- Analysts see $60,000 as the correction bottom for the 2024 cycle.

- However, price consolidation could take longer.

Last week was perhaps the worst for the markets, especially for risky assets Bitcoin [BTC]. US stocks ended the week in the red.

Similarly, BTC extended its weekly losses in April, hitting a low of $59.6K amid the halving, US tax season and tensions in the Middle East.

BTC has since improved and stood above $66K, poised to reverse recent losses. Moreover, the halving and the US tax season are out of the picture. Tensions in the Middle East have also decreased slightly.

This begs the question: is the Bitcoin halving sell-off over? Some market watchers think so.

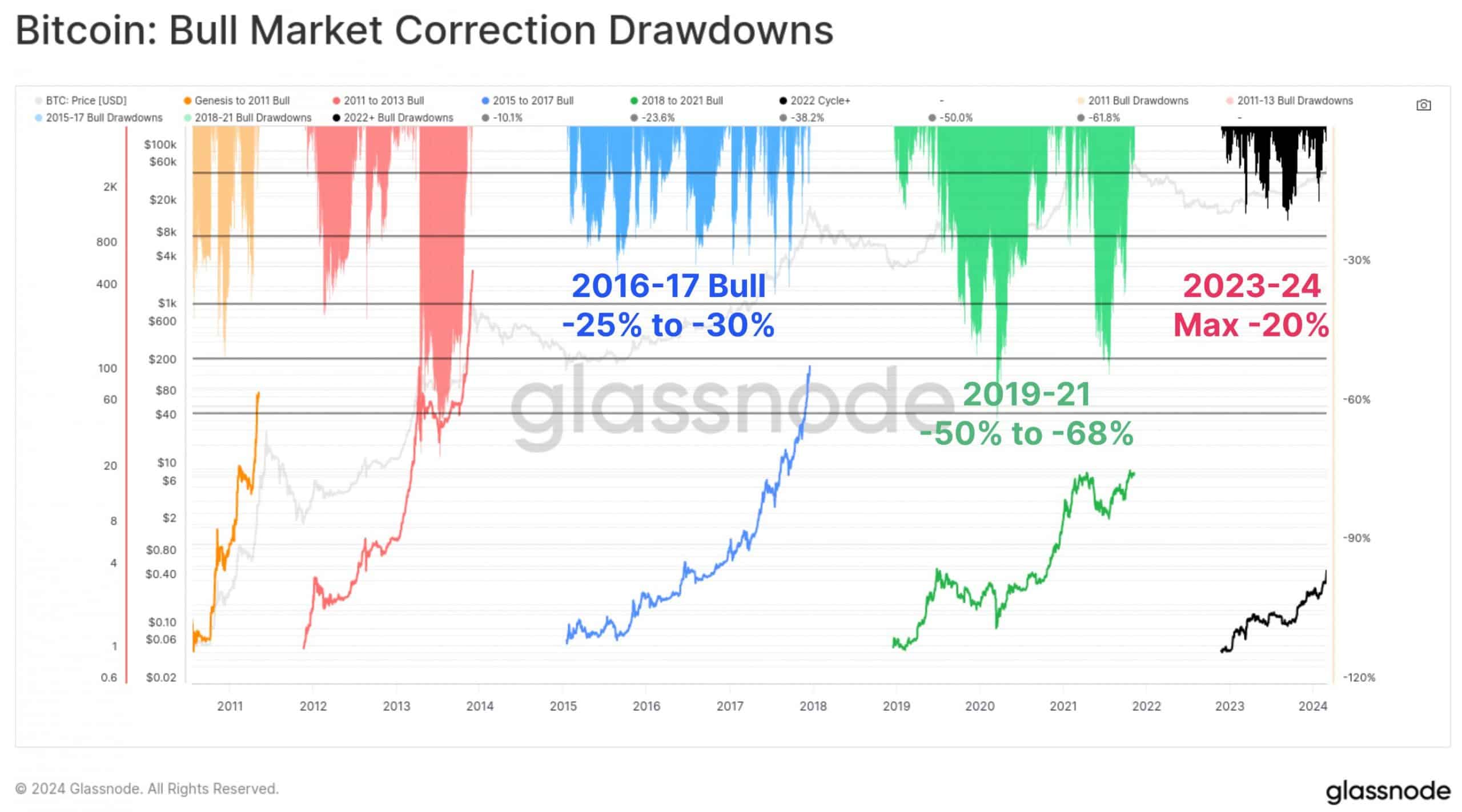

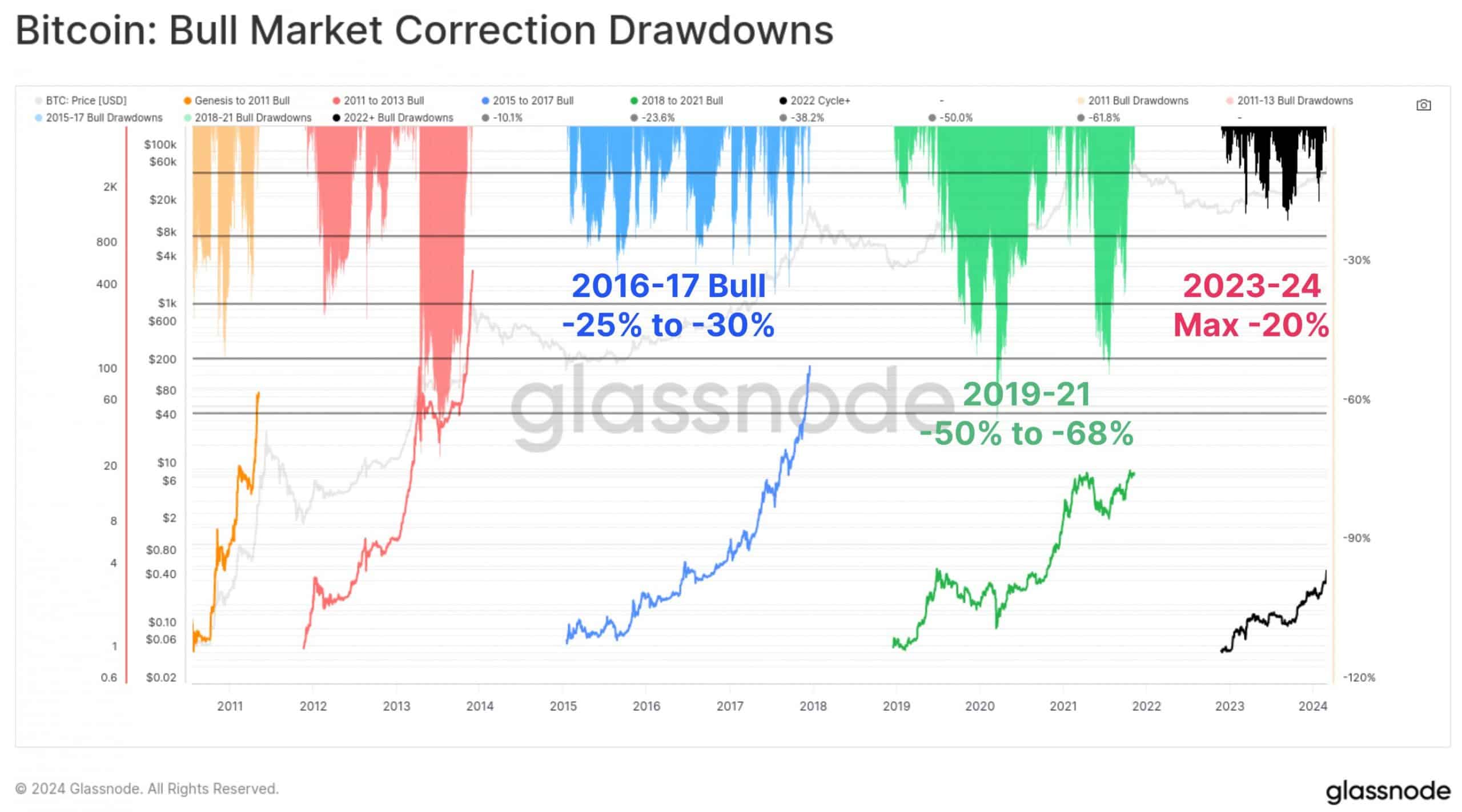

Renowned crypto analyst Tuur Demeester recently declared that $60K could be the low of the current correction and fits into Glassnode’s current bull pattern.

“Bitcoin: I think it’s likely that $60,000 will ultimately be the bottom of this correction. 20% drop from the peak.”

Source: X/Santiment

What next for the BTC price after the halving?

Another pseudonymous crypto analyst, McKenna, echoed Demeester’s correction bottom is at $60,000. According to McKenna, BTC’s halving sell-off could be over and an extended sideways move was likely.

