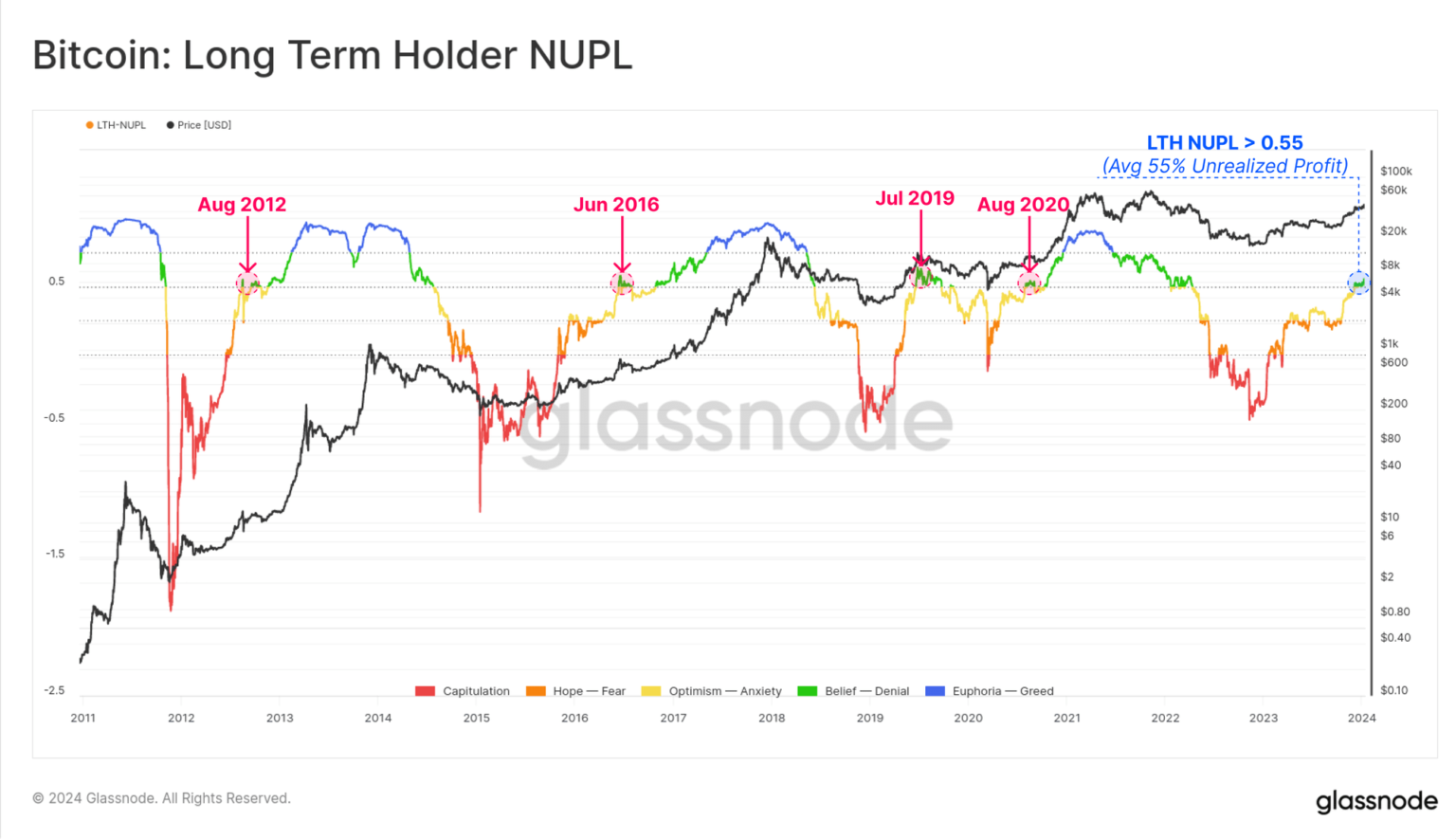

Data from the chain shows that long-term holders of Bitcoin (so-called HODLers) now have an average unrealized gain of 55%.

Bitcoin long-term holder NUPL has reached a value of 0.55

This is evident from the latest weekly report Glass junctionthe profits held by long-term holders of BTC have been increasing lately. The indicator of interest here is the ‘Net Unrealized Profit/Loss’ (NUPL), which tracks the difference between the unrealized profit and the unrealized loss that Bitcoin investors are currently bearing.

What is meant here by “unrealized” is that the profit or loss has yet to be harvested because the investor carrying the Bitcoin has not yet transferred their BTC to the blockchain. Once the holder would eventually move the coins, the gain/loss he was holding would be ‘realized’.

In the context of the current discussion, the NUPL of only a specific segment of the market is relevant: the long-term holders (LTHs). The LTHs are the Bitcoin holders who have been letting their coins sleep on the network since at least 155 days ago.

These are the diamond hands of the market that are known to hold in both periods of up and down trends and only sell when major market events occur.

“This includes periods when the market is establishing new ATHs, around cycle tops and bottoms, and during major shifts in market structure (e.g. Mt Gox, Halvings and now the launch of spot ETFs),” the analytics firm explains.

Here is a chart showing the trend in the Bitcoin LTH NUPL over the asset’s history:

The value of the metric seems to have been going up in recent weeks | Source: Glassnode's The Week Onchain - Week 3, 2024

As shown in the chart above, the Bitcoin LTH NUPL has registered an increase in recent months as the spot price of the cryptocurrency has experienced a notable increase.

“This measure reached 0.55 this week, which is meaningfully positive, and puts the average long-term investor at an unrealized gain of 55%,” the report said. Interestingly, BTC has registered some resistance around this level in the past.

As Glassnode has highlighted in the chart, the bulls here ran into trouble in August 2012, June 2016, July 2019 and August 2020. In all these cases, the resulting top was only local, except in July 2019, where the recovery The rally of the cycle reached a top that BTC would not surpass for a significant period of time.

In general, investors who make a profit are more likely to sell their coins. The higher the profits they control, the stronger the appeal of taking profits can be. So it is not surprising to see that LTHs with significant gains during previous cycles have led to selling pressure in the market.

Indeed, LTHs have also participated in a number of sales recently, as evidenced by their supply data.

Looks like the value of the metric has seen some decline recently | Source: Glassnode's The Week Onchain - Week 3, 2024

Bitcoin LTH supply is now down 75,000 BTC from its all-time high in November, while the opposite cohort, short-term holders (STHs), have obviously gained some market share.

“While 75,000 BTC is a meaningful amount, it should also be seen in the context of the total LTH supply, which represents a whopping 76.3% of the circulating coin supply,” the report says.

BTC price

Bitcoin has continued its recent sideways trend over the past day as the price is currently hovering around the $42,600 level.

The price of the coin hasn't shown much volatility recently | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.