- Buying sentiment remained dominant in the market.

- Market indicators pointed to a few more slow days.

The Bitcoin [BTC] The halving caused a bull rally for altcoins, but BTC itself didn’t show much volatility. However, if historical data is to be believed, things could turn bullish for BTC as well.

That’s why AMBCrypto analyzed the state of BTC to understand what we could expect from it after a few days of halving.

Bitcoin remains calm after the halving

Just a few days after the highly anticipated BTC halving, altcoins started bull rallies, allowing several cryptos to register double-digit growth. Meanwhile, BTC remained low as it failed to push its price up by a huge margin.

According to CoinMarketCapBTC has risen 2% in the past 24 hours. At the time of writing, it was trading at $64,992.95 with a market cap of over $1.28 trillion.

But there was more to it, as BTC has exhibited similar behavior in the past. Rekt Capital, a popular crypto analyst, posted one tweet about past incidents.

According to the tweet, BTC’s price has always consolidated during the halving months in 2020 and 2016. This indicated that investors might see less volatility in April.

But the trend could change in May and June, as BTC’s price has historically gained bullish momentum in the months following the halving. Therefore, the chances that BTC would end the second quarter on a good note seemed high.

What can we expect in the short term?

If history repeats itself, things could get volatile for BTC next month, but to see what investors can expect in the near term, AMBCrypto analyzed BTC’s metrics.

Our analysis of CryptoQuant’s facts revealed that BTC’s foreign exchange reserve was declining. This meant that buying sentiment was dominant.

Source: CryptoQuant

The King of Crypto’s Binary CDD indicated that long-term holders’ moves over the past seven days were lower than average, suggesting they have an incentive to hold on to their coins.

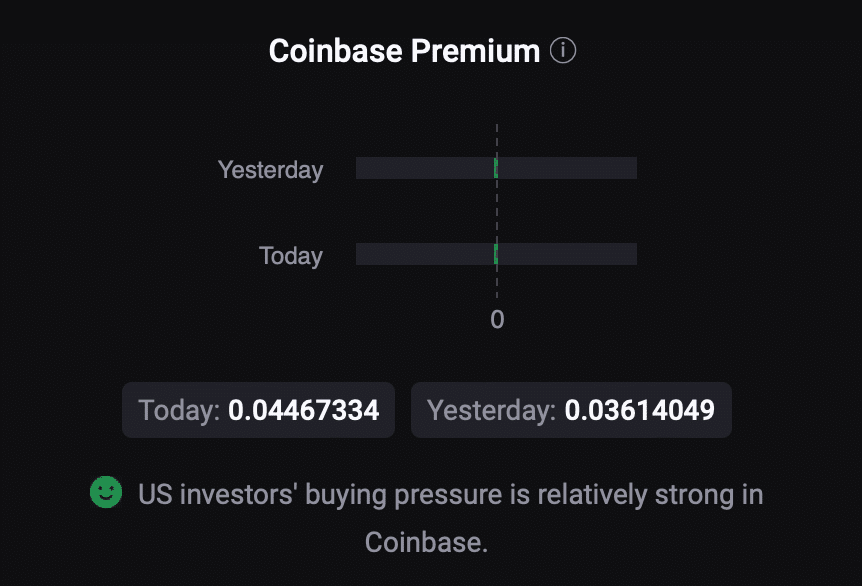

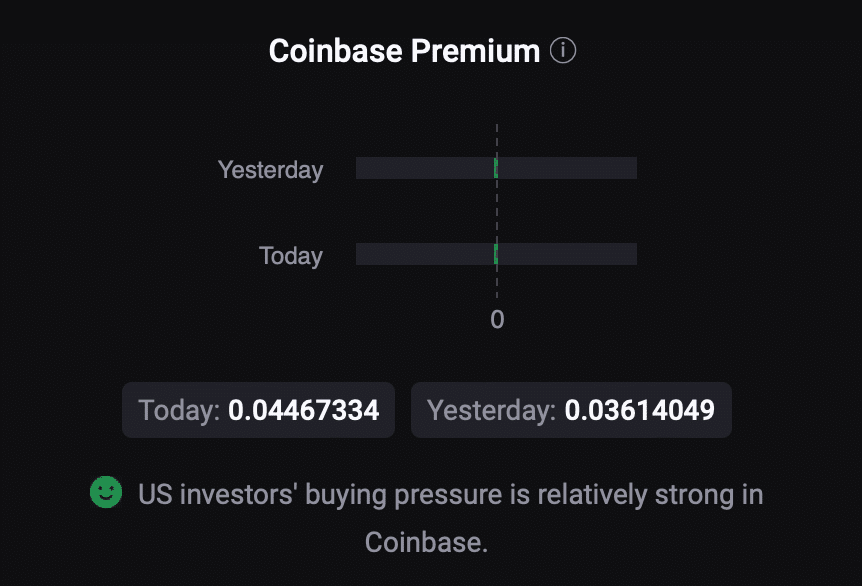

Buying sentiment among US investors was also dominant, as evidenced by the green Coinbase Premium. This meant that investors had confidence in BTC and expected its value to rise in the coming weeks.

