In the dynamic landscape of cryptocurrency, the completion of Ethereum’s transition to Ethereum 2.0, known as “The Merge,” on September 15, 2022, stands as a pivotal moment in blockchain history. This update represents more than a technological advancement — it is the dawn of a new era for Ethereum.

Hi, I’m Zifa. In this article, I’ll guide you through The Merge, exploring its impact on Ethereum and its meaning for our crypto community.

What Is Ethereum Merge?

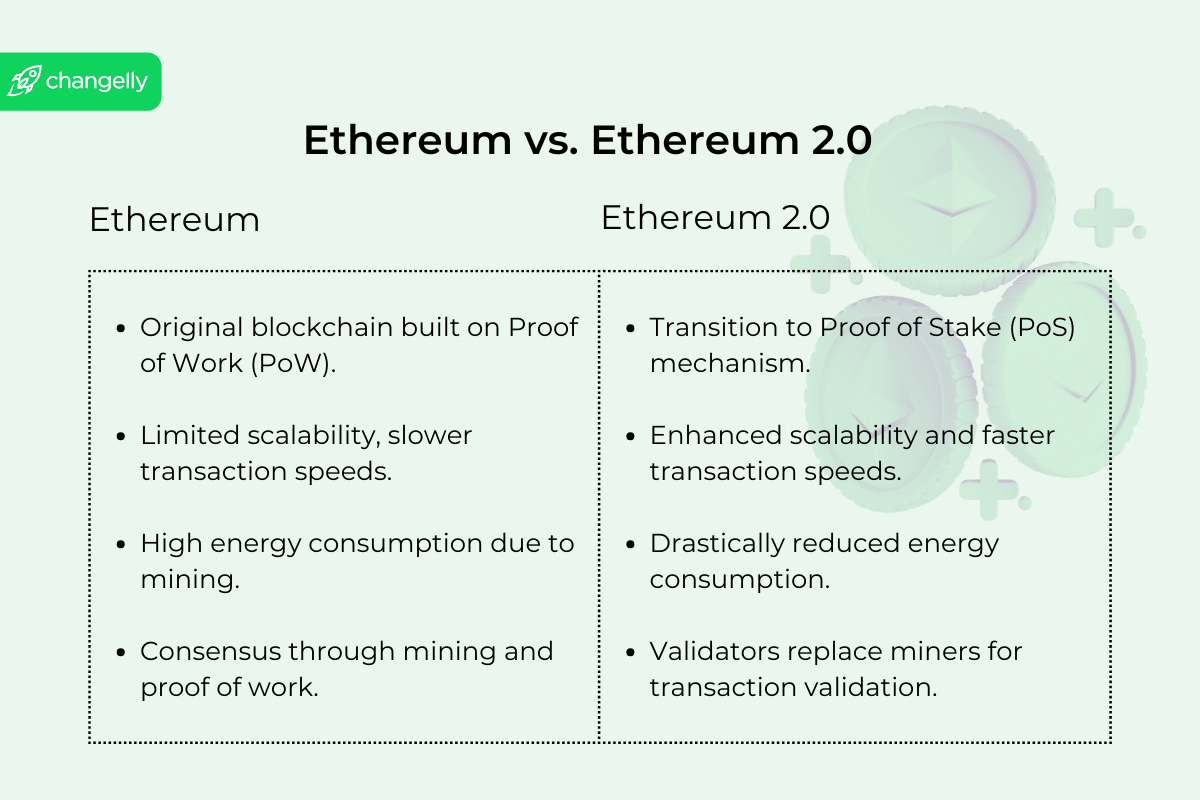

The Ethereum Merge, a landmark event in the blockchain realm, marked the transition from Ethereum’s original proof-of-work (PoW) consensus mechanism to the much-anticipated proof-of-stake (PoS) system in Ethereum 2.0. This transition was not merely a shift in how Ethereum operates; it signified a transformative approach to blockchain technology with far-reaching implications for security, transaction speed, and network efficiency.

