- MSTR extended its weekly losses to about 20%.

- Concerns about Bitcoin’s halving and overvaluation could provide more upside for sellers

Shares of MicroStrategy (MSTR) extended their weekly losses to more than 19% just hours earlier Bitcoins [BTC] fourth halving. After hitting an all-time high of $1,999.99 on March 27, the stock reversed some of its monthly gains. MSTR’s weekly losses marked a three-week long slump on the charts.

On a quarterly basis, the stock fell 30% in the second quarter. On the contrary, its Year-to-Date performance stood at +73.4% at the time of writing.

On April 17, MSTR closed at $1,188.05, a huge discount for anyone who hadn’t jumped into the stock before. Still, macro conditions and price charts showed that juicier discounts could still be attainable for anyone who chooses to dive in.

Will MSTR Extend Losses During Bitcoin Halving?

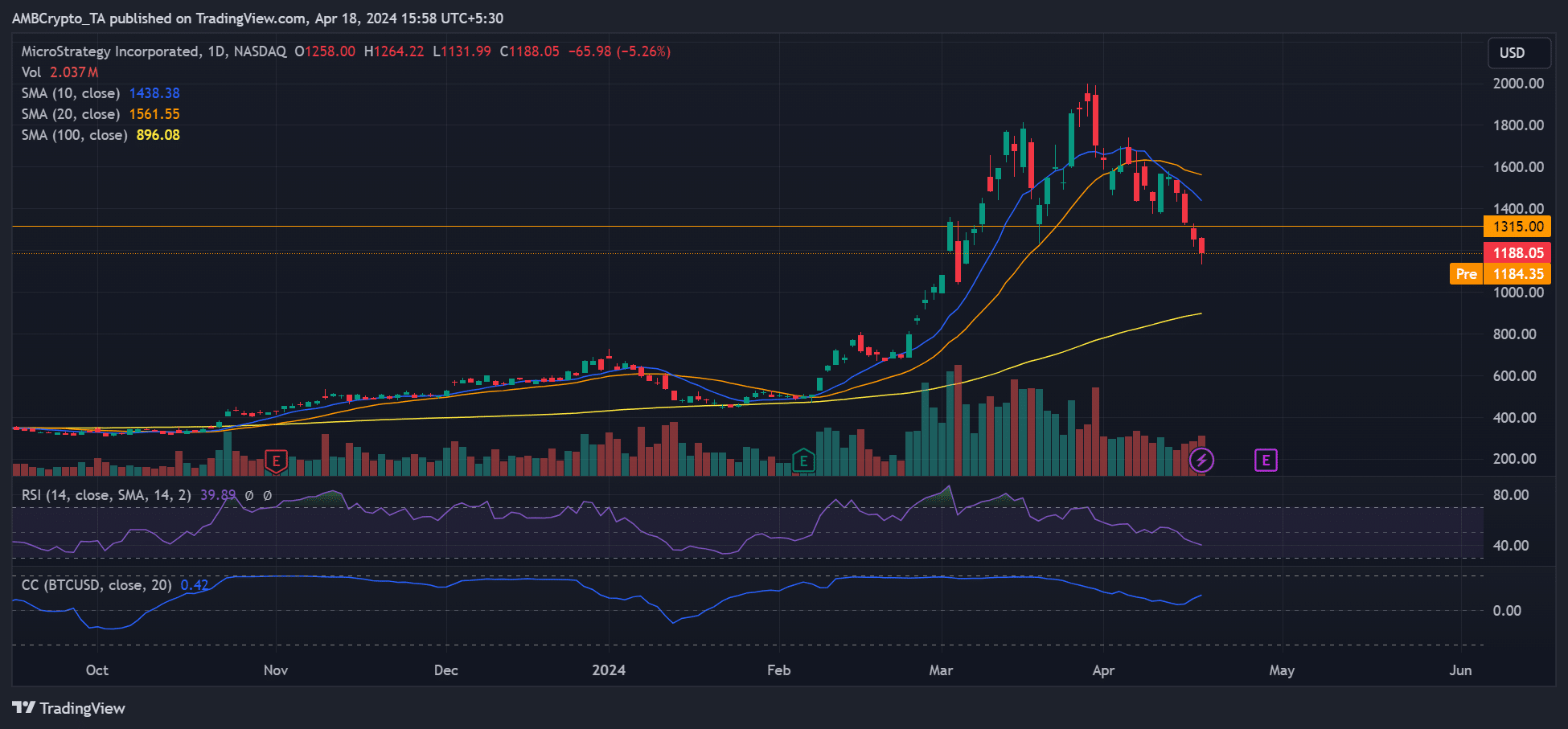

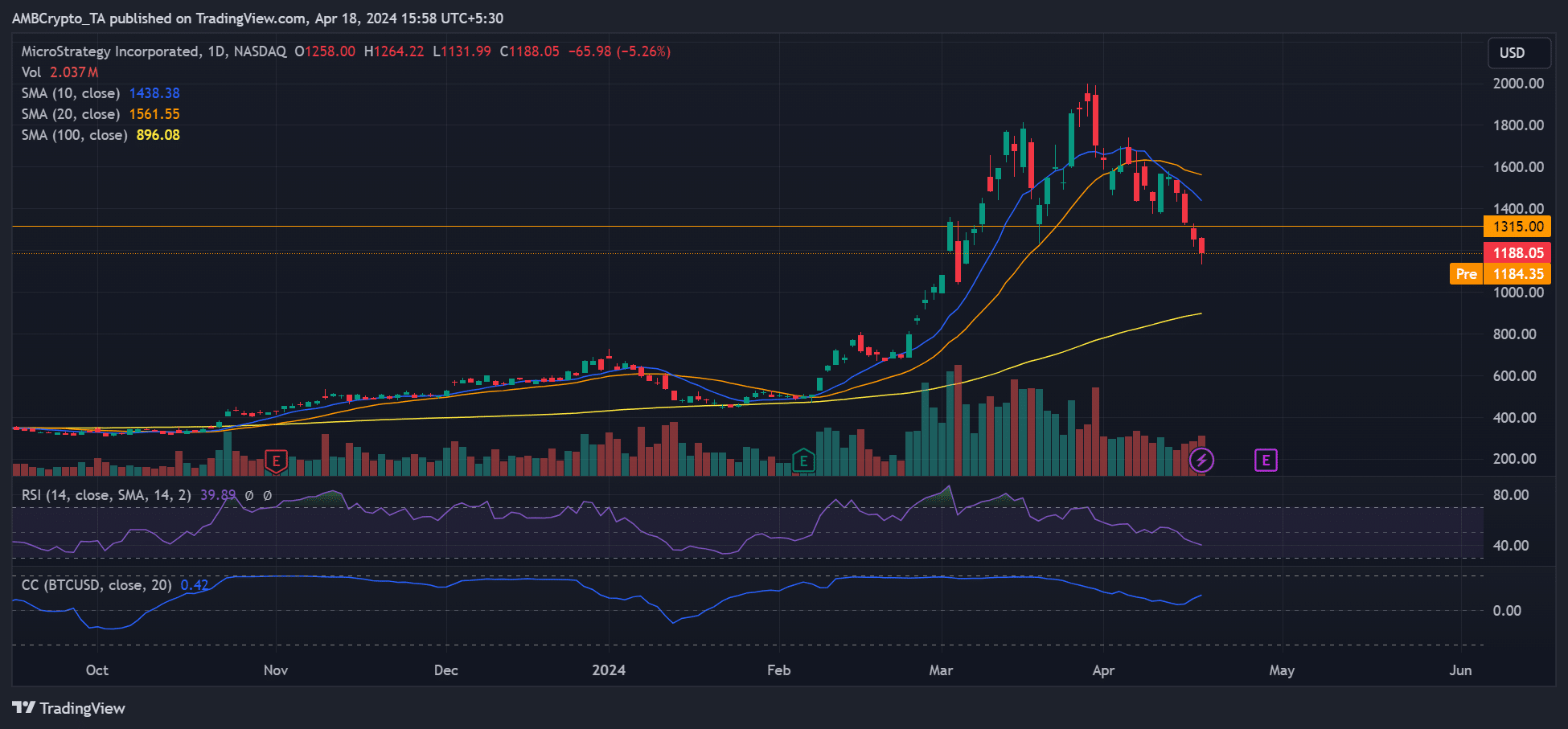

Source: MSTR Stock, Daily Chart

As one of the companies with a Bitcoin strategy, MSTR stock strongly correlates with BTC. This was evident from the positive correlation coefficient since mid-February.

What this means is that BTC’s extensive price dump has also dragged down MSTR stock.

Between March 27 and April 18, BTC fell 13%, from $71.7K to $62.4K on Bitstamp. During the same period, MSTR fell 40%: more than three times BTC’s decline.

Right now, bears have more leverage after dropping the MSTR below the 10- and 20-day SMA (Simple Moving Average), highlighted in blue and orange, respectively.

