Since then, the relationship between Ripple’s buyback of XRP and its impact on the price has been a topic of intense debate. Crypto Mark, an active community member on X, asked a pertinent question about Ripple’s strategy to buy more of the cryptocurrency. “Shouldn’t Ripple try to distribute XRP and not buy more? I would like to see them own less XRP, not more,” said Crypto Mark.

The influence of Ripple’s XRP buyback on the price

This research was covered by Mr. Huber, a renowned member of the community, who provided a detailed explanation of the dynamics involved. Huber highlighted the strategic rationale behind Ripple’s buybacks.

‘That’s just a matter of your knowledge. Ripple makes it transparent. That’s why we know. And you want Ripple to buy back XRP. You don’t want them to just sell it. Believe me. If XRP actually has any use for Ripple, then you want them to buy on open markets for liquidity reasons,” he says explained. This statement highlights the necessity and benefits of Ripple’s buyback strategy, suggesting that it is beneficial for maintaining market liquidity.

In his analysis of the market, Mr. Huber said pointed out key patterns: “Facts; 1. XRP has sudden, inexplicable, very rapid price spikes between 30 and 100%, which are then lost over several months. 2. These price spikes almost always coincide with Ripple buybacks on open markets. They take place approximately once a quarter. 80% reliability. 3. When you look at these buybacks, you realize that if Ripple buys $100 million in net buys within 1-2 days, it will create a price spike of about 50%.

