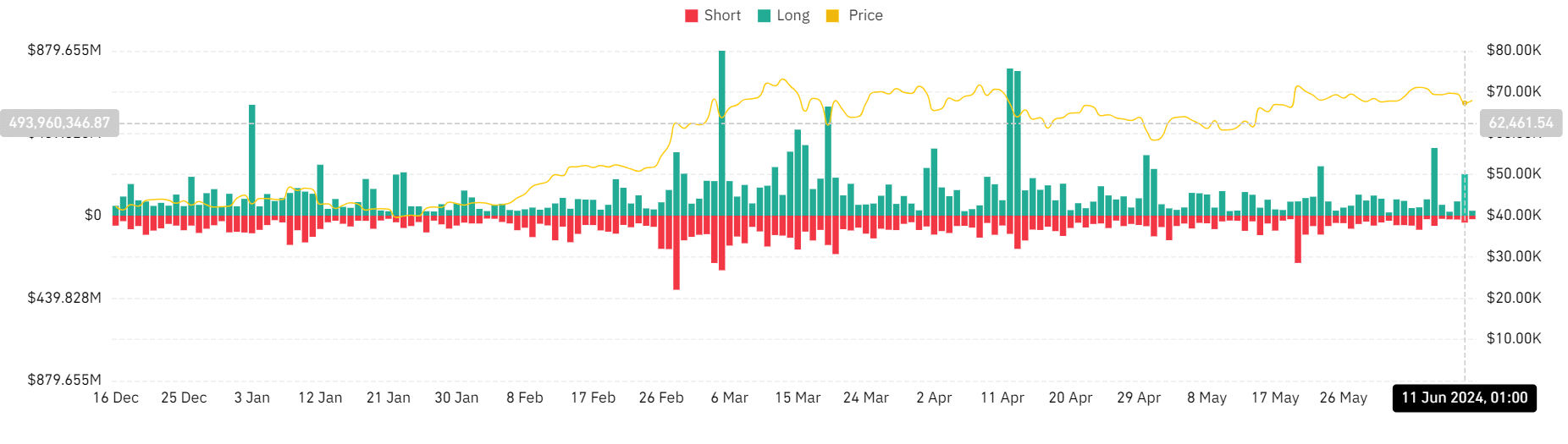

The liquidation schedule is also included Mint glass showed that crypto liquidations on June 11 were quite significant. The chart indicated that long positions were liquidated more often than short positions as prices fell sharply.

Source: Coinglass

The long liquidation volume was over $221 million, while the short liquidation volume was approximately $37 million.