Ethereum’s Original PoW Mechanism

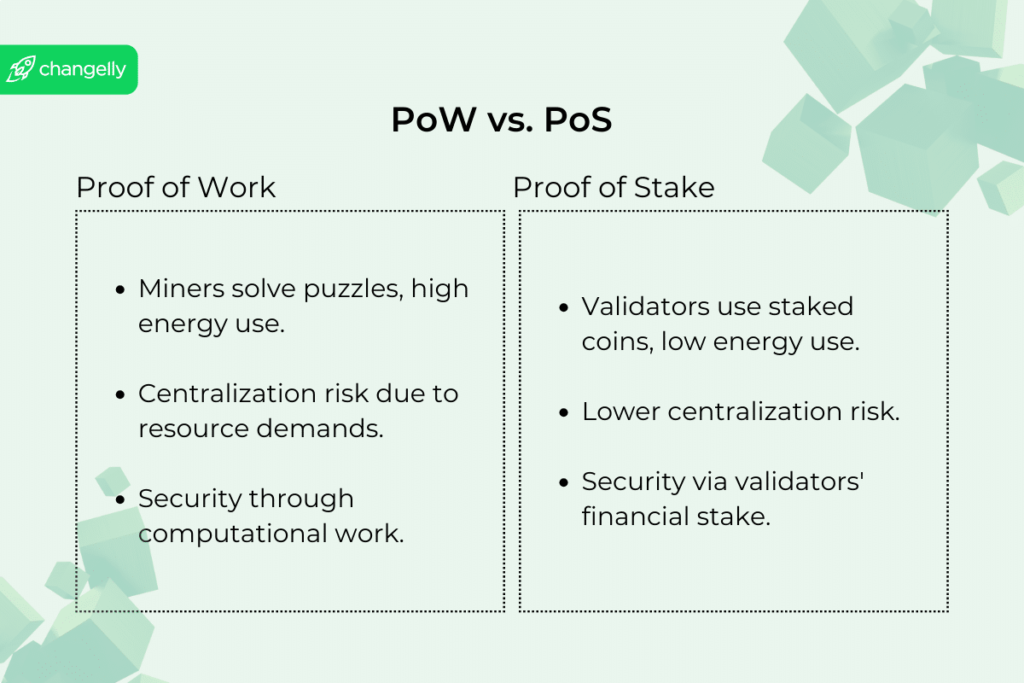

Ethereum, like many other cryptocurrencies, initially operated on a PoW mechanism. Under PoW, miners used powerful computers to solve complex mathematical puzzles. The process of successfully solving these puzzles, known as ‘mining,’ validated transactions and added new blocks to the blockchain. While secure, it was energy-intensive. The competitive nature of mining led to an arms race in computational power, resulting in significant electricity consumption and environmental concerns. PoW provided robust security due to the computational work required, making fraudulent activities like double-spending practically infeasible. However, this security came at the cost of scalability and speed, with the network often facing congestion and high transaction fees during peak usage.

Overview of the PoS Mechanism in Ethereum 2.0

The Merge introduced the PoS mechanism to Ethereum, revolutionizing the way transactions are validated and blocks are created. In PoS, network validators replace miners. Instead of solving puzzles, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to ‘stake’ as collateral. This shift significantly reduces the energy requirement, as it eliminates the need for energy-intensive mining operations.

PoS offers several other benefits over the traditional proof-of-work (PoW) model: it eliminates the need for expensive hardware, opens the door to greater scalability potential, and reduces the risk of network centralization. Ethereum co-founder Vitalik Buterin has long supported PoS, advocating its efficiency and security improvements in line with Ethereum’s vision for a sustainable and scalable blockchain network.

Read also: PoW vs. PoS.

The Merge: Understanding Key Concepts

The Beacon Chain: The Backbone of the PoS System

The Beacon Chain, introduced in December 2020, is the cornerstone of Ethereum’s transition to a proof-of-stake (PoS) system. As the backbone of Ethereum 2.0, it fundamentally redefines the way the network operates. In contrast to the original Ethereum blockchain (Eth1), which relied on the energy-intensive proof-of-work (PoW) mechanism, the Beacon Chain utilizes PoS to achieve consensus. This involves validators instead of miners. Validators are chosen to confirm blocks and validate transactions based on their stake in the network, which is a certain amount of Ether locked in the system. The Beacon Chain is crucial for coordinating these validators, managing stakes, and overseeing consensus rules. This shift not only drastically reduces the energy consumption of the Ethereum network but also paves the way for a more secure and scalable blockchain. The Beacon Chain operates in parallel with the existing Ethereum chain, ensuring a smooth transition and continued operation during the upgrade process.

