- Bitcoin fund holdings surpassed the level of the 2021 bull market peak.

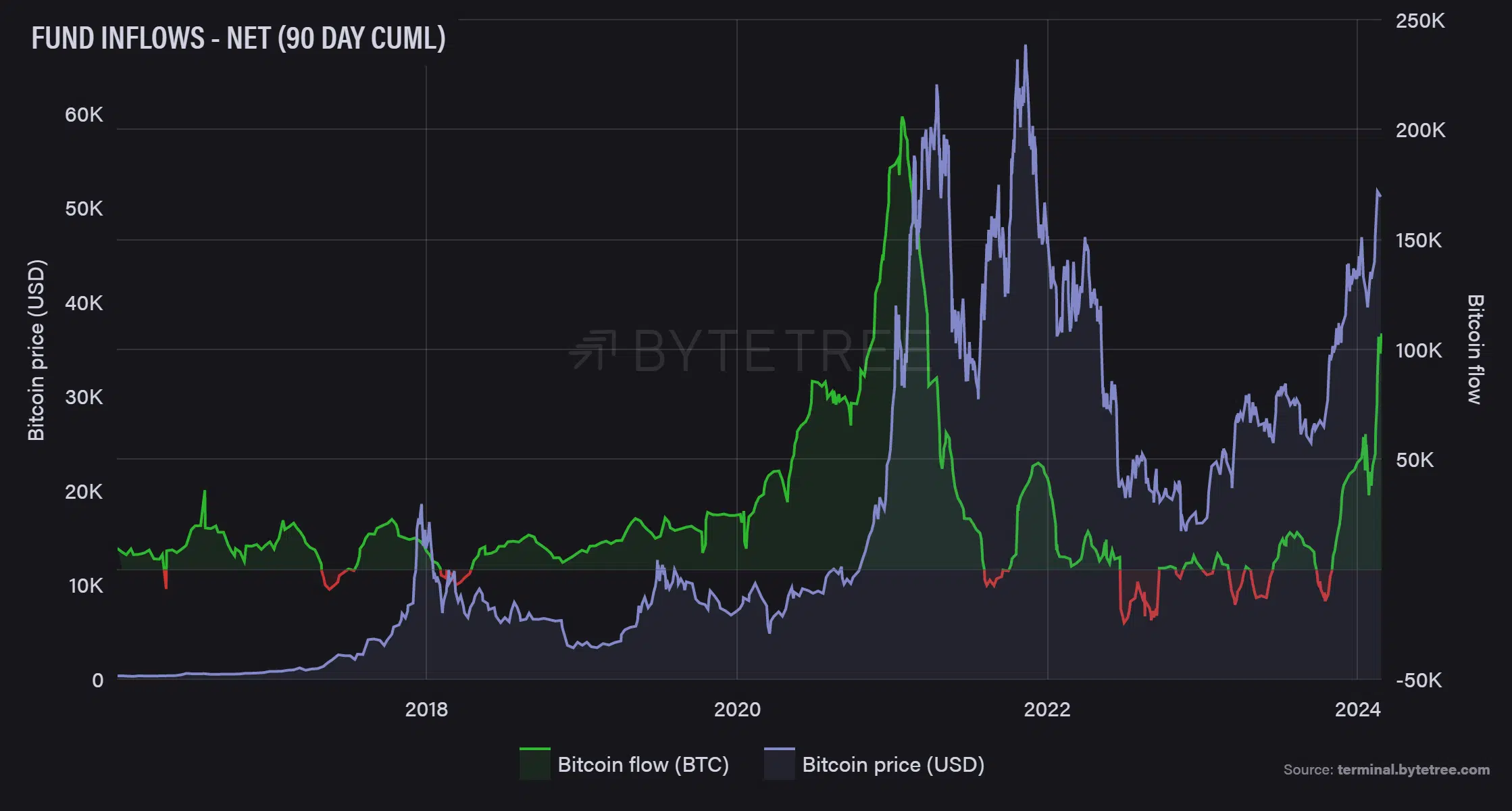

- Daily fund inflows increased significantly in February.

