- Friend.tech has made changes to improve the security of its network.

- Base activity remained high, but TVL dropped significantly.

Friend.tech has been gaining popularity in SocialFi since its inception. People were attracted by its unique pricing model, which helped bring in users from different parts of the crypto world.

New changes

Recently, Friend.tech successfully completed an on-chain transaction, transferring ownership of its contracts and funds to a new multi-signature and professional custody arrangement.

In particular, the protocol charge receiving address (0xdd9) has been moved 7821 Ether [ETH] (equivalent to $16.94 million) to Coinbase. This increases long-term security and ensures that tax obligations are met.

We have completed onchain transactions to transfer ownership of the friendtech contract and funds to a new combination of multisig and professional custody.

These changes will improve friendtech’s long-term security and allow us to meet tax obligations

— friend.tech (@friendtech) December 2, 2023

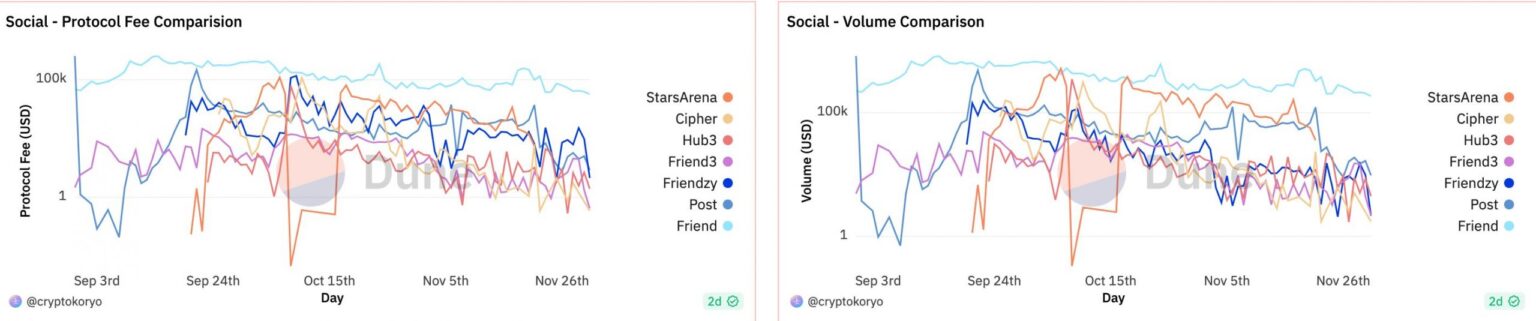

In terms of fees collected and total volume on its network, Friend.tech vastly outperformed its competitors.

Overall, however, activity on the network was down at the time of going to press. Furthermore, the number of transactions taking place on the Friend.tech network has also decreased in recent weeks.

But these declining numbers weren’t due to Friend.tech’s underperformance. This happened as a result of the general decline in interest in the SocialFi sector. The number of transactions on other networks also decreased during this period.

Condition of base

Only time will tell how Friend.tech can impact the grassroots network. At the time of going to press, Base was seen to have seen an increase in the number of daily active addresses, exceeding optimism [OP] in the process.

Coupled with this, it also saw a spike in the number of transactions taking place on the network. Despite this, it still couldn’t compete with the likes of Arbitrum [ARB] or zkSync in the Layer 2 space.

As for the DeFi space, the TVL collected by Base was seen to have fallen. DEX volumes on the network were also down over the same period.

A decline in both metrics simultaneously indicates a decline in the overall activity of the DeFi ecosystem. However, this does not always have to be the case.