Sharding: Enhancing Scalability and Efficiency

Sharding is a key feature in Ethereum 2.0 that promises to enhance the network’s scalability and efficiency. Essentially, sharding involves dividing the Ethereum network into multiple portions, known as ‘shards.’ Each shard contains its own independent state, meaning a unique set of account balances and smart contracts. The idea is to spread the network’s load across these shards. This division allows for transactions and smart contracts to be processed in parallel, rather than consecutively as in the original Ethereum blockchain. As a result, the network can handle more transactions at a time, reducing congestion and improving transaction speeds. Sharding is particularly crucial as Ethereum continues to grow in popularity, with an increasing number of decentralized applications (dApps) and users demanding more from the network. By implementing sharding, Ethereum 2.0 aims to significantly increase the network’s capacity, making it more efficient and scalable for a global user base.

Slashing: Maintaining Network Integrity

Slashing is a critical security mechanism within the PoS system of Ethereum 2.0. It acts as a deterrent against dishonest or malicious behavior by validators. In the PoS context, validators are responsible for validating transactions and creating new blocks. They must stake a certain amount of Ether as collateral. If a validator acts maliciously — for instance, by attempting to manipulate the network or validating fraudulent transactions — a portion of their staked Ether is ‘slashed,’ or removed, as a penalty. This mechanism ensures that validators have ‘skin in the game,’ making it economically disadvantageous for them to act against the network’s best interests. Slashing is designed to protect the integrity and security of the Ethereum network, ensuring that validators are incentivized to maintain honest and reliable operations. Through slashing, Ethereum 2.0 strengthens its security framework, fostering a more trustworthy and stable blockchain ecosystem.

If you’re looking to seamlessly exchange Ethereum and other cryptocurrencies, Changelly is a great platform to consider, as it offers swift transactions and a wide range of altcoin options.