Bitcoin and Ethereum lead market dip

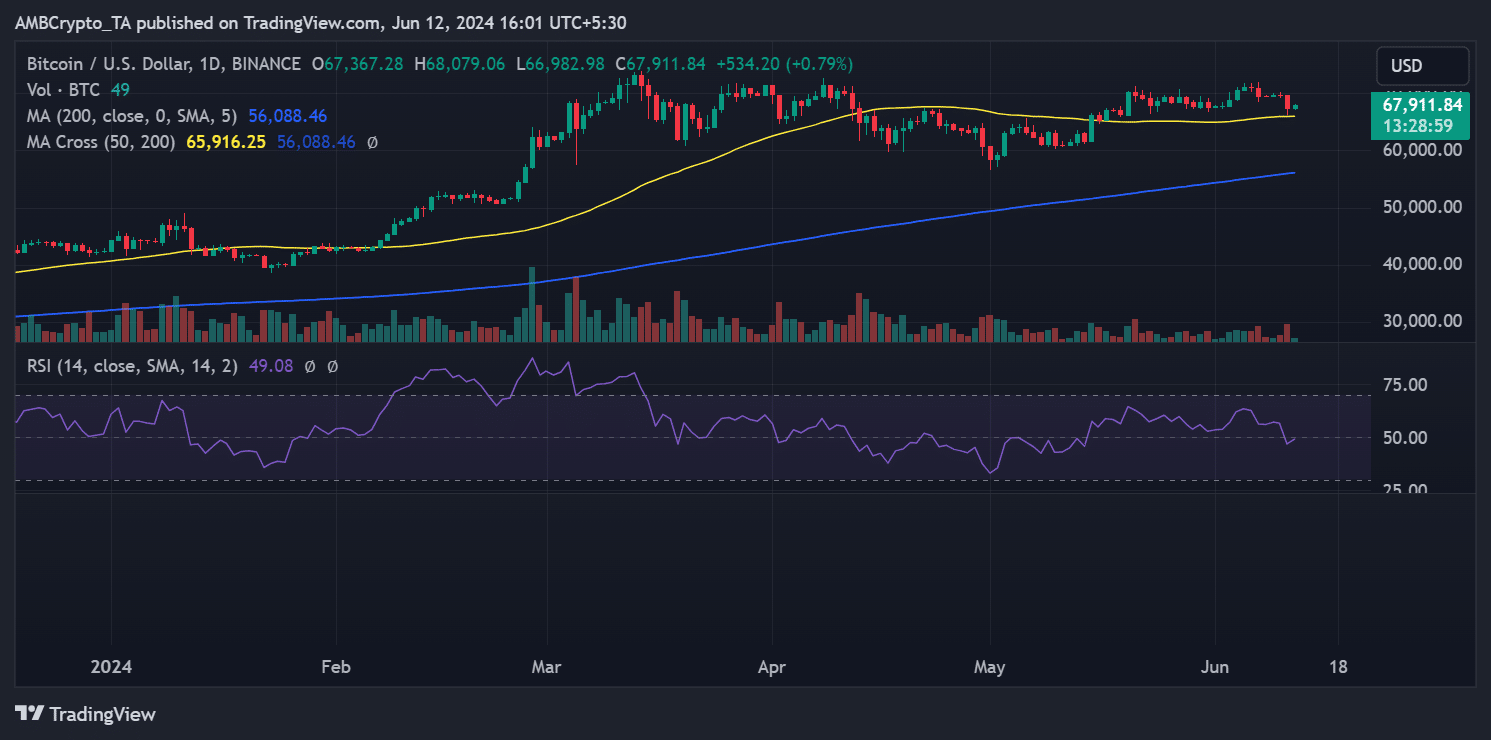

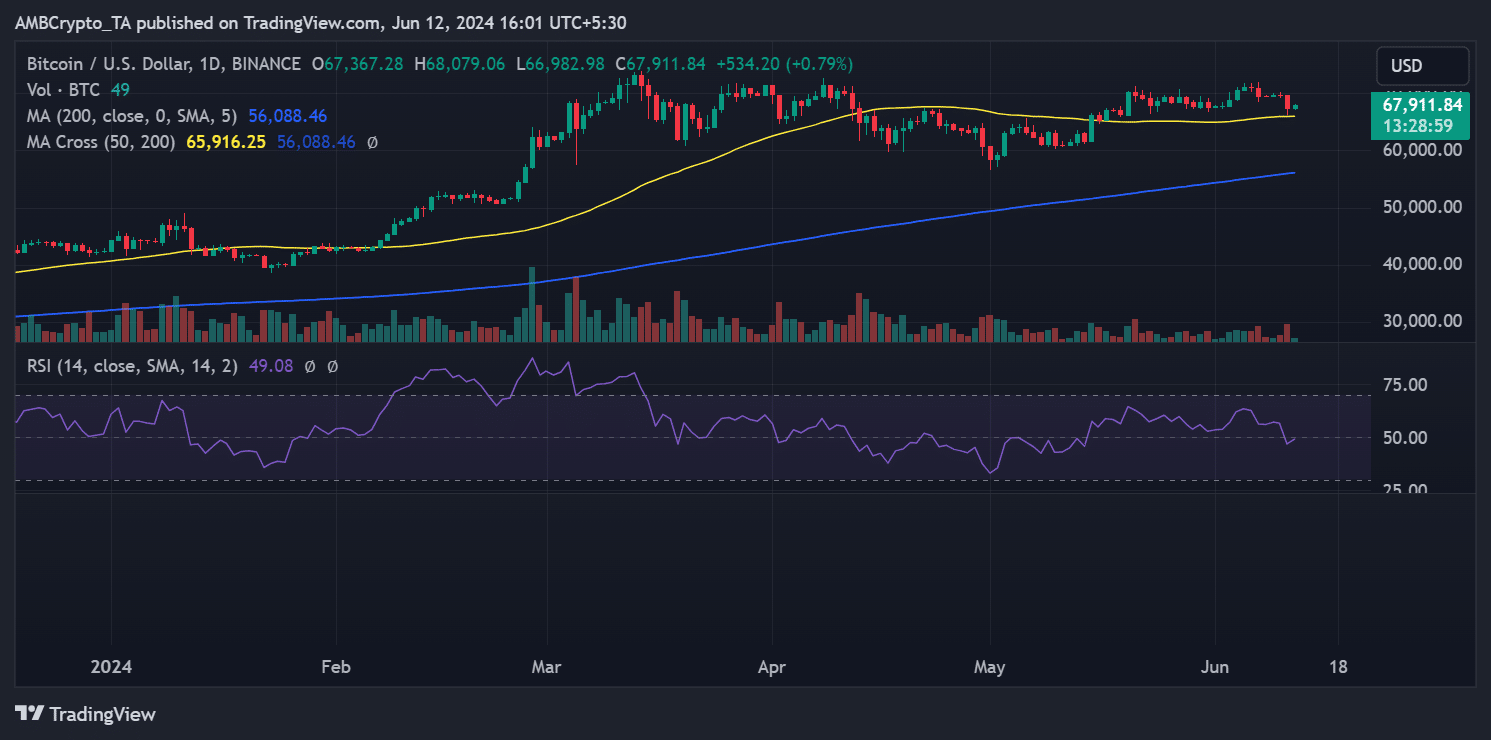

Looking at Bitcoin on a daily time frame, AMBCrypto saw it drop over 3% on June 11. The chart indicated that this drop dropped the price to around $67,377.

BTC’s liquidation chart showed that this drop led to a liquidation volume of over $66 million.

Source: TradingView

More specifically, long liquidations accounted for more than $52 million, while short liquidations amounted to more than $14 million.