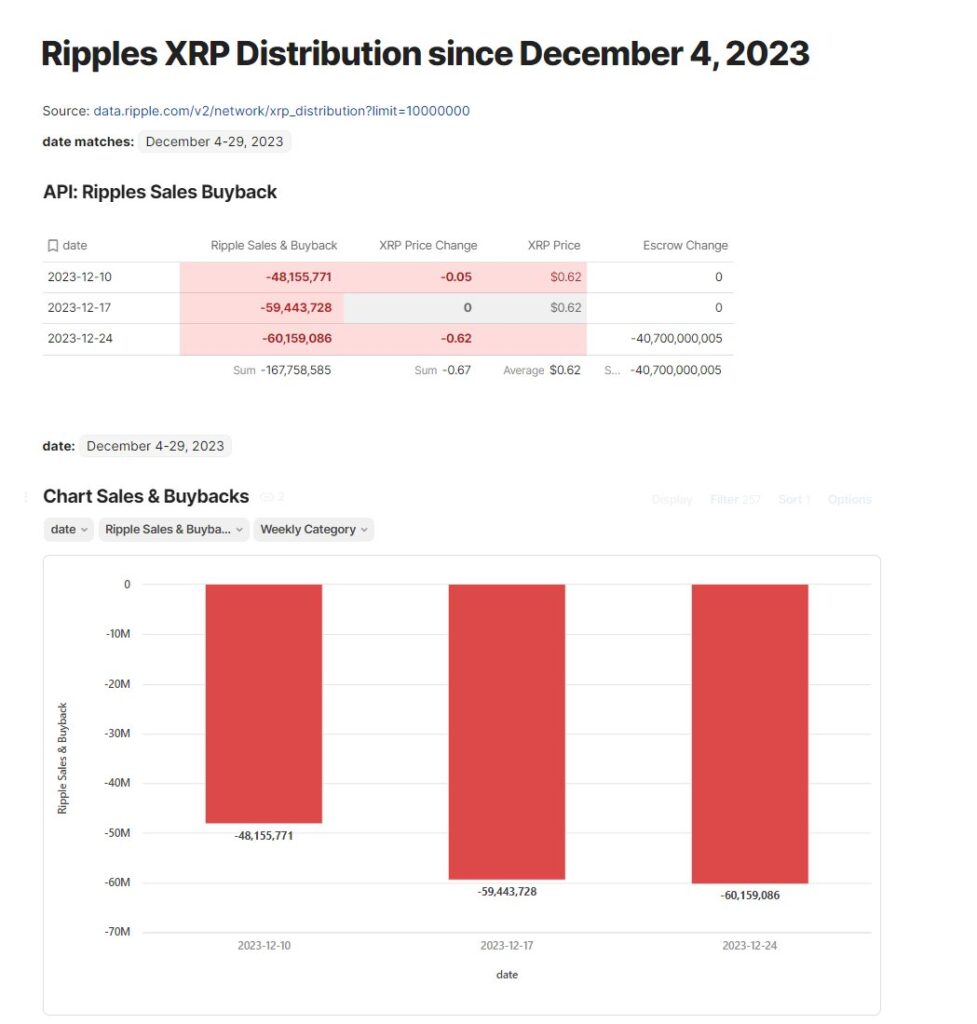

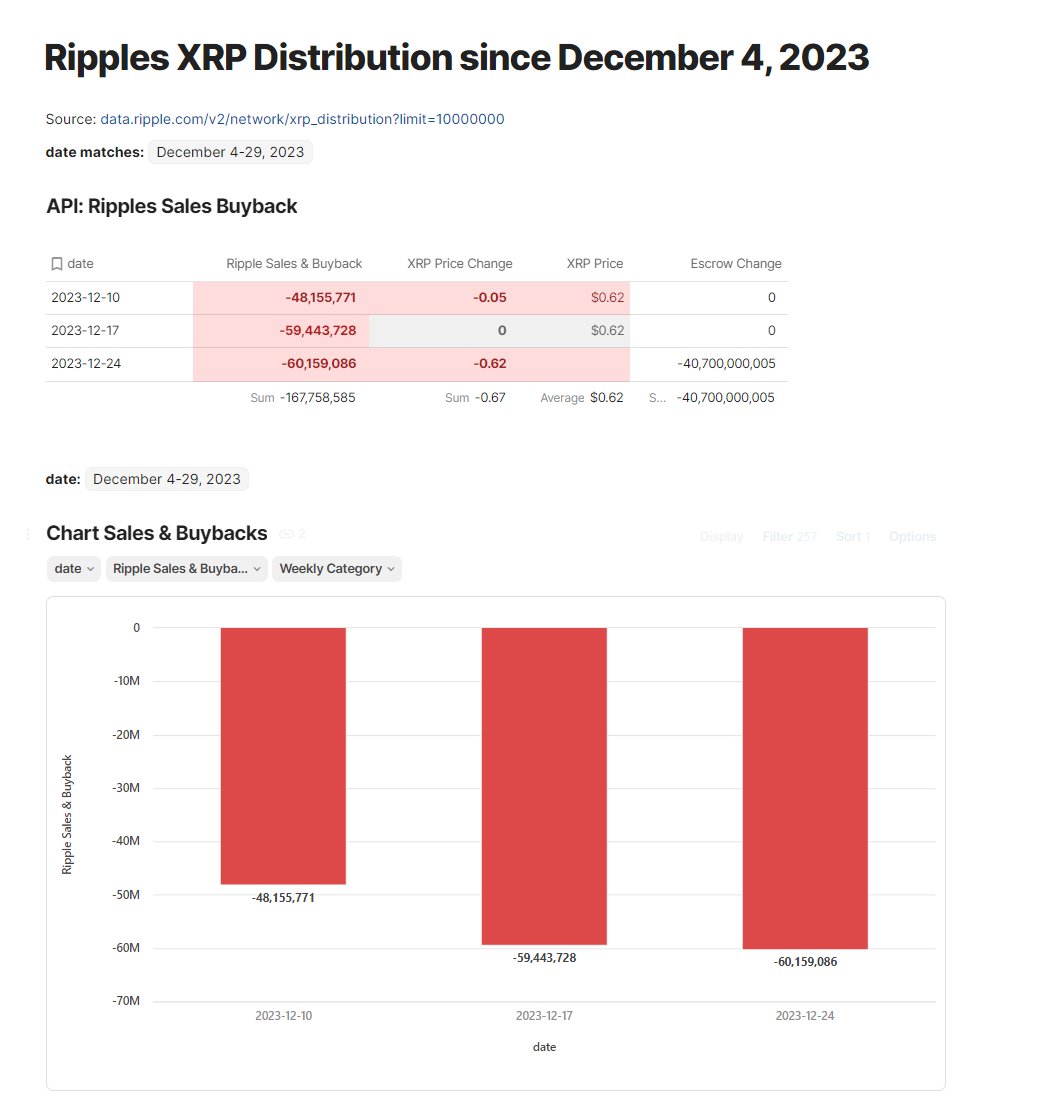

Recent data from Ripple’s API showed a notable decline in the company’s buyback activity. The researcher noted that the API was updated with the latest data just a few days ago. Ripple’s revenue now amounts to 167,758,585

“This is twice the usual sales volume of the past six months. I suspect that Ripple will want to make this reduction again at the next buyback,” said Mr. Huber.

In response to a user’s question about the size of investments needed for a substantial increase in the price of the cryptocurrency, Mr. Huber said declared, “$100 million dollars causes a price swing of about 30-50%. So for 2,000% you should expect at least $4-6 billion in net purchases.” This answer provides a clear indication of the financial size required for substantial market movements.

Impact of Ripple Sales and Distributions

Additionally, Mr. Huber compared Ripple’s sales and distribution strategy to other cryptocurrencies. He wrote, “Ripples Sales and Distribution of XRP from the Past 10 Years. 6.48% inflation for 2023. When compared to SOL and ETH, it becomes clear that the price action is much more due to a lack of demand than Ripple sales.”

He added: “ETH – Supply reduction and proof of stake, but hardly any price action since the merger. […] The (XRP/XRPUSD)/(BTC/BTCUSD) chart shows that the supply of XRP has increased only 22.73% more than the supply of Bitcoin over the past 9 years.”

At the time of writing, XRP was trading at $0.63135.

Featured image from Kraken Blog, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.