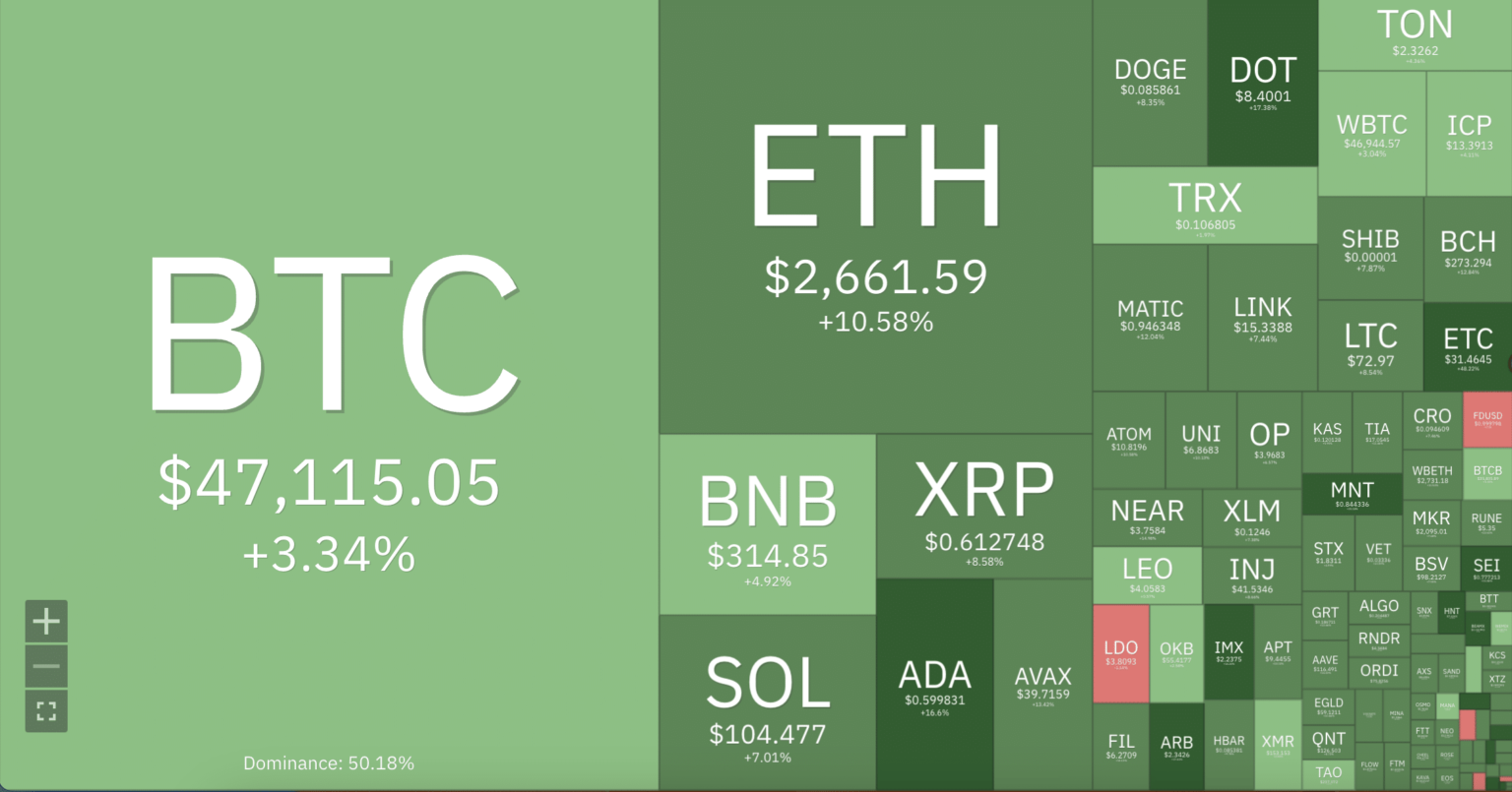

- The altcoin market has witnessed significant growth in the last 24 hours.

- ETC and ENS have seen their values increase by double digits.

The cryptocurrency market is experiencing a significant surge following the landmark approval of spot Bitcoin ETFs. This long-awaited decision has led to a widespread rally in the values of several assets.

Source: Coin360

Ethereum-linked tokens Ethereum Classic [ETC] and Ethereum name service [ENS] have taken the lead in this rally and have risen to the highest price level in more than twelve months.

ETC has seen its price rise by more than 47% in the last 24 hours, while ENS has risen by 37%, according to data from CoinMarketCap.

Both assets have also seen a spike in trading volume over the past 24 hours. ENS trading volume during that period was $504 million, an increase of 200%.

As for ETC, trading volume increased by more than 250% to a total of $2.16 billion, the highest since September 2022, AMBCrypto found.

The price rally has a price

At the time of writing, ETC was trading at $31.42. The last time the coin traded at this high was in September 2022, according to data from CoinMarketCap.

The price movements assessed on a weekly chart showed a continued accumulation pattern among traders. This happened despite the downward trend in the ETC price since the year prior to the recent rally.

Key momentum indicators were at overbought levels at the time of writing. For example, the coin’s Relative Strength Index (RSI) was 72.75, while the Money Flow Index (MFI) was 75.15. At these values, these indicators suggested that buying momentum was greater than the coin sell-off.

Furthermore, the coin’s Chaikin Money Flow (CMF) was seen in an uptrend of 0.18, showing a steady inflow of liquidity into the ETC market.

However, the unexpected price rally resulted in greater price volatility. The coin’s price was trading significantly above the upper band of the Bollinger Bands indicator at press time. When this happens, the market is considered to be overheated and a retracement usually follows.

Source: TradingView

ENS follows this example

The ENS market also witnessed a double-digit price increase in the last 24 hours and was significantly volatile at the time of writing. As the price rose, the gap between the upper and lower bands of the Bollinger Bands indicator widened.

Source: TradingView

When the gap between the upper and lower bands of the Bollinger Bands widens, it is generally considered a sign of increased volatility.

Confirming that ENS’s price was sensitive to fluctuations, the Average True (ATR) range started an uptrend. At the time of writing, this indicator returned a value of 2.67.

This indicator measures market volatility by calculating the average range between high and low prices over a certain number of periods. When it rises, there is volatility in the market.