Binance’s $4.3 billion settlement with US regulators was a major shift in the mindset of institutional adoption of digital assets, which has seen many dismissals from institutional players who label digital assets as flashy, worthless assets used by criminals are pushed forward.

Gradually, the tectonic plates of ideas that shaped the sentiments of these institutional corridors of power have shifted. For the first time in decades, digital assets like Bitcoin (BTC) could come into ideological collision with a hallmark of institutional adoption.

Many innovative ideas are flooding into the cryptocurrency space, creating endless market opportunities. Binance’s partnership with Signum, which allows major players in the cryptocurrency space to hold their assets elsewhere, further amplifies many revolutions and will allow institutions to explore digital assets.

Furthermore, institutions have continued to enter the crypto market following the approval of the Bitcoin Exchange-Traded Fund (ETF), allowing many companies to trade a proxy with low management fees and engage in other strategies such as hedging.

These factors have generated a lot of attention and money flows into the crypto space, as is clearly visible in Bitcoin’s performance, which has reached new all-time highs. Smart money, retailers, families, hedge funds, and corporations have all recently added Bitcoin as a portfolio diversification strategy.

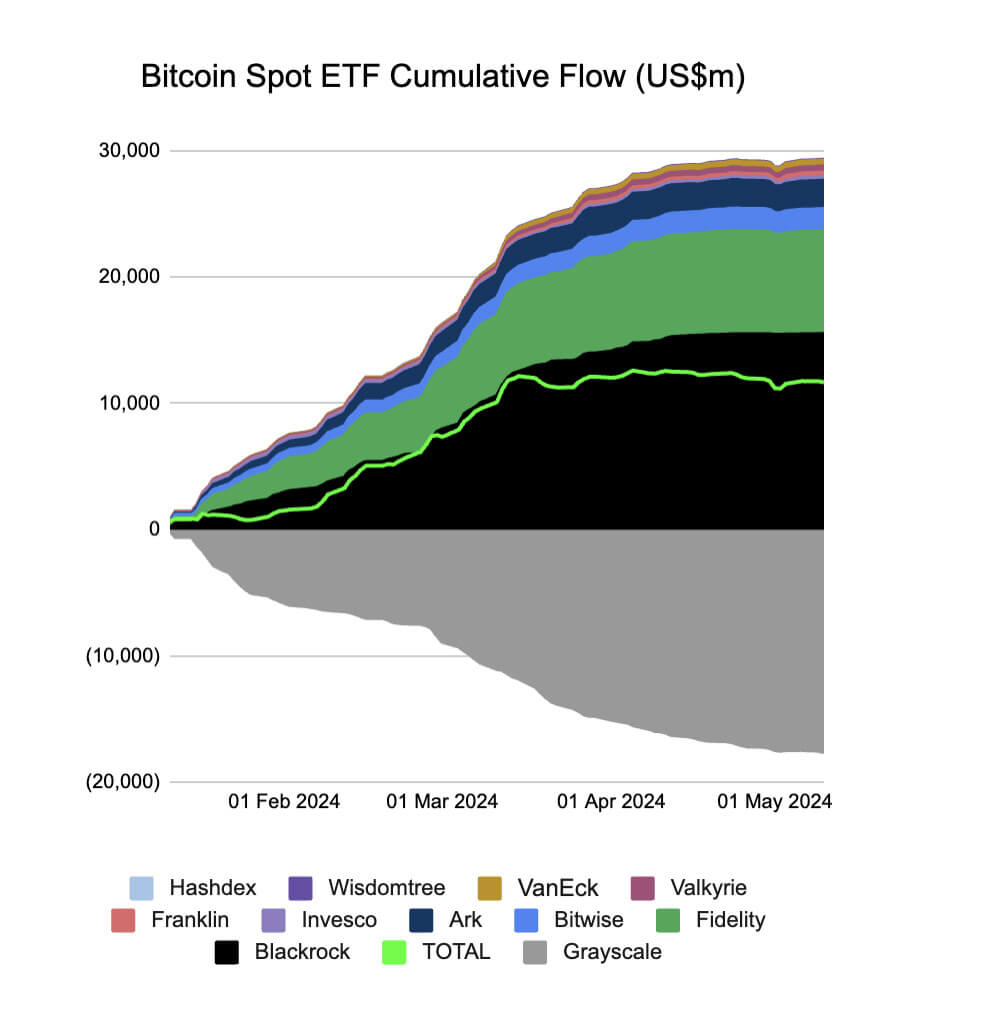

Research has shown that this is a baffling finding $17 billion in institutional capital has flooded the cryptocurrency space this year alone, as institutions continue to allocate a percentage of their investments to digital assets.

