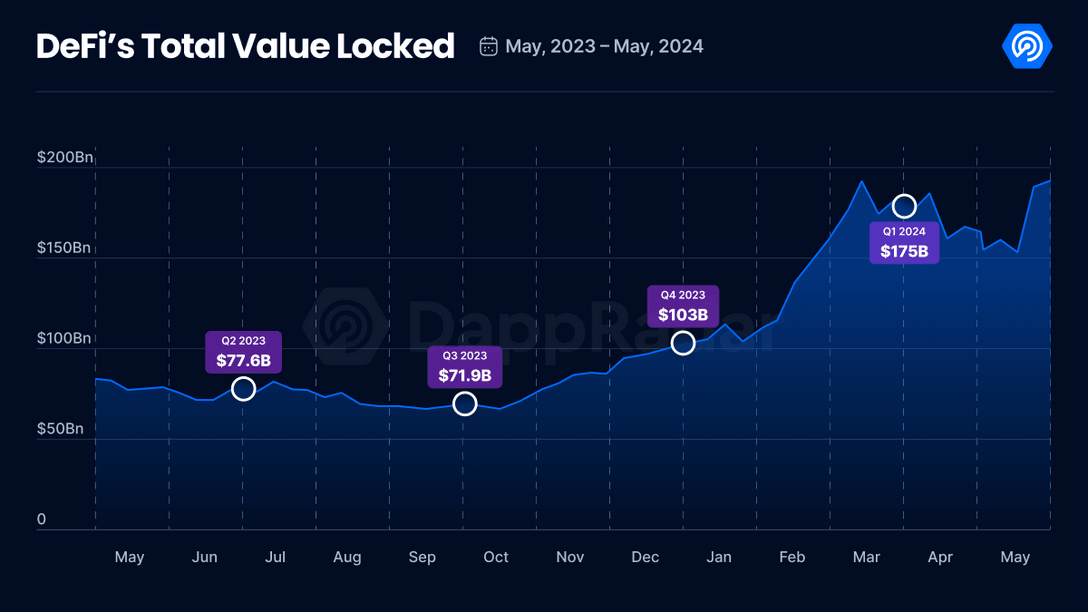

New data from market research firm DappRadar shows that the total locked value (TVL) within the decentralized finance (DeFi) sector has risen to the highest level in fifteen months.

In a new blog postDappRadar notes that DeFi’s TVL has reached $192 billion, up 17% from the previous month and the best it has recorded since February 2022.

TVL refers to the amount of capital deposited within a protocol’s smart contracts and is often used to measure the health of a crypto ecosystem.

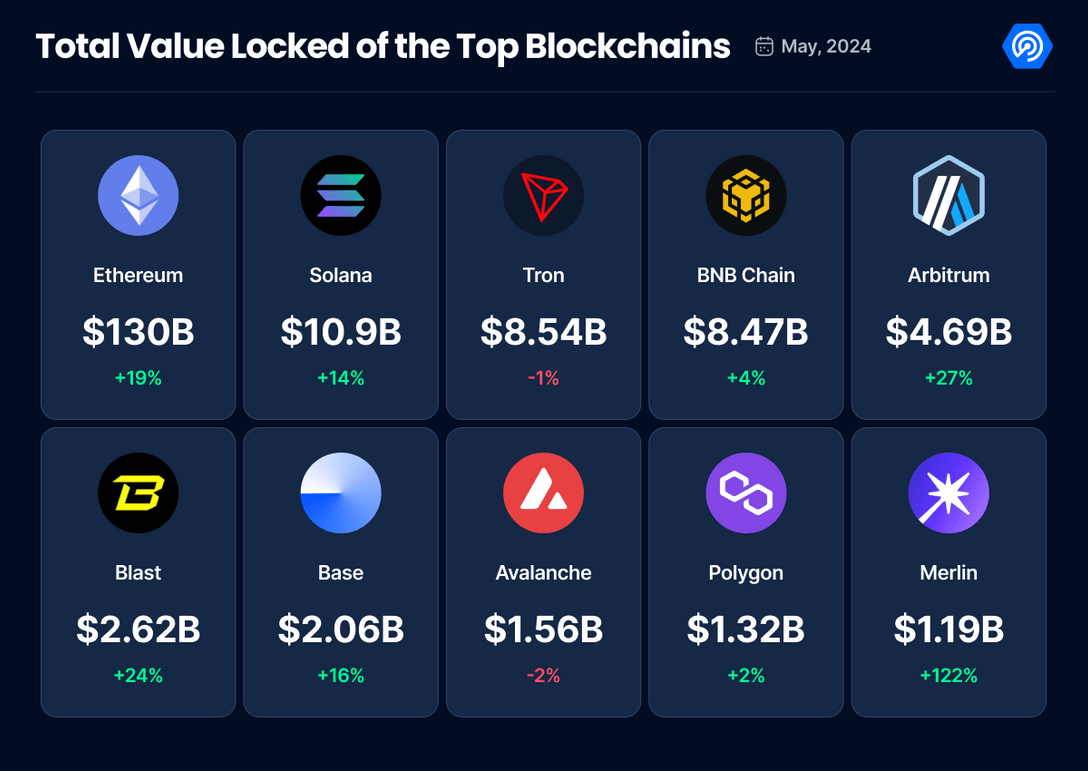

According to the crypto analytics firm, most of the growth was driven by a rise in token prices, particularly those of smart contract platforms Ethereum (ETH) and Solana (SOL).

“Ethereum owns the majority of the entire TVL of DeFi, and this month its dominance stands at 68%. Followed by Solana, which has been driven by memecoin trading and DeFi activity on its network in recent months. Additionally, the native SOL token is up 11% over the past 30 days.”

ETH is trading at $3,692 at the time of writing, while SOL is worth $158.94.

DappRadar further notes that Bitcoin’s (BTC) layer-2 solution Merlin Chain (MERL) also made a major contribution in May, becoming the crypto king’s largest sidechain, dwarfing the Lightning Network.

“The story around the Layer-2 networks remains strong, but the real highlight this month is Merlin. It has become the largest Bitcoin sidechain and more than three times the size of the payments-focused Lightning Network.

More than half of Merlin’s $1 billion is in Solv Finance, a protocol that allows users to deposit Wrapped Bitcoin and receive ‘Solv Points’ in return.”

MERL is trade at $0.441 at the time of writing, down 10.10% over the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney