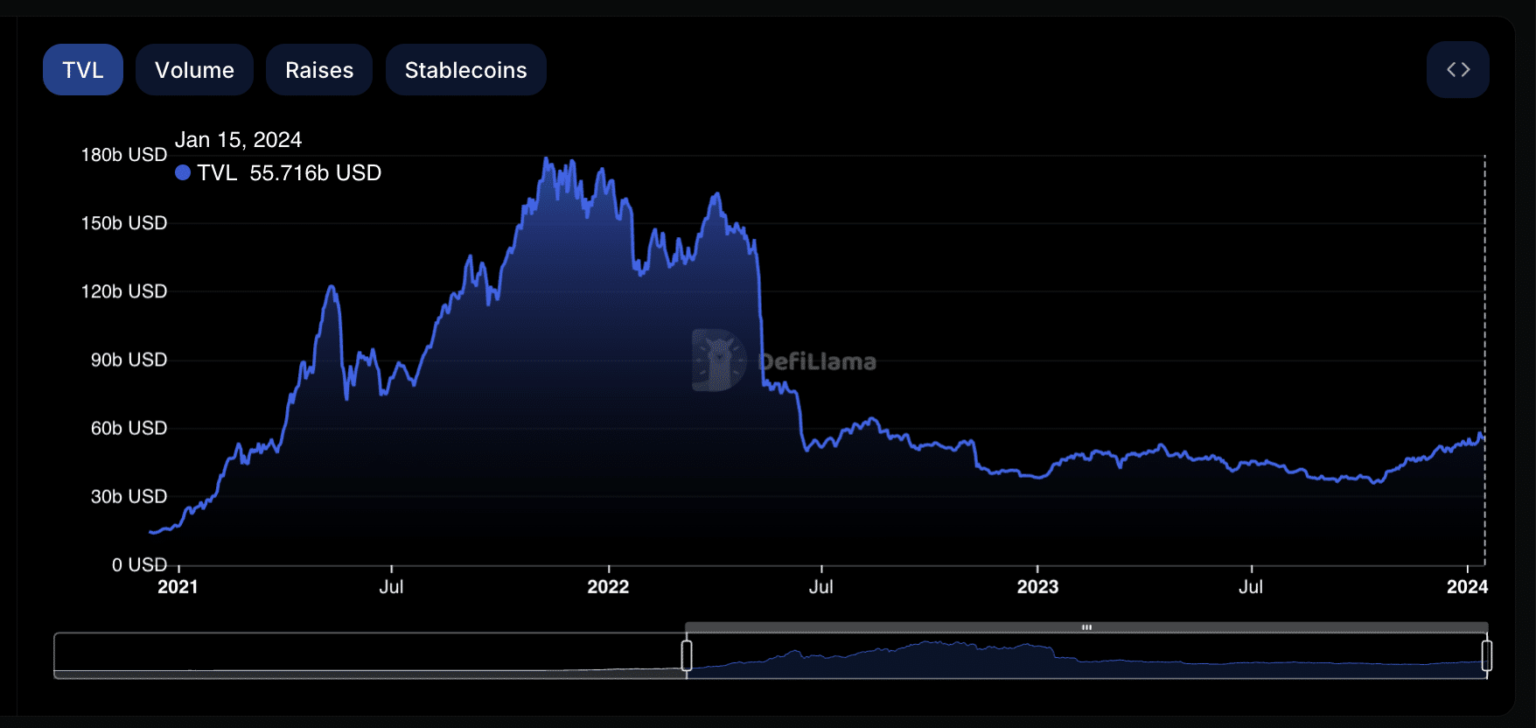

- DeFi TVL has increased significantly since October.

- While Lido recorded an increase in user activity over the past month, MakerDAO remained stagnant.

The decentralized finance (DeFi) industry is experiencing a resurgence, with Total Value Locked (TVL) hitting a multi-month high, according to data from DefiLlama.

According to the DeFi data aggregator, the sector’s TVL has increased significantly in recent months, with most of the growth coming after the general market rally in October.

Since October 11, DeFi TVL has increased by 51%, from $37 billion to $56 billion within three months. So far this year, growth is up 3%.

At the time of publication, DeFi TVL was at the highest levels last seen in August 2022, DefiLlama data showed.

Source: DefiLlama

Lido in the past month

The leading DeFi protocol from TVL, Lido Finance [LDO], has registered a 17% increase in TVL over the past 30 days. This comes amid a rally in user activity on Ethereum [ETH] liquid strike platform.

AMBCrypto found that over the past 30 days, the average number of addresses depositing or withdrawing ETH from Lido each day totaled 562. This represented a 41% growth in the number of active daily users of the protocol.

According to Lido data, Lido has registered a user count of 14,010 so far this year Token terminalmarking a 27% rally from the 11,000 recorded in December.

Following Lido’s surge in activity over the past month, monthly net deposits into the liquid staking platform have risen to a new high.

Data from Token Terminal shows that net deposits on Lido over the past 14 days have reached $22.1 billion, marking a 6% growth from the $20.9 billion recorded over the 31 days in December.

Source: DefiLlama

Over the last 30 days, network costs totaled $71 million, reflecting 5% growth. Revenues from these fees amounted to $7.13 million in the same period, representing a corresponding growth of 5%.

Maker is all red

The second leading DeFi protocol from TVL MakerDao [MKR] has registered just a 1% increase in assets locked over the past month, according to data from DefiLlama. This decline is due to a decrease in user activity on the protocol.

Realistic or not, here is the market cap of LDO in terms of BTC

As before reportedthe low user activity on Maker could be due to the decline seen in DAI’s offerings in December.

According to data from Token Terminal, user activity on Maker has dropped 27% in the last 30 days. As a result, fees and revenue from transactions completed through the protocol fell by 34% over the same period.

Source: DefiLlama