Source: CryptoQuant

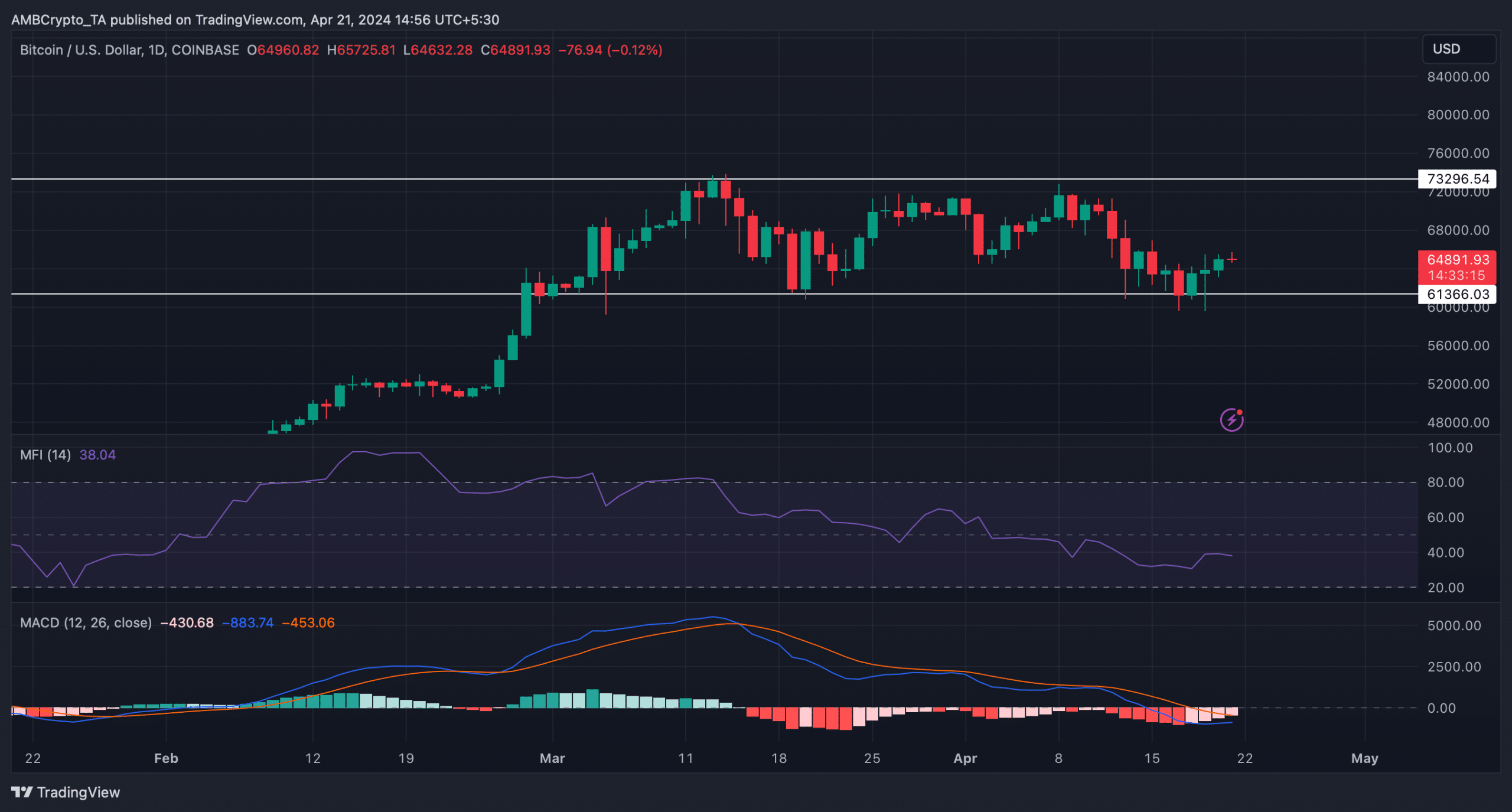

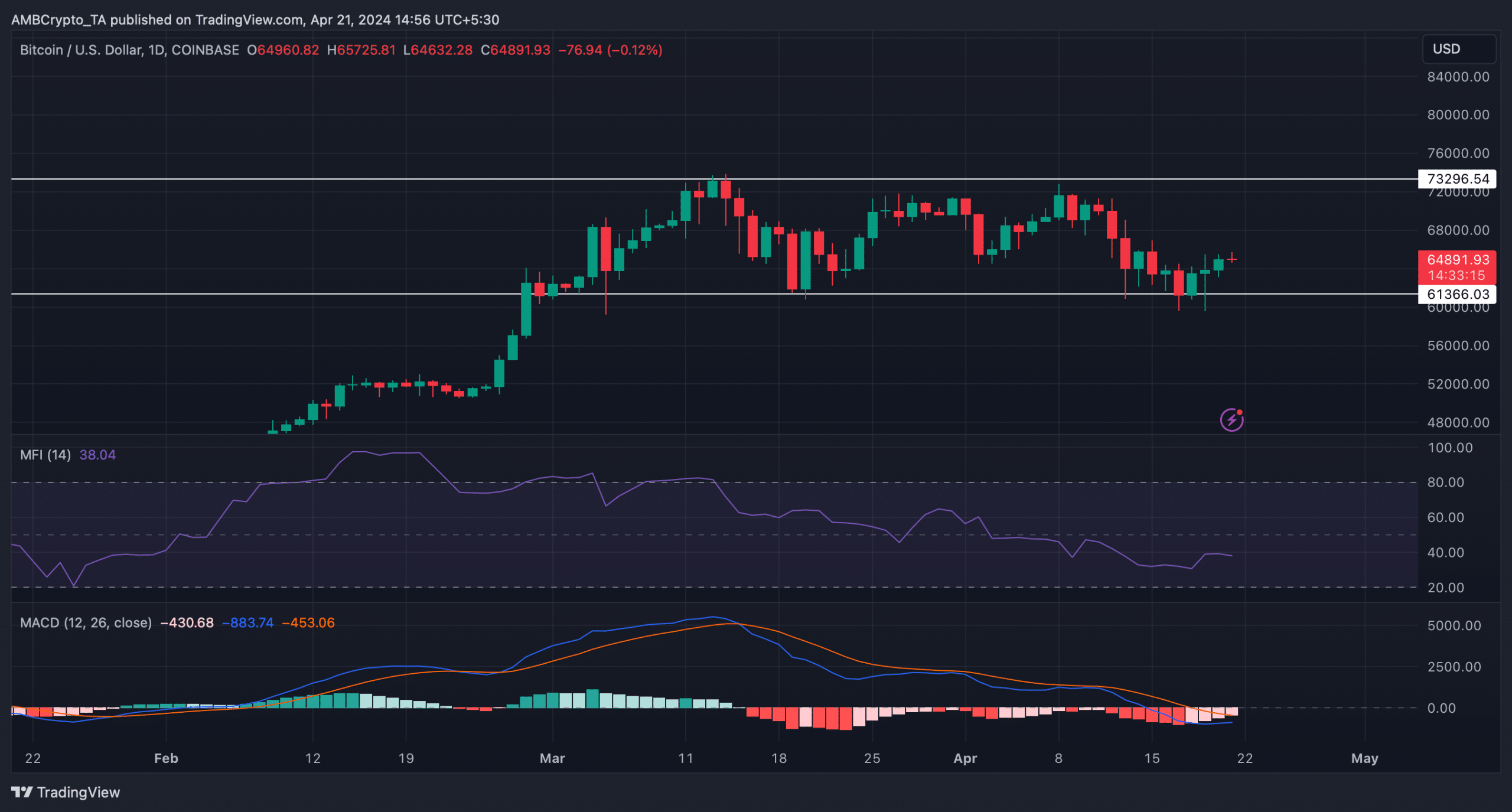

To see which direction BTC could go in the coming week, AMBCrypto looked at the daily chart. According to our analysis, the price of BTC could continue to move in a parallel channel between the ATH and $61,000.

Read Bitcoins [BTC] Price prediction 2024-25

The Money Flow Index (MFI) fell sideways below the neutral line, further indicating a few more sluggish days.

However, the MACD showed the possibility of a bullish crossover, which could make BTC volatile if this were to happen.

Source: TradingView