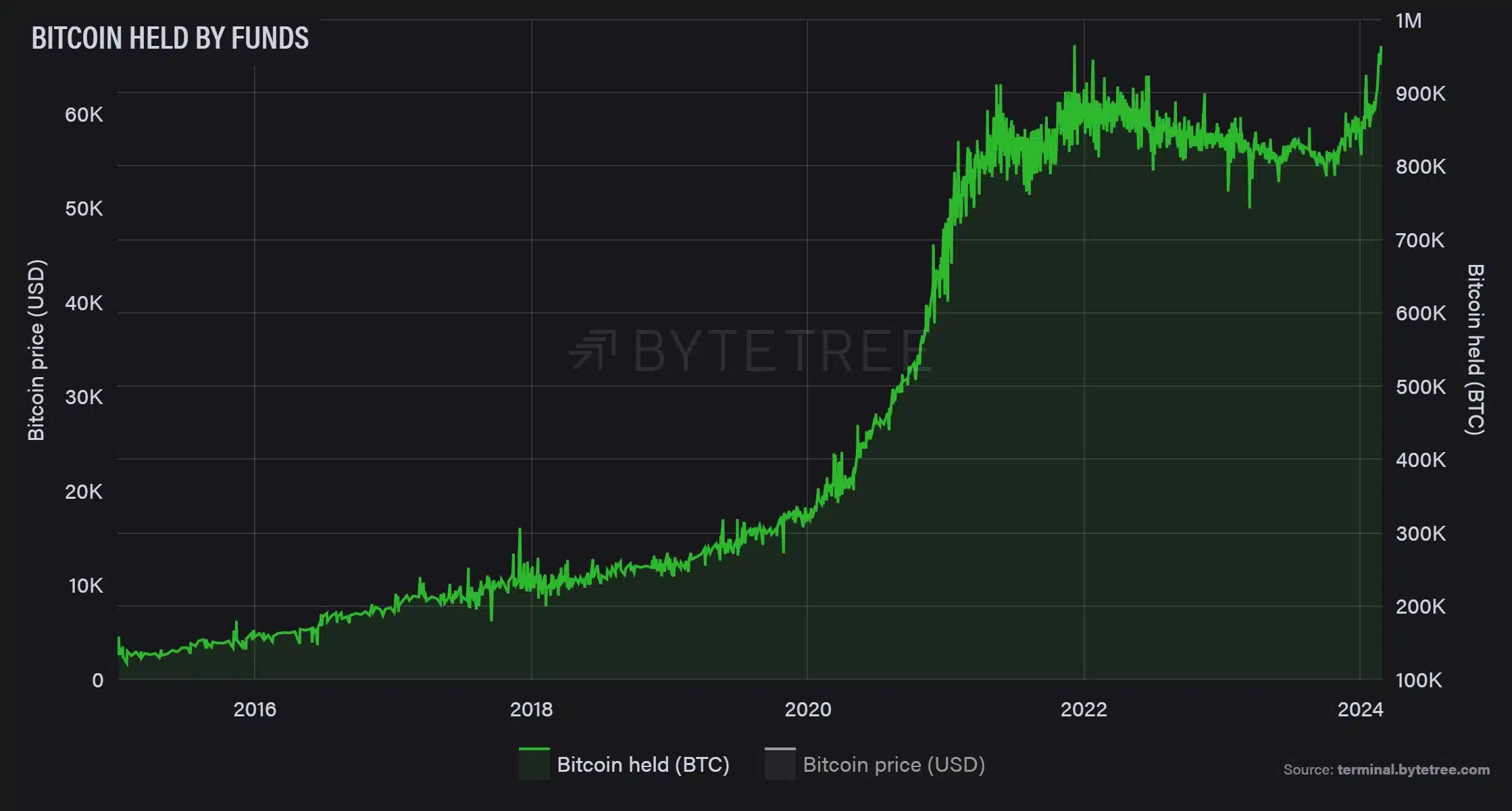

The total number of Bitcoins [BTC] held by digital assets such as trusts, ETFs and funds are reaching the highest levels in history, as institutional interest in the prized crypto asset continues to rise.

According to AMBCrypto’s examination of Bytetree’s data, nearly 950,000 BTCs were locked in these investment vehicles at the time of writing, exceeding the levels observed during the 2021 bull market peak.

US spot ETFs are driving the change

The inflows have accelerated in recent months, building on the frenzy surrounding spot Bitcoin ETFs in the US market.

As the chart below shows, daily capital injections started to rise sharply around November last year.

After spot ETFs were given the green light last month, a sharp decline was observed, which was further exacerbated by outflows from the Grayscale Bitcoin Trust. [GBTC].

However, outflows decreased significantly in February, leading to a steady increase in daily inflows. In fact, more than 107,000 Bitcoins flowed into the funds on February 25, the highest since March 2021.

Why does this matter?

As more and more Bitcoins find their way into these funds and become real estate, this already scarce asset would become even scarcer.

If demand remains high, this supply/demand dynamic would eventually force a price increase, making Bitcoin a valuable store of value.

