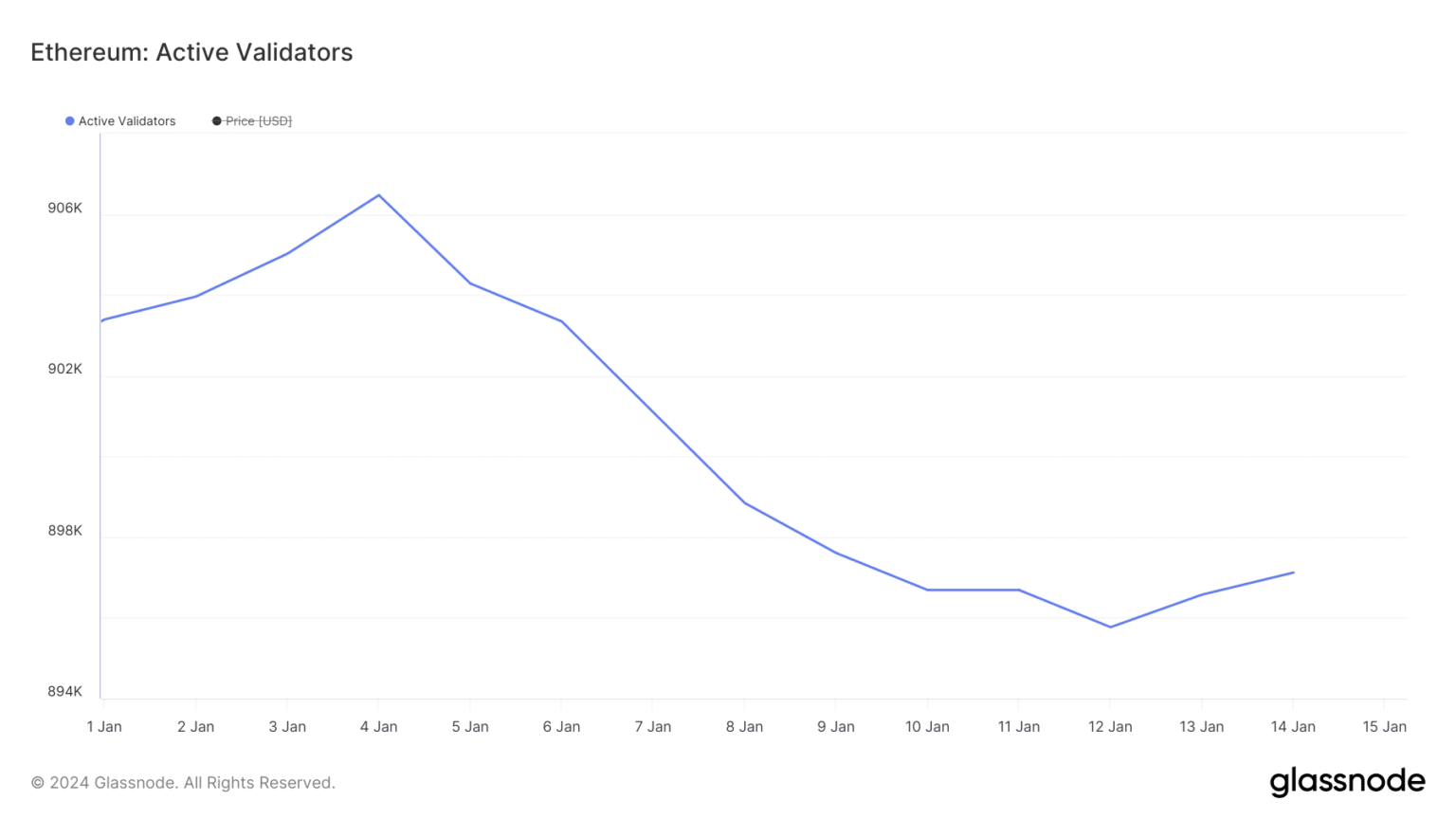

- Since January 4, there has been a steady decline in the number of active validators on Ethereum.

- ETH accumulation continues among coin traders.

The Ethereum [ETH] The Proof-of-Stake (PoS) network has witnessed a sharp decline in the number of active validators, hitting a year-to-date low on January 12, according to data from Glass junction.

Source: Glassnode

AMBCrypto found that the decline began on January 4, the same day the total number of validators voluntarily leaving the network’s validator pool rose to an all-time high of 17,821.

Source: Glassnode

This trend emerged just a day after Matrixport, a leading provider of crypto investment services, predicted a possible rejection of all Bitcoin ETF applications by the US Securities and Exchange Commission (SEC).

Following the report’s publication, prices of leading assets plummeted. cause more than $500 million in liquidations.

Many feared that Matrixport’s predictions could be accurate and result in a severe market decline, hence the sharp increase in the daily number of validators leaving the Ethereum network on January 4.

Although the number of daily active validators on the PoS chain has started to increase, it is still at the low levels recorded in December.

As of January 14, the number of active validators on Ethereum stood at 897,121. Likewise, with the increase in the price of ETH following the adoption of the ETF, voluntary departures from the chain have decreased.

On January 14, only 124 validators left the network, Glassnode data showed.

The bullish momentum is intensifying

At the time of writing, ETH was exchanging hands at $2,517, according to data from CoinMarketCap. The price of the coin has risen by 15% in the past week.

The price movements, assessed on a weekly chart, showed that bullish pressure continued. This was inferred from ETH’s momentum indicators, which show that traders have continued to accumulate the altcoin.

For example, the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) indicators were spotted at 70.37 and 87.02 respectively. These levels suggested that despite the recent rebound, buying pressure outweighed the coin sell-off.

Source: TradingView

Is your portfolio green? Check out the ETH profit calculator

However, it is important to note that these RSI and MFI readings generally indicate an overheated market. So a small downside in the value of ETH must be taken into account.

ETH’s Chaikin Money Flow (CMF) remained in an uptrend and was above the zero line at the time of writing. At 0.16, ETH’s CMF showed a steady supply of liquidity needed to sustain a price rally.