Impacts of the Ethereum Merge

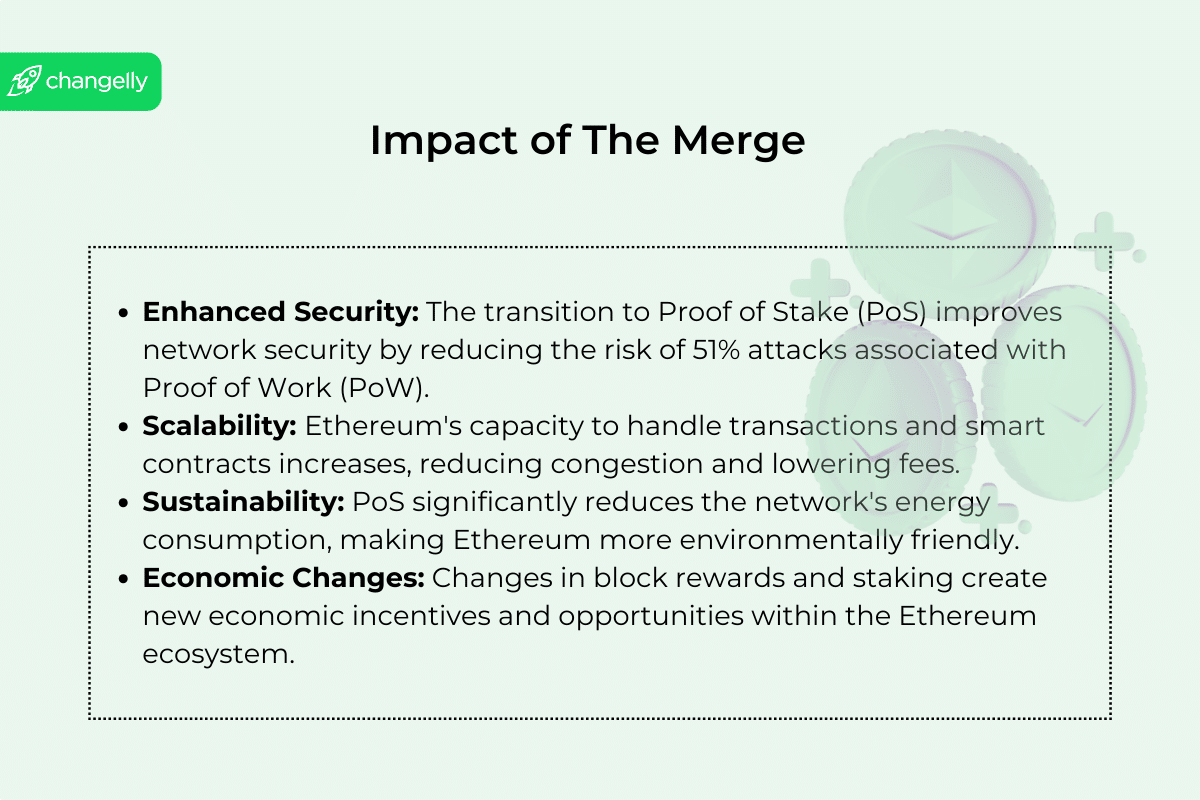

Security: Enhancing the Ethereum Network

The Ethereum Merge enhanced the network’s security. By transitioning from proof of work to proof of stake, Ethereum shifted to a system less vulnerable to certain types of attacks, such as the 51% attacks that are more feasible in PoW. In PoS, the network security is upheld by validators who have a substantial financial stake in the ecosystem. This stake acts as a deterrent against malicious actions, as validators stand to lose their investment if they attempt to compromise the network. Furthermore, the introduction of mechanisms like slashing reinforces honest participation. This shift to PoS, therefore, not only improves energy efficiency but also strengthens the overall security framework of Ethereum, making it more robust against threats and manipulations.

Scalability: Improvements in Transaction Handling

One of the primary goals of the Merge was to lay the groundwork for better scalability of the Ethereum network. The transition to proof of stake is a step towards a more scalable system; it sets the stage for future upgrades such as sharding. PoS allows for faster processing of transactions compared to PoW, thereby increasing the transaction throughput of the network. This means that Ethereum can handle more transactions simultaneously, reducing congestion and improving user experience. The anticipated introduction of sharding will take this capability to a new level: the network will be able to process many more transactions in parallel, and Ethereum’s ability to scale and meet growing demand will be boosted like never before.

Sustainability: Environmental Impact of Moving to PoS

The shift from PoW to PoS had a profound impact on Ethereum’s environmental footprint. PoW, known for its high energy consumption due to competitive mining, was replaced by the more energy-efficient PoS mechanism. This change significantly reduced the overall energy requirement of the Ethereum network. The reduction in energy consumption is a critical step towards sustainability, aligning Ethereum with broader environmental goals and making it more appealing to environmentally conscious investors and users. This move marks a milestone in the blockchain industry’s journey towards greener and more sustainable practices.

Transaction Fees: Potential Changes in Fee Structures

The Merge brought about changes that could potentially impact Ethereum’s transaction fee structure. While the immediate effect on fees was not drastic, the transition to PoS and future scalability solutions like sharding are expected to reduce network congestion. Lower congestion typically leads to lower transaction fees, as users won’t have to outbid each other as aggressively to get their transactions processed quickly. However, it’s important to note that fees are also influenced by demand for block space and network usage, so they can fluctuate based on overall activity on the Ethereum network.

Block Building and Reward Subsidy: Economic Implications

The transition to PoS also altered the economic dynamics of block creation and rewards within the Ethereum network. In the PoS system, validators receive rewards for proposing and attesting to blocks, rather than miners earning rewards through block discovery as in PoW chains. This change reduced the issuance rate of new Ether, leading to a decrease in block reward subsidy by about 90%. This reduction in new Ether issuance could have deflationary effects on the Ethereum economy, potentially impacting Ether’s value. Moreover, the new model aligns the interests of validators with the long-term health of the network, as their rewards are directly tied to their stake and the overall stability and security of the system.

How Did The Merge Impact Users and Investors?

- Staking Procedures and Rewards:

- Post-Merge, Ethereum transitioned from mining to staking, fundamentally altering how network participants earn rewards.

- Staking is accessible to anyone with a sufficient amount of Ether. The process involves holding and “staking” Ether to support network operations.

- This change democratizes network participation, allowing broader user involvement in maintaining Ethereum’s security.

- Impact on Investment Strategies:

- The shift to staking introduces a new method for passive income generation through staking rewards.

- Unlike mining, staking is less resource-intensive and offers more predictable returns.

- The reduction in Ether issuance post-Merge could influence its market value, potentially making Ether more attractive for long-term investment.