The other side The Bitcoin ETF flow shows that major players such as BlackRock, Fidelity, VanEck and other institutional firms have shown a lot of interest in digital assets, with institutional money playing a key role in the current buzz of the cryptocurrency market.

More than seven in ten institutional investors have shown an eagerness to diversify their investments in digital assets, with more than five of these institutional investors making significant moves to own these crypto assets.

BlackRock leads institutional money flowing into crypto

BlackRock, a leading asset manager and one of the world’s largest institutional giants, has taken a keen interest in the cryptocurrency ecosystem, driving much innovation in the tokenization of cryptocurrency assets.

These actions from respected financial services demonstrate growing adoption of blockchain technologies among traditional organizations. The incredible benefits that the blockchain ecosystem offers, such as transparency, liquidity, and use cases across projects, are the driving force behind this adoption.

Private companies have initially dominated the blockchain ecosystem, but its mass adoption by institutions could pave the way for greater operational efficiency. Innovative ideas such as the tokenization of digital assets by a crypto startup, Libre, attracted a lot of attention from JPMorgan and BlackRock, shifting their focus more towards bringing innovation to this space and tokenizing digital assets.

BlackRock CEO Larry Fink sees blockchain technology and tokenization of crypto assets as a blueprint to one day replicate such great ideas across stocks and bonds to achieve a unified blockchain ledger that enables instantaneous transactions.

Unlocking institutional opportunities

Amid the rapidly evolving financial world, asset tokenization remains widespread among institutional organizations such as BlackRock, JPMorgan, Fidelity, and others. It aims to be a central force and a promising transformation for these institutions in the near future.

Recent research from Boston Group Consulting (BGC) and investment firm ADDX shows a clear direction for most institutional companies showing more interest in the cryptocurrency ecosystem as their interest leans toward tokenization of assets. Asset tokenization is expected to be a $4 trillion industry as it attracts more institutions to the space and could materialize in the coming decades.

This shift in the tokenization of assets by financial institutions is not speculative compared to the trend in the foreign exchange market, as concretely expressed by these market players, who recognize the potential of this sector. The centerpiece of traditional finance and blockchain technology bridging the gap would be a ball in motion as this would enable liquidity, efficiency and greater accessibility.

As this presents many opportunities for institutional investors, emerging technologies such as artificial intelligence (AI), copy trading, social trading and others have been adopted by many retailers to tap into the endless money flowing into the crypto space by institutional investors.

Margex Copy Trading helps retailers position themselves better on the market

The idea of traditional finance entering the cryptocurrency market was a mirage. Only recently have many traditional financial institutions shown much interest in the crypto space.

Traditional financial institutions entering the cryptocurrency market are exciting many retailers. A lot of fresh money has been pumped into the market, suggesting that the current upward trend in the market is a factor in their presence. Many retailers are keen to capitalize on current market sentiment.

Exchange-traded funds (ETFs) and real-world assets (RWAs) have captured the attention of institutions. Digital assets under this trend have exceeded expectations in recent months, with the Margex platform ensuring that these high-conviction assets are available for transactions.

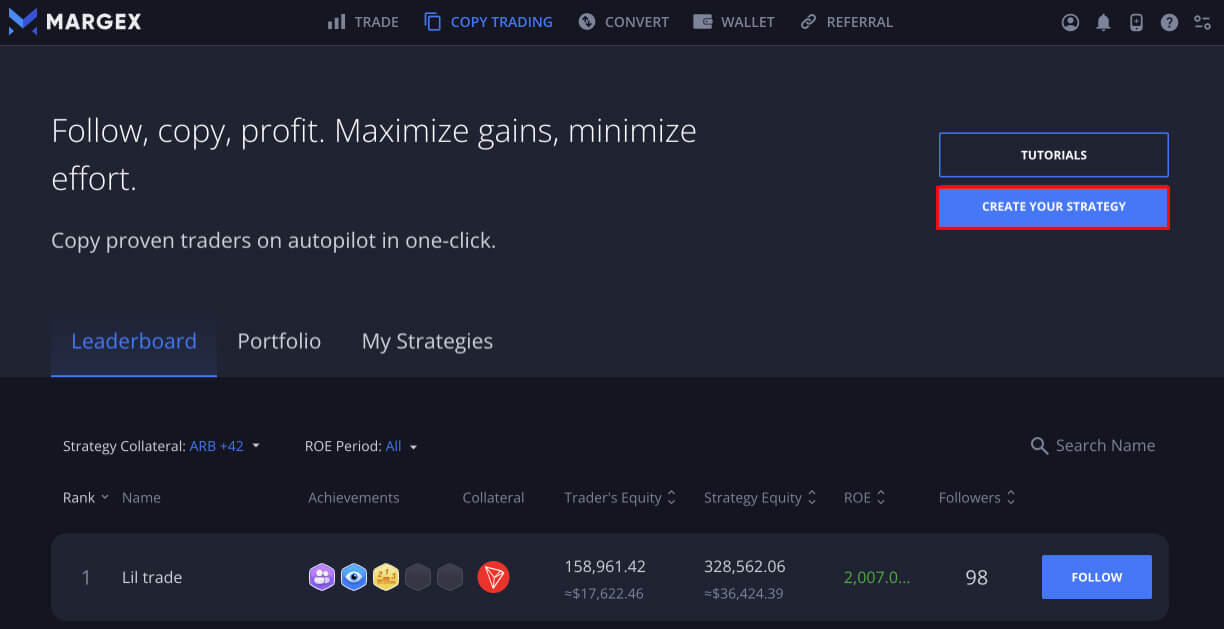

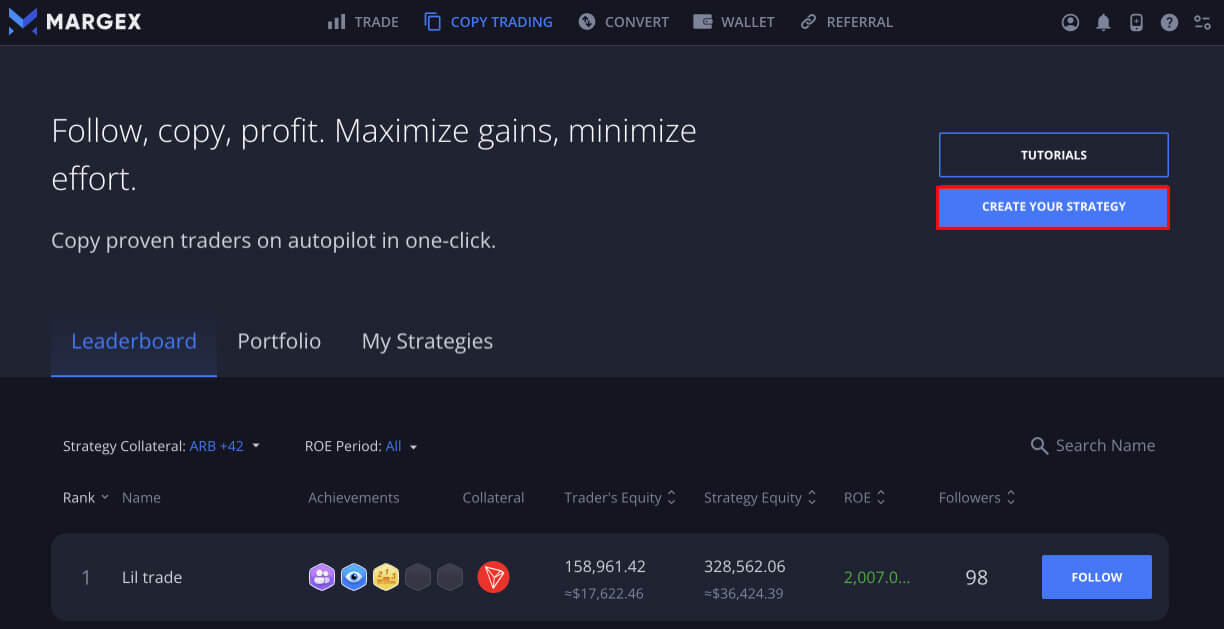

Margex is a leading cryptocurrency copy trading platform that allows users to replicate the trades of expert traders. This gives users the opportunity to explore digital assets with real-world examples and better profit potential.

