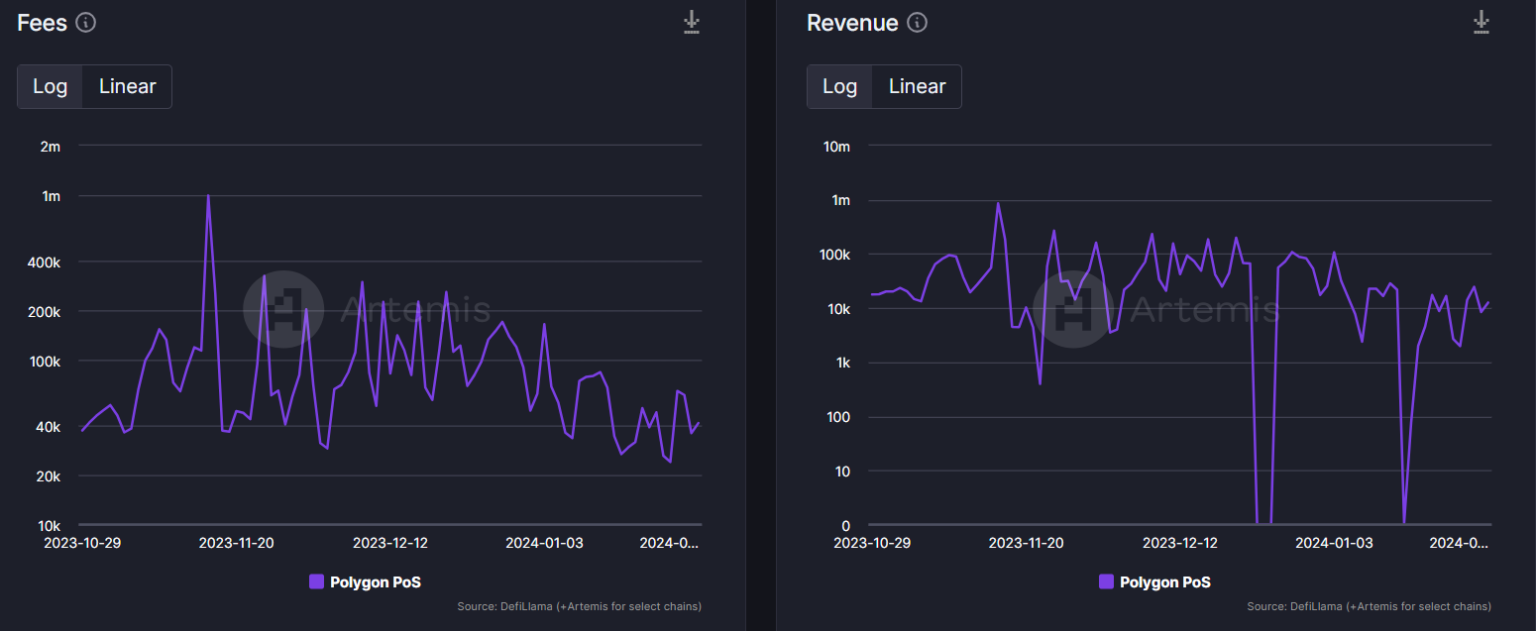

- Both MATIC’s fees and revenues fell last month.

- MATIC is up over 3% in the last 24 hours and the metrics looked bullish.

After days of sideways price movements, Polygon [MATIC] finally managed to turn the graph green with gains. Meanwhile, one of the blockchain’s most important metrics has increased, placing it second only to the king of alt coins, Ethereum. [ETH].

Is Polygon’s turnover increasing?

Today In Polygon recently posted a tweet highlighting one of Polygon’s latest achievements. According to the tweet, Polygon had the second-highest number of “superuser DEX swappers” in 2023, behind only Ethereum.

To start with, super users are users who have completed more than 100 on-chain transactions.

NEW: Polygon had the second highest number of “superuser DEX swappers” in 2023, behind only Ethereum.@flipsidecrypto defines super users as users who have performed more than 100 onchain transactions. pic.twitter.com/HrsdNZHurn

— Today in Polygon (@TodayInPolygon) January 26, 2024

To understand if the blockchain DeFi sector was growing, AMBCrypto checked the facts. We found that after a significant spike, the blockchain’s TVL has trended downward in the recent past.

A similar trend was noted in terms of Polygon’s captured value. This was evident from the fact that MATIC’s rates and revenues have fallen slightly in recent weeks.

Source: Artemis

While that was happening, blockchain network activity did increase. According to the latest data, MATIC’s daily active addresses gained an upward trend, but the number of daily transactions remained low, which was surprising to see.

MATIC’s reaction is bullish

Although the blockchain’s network activity looked risky, MATIC’s price action gained bullish momentum. According to CoinMarketCapMATIC is up more than 3% in the past 24 hours.

At the time of writing, MATIC was trading at $0.7607 with a market cap of over $7.3 billion.

As the price of the token rose, buying pressure increased MATIC also increased.

AMBCrypto’s analysis of Santiment’s data revealed that Polygon’s supply on exchanges fell last week. At the same time, supply outside the stock exchanges peaked, which meant that buying pressure was high.

This can be interpreted as a bullish signal, indicating a possible continued price move northward in the coming days.

Source: Santiment

To better understand whether the uptrend would continue, AMBCrypto looked at MATIC’s daily chart.

Our analysis showed that Polygon’s MACD showed the possibility of a bullish crossover. Moreover, MATIC’s Relative Strength Index (RSI) recovered from the oversold zone, indicating further price appreciation.

Read Polygon [MATIC] Price prediction 2024-25

A similar increase was also noticed on the blockchain’s Money Flow Index (MFI) chart.

Considering the above statistics, despite the decline in captured value, the likelihood of this happening is high MATIC Sustaining the price increase seemed quite high.

Source: TradingView