- Bitcoin continued to trade below $70,000.

- More than 1 million addresses have purchased BTC at the current price range.

Bitcoins [BTC] the rally has stalled and has now fallen below the $70,000 price zone, which serves as strong support.

However, other on-chain metrics suggested that BTC could maintain this price zone and potentially trigger another positive run.

Bitcoin falls below $70,000

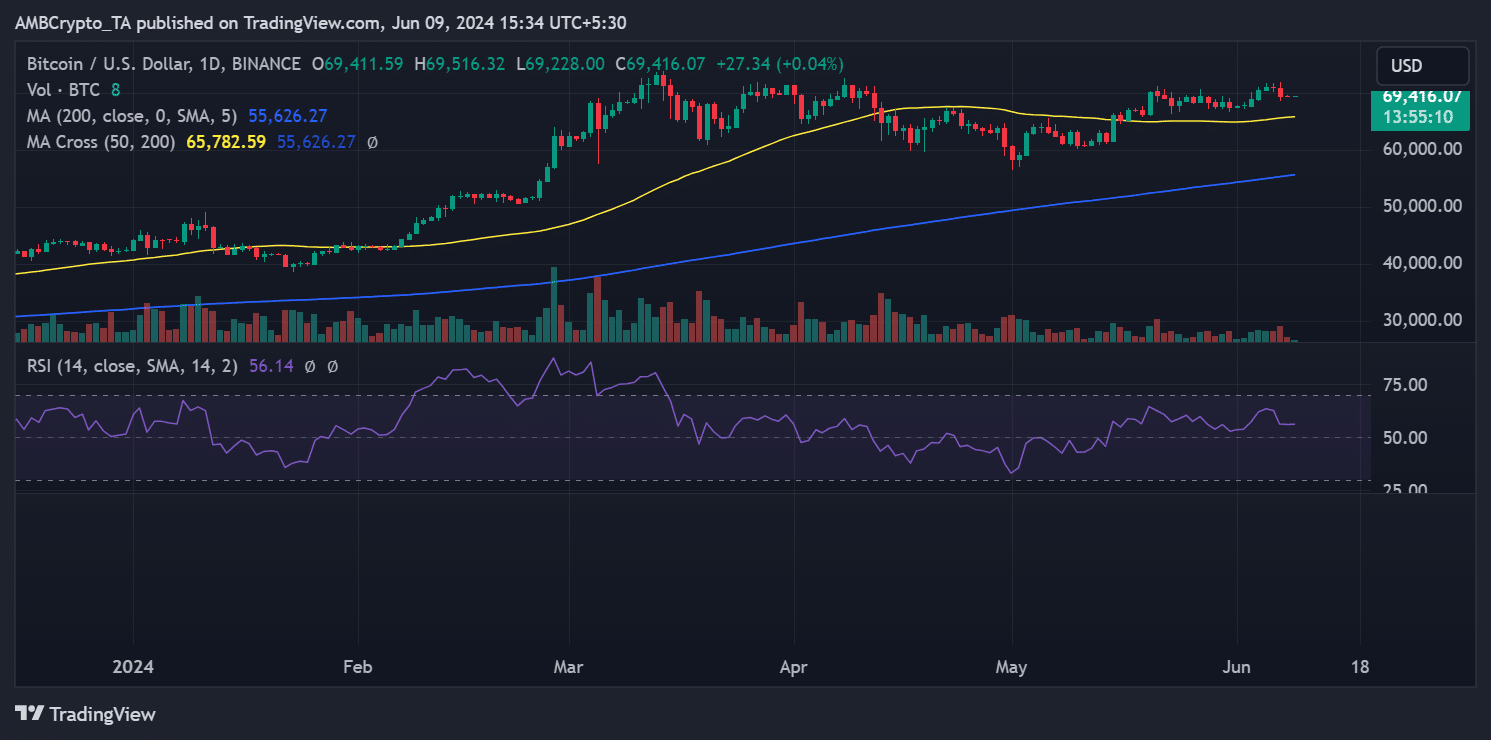

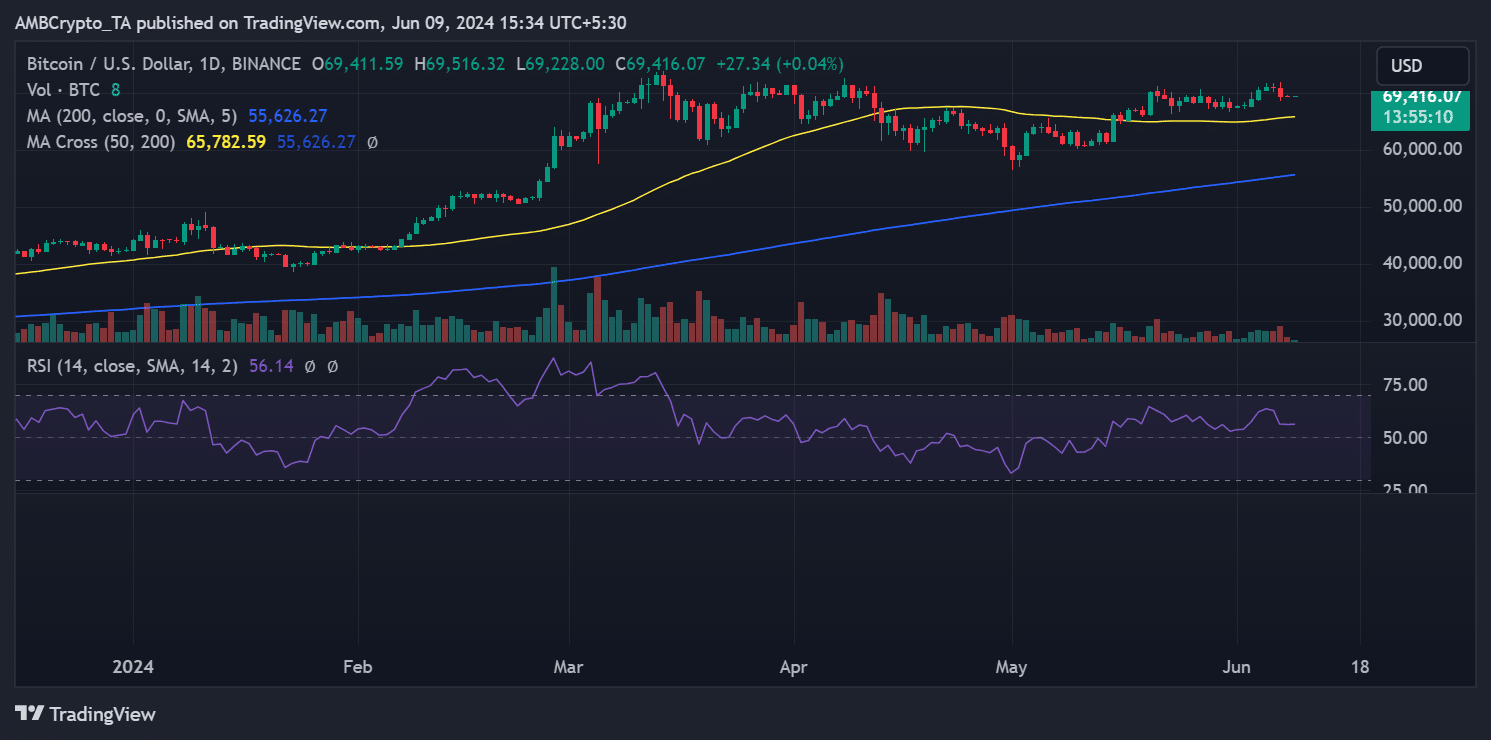

AMBCrypto’s analysis of Bitcoin’s price trend revealed a decline of 1.97% on June 7. This significant drop pulled the price away from the $70,000 zone.

Before the decline, BTC experienced successive uptrends that took it into the $70,000 range, indicating that it was building momentum to cross this threshold.

However, the drop between June 6 and 8 lowered the price to around $69,300.

At the time of writing, BTC was still trading in the $69,000 price range, with a slight increase to around $69,400. The graph showed that the general trend remained positive.

The Relative Strength Index (RSI) was above 55, indicating a bullish trend.

Source: TradingView

Moreover, at the time of writing, Bitcoin was trading above its short-term moving average (yellow line), providing immediate support around the $66,000 price range.

Bitcoin should remain stable in this zone

Bitcoin also saw strong support between the price zones of $69,380 and $67,350, with significant accumulation volume in this range.

The data showed that approximately 1.97 million addresses within this range acquired approximately 964,000 BTC.

At today’s price, this amounts to approximately $67 billion spent accumulating Bitcoin. This strong support suggests that BTC needs to hold this level firmly to sustain a positive trend.