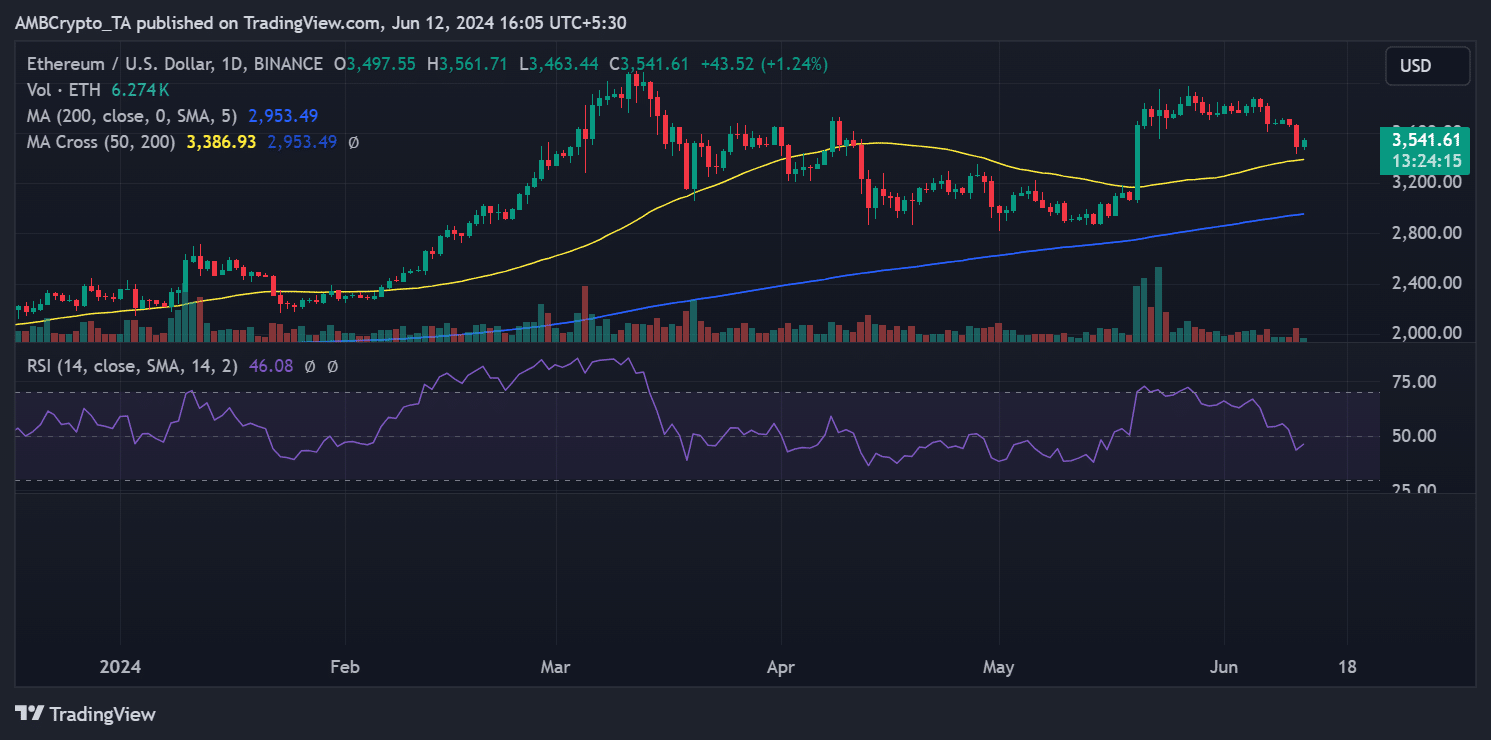

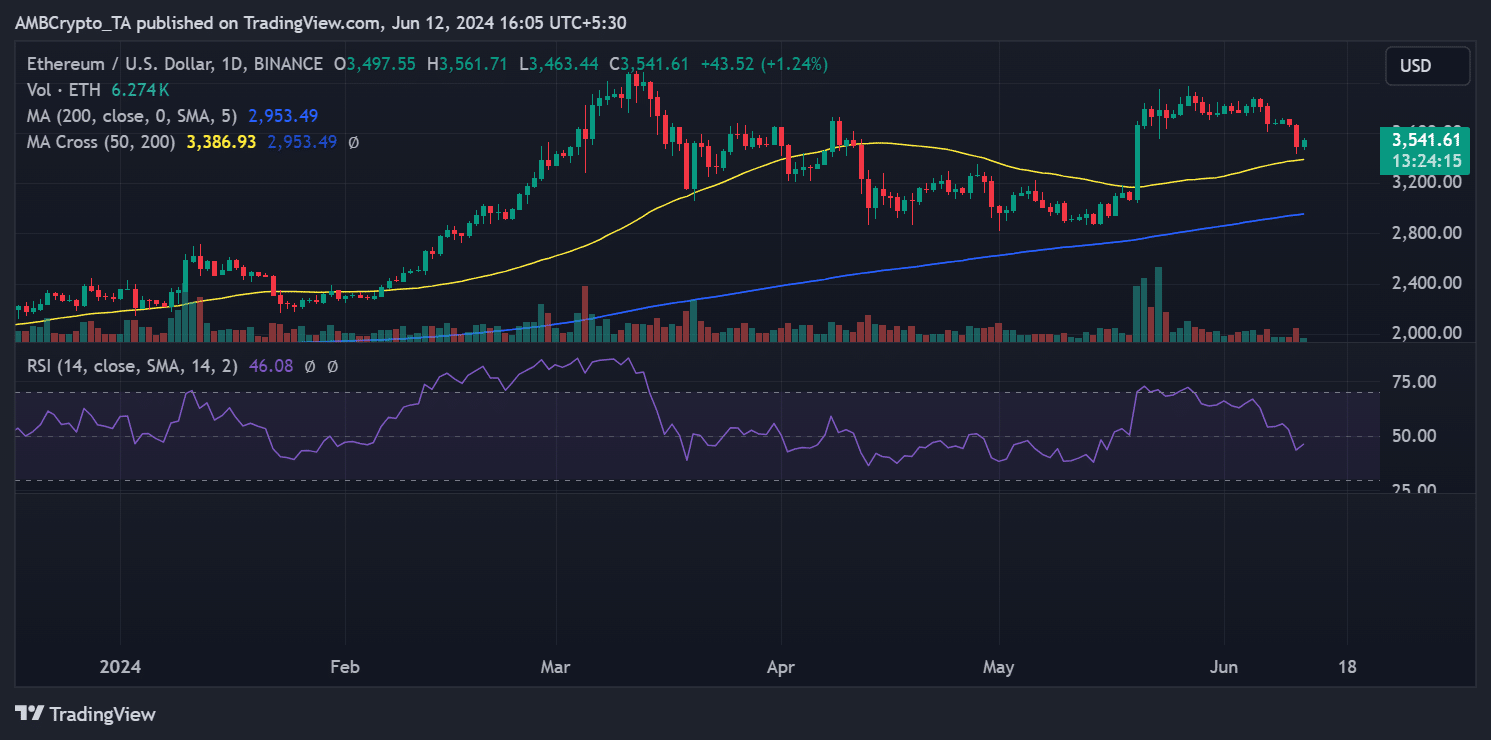

Ethereum showed a decline of almost 4.6% in the same time frame as its price fell to around $3,500. The liquidation chart showed that more than $69 million was liquidated as a result of the decline.

Of these, long liquidations accounted for approximately $62 million, while short liquidations amounted to more than $7 million.

Source: TradingView

CPI and FOMC are causing panic

Historically, the crypto market often experiences significant fluctuations when Consumer Price Index (CPI) data is released or the Federal Open Market Committee (FOMC) adjusts interest rates.

This is because investors adjust their risk exposure in response to these economic indicators. Normally, an increase in the CPI correlates with a decrease in the price of Bitcoin.

Is your portfolio green? Check out the BTC profit calculator

Increases in essential goods reduce the amount of disposable income people have, leading to reduced investment in crypto.

The FOMC is expected to maintain current interest rates between 5.25% and 5.50%. Meanwhile, the CPI is expected to increase modestly and remain within the range of 0.1% to 0.3%.