“I think there is a good chance that the halving floor has been reached, but at the same time I think there is an equally good chance that we form a reaccumulation range. This means you can expect sideways price action for longer than expected.”

McKenna claimed that BTC’s possible sideways move could create stronger altcoins. But an AMBCrypto report recently discovered that the market was not yet ready for an altcoin season.

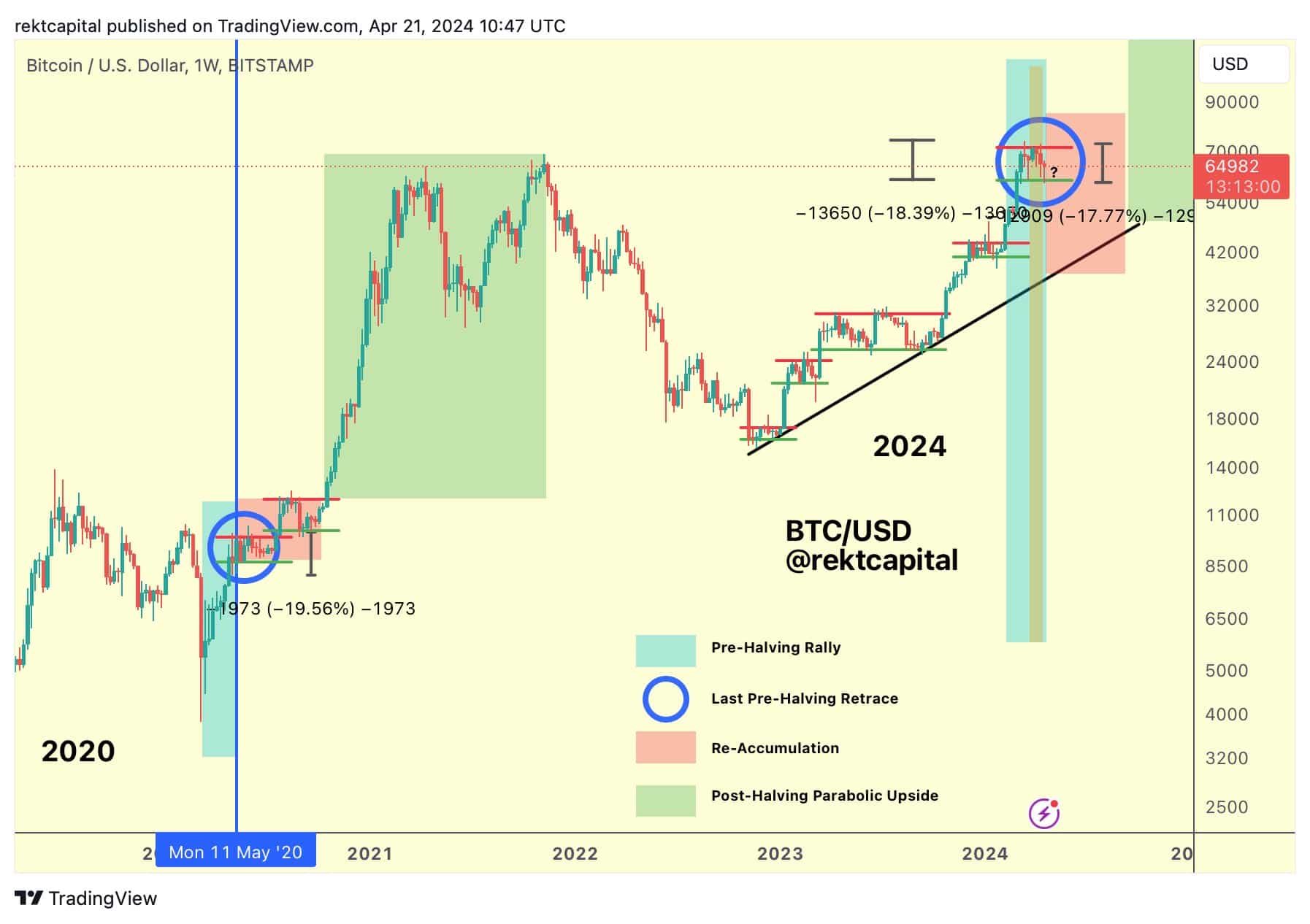

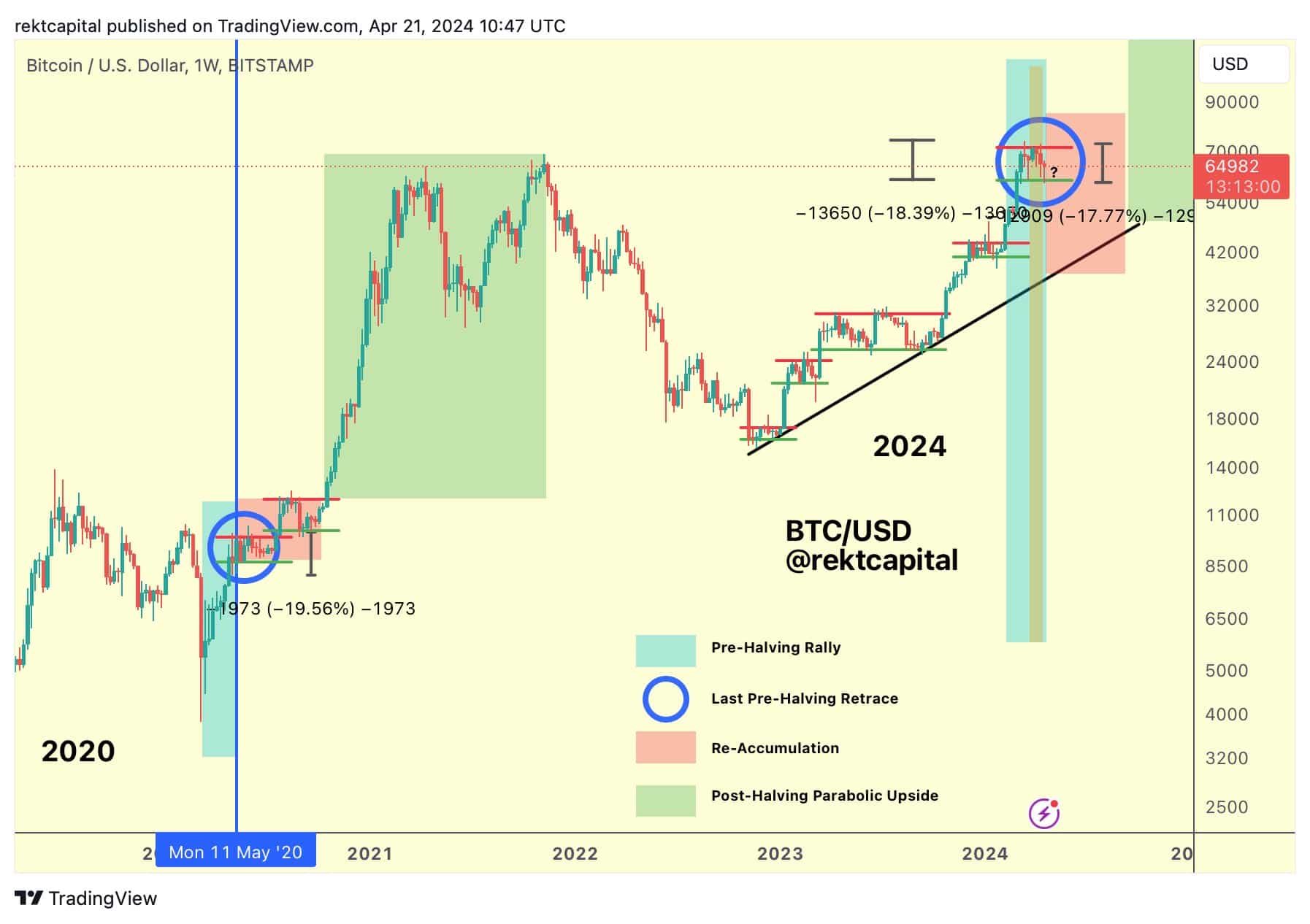

For his part, Rekt Capital, a renowned trader and market cycle analyst, opined that current prices could be the best bargain for BTC if we are in the reaccumulation phase.

“What if Bitcoin has already revealed the top and bottom of its post-halving reaccumulation range? Then prices within this range would be the best we can get before Bitcoin finally finishes post-halving parabolic upside.”

Source: X/Rekt Capital

Some market watchers expect better conditions from May.

In a statement in early April, BitMEX founder Arthur Hayes predicted that market conditions could improve in May following the US tax season and BTC halving. Part of his statement read,

“The timing of the halving adds even more weight to my decision not to trade until May.”

If the sideways move continues and market conditions improve in May, the current range of $60,000 and $71,000 could be crucial hold levels going forward.