This sentiment was echoed by the popular on-chain analyst ted. He claimed,

“Demand for Bitcoin currently exceeds new supply by more than three times… If this continues, there is only one way to determine the price, and that is UP!”

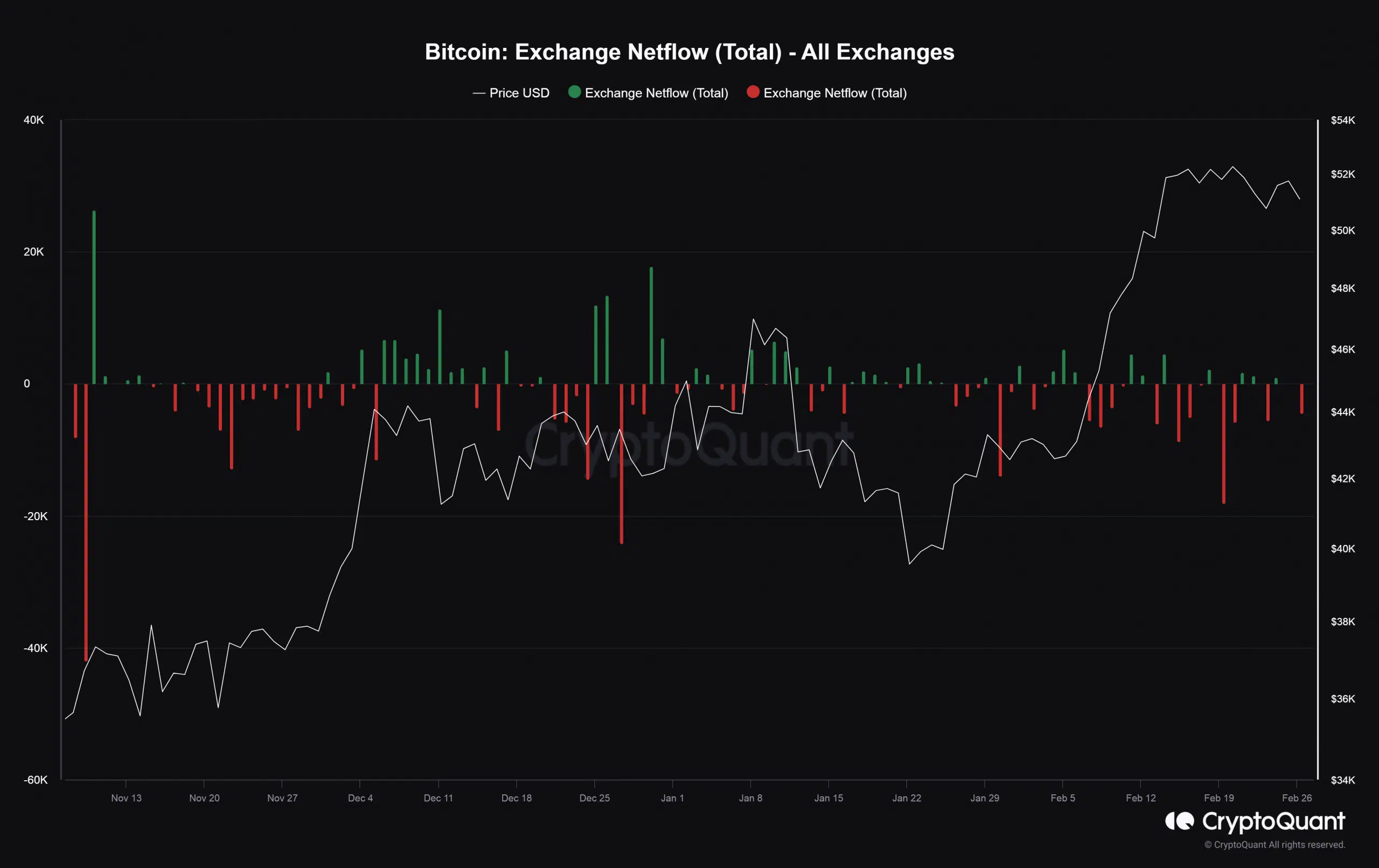

There has been a wave of Bitcoin withdrawing from centralized exchanges in recent weeks.

CryptoQuant data accessed by AMBCrypto showed a higher number of net outflow days than net inflow days in February.

Read Bitcoin’s [BTC] Price forecast 2024-25

The trend was observed alongside the rally that took Bitcoin above $50,000, indicating that users were accumulating and waiting for prices to rise further.

The dominant market sentiment has been one of greed, according to the latest reading of the Bitcoin fear and greed index. This meant a continuation of the accumulation wave and the possibility of a breakout above $52,000.