Should the bears move further, the next target is the 100-day SMA ($896), which will mark an attempt to push MSTR’s value below $1000. If this happens, it could be a better discount for bulls who missed the previous action.

The below-average value of the RSI (Relative Strength Index) is a sign of increased selling pressure and supports the longer decline projection.

Halving of Bitcoin and ‘overvaluation’ of MSTR

Additionally, Bitcoin’s halving could encourage MSTR prices if BTC selling pressure increases around the event.

MicroStrategy’s current BTC holdings amount to 214,246 coins, worth over $13 billion based on current market prices. Most of these were acquired through convertible bonds issued by the company.

However, the ongoing dump is also resonating with some market watchers who believe MSTR stock is overvalued. Last month, private investment manager Kerrisdale Capital said declared the same,

“We are long Bitcoin and short shares of MicroStrategy, a proxy for Bitcoin trading at 1.25 euros unjustified premium for the digital asset that determines its value.”

Kerrisdale Capital argued that new spot BTC ETFs offer alternatives to gain exposure to BTC, denying MicroStrategy any unique advantage for the premiums it charges.

For perspective, some investors had previously preferred to buy MSTR to gain indirect exposure to BTC.

Simply put, the private investment manager sees the fair value of MSTR at $700 – $800. The upper estimate is closer to the bearish target highlighted by the 100-day SMA (yellow).

However, the projection could be debunked, especially in the unlikely event of a massive Bitcoin rally around the halving.