Ethereum in a Global Context

The Merge, a technological milestone in its own right, bolstered Ethereum’s stature in the global cryptocurrency market. As a leading blockchain platform, Ethereum’s shift to a proof-of-stake (PoS) mechanism resonates across the crypto landscape, influencing market dynamics and setting a precedent for other networks contemplating similar transitions. This move reinforces Ethereum’s position as a forerunner in blockchain innovation and demonstrates its commitment to adapting and evolving in response to technological and environmental challenges.

Regulatory Implications and Acceptance

Ethereum’s transition has drawn attention from regulators around the world, turning the spotlight on the potential of blockchain technology to align with global environmental goals. By cutting its energy usage, Ethereum aligns with the growing regulatory focus on sustainability, which could encourage broader acceptance and integration of cryptocurrencies into mainstream financial systems. Moreover, Ethereum’s proactive approach to scalability and efficiency issues showcases the blockchain industry’s potential for responsible and sustainable growth, potentially shaping future regulatory frameworks and policies in the crypto space. This global recognition and regulatory interest underscore Ethereum’s influence and the increasing relevance of blockchain technology in various sectors.

The Merge Network Update: Challenges and Criticisms

Ethereum’s shift to proof of stake (PoS) has been met with concerns about centralization, a challenge that persists a year after The Merge. In the PoS framework, validators who confirm transactions and create new blocks are required to stake 32 ETH, roughly equivalent to $80,000. This high entry threshold raises concerns that the network’s validating power might concentrate in the hands of a few large stakeholders or “whales.”

The technical and financial complexities of setting up and maintaining a validator node add to these concerns. Missteps in this process can lead to penalties, dissuading smaller players from participating. This situation could potentially limit the diversity of validators, skewing power towards those with significant financial resources and technical expertise.

Prior to The Merge, there were fears that PoS might lead to increased centralization within Ethereum. Observations post-Merge indicate that these fears may hold some merit. For instance, Lido, a major decentralized staking pool, has amassed a substantial share of the total staked ETH. As Lido’s share approaches the 33% mark—a point considered risky by many developers—the apprehensions regarding centralization and its implications for network security grow more pronounced.

Many users thought that The Merge would lead to gas fees being trimmed down, only to find out they were wrong because this major upgrade, developed over six years, had no direct effect on lowering these costs. However, it’s important to understand that The Merge was not designed to directly address high gas prices. Rather, its role was to lay the groundwork for subsequent upgrades, which are expected to progressively decrease transaction costs.

Critics also point out potential shortcomings in terms of security, incentive structures, and fairness under the PoS model. The concentration of staking power among a few entities indeed poses security risks, but it is more than that. It challenges the decentralized nature of the blockchain, potentially undermining the principles of fairness and equal opportunity that are foundational to Ethereum.

Up Next: What Is the Ethereum Cancun-Deneb (Dencun) Update?

The Ethereum Cancun-Deneb (Dencun) Upgrade, scheduled for early 2024, is a big step in Ethereum’s ongoing development, focusing on improving the scalability, security, and usability of the network. A crucial component of this upgrade is the introduction of Proto-Danksharding, a precursor to the full implementation of Danksharding. This feature is expected to significantly reduce transaction costs (gas fees) and strengthen transaction processing capacity by integrating data ‘blobs,’ which are large data units that allow for more efficient and cost-effective data storage and transaction processing.

The Dencun upgrade, which includes both Cancun and Deneb enhancements, aims to refine Ethereum’s Execution Layer (EL) and Consensus Layer (CL). It incorporates a suite of Ethereum Improvement Proposals (EIPs) that are vital for the network’s advancement. These EIPs include EIP-4844 (Proto-Danksharding), which paves the way for full Danksharding implementation and scalability improvements, EIP-1153 for more economical on-chain data storage, EIP-4788 to enhance cross-chain bridge architecture and staking pools, EIP-5656 for subtle modifications to the Ethereum Virtual Machine (EVM) for better performance, and EIP-6780, advocating for the deprecation of the SELFDESTRUCT function in smart contracts.

The Dencun upgrade is anticipated to bring several enhancements to Ethereum, such as scalability improvements, especially benefiting layer 2 solutions, a significant reduction in gas fees, advancements in network security, optimized blockchain data storage, and improved cross-chain interactions.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.