Margex has spent more than $3 million redesigning its platform with an emphasis on usability. It introduced a zero-fee converter that allows users to exchange tokens easily and free of charge. Margex plans to unveil a state-of-the-art wallet that will provide users with great security over their assets and help them get full custody of assets within the same platform.

Margex’s design of its copy trading platform gives users an edge over other platforms. It allows users to copy the best traders with a win rate of over 90% and good risk management of users’ assets. Most importantly, transactions are executed automatically without much supervision.

Exploring Margex copy trading and earning mouth-watering returns from automated trades has never been easier. Here is a three-step process for using the Margex copy trading strategy.

1 Create a Margex account

Creating one Margex gives users access to the copy trading.

2 Follow profitable expert traders

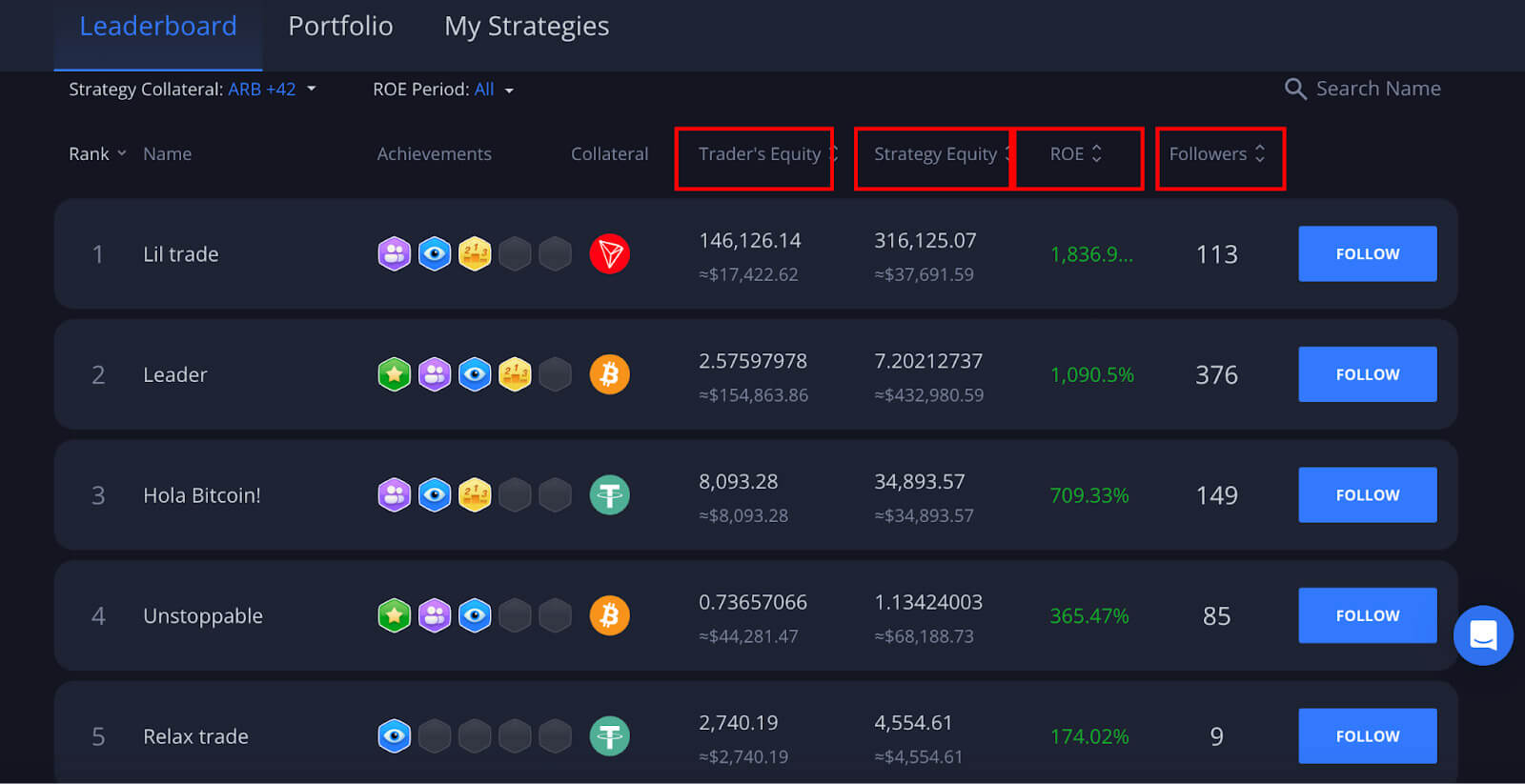

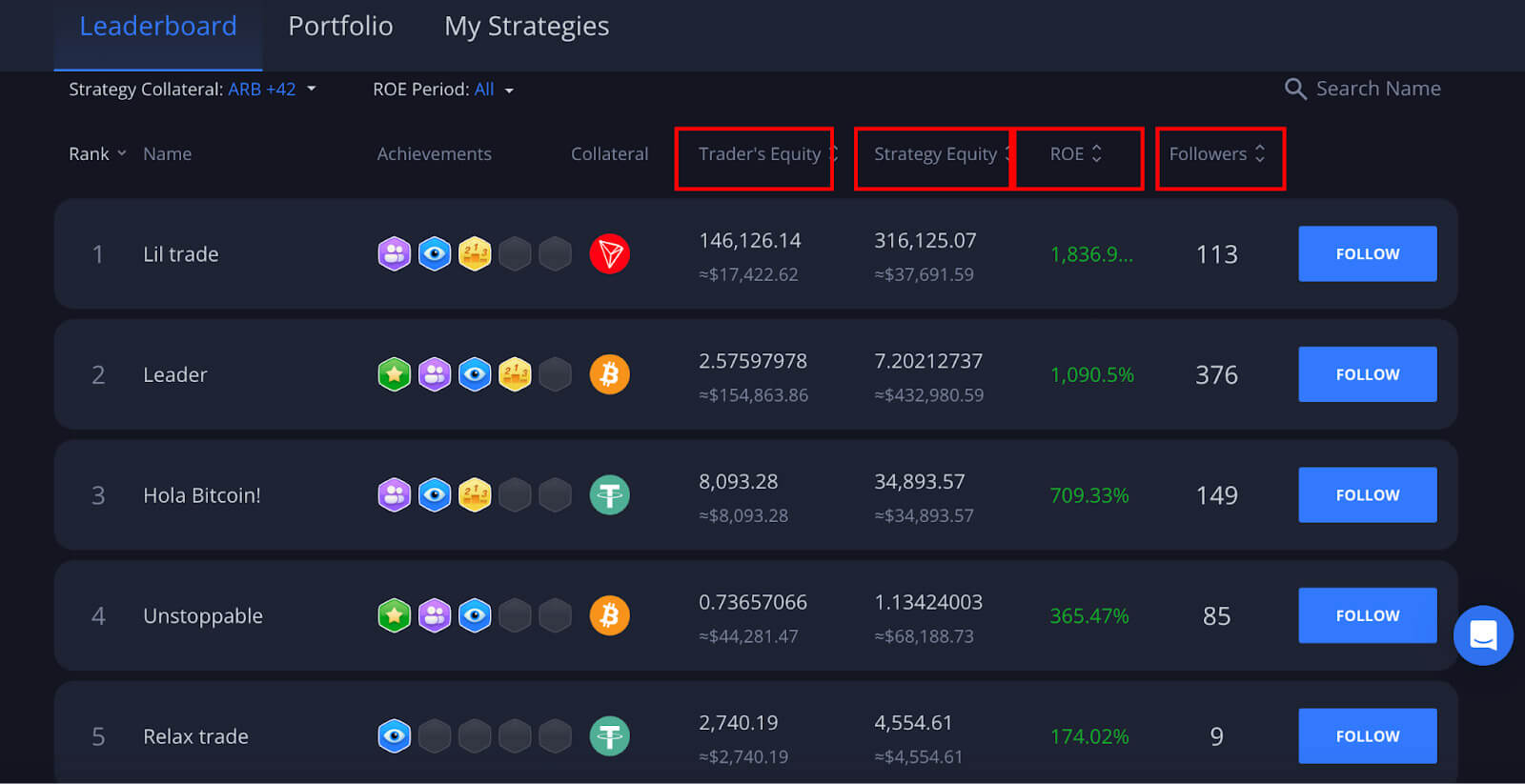

Follow your favorite expert trader to automatically replicate all trades and strategies. Margex copy trading leaderboards provide all the information users need to make the most informed decision about which expert trader to copy.

3 Allocate funds to automate copy trading

In all trades executed in real time, users can copy the strategy or create a plan that suits them, after allocating the desired amount to be entered per trade.

As low as $10 is the minimum amount Margex requires to participate in copy trading strategies.