More BTCs are leaving the exchanges

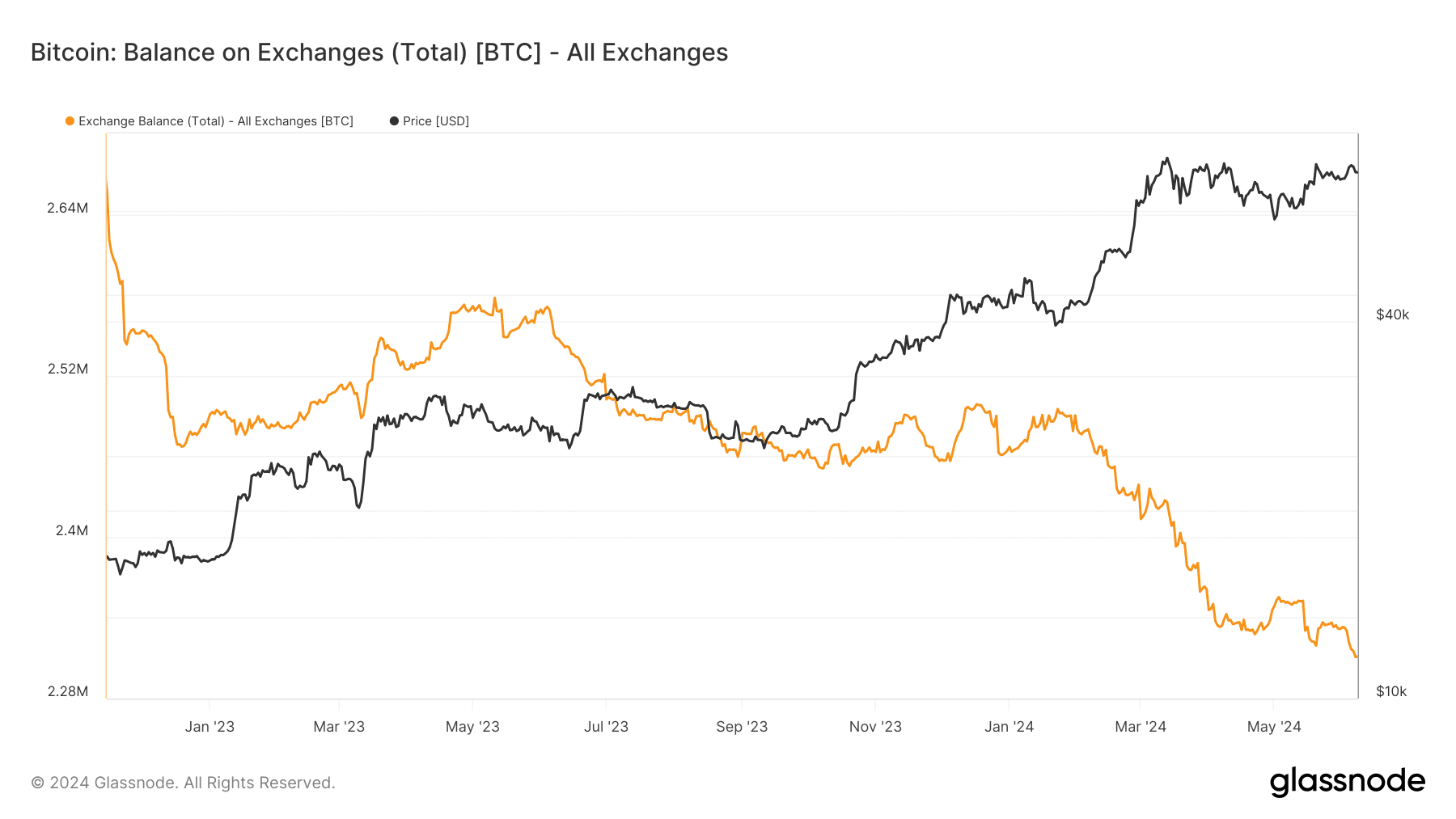

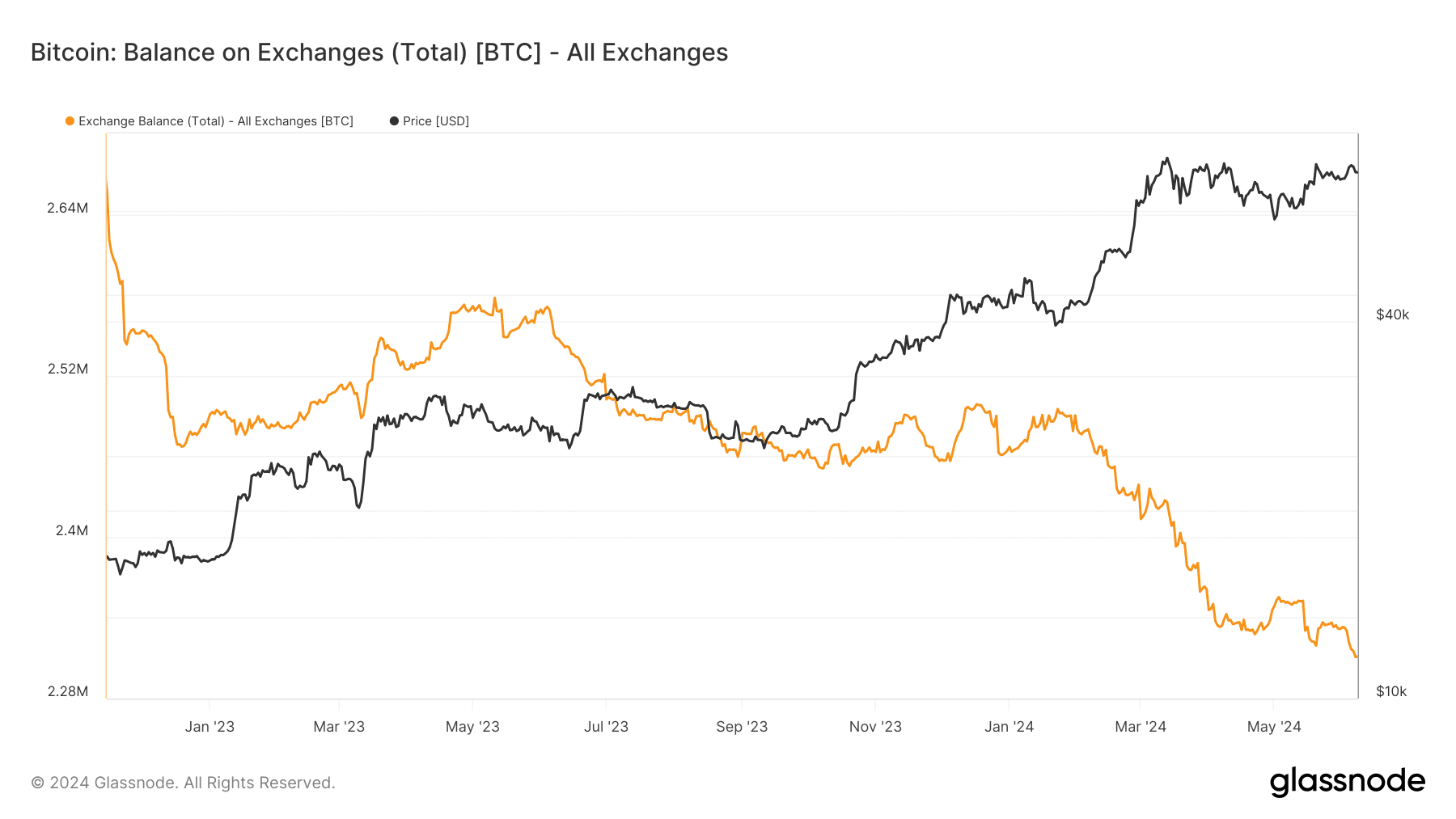

AMBCrypto’s analysis showed that given the supply of Bitcoin on exchanges, there was an increase in BTC withdrawals in recent days.

Also according to Glass junctionBetween June 1 and June 8, more than 21,000 BTC were withdrawn from the exchanges.

On June 1, the volume of BTC on the exchanges was approximately 2.332 million. At the time of writing, that volume had dropped to approximately 2.311 million.

Source: Glassnode

This means that approximately $1.57 billion worth of BTC has been withdrawn from exchanges in the past week.

Read Bitcoin’s [BTC] Price forecast 2024-25

This is a positive signal for Bitcoin as it suggests that there is no significant influx of BTC that could crash the price on the exchanges.

Consequently, Bitcoin may maintain its support level, which could potentially lead